Gold, Stocks and the Miners Analysis

Stock-Markets / Stock Markets 2016 Mar 11, 2016 - 05:48 PM GMTBy: Gary_Tanashian

One is the star of the year so far, grinding higher in what could be the launch phase of a new bull market as confidence wanes in the face of NIRP and other desperate global policy actions, and the realization that this disgraceful policy designed to spur speculation and asset price appreciation is all policy makers have got left in their bags of tricks. The endgame is a bag with a hole in it; a monetary black hole.

One is the star of the year so far, grinding higher in what could be the launch phase of a new bull market as confidence wanes in the face of NIRP and other desperate global policy actions, and the realization that this disgraceful policy designed to spur speculation and asset price appreciation is all policy makers have got left in their bags of tricks. The endgame is a bag with a hole in it; a monetary black hole.

The other grinds on in what could be the last significant hope replenishing bounce before new downside is explored. Various US and global indexes are already in bear markets but casino patrons are trained to look at the S&P 500, Nasdaq 100 and Dow as “the stock market” and these have not yet gone ‘bear’. If the current bear-trend bounce fails however, that confirmation would be coming promptly.

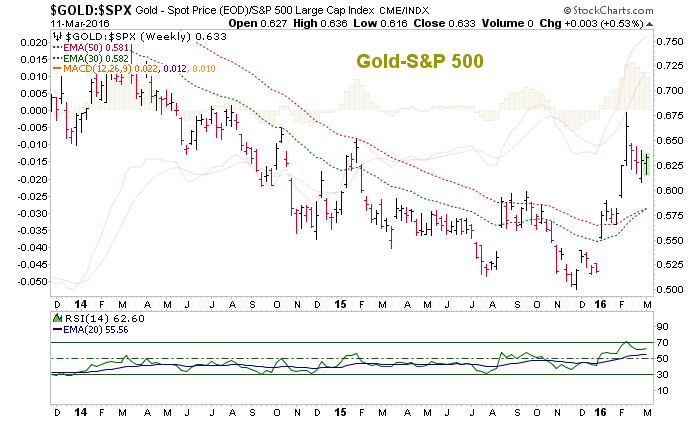

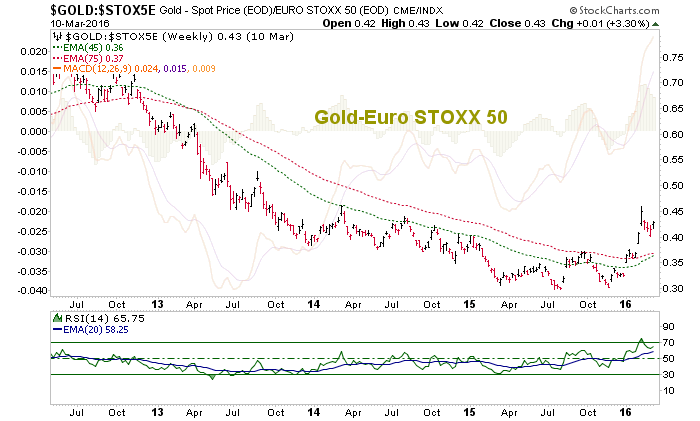

The comments above are verified by the charts of gold vs. the S&P 500 and the Euro STOXX 50. The bullish move and current consolidation are representative of all major stock markets. This is a trend change in gold vs. stocks (joining gold vs. commodities, which turned up long ago).

Charts are and are not lots of things, but one thing they are is 100% accurate pictures of history. Very recent history has seen gold break bear market trends as measured in these stock markets. As you can see by weekly RSI and the MACDs faded into the background gold became over bought vs. stock markets. That was impulsive and potentially a bull market signal, but it has also been in need of a cool down, which is thus far taking the form of a bull flag consolidation, which will provide a test of the bull thesis.

