Bitcoin Price Close to $700

Currencies / Bitcoin Jun 15, 2016 - 04:48 AM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Bitcoin is on the move up. New “reasons” are being dug up for the appreciation. In a Bloomberg article, we read:

Bitcoin surged to a two-year high amid expectations supply of the digital currency will shrink next month.

The cryptocurrency rallied to $696.5 on Monday in Hong Kong, the highest since February 2014, according to data compiled by Bloomberg. It was trading at $689.23 as of 3:50 p.m. in Hong Kong, up 19 percent from Friday.

Profits from mining bitcoins will be reduced in July, a process that’s written into the code to limit supply, according to Chinese exchanges OKCoin and Huobi. Increased attention from venture capitalists and banks on blockchain, the technology of digital ledgers, has boosted bitcoin’s legitimacy, Jack C. Liu, chief strategy officer at OKCoin, said in Hong Kong.

We have read stories on how China was behind the move. Now, China is only part of the story with the mining mechanics featured more prominently. Actually, the “mining reward” story might not be as credible as would be suggested in recent commentaries. As the rewards for Bitcoin miners will be halved, it might actually make more sense for miners to intensify their processes now rather than later. This would mean more supply now rather than later and possibly downward pressure on prices now rather than later. This is now what we’ve seen recently. This might mean that any downward pressure has been drowned out by the demand for coins.

For now, let’s focus on the charts.

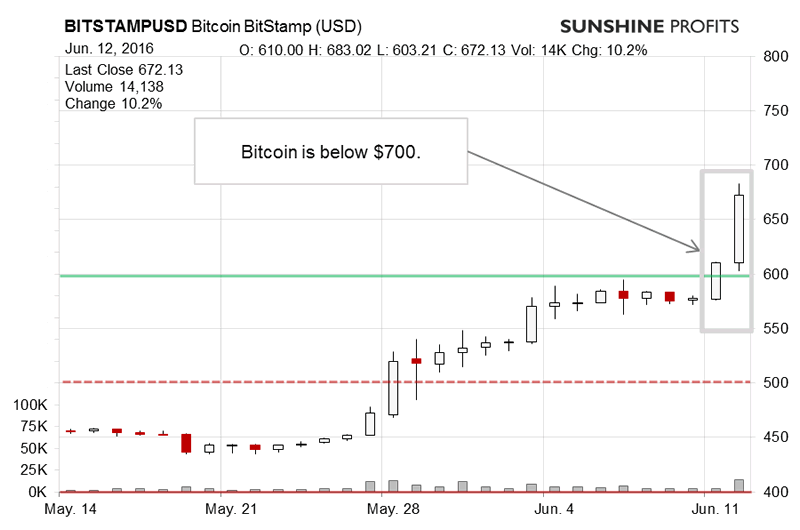

On BitStamp, we saw yet another move to the upside. Bitcoin went up on significant volume and the magnitude of the move mean that the currency is now above $700. Recall our recent comments:

(…) we saw a decisive move to the upside over two days and on visibly larger volume – Friday and Saturday. Sunday was a day of action suggesting a possible reversal. The volume was weaker which also supported the reversal hint. Today, however, we’ve seen some appreciation, which is not a clear sign of a move down. From a short-term point of view, we are now in overbought territory, after a day of a possible reversal followed by appreciation on decreased volume. This is a bearish indication. For the time being, the fact that we are above the November 2015 high still makes the situation relatively risky. If we see a move back below this level, we might re-renter short positions.

The additional two days of appreciation, followed by similar action today make the situation more bullish. On the other hand, the extremely overbought situation still has bearish implications for Bitcoin.

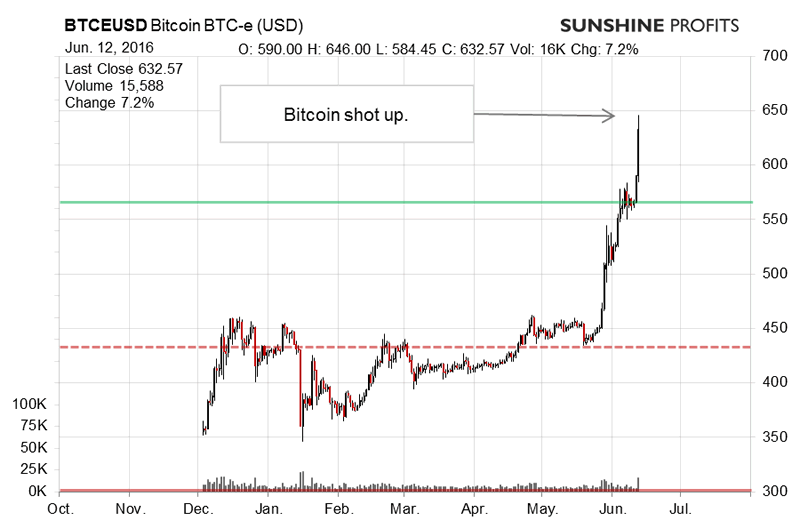

On the long-term BTC-e chart, we see that Bitcoin didn’t really reach $700. Our previous remarks:

One additional indication pointing to lower prices in the short-term is the extremely overbought status based on the RSI. The indicator went above 85 and now it is moving down. It is possible that we will see a downswing in the next couple of days. The situation is not yet clear, so please stay tuned.

Our recent comments remain up to date as far as the extremely overbought nature of the market is concerned. The RSI is very close to where it was in November 2015. This might mean that we are at a local top. If we see a move down and the RSI going below 70, this might be a confirmation. At the moment, going short seems risky as there might still be momentum to the upside.

Summing up, in our opinion no speculative short positions are suggested.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.