Low Prices for Oil Cure Low Prices for Oil

Commodities / Crude Oil May 03, 2016 - 12:28 PM GMT Veteran investor Bob Moriarty discusses one company that is poised to benefit from the volatililty in the oil markets.

Veteran investor Bob Moriarty discusses one company that is poised to benefit from the volatililty in the oil markets.

As investors we tend to over-think our investments. Regardless of why oil went down, at some point someone had to figure out that it was too cheap and should be bought. It didn't make any difference why oil was so cheap, at some point it was a screaming buy.

That took place on Feb. 11 of this year as the near futures contract just about touched $26 a barrel. The ratio of oil to gold was a blistering 48:1, higher by 20% than during the Great Depression. Low prices cure low prices. In the next six weeks after the low, the price of oil went up over 70%. I'm perfectly comfortable saying we have seen the bottom.

The fastest money to be made in commodities and resource shares are in the initial bounce higher after a blowout low. We have seen that. But the safest money to be made is after a correction of that first move up. We have a correction in oil coming. I can't say if it will be today, tomorrow or a month from now but the rocket higher brought in a lot of bulls and the market will want to punish the latecomers.

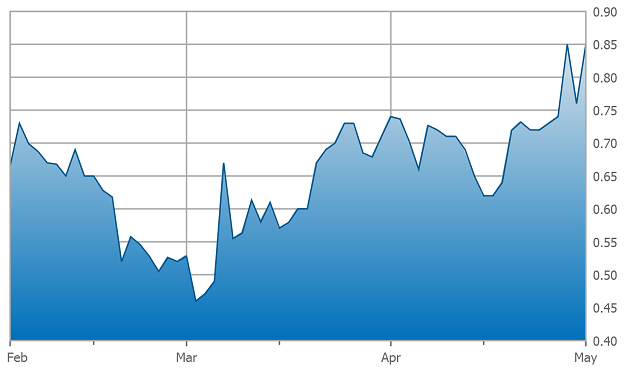

I wrote about an oil company with a giant unconventional oil field in West Texas last August. Oil was over $50 a barrel and the company's shares were almost $1 apiece. Oil plummeted and took the price of Torchlight Energy Resources Inc. (TRCH:NASDAQ) shares with it. Torchlight dropped to a low of $0.42 in early March. It has since recovered to $0.72.

Commodities hit a 5,000-year low when measured in constant dollar terms in January. All commodities, not just gold and oil, were on the sales table at blowout prices. They have completed a first leg up and are due a healthy correction, but all signals are go for launch. Oil will be higher a year from now, probably a lot higher. So will Torchlight.

In September Torchlight announced taking all the risk out of developing the field when it said it had signed a farm-in agreement providing for a partner to spend $50 million in development in the Wolfpenn/Orogrande field. Torchlight owns a 95% interest in the project measuring 168,000 acres with 1,300 feet of pay zone. If you use the metrics from the similar Delaware and Midland basins, the Orogrande project could yield 156 sections containing 4 to 6 million barrels per section. Torchlight's financial partner, Founders Oil and Gas, will contribute $50 million to development and at the end will own 50% of Torchlight's interest.

The deal with Founders gives us a metric with which we can measure the relative value of Torchlight simply based on what Founders was willing to pay. If Founders' 50% is worth more than $50 million and it has to be or it wouldn't have done the deal, then Torchlight's remaining 50% also is worth a minimum of $50 million. As I write, the market puts a value of $25.5 million on the company. Naturally I think it will go up a lot even if oil didn't go up as I believe it will.

On April 25, 2016, Torchlight announced starting to drill what they call the University Founders B-19 #1 well. Drilling will be complete in a few weeks. It's a vertical well intended to help make plans for the field development. Torchlight and Founders will need a lot of vertical wells to prove up the field so it really doesn't matter what the price of oil is today. We will need oil in the future, so low prices for oil today only mean their drilling and labor costs are far lower than they were a year or two ago and they have to drill anyway.

Torchlight is not a single trick pony. In early April it announced an agreement to purchase a 66.66% working interest in 12,000 acres in the Midland Basin. Its plan is to do exactly what it has done in the Orogrande project, farm out a partial interest to a larger company in exchange for financing the work.

Torchlight is a low-cost pure call on the price of oil. With excellent management in place and cash in the treasury, it is taking advantage of a disastrous market for others to increase its end potential.

I own shares bought at a higher price. I own shares bought lately and I have participated in a couple of PPs. I am biased. They are advertisers and I have a large vested interest in their success. Do your own due diligence.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I or my family own shares of the following companies mentioned in this interview: Torchlight Energy Resources Inc. My company has a financial relationship with the following companies mentioned in this interview: Torchlight Energy Resources Inc. I determined which companies would be included in this article based on my research and understanding of the sector. Statement and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Bob Moriarty was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Torchlight Energy Resources Inc. The companies mentioned in this interview were not involved in any aspect of the article preparation or editing so the expert could comment independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.