Gold And Silver 11th Hour: Globalists 10 v People 0

Commodities / Gold and Silver 2016 May 21, 2016 - 12:54 PM GMTBy: Michael_Noonan

At the proverbial 11th hour, the globalists have a shut out going for themselves with people unable to mount any meaningful opposition. While the word “hour” is referenced, the time could be measured in months, even a few more years. Whatever the duration is, the time frame continues to shorten.

At the proverbial 11th hour, the globalists have a shut out going for themselves with people unable to mount any meaningful opposition. While the word “hour” is referenced, the time could be measured in months, even a few more years. Whatever the duration is, the time frame continues to shorten.

Rather than provide supply/demand facts for gold and silver, amply illustrated with lots of graphs and charts, provide information on Commitment of Traders data, and so much more, we prefer to engage in other situations that may be having more of an effect as to why gold and silver prices are not rallying to price levels that would reflect the true supply/ demand circumstances. These are the more pragmatic reasons for owning and holding either or both physical metals.

Unseen and unacknowledged forces are keeping a manipulated lid on gold and silver, the US being the primary instigator, [always acting was the behest of the globalists that are actually in charge]. So we point to other areas most people do not associate with why gold and silver are the only commodities that have not been price adjusted for so many decades to account for changes that would otherwise impact both metals.

The word patriot is not defined in Black’s Law Dictionary, but pauper is. Moneychangers have no interest in patriots but paupers are grist for keeping the masses suppressed, used as examples for those considering acting in one’s own best interest, which, of course, can only mean acting against government interest.

The last well-known patriot in the United States was Edward Snowden, a notion that may shock the senses of those who choose not to think for themselves. a patriot is one who both supports and defends his/her country against enemies. Who, or what has done more harm to this country than the federal government. Snowden made public, and did an immense public service, by exposing the unprecedented and totally kept secret mass surveillance of every American that has a computer, cell phone, e-mail, to the extent that there is no privacy whatsoever, none!

Why all of the massive spying? National security, protection from the terrorists, etc, etc.

How many terrorists have been caught as of result of all of the spying, to date? None, nil, nada, zero, zip. Quite an impressive scorecard for the federal government that serves the interests of the globalists and not the American public. Remember, the globalists had all American citizens become enemies of the federal government [a corporation] via the 1933 Amendment to the Trading With The Enemy Act of 1917.

This Act originally excluded citizens of the United States, but in the Act of March 9, 1933, Section 2 amended this to include “any person within the United States or any place subject to the jurisdiction thereof”.

Here is another piece of information the federal government conveniently chooses not to make the public aware of the fact that the United States has been in a state of declared national emergency since the elites forced the US into bankruptcy on 9 March 1933. Every president, upon being sworn in, has to formally renew the national emergency. Why? When under a state of national emergency:

the President may: seize property; organize and control the means of

production; seize commodities; assign military forces abroad; institute martial law; seize and control all transportation and communication; regulate the operation of private enterprise; restrict travel;

and… control the lives of all American citizens”

Oh, and one more little thing, under a declared state of national emergency, the Constitution is suspended, has no effect. Theses are the kind of pesky details the globalist- controlled federal government does not want the people to know. Just go about your business.

Does anyone think the current war on cash is not without covert purpose?

Fewer and fewer people use cash for everyday transactions, preferring using debt, instead: credit cards, digital bank paper transactions, [checking accounts, where no real money is ever used]. Now, the EU wants to cease printing the €500 note, and in the US, cease printing the $100 fiat Federal Reserve Note, the most widely used fiat currency in the world.

One oft-repeated excuse is that terrorists use cash. Yet, there has been no call for a ban on cell phones, air travel, hotels, etc, also used by terrorists. Let us call it what it is, more control by government over the private lives of people. Moving to a cashless society means tax evasion will take a huge hit. There would be a paper trail for everything, and the government can, and will monitor everything, most assuredly by threat for not using a paper trail to memorialize all transaction. Privacy, or what is left of it, goes out the window.

Introducing negative rates [essentially a hidden tax], means people will be charged to carry bank balances. More people will simply take their fiat money out of the bank rather than incur a charge. Going cashless, there is no “money” to be taken out, and the suckers captured depositors will become more exposed to greater negative rates.

What happens of the government decides it does not like your politics of believes not aligned with government mainstream dictates. “Sorry. There seems to be a problem with your digital bank account, but not to worry, “we” are working on it. Or how about hackers gaining access to bank accounts? That already goes on with large central bank holdings.

