US Economic Growth Remains Sluggish…Markets Remain Uninspired

Stock-Markets / Financial Markets 2016 Mar 24, 2016 - 04:33 PM GMTBy: Dan_Norcini

This morning’s Durables Goods report underscored just how moribund economic growth in the US remains.

This morning’s Durables Goods report underscored just how moribund economic growth in the US remains.

Additionally we learn that US business investment remains lackluster at best.

While Central Banks are spiking the punch bowl, it appears the party goers are not imbibing.

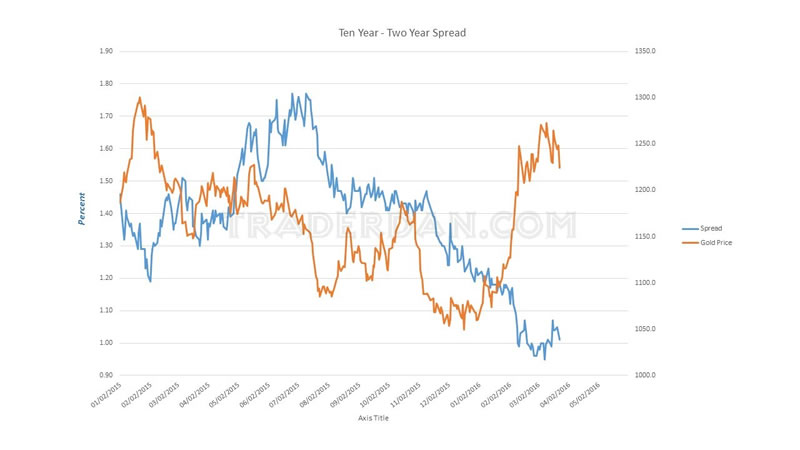

Look at the yield curve as reflected by the spread between the Ten Year Treasury and the Two Year Treasury yields. It is going NOWHERE.

I have said it many times here before but will do so again – monetary policy has been proven INSUFFICIENT to deal with what ails not only the US economy, but the global economy in general. What is needed, and what we are not likely to get anytime for the remainder of this year, is STRUCTURAL REFORM. That includes both tax policy and regulatory policy. Succinctly – as long as we have a quasi Marxist in the white house here in the US, it ain’t gonna happen.

That means that the economy will continue to essentially muddle along flatlining at best.

It is going to be a long year.

In this environment, it is really extremely difficult for me to see why we had such a rush of hot money into the commodity sector.

I have commented previously on how confused I am when I see the various commodity indices moving higher, indicating expectations for improving growth prospects, and the yield curve going nowhere. Something is out of whack, in a big way. BOTH CANNOT BE TRUE.

I tend to side with the yield curve as the bond guys are more knowledgeable in my opinion. There is no doubt that a lot of the buying we had recently seen in the commodity sector, including oil, has been primarily that tied to short covering. To sustain higher commodity prices and to actually start strong uptrends, we need to see fresh buying and lots of it. Why we would see that in such a sluggish growth environment is a mystery to me.

I said all that to say this – I expect to see more range trading and consolidation in many commodity markets and not strong uptrends in general. Not until we see some signs of real growth and by that, I mean sustained growth, not one quarter anomalies that come and then fizzle out. Hell, we cannot even get a single quarter in which growth can impress any of us.

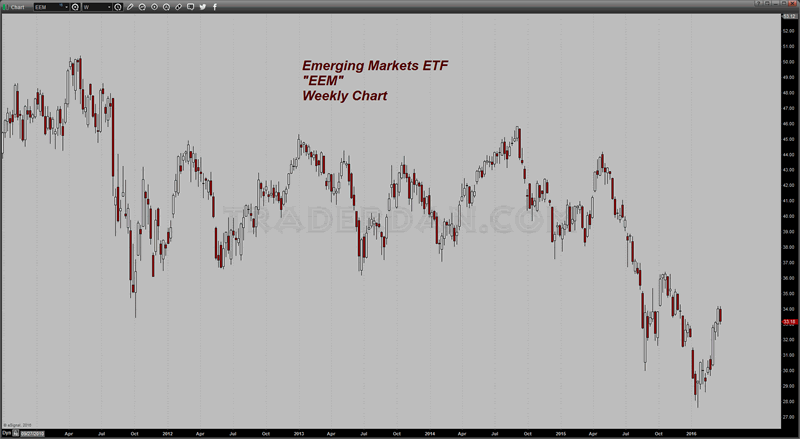

Watch the Emerging Markets to see how those fare. They are a good clue as to what investors/traders are expecting. Right now, they show little excitement about improving growth prospects.

As noted previously, there is a world of difference between markets that stop going down because the bears see little prospect of forging new lows and markets that actually are starting serious uptrends. Just because a market does not want to move down into fresh lows does not mean it is ready for a rip-roaring bull. It can often mean, and more and more I am coming around to thinking this is the present case, that traders expect Central Bank policy to be able to prop up the economies but also do little if nothing to create an environment in which sustained long term growth is likely.

What a dismal mess.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.