Words Still Mean Things – Brexit With Graham Mehl

ElectionOracle / EU_Referendum Jun 20, 2016 - 06:17 PM GMTBy: Andy_Sutton

Last time our piece focused on what has come to be known as 'escape velocity' and how an aeronautical term has come to be used to provide some boost to the perception of the USEconomy when in fact it actually has noelocity whatsoever. This week we're going to take a look at another term, and even though it is an amalgam of two words, it still has profound meaning.

Last time our piece focused on what has come to be known as 'escape velocity' and how an aeronautical term has come to be used to provide some boost to the perception of the USEconomy when in fact it actually has noelocity whatsoever. This week we're going to take a look at another term, and even though it is an amalgam of two words, it still has profound meaning.

It would appear, at least according to the media, that few in England actually know much about the idea of Brexit and what it means for them, their families, their country, and their way of life. We surmise that even fewer Americans understand the ramifications it might have for the US.

Brexit, in short, stands for 'Britain Exit'. Exit from what? Exit from the European Union. Britain is kind of an anomaly in many ways regarding its membership in the EU. For one, Britain still has its own currency, the Pound. Britain also has some geographic separation from the EU as well and is still a very strong banking hub, rivaling that of New York, Brussels and the BRICS Bank.

The purpose of this paper is not to providenalysis of whether or not Britain should exit (although we both believe it should AND whole failed EU be dissolvedr that matter), but to take a look at some of the factors driving the referendum, perceptions and connotations surrounding the term Brexit, and look at the fact that if this happens it would be akin to a major US state seceding from the (now) forced union that is the United States. The economic ramifications are far reaching, and as yet not quantifiable, but we'll likely do a follow-up and take a look at what we might be able to expect with regards to the financial markets and the global economy. We'll say up front that we don't believe a vote to exit the EU is equivalent to the end of the world financially or economically, even if the establishment allows the separation to occur following an affirmative vote.

Along those lines, we've heard those in favor of Brexit called everything from anarchists to traitors, worthy of execution by the lapdog establishment press. The press in England is a tad more 'free' than here in the US, but will still fall into line After all, when required even though more renegade investigative journalism is permitted. this provides the illusion of a 'free' press. The labeling and marginalization of people calling for Brexit in England runs parallel to the movement in the US that calls for a return of the federal government to its proper role and for the states to assume control in many areas where the feds have intruded.

Once again, words mean things. The terms traitor and anarchist conjure up strong images of ignorant masses or those sneaking around after dark, conducting clandestine business or selling secrets. Edward Snowden was called a traitor by the US establishment. To others who are in favor of more transparency in government, Snowden was and is hailed as a hero. The same goes for Julian Assange. Unfortunately, this is another one of those situations where perception is going to be guided by biases and what side of a particular fence one's allegiances lie.

But at its heart, Brexit is basically a secession movement. It is similar to what preceded the Civil War in America. Oddly, the reasons behind both secession movements are partially similar, although the history books certainly don't come close to the real reasons in the instance of the American Civil War. Regardless of whether or not Brexit actually takes place, we are sure the history books will revise events again as well. A secession is an untidy affair to be sure. It is a divorce on a national level. It is a breaking of bonds, a dissolution, a separation, a tearing apart.

The Reasons for the Referendum

It is important to note that not being the aggrieved – in this case, British citizens – it is sometimes dangerous to analyze the motives of others. This case is no different. It is important to note that the European Union (among many other things) was originally organized as a trading bloc. Of primary concern to many proponents of Brexit is that other world bodies have replaced and stood in parallel with the EU with regards to making trading rules. Among these are the ISO and the WTO.

The result in this instance is a diluted benefit to remaining in what is basically a regional trading union when there are already global rules and guidelines in place that supersede those of the EU. Remember, the goal was always globalism. Entities like the EU and the long-desired North American Union are simply steps along a pathway. The point here is not only does England need a Brexit, it needs an exit from globalism as wells do the rest of us for that matter.

A good example of the ‘copycatting’ the EU has been continuously guilty of is the adoption of Codex Alimentarius or ‘food code’. This was an EU regulation that was grafted from the WTO and put hefty regulations on British food products.