Need we point out this could never happen with gold and silver owned and personally held by you? Precious metals are a nemesis for central bankers/government because owners of

PMs are financially independent and have no need to rely on government.

Everyone should be paying attention to what is going on in Venezuela. It is an example of what can happen when government fails, money fails, everything fails. Something like this can happen in your own neighborhood, to some degree and at some point. Watch this five-minute video. There are two things we would like to point out.

What you see is the not as well-trained or coordinated Venezuela national guard. In the US, the police are now paramilitary forces and better armed than most actual military units. Even without civil unrest to the degree depicted below, cops are routinely shooting civilians first and asking questions later. Under more dire conditions, cops will become considerably more violent towards people.

Secondly, the Venezuelan population is unarmed. This is the main reason why Obama has pushed so hard for national gun control. They [the globalists] want guns out of the hands of people. A well-armed American public is one reason why there has not been even greater government control forced upon civilians.

This is not a pretty picture, but it could be a preview of your own neighborhood in the future.

Meanwhile, here is a preview of what one may expect tomorrow. Parts of it are graphically brutal.

There are countless stories and totally [seemingly]unrelated situations like these that offer the greatest reason[s] for buying and personally holding gold and silver. How important are the myriad stories about record coin sales, more Chinese buying gold, etc, etc, etc, as compared to events like these going on all over the world. We did not even bring up the European immigrant problem purposefully created by the globalists to destabilize the EU and make a One World Order takeover more acceptable to the bruised and abused masses.

We sometimes get criticism for not being more bullish on the metals, always wanting to see confirmation. Gold and silver appear to be at a turning point. The probability of last November/December lows being a bottom keeps increasing. While decreasing in its probability, one more downside washout of those lows still exists, however small the potential may seem.

There has been clear change in developing market activity that is favorable for gold and silver, both having the best and strongest recent rally since the 2011 highs. The rallies were also accompanied by the strongest volume increases over the past few year, another positive sign.

For us, charts are the proverbial picture being worth 1,000 words for they convey what the actual market is doing in real-time, irrespective of the [un]related news on any given day.

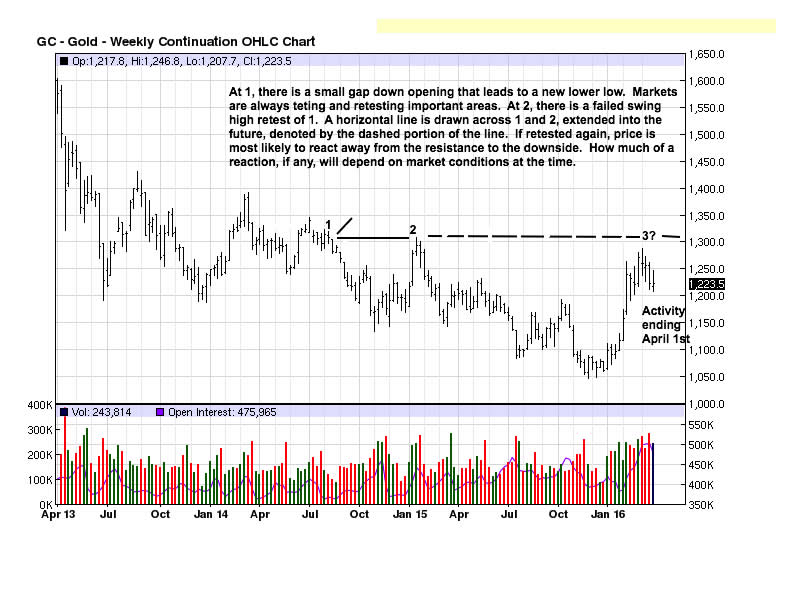

For the weekly gold and silver charts, we will first show activity ending at the beginning of April. The purpose is to demonstrate how past activity can, and does relate to the future, which them becomes present tense.

Points 1 and 2 are the reasons for expecting some kind of future reaction at 3, whenever price reaches that level. It is a way to be prepared at higher probability reaction areas.

