GOFO and Gold Prices

Commodities / Gold and Silver 2016 May 20, 2016 - 02:51 PM GMTBy: Arkadiusz_Sieron

The Gold Forward Offered Rate (GOFO) is the swap rate for a gold-to-U.S. dollar exchange. In other words, it is a rate at which someone is ready to lend gold on a swap basis against greenbacks (the benchmark used to be quoted by a few banks involved in the rate-setting process which were prepared to lend gold to each other). For example, if someone owns gold and wants to borrow U.S. dollars, he can use gold as collateral to secure the loan. The GOFO is the interest rate on that loan. Since gold is an excellent collateral (it’s portable and liquid), the GOFO rates used to be relatively small. Actually, certain rates were sometimes negative in what signaled high physical demand.

The Gold Forward Offered Rate (GOFO) is the swap rate for a gold-to-U.S. dollar exchange. In other words, it is a rate at which someone is ready to lend gold on a swap basis against greenbacks (the benchmark used to be quoted by a few banks involved in the rate-setting process which were prepared to lend gold to each other). For example, if someone owns gold and wants to borrow U.S. dollars, he can use gold as collateral to secure the loan. The GOFO is the interest rate on that loan. Since gold is an excellent collateral (it’s portable and liquid), the GOFO rates used to be relatively small. Actually, certain rates were sometimes negative in what signaled high physical demand.

The GOFO started to be quoted in 1989 to increase transparency in the market for borrowing gold. For decades, the LBMA has published GOFOs for one, two, three, six and twelve months each business day at 11.00 a.m. (GMT), serving as an international benchmark and the basis for the pricing of gold swaps, forwards and leases. Unfortunately, the GOFO was discontinued effectively since January 30th, 2015, as Deutsche Bank and Société Générale decided to leave the GOFO rate-setting process in October 2014. It does not mean that there are no longer swaps of gold against the U.S. dollars, but that the gold forward rate benchmark no longer exists (the GOFOs are now quoted individually and are available only to bank customers). Although the GOFO is no longer published, it is still worth understanding, because if we truly grasp the GOFO, we will also understand gold swaps, forwards and leases – the building blocks of the gold wholesale market.

Indeed, the GOFO resembles the gold forward rate and may be interpreted as the difference between the U.S. dollar interest rate (LIBOR) and the gold lease rate (GLR). In our example a central bank lends gold on swap against U.S. dollars – it essentially sells gold spot and buys gold forward. It is a forward swap that simulates lending (a gold loan collateralized with greenbacks). Let’s assume that the central bank owns gold that it wants to put up as collateral for a one year dollar loan, so it agrees with its dealer on a swap transaction. We can break down this transaction: dealer gives dollars to the central bank which invests them (receiving LIBOR) and borrows gold (paying GLR) to give it to the dealer. Therefore, the GOFO may be considered as the difference between the interest rate that could be earned on dollars (typically LIBOR) and the interest rate that could be earned on gold (GLR) – actually, it should not surprise us that the rate on a swap is the difference in the interest rates between the two assets being swapped.

Usually, the GOFO is positive, i.e. the interest on the dollar-denominated loans is higher than the GLR. In other words, if we lend gold and borrow greenbacks, we have to pay interest, since gold serves only as the collateral for borrowing U.S. dollars at a lower interest rate than one would have to pay for an unsecured loan. Because the GOFO resembles the gold forward rate, the price of gold for delivery in the future is usually higher than the spot price, i.e. there is contango in the gold market. However, sometimes the GOFO turns negative which implies backwardation in the gold forward price. Negative GOFO means that the urge to borrow gold is greater than the urge to borrow dollars, since the institutions are willing to pay interest to borrow gold against the U.S. dollars as collateral (in other words, gold is perceived as more valuable as something to hold than dollars are). Negative GOFO used to be a very rare phenomenon with a shortage of metal liquidity for leasing (being a bullish signal), however since the introduction of ZIRP, GOFO has gone negative much more often and for longer periods.

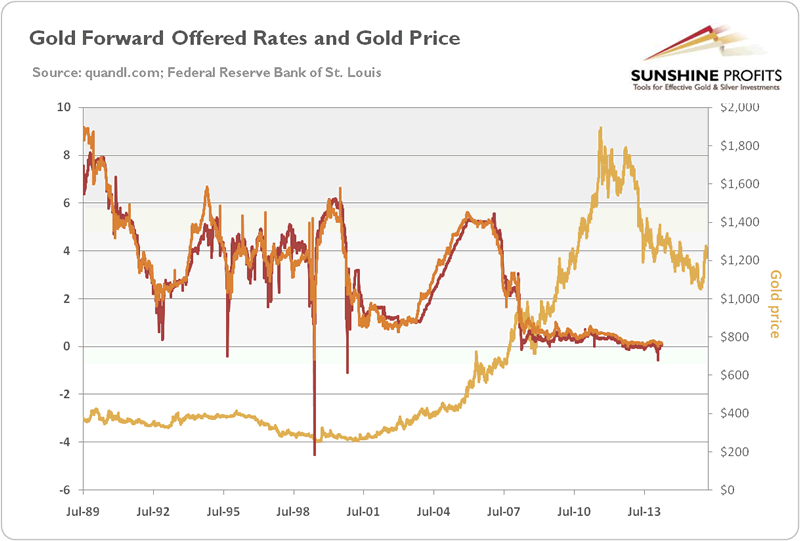

Indeed, as one can see in the chart below, from 1989 to the 2010s, GOFO turned negative only a few times for a very short period, sometimes along with the bottom of gold price. For example, in early 2001, the negative GOFO coincided with the bottom of the bear cycle in the gold market. Similarly, in 2008, the negative GOFO (resulting from the flight to gold as a safe-haven) appeared almost exactly at the bottom of the 2008 gold correction. However, in the current zero interest rate environment, the negative GOFO is no longer a reliable bullish indicator.

Chart 1: The price of gold (yellow line, right axis, London P.M Fix), 1-month GOFO (red line, left axis, in %) and 12-months GOFO (orange line, left axis, in %) from July 1989 to January 2015.

Summing up, the GOFO is the swap rate for a gold-to-U.S. dollar exchange, making it one of the most important gold market-related interest rates. In February 2015, the London Bullion Market Association stopped publishing the benchmark for the GOFO, which decreased transparency in the gold market. However, the GOFO still contributes to better understanding of the wholesale gold market. Resembling the gold forward rate, the GOFO links to the GLD and may be used to assess whether the gold market is in contango or backwardation. In the past, negative GOFO tended to precede rallies in the gold price, but the ZIRP reduced its role as a bullish indicator.

If you enjoyed the above analysis and would you like to know more about the gold lending and swap market, we invite you to read the May Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

If you enjoyed the above analysis and would you like to know more about the structure of the gold market, we invite you to read the March Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.