Gold And Silver - Shanghai Exchange Effect On Silver?

Commodities / Gold and Silver 2016 Mar 19, 2016 - 06:09 PM GMTBy: Michael_Noonan

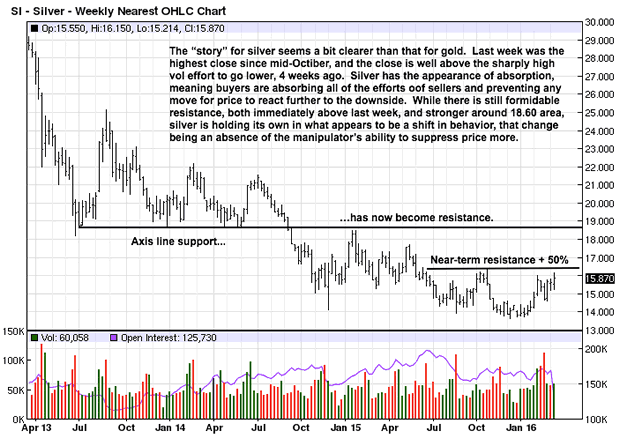

The trend for silver remains down, for now, but there is something going on within this market that does not confirm a change in trend but "appears" to be indicting a one. It has been acknowledged that the fundamentals for both silver and gold are overwhelmingly positive, yet price has not responded. More accurately, price has not been allowed to respond by the globalist's manipulation via their central banks, in general, and specifically by the both military and money might of the also manipulated United States, the federal corporate government version.

The trend for silver remains down, for now, but there is something going on within this market that does not confirm a change in trend but "appears" to be indicting a one. It has been acknowledged that the fundamentals for both silver and gold are overwhelmingly positive, yet price has not responded. More accurately, price has not been allowed to respond by the globalist's manipulation via their central banks, in general, and specifically by the both military and money might of the also manipulated United States, the federal corporate government version.

The question that arose in our mind for the past few weeks has been: are we seeing the effects of the Shanghai Exchange on silver? In other words, while the belief that the East is now overtaking the West in financial power, in the form of acquiring gold and silver, has been widespread, it has not yet been reflected in price behavior.

Everyone knows that the effects of manipulation, now being countered by the rise in power of China, and even Russia, had to lose its grip against the undeniably strong fundamentals for both silver and gold. With the blatant exercise of market/price control by COMEX and LMBA not even being cleverly disguised, China, having the loudest but silent voice, indeed now even control over what goes on in PMs, is taking a page from Theodore Roosevelt's foreign policy by "walking softly and carrying a big stick" and China beginning to exert its influence.

COMEX and LBMA, once the pillars for precious metals, have now decayed into a Comedy Central tag team that has lost its audience and credibility. China does not play, nor does it tolerate, that kind of low-level display of incompetence masquerading as authority.

Both exchanges have been derivative-driven, doing everything [un]imaginable to protect their excessively hypothecated Ponzi scheme and no longer function as legitimate sources that stand ready to deliver gold and silver on their futures contracts. They offer digital "currency" instead of actual delivery of any physical metal.

再见 COMEX, 再见 LBMA. [Bye-bye], your days are coming to an inglorious end. 你好

Shanghai Gold Exchange, [Hello], where physical metal is actually delivered and just as importantly, price will reflect real supply and demand, that is once the switch is fully implemented and China pulls the switch on COMEX and LBMA. Sum Ting Wong with the way you do business.

This is our sense of why silver refuses to be pushed lower with impunity by globalist interests and why silver has begun to exhibit a change in behavior that, while not being definitively seen as a change in trend, it may now be recognized as what so many have been so eagerly awaiting for: reality to come center stage for gold and silver. It further explains what we have been saying for the past few years: fundamentals are not what are moving the PM markets. They should be, and they have been relentlessly bullish but with no bullish impact.

One thing about reading developing market activity, via price in volume depicted in a chart, is that one does not always have to have an answer for what is going on. In fact, when the market "story" is not clear, that is a sufficient message in itself. It suggests change, transition, and the process takes time and may not be readily defined from time to time. It is okay not to know.

Markets, even manipulated ones, are organically undergoing change in process at all times, and when clarity is not apparent, wait for it to sort out, as it always does.

Silver's refusal to break lower in July through August of 2015, and then again from October through December of 2015 looks like an expression of market change not yet completed, hence the lack of clarity. Our "The Fundamentals Do Not Matter" mantra, at least for the past few years, may be coming to an end, and the globalist's banker's paper market, where "the paper holds their folded faces to the floor, and every day the paperboy beings more." [From Pink Floyd's appropriately entitled song, Brain Damage.], is coming to an end.