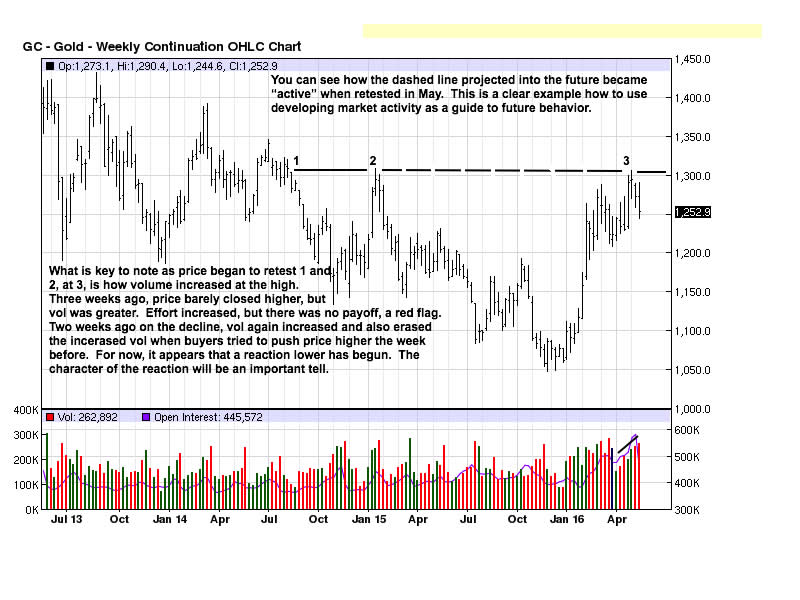

The potential area at 3 became reality the first week in May. The question then became, is price absorbing to go higher, or will it fail, at least temporarily, and react lower. It has reacted. The information from increasing volume at the 1300 level was not totally clear until the last 2 trading weeks, and really not until the very last week. See daily.

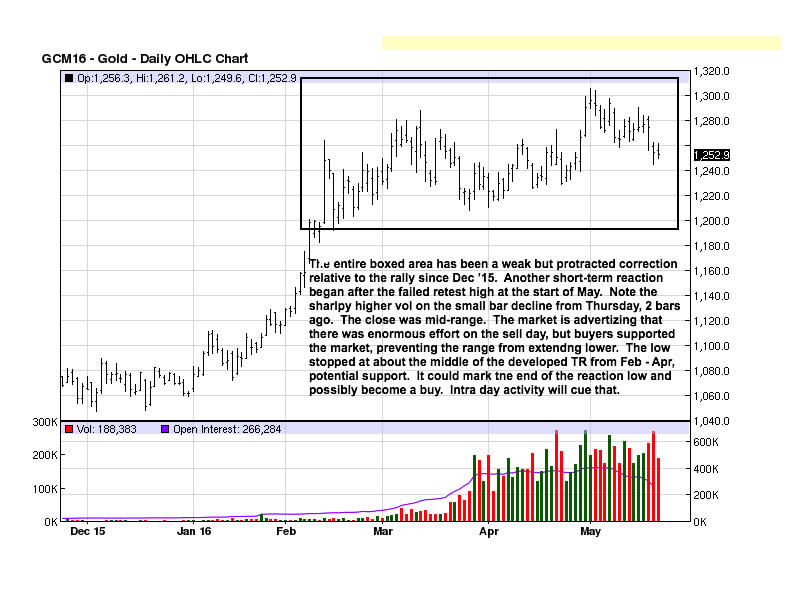

The small range bar at the high was a red flag potential because price stalled. The picture was not clear because there was no real reaction lower, and price could still be absorbing sellers in preparation to rally above 1300. The last five TDs indicated a correction would develop. Now, it is a question of how much? Last Thursday’s high volume, coupled with the small range and just above mid-bar close says buyers were more dominant than sellers,