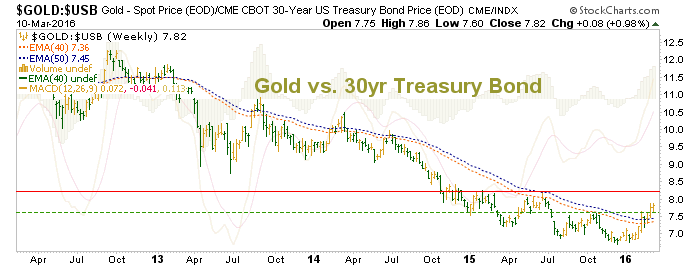

Gold vs. Long-term US Treasury bonds is also making a step in a positive direction toward trend change, but is not nearly as advanced.

The above items indicate changing trends in confidence by the investing masses in global Central Banks that have had a really good run over the last few years, with ironclad confidence in their policies by conventional market participants. Of course, hard core gold bugs would not bow to this unprecedented case of global financial fascism, and for their beliefs they were served years of pain. Now the cycles appear to be changing.

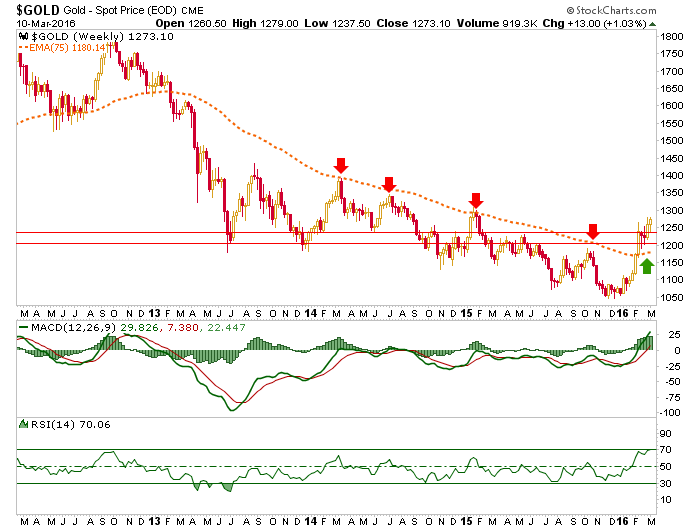

Through gold’s bear market I, a believer in more honest monetary systems, had to call it what it was. Beliefs and the biases they inspire had to be subjugated to the simplicity of charts like this one that said “Gold is below the EMA 75? It’s in a bear market.” Not having cheered gold in the face of the bear evidence, I feel I have the right to claim now that gold has broken the bear market limiter and made a strong (but not yet definitive) case for the beginning of a bull market.

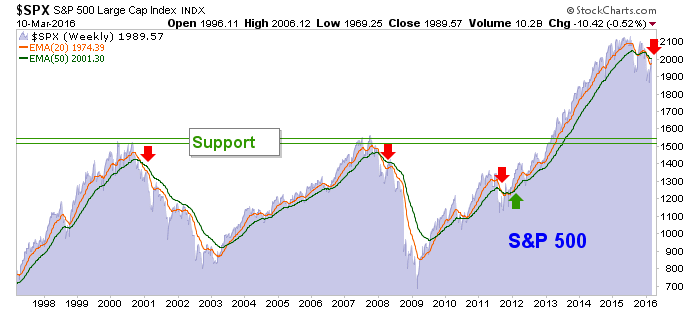

As for stocks, the S&P 500 has made a weekly moving average signal that produced bear markets in 2 of the last 3 instances.

Yes, the market is bouncing and we anticipated this in NFTRH well before the current crop of now-bullish momentum players came out of hiding.