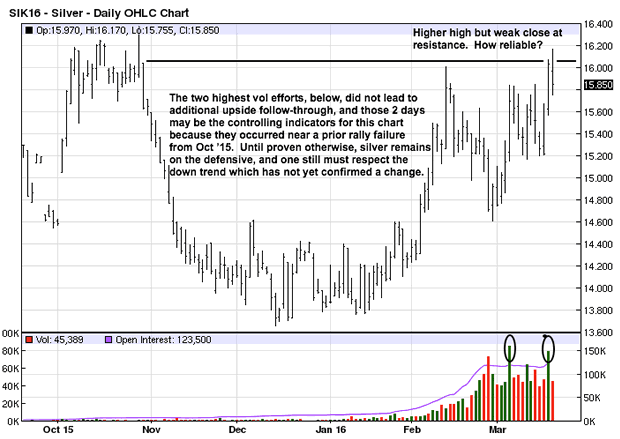

The daily chart is least conclusive, at least for us. The current rally stalled at a prior failed swing high from last October. Yet, the market, as of last Friday, just made a higher high, however tenuously, after having formed a higher low last month. While Friday's activity could be a red flag leading to a correction, we see no [overt] supply entering the market. The two high volume days are not supply, so much, but neither high volume effort has led to further upside, so it can be sellers still present meeting the efforts of buyers, where sellers may eventually losing their control without having fully lost it.

Change takes time. Silver is looking better. The gold/silver ratio peaked at 83+:1 in the past two weeks and closed around 79:1 on Friday, as silver held better than gold. We still see silver outperforming gold to the upside, and the ratio does not stay over 80:1 for very long before realigning to a lower ratio, and that favors silver.

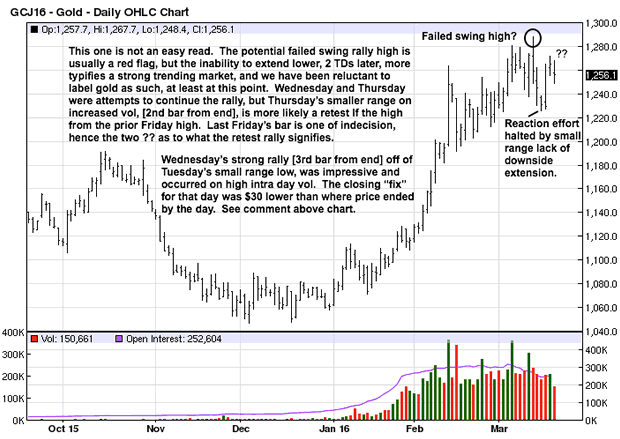

While gold is obviously at a resistance level from the failed rally of January 2015, what stands out is the strength of how gold reached that level: in a very strong manner, and that speaks to the character of a market. Bars have been overlapping for the past five weeks, and that reflects a battle between buyers and sellers. By contrast, the three-weeks just before the five weeks just mentioned shows EUM [Ease of Upward Movement], where there was no battle waged between buyers and sellers. Buyers took control and ran with it.

The chart comments express our take on this market. The potential failure of a swing high, as noted, has to be respected. What may weaken its impact is how price moved strongly to get there, and while the bars have been overlapping since almost mid-February, there has been zero evidence of a strong reaction lower. Weak reactions, as gold is showing for now, usually lead to higher prices.

It appears gold may also be transitioning in its trend, stopping the downward trend and moving more sideways in preparation to go higher.

This is the Chinese Zodiac Year of the Monkey.

The monkey is a clever animal. It is usually compared to a smart person. During the Spring and Autumn Period (770 - 476 BC), the dignified Chinese official title of marquis was pronounced 'Hou', the same as the pronunciation of 'monkey' in Chinese. The animal was thereby bestowed with an auspicious meaning. We shall see.

In reference to last Wednesday's strong rally bar, the goofs at COMEX "fixed" the settlement price $30 lower from where price was at the time of closing. This is another example of why we say the attempts to manipulate the market are not even disguised as this was an obvious effort to cater the globalist's bank's derivatives positions. Bankers have no shame, just pure greed.

Keep buying physical gold and silver. We favor silver for the extreme ratio status, at present, but if one prefers gold over silver, just keep on buying and personally holding.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.