Central Bank Demand & Emerging Market Demand Are, To Me, The Bit Under The Gold Market!

Commodities / Gold and Silver 2016 Apr 06, 2016 - 06:17 PM GMTBy: Gordon_T_Long

FRA Co-founder Gordon T. Long is joined by Jordan Eliseo in discussing the value of precious metals as an investment.

FRA Co-founder Gordon T. Long is joined by Jordan Eliseo in discussing the value of precious metals as an investment.

Jordan Eliseo is a much sought-after and respected financial commentator and economic analyst with close to 20 years experience in the financial sector. After working for some of the biggest names in the global financial marketplace including Deutsche Bank, JP Morgan and AMP Capital, Jordan has amassed a wealth of experience analyzing investment markets.

Jordan not only ‘talks the talk’ but has walked the walk, setting up his own precious metal and mining fund back in 2003, when most people had never even heard of precious metal investment, and is also the founding partner of a national financial advice business, helping Australians take control of their finances and maximize their superannuation. And now he is the Chief Economist of Australasia’s largest independent bullion dealer – ABC Bullion.

Jordan holds a BA in Banking and International Finance from Flinders University and a Graduate Diploma in Applied Finance and Investment from FINSIA. He also holds the Diploma in Financial Planning (Financial Services) with specialist SMSF accreditation.

PRECIOUS METALS: GOLD

It’s been a very impressive quarter for anyone who’s gone long in precious metals, with gold up 16% and silver up 11% for the quarter, welcome respite after the cyclical correction in precious metals that started in 2013. In a world where equity markets are increasingly volatile and central banks are taking more extreme monetary policy positions and decisions, the merits of holding gold as part of a portfolio are high.

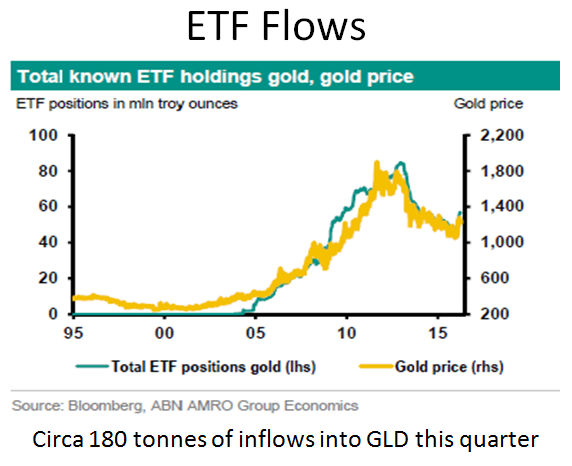

In 2013-15 there were hundreds of tonnes of gold diverted from gold ETFs, but that has increased in the last few months.

“People are, if not adopting it as a major holding, openly looking at it and analyzing the merits of including it alongside more traditional assets.”

People long term in gold argue that if there’s any interest in gold ETFs, there might be a shortage of physical gold. But there is several thousand tonnes of gold in London at this point and there’s the better part of 3000 tonnes of organic or freshly mined production being brought to the market every year.

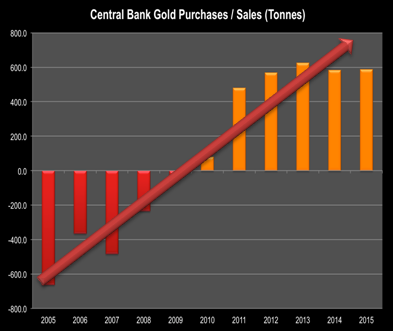

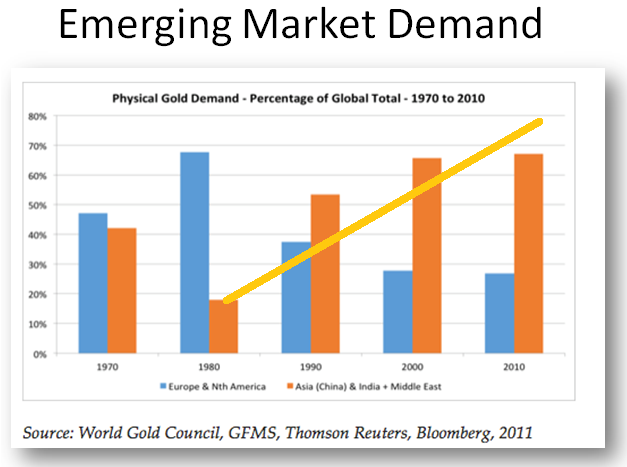

“Central banks demand and emerging market demand are, to me, the bit under the gold market that will support it for the next few years.”

But for gold to move substantially higher, we will need to see western investors adopt it in their portfolio. It doesn’t have to be a major move, just 2-5% of the average western investor’s portfolio, we’d see prices move much higher.