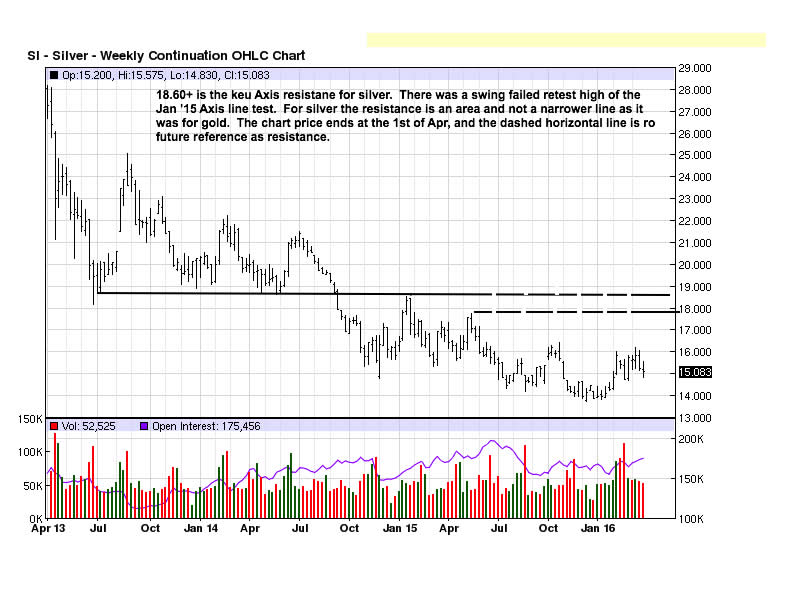

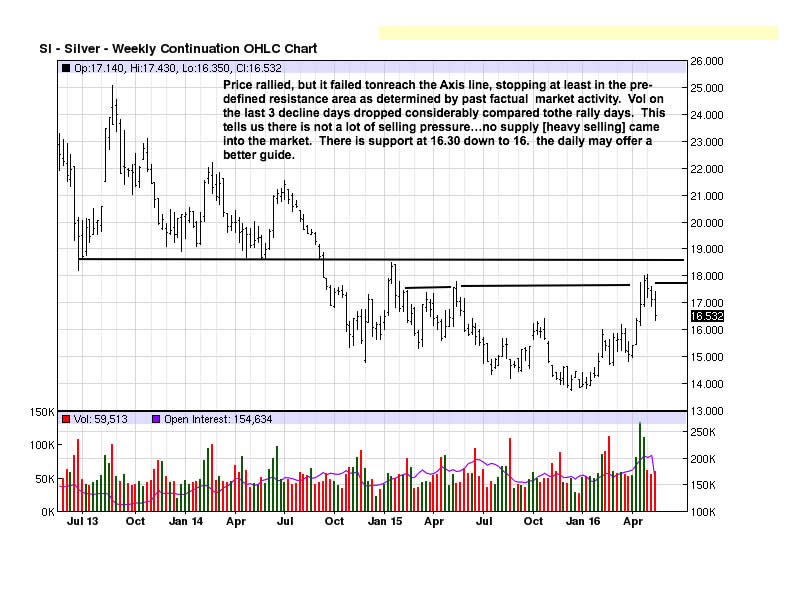

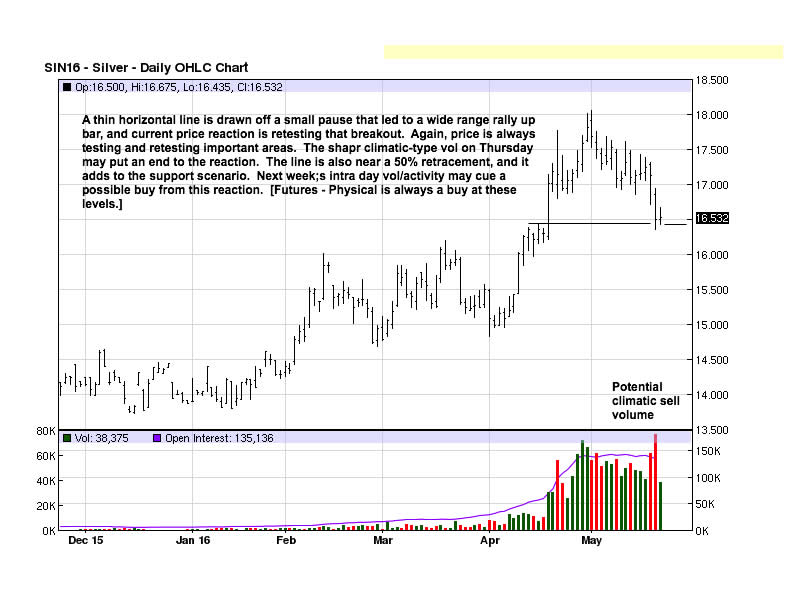

With silver, the potential for future resistance was an area and not a single price level as it was for gold. Still, it allows one to be prepared for a possible reaction based on past price activity. Monitoring the market in this fashion eliminates the folly of “predicting,” always an exercise in futility. Stay with facts, not conjecture and ego.

The upper horizontal bar would have been more formidable to overcome, but price stopped at the lower bar, an indication that silver is still not quite as structurally strong as gold. Nonetheless, silver continues to do slightly better than gold in performance.

Next week could provide a limited risk buy opportunity, as outlined in the chart comments. Again, any buy, sell, avoid decision is a function of past market activity that is factual, and current price volume behavior is also a factual relationship. The combination may be a useful guide to take action, if warranted.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.