Stock Market Cycles are Delayed. A Panic May Play Catch-up

Stock-Markets / Stock Markets 2016 Mar 21, 2016 - 02:16 PM GMT All eyes are on China as PBOC attempts to manage its debt load while keeping the markets aloft. The Shanghai Index closed above 3000 for the first time since January. This is an inversion of a Master Cycle which was due for a low this week. Instead, it will be a high. However, these inversions don’t end well, as the low may arrive within the next two weeks .

All eyes are on China as PBOC attempts to manage its debt load while keeping the markets aloft. The Shanghai Index closed above 3000 for the first time since January. This is an inversion of a Master Cycle which was due for a low this week. Instead, it will be a high. However, these inversions don’t end well, as the low may arrive within the next two weeks .

ZeroHedge reports, “The sarcastic highlight of the overnight session was the Chinese stock market, where just one month after injecting a record amount of new loans into the financial system, the PBOC lamented the danger posed by China's tremendous debt load: "Lending as a share of GDP, especially corporate lending as a share of GDP, is too high" People’s Bank of China Governor Zhou Xiaochuan told China Development Forum yesterday.

At the same time he warned about dangers from a stock market bubble, and perhaps just to assure the bubble gets even bigger, at the same time China eased on margin debt limits, in the process sending Chinese stocks soaring higher by 2.2%, and pushing the Shanghai Composite over 3000 for the first time in months as China now appears set to attempt another housing bubble "soft landing" while at the same time restarting its housing bubble.”

It seems that the PBOC requested that the Fed lend them their “plunge protection” playbook last summer.

Today is also an inversion day for US stocks. You may recall that I had suggested March 21 may be due for the next Cycle low. Instead, it is a high (as of Friday). However, It has been in disagreement with the PI Cycle, which is due for a low next week, instead. The PI Cycle accurately predicted the August 24 low as well as the January 20 low. At the moment, it is aimed for March 29. I am inclined to think that it may extend another 24 hours to March 30 to make an 8.6 day decline from Friday’s high.

The Premarket is down this morning with a probable trendline crossing at 2030.00. That may give an aggressive entry for a short position.

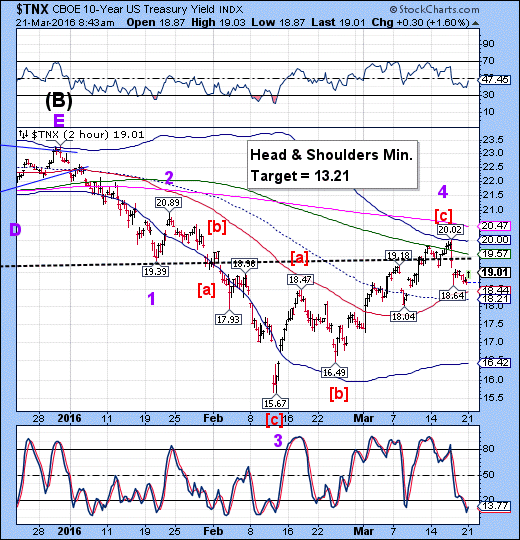

It appears that the low in TNX (high in USB) which was due today will also be delayed. The question is, how far over will it go? The next Primary Pivot day appears to be Friday, suggesting the all-time high for treasuries may be then, or early next week.

Bloomberg reports, “The world’s biggest bond dealers are getting saddled with Treasuries they can’t seem to easily get rid of, adding to evidence of cracks in the $13.3 trillion market for U.S. government debt.

The 22 primary dealers held more Treasuries last month than any time in the last two years, Federal Reserve Bank of New York data show. While at first glance that may suggest a bullish stance, the surge in holdings is more likely the result of investors including central banks dumping the debt on the firms, said JPMorgan Chase & Co. strategist Jay Barry. Foreign official accounts sold a net $105 billion of the securities in December and January, an unprecedented liquidation, Treasury Department data show.”

Could this be the final straw, as the banks attempt to unload their pile of treasuries on an unsuspecting public? And will the cash to do so come from falling stocks?

It appears that we may have a panic in the making.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.