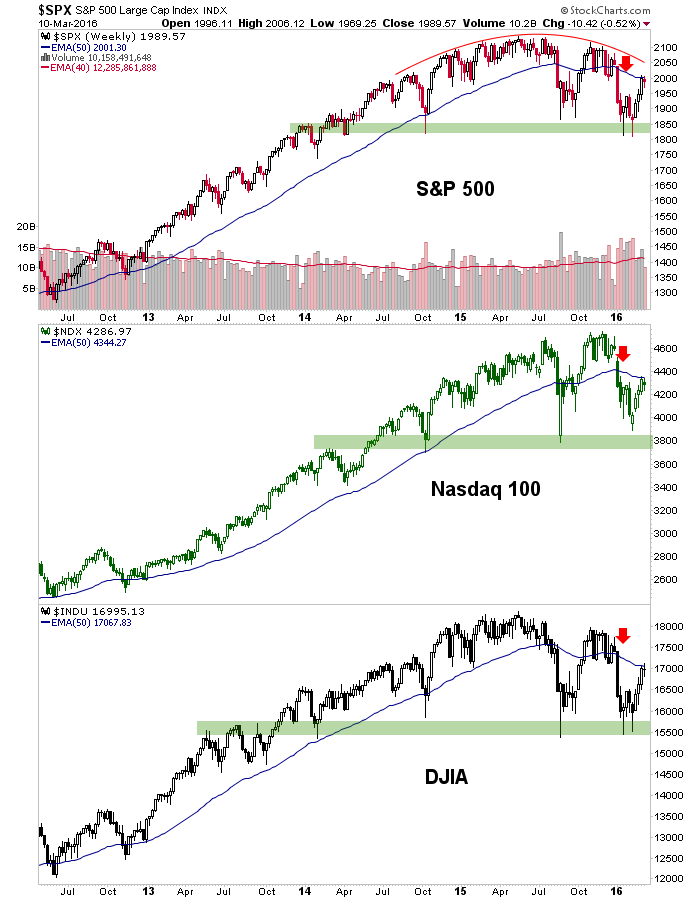

Here is the view of the troubled, but unbroken US headline indexes. As we have been noting, the SPX and Dow can break above the weekly EMA 50’s and still remain in a bear trend (NDX, in maintaining a series of higher highs and higher lows is in a relative bull stance) after bouncing from critical support as expected.

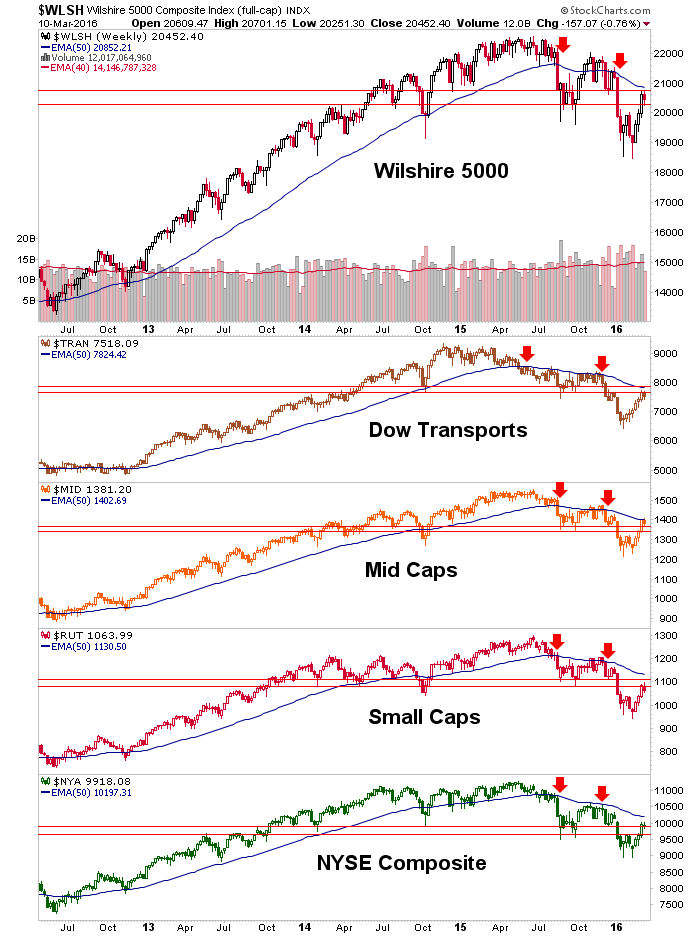

It is in the broader indexes that the US market really flashes bearish. All items are in intermediate bear trends but bouncing back to critical former support, now resistance. If they manage to negate the trends then so be it. We go with what the markets instruct, not our biases or egos. But the fact is that this is a bear bounce only, until otherwise indicated.