“In a world where we earn less than nothing on cash, when there’s 20 trillion Dollars of sovereign debt… it probably makes sense to hold this asset class.”

EFFECTS OF JAPAN AND NIRP

There’s a lot more discussion on a cashless society ever since Japan announced NIRP, which correlates with the increase in consideration of gold. This has changed the perception around financial market risk and financial markets as a whole, and gold is affected.

A retail investor concerned about QA and bank bail-ins would find the argument for holding gold strengthened. An institutional investor with a volatility mandate and return objective would be more interested in the potential for gold to deliver alpha in a low rate environment, since gold is uncorrelated to the financial markets.

PROBLEM OF LIQUIDITY

If you look at liquidity, it’s drying up in financial markets. In the last twelve months there have been multiple warnings about the waning of liquidity in markets. They’re worried in the liquidity might not be there in the event that investors move to cash and liquidize their bond portfolios. This is extraordinary as bonds are supposedly low risk and highly liquid.

If you’re an institutional investor, you need a large market to go into – gold fits that bill and has the advantage of having 0 credit rising despite its growing size.

PRECIOUS METALS: SILVER

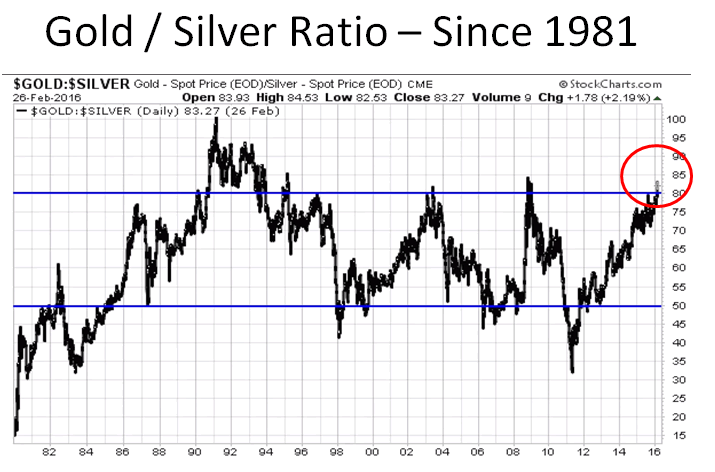

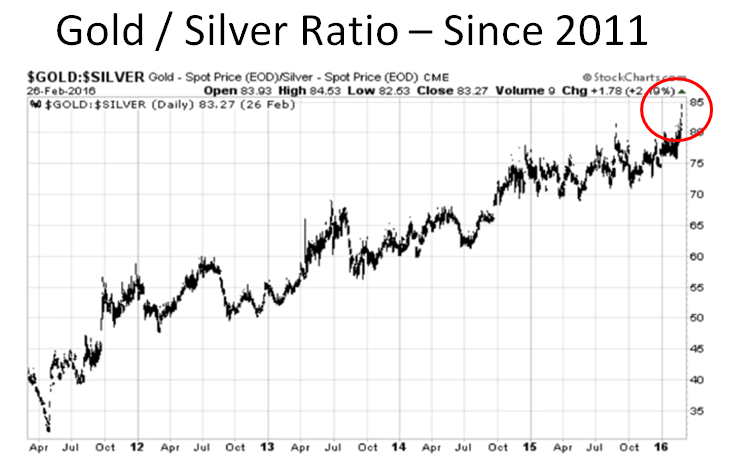

The gold-silver ratio is now roughly 80:1, which indicates that it’s underpriced by many historical measures. In the last twenty years it’s only been even cheaper relative to gold once. We’re at a level now where the last three times we reached this kind of ratio,

it really did market to bottom in the gold to silver ratio and silver comfortably outperformed to the outside.

I think there’s a couple reasons why it’s so cheap. In 2015 there was a bloodbath in industrial and energy commodities commodities. Gold has always been considered a pure monetary asset and store of wealth, but silver still has the quasi-monetary quasi-industrial status. So in environments with concerning rates of economic growth, it’s natural for silver to under perform.

But the smaller market means it will take less Dollars to move the price of silver. As a physical asset, silver is very attractive to hold. The future looks very good for silver in particular, even though it’s not getting the recognition that it should have.

SOUTH-EAST ASIA AND AUSTRALIA

In South-East Asia, there’s 3 billion people getting wealthier who understand the value of saving and investing. There’s misallocation of capital on a grand scale, especially in certain parts of China, but broadly speaking I’m bullish on the whole area.

If we bring it back to Australia, we’re facing some pretty strong headwinds in the next few years. The worst in the fall in commodity pricing is now behind us, but we will be in a softer real commodity environment for a few years.

“The investment in the money sector breaks 8% of GDP in Australia at one point. The long run average is closer to 2%.”