The global picture is similar, except that most global stock markets are bouncing from already mature bear trends as opposed to the US market’s newer bear trends.

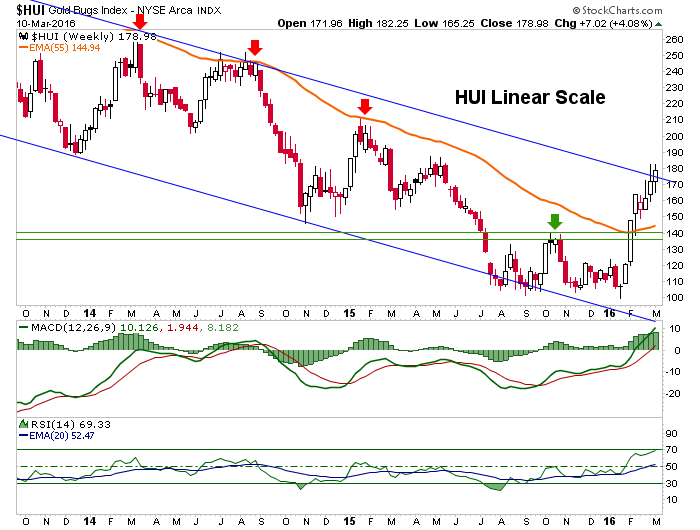

Transitioning back to gold, the yellow metal is an insurance policy and a holder of value, long-term. The miners are the speculation associated with this boring asset and they are decidedly not boring. While we have been expecting a cool down (AKA correction), this has not yet come to be. HUI is in the hands of the momentum players now, desperately buying in so as not to miss the train. Sooner or later they will be punished and people should be actively managing a sector that may be birthing a baby bull market per their own orientations (i.e. trade, buy the dips, etc.). Personally, I mostly trade it now and will look to establish longer-term positions later.

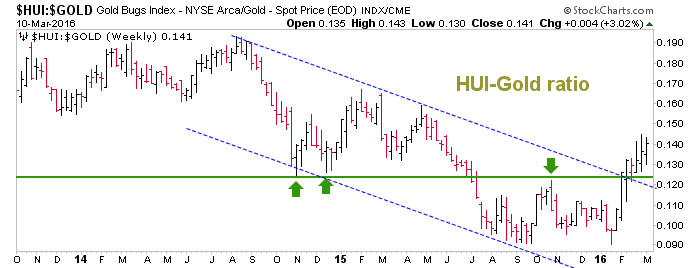

We call it a potential baby bull not simply because HUI broke above key resistance (now support) at 140, but due to other signals like the SPX-Gold and STOXX-Gold ratios above and the HUI-Gold ratio below.

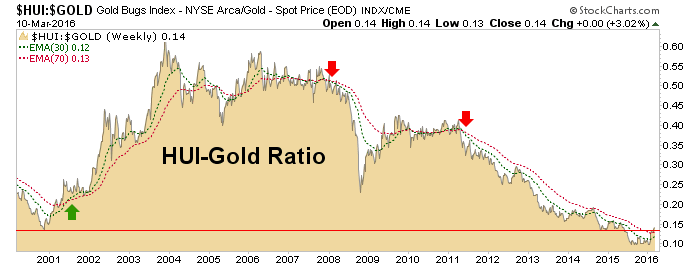

Here is the bigger picture view, also making progress but with some work to do as the long-term bull signal would come with a cross up of the moving averages

NFTRH manages not only the general views like those above, keeping subscribers up to date each week with a detailed report on events, but also in-week as dynamic markets go through their motions presenting opportunities to gain capital and also protect it. We have been right on with the market’s themes all along, not by trying to play Swami or Guru, but by staying on the pulse of macro trends, indicators and market technicals. That is the only way to manage soundly. Assuming you are not a day trader or pure momentum player, I am sure that you will find value in this hard working, time-tested and quality service.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.