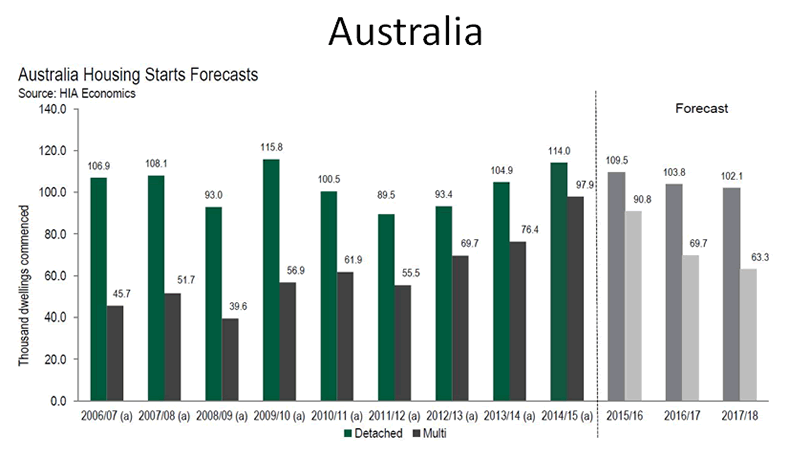

What’s kept the Australian economy going in the last few years was construction. The housing industry thinks that 2015 was the peak for home construction, and it’s going to ease up over the next three years.

Wages are also growing at less than the rate of inflation. While Australia has no sovereign debt issue, we have the high private sector indebtness in the world.

The average person in Australia has very little money in actual savings to spend, has never been more indebted, and is facing an uncertain employment outlook where their real wages are unlikely to keep pace with inflation. The majority of their financial assets are ring-fenced inside of superannuation.

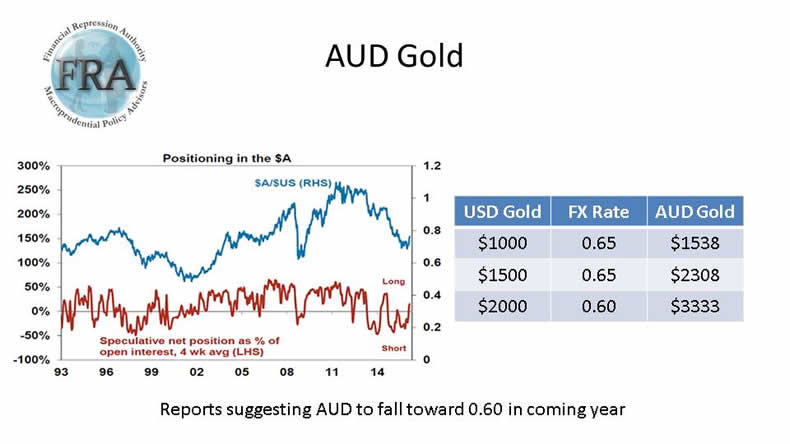

“We will continue to see declines in real incomes, recession-like conditions, and much lower interest rates from the RBA, at least 1.5% if not lower, between now and the middle of next year.”

BACK TO BULLION

This reasserts the importance of owning gold, even for Australian investors, because all the interest rates they’ll earn on cash will decline and fall below zero. Our stock market has an almost unprecedented sector concentration within our stock market where about 45% of the ASX 200 is concentrated in financials, VS 20% MSCI world average. This worked well in the last 25 years, but that cycle is starting to change now.

POSITIVE OUTLOOKS ON THE FUTURE

“Even if we don’t grow at a substantial rate, that doesn’t also mean we’re going to have an absolute collapse in GDP.”

During the global financial crisis, financial markets fell more than 50% but GDP fell around 2%.The value we put on our output plummeted, but the actual output fell by a small amount. There will not be any major greenshoots on the horizon that are going to help the global economy grow in any meaningful way.

China’s slowing down, and there are huge problems in Brazil and Russia. Europe and Japan are still disasters and even the US is slowing down. There will not be an uptick in global growth, but there is no major reason to panic.

“As an investor, it comes down to making sure the portfolio is well constructed to protect yourself against the overvaluation in financial assets and making sure you protect real wealth through this more challenging period.”

Abstract by: Annie Zhou a2zhou@ryerson.ca

Video Editor: Sarah Tung sarah.tung@ryerson.ca

Gordon T. Long

Publisher - LONGWave

Signup for notification of the next MACRO INSIGHTS

Request your FREE TWO MONTH TRIAL subscription of the Market Analytics and Technical Analysis (MATA) Report. No Obligations. No Credit Card.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that you are encouraged to confirm the facts on your own before making important investment commitments. © Copyright 2013 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or suggestions you receive from him.

Copyright © 2010-2016 Gordon T. Long

Gordon T Long Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.