Inefficiencies Galore

From a strictly academic point of view, which happens to coincide with the views of most pro-Brexit people, continued membership in the EU results in many inefficiencies. The rationale given upon proposal of the union in the firstas that instead of functioning as individual economic actors, members of the union would be able to achieve something along the lines of economies of scale. Not by purchasing or manufacturing in bulk, but merely by acting as group. The thought was that the EU could come up with its own rules that would benefit members and trump those of the WTO, IRC, OECD, and ISO – to name a few. It should be pretty easy to see that the more these organizations are involved in dictating policy, the less efficient the resulting policy becomes.

The inefficiencies, however, don’t end with trade. Some of the most intrusive of the EU’s rules come in the area of financial services. Utterly shocking, right? From the Basel III Accord to the Bank for International Settlements and IMF and their rules on banking and bailouts alone, it is obvious that more isn’t merrier. Then there is the matter of the bail-in. Keep in mind that despite the idea of a Brexit that it was the Bank of England – with only the FDIC as a co-signatory - that crafted one of the first whitepapers describing and illustrating the bail-in resolution mechanism. So even if a Brexit occurs, there are still issues involved that will need to be addressed. The biggest problem is that the countries of the world have all had a bit of their sovereignty taken (and freely given away) over the past two decades as the fire of globalization swept the planet.

The biggest downside to the Brexit referendum is the unknown of how much life for the average citizen will actually change. There will certainly be some pain, especially in the short-term. On the other hand, there is no progress without pain and sacrifice. This referendum is happening because a country has been overwhelmed. Initiatives like Brexit don't happen for no reason. People as a group are resistant to change and drastic change requires drastic circumstances. This is precisely that which faces the British people as they go to the polls on June 23rd. We are more and more convinced that even if Brexit does occur that what will result is a hybrid of sorts and there will be more divorcing from the globalist entities listed above (and others) necessary if Britain is going to truly regain its sovereignty.

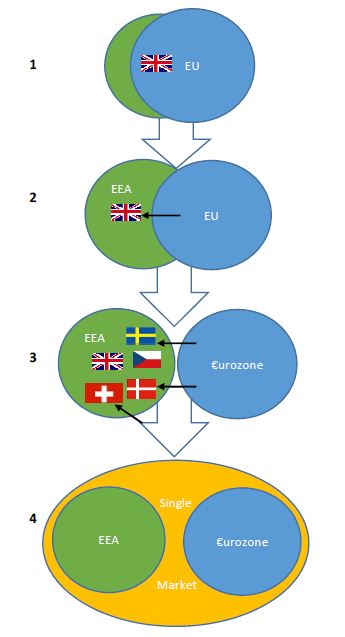

The only real reason Britain can even consider a Eurozone exit is because it has not ceded its currency to the union. This alone should be a huge lesson for the next Greece that runs towards international cohesiveness and the embracing of global rule. So, given that Britain can exit, and combined with what we’ve already outlined, is the problem that the EU has ripped off many a think tank and group for its own failed policies. Sometimes to the letter. Stepping away from the twisted carnage of the EU is only the first step. To be truly free, Britain will have to learn to once again operate as a sovereign entity. How will a globalized world accept such a move? Frankly it shouldn’t matter what the world thinks, but it will. This is why we foresee a hybrid. Even the pro-Brexit Adam Smith Institute is advocating for Great Britain to remain festooned to its former EU partners post Brexit in the form of the European Economic Area or EEA.

The EEA pre-dated the formation of the EU is moreymbolic of cooperation and flow of people, product, and capital than an operating agreement. It makes no sense to ship a product from halfway around the world if your neighbor can make it for the same cost, etc. Basically, the Adam Smith Institute’s position pro-EEA while being pro Brexit on the foundation that the EU is nothing more than a useless and intrusive layer of government that does little of its own and essentially rips off other global governing entities for its policies and procedures.

Breaking Entanglements

The best way to describe all of these entanglements is to liken it to an onion. There are many layers. Brexit and the EU are the first layer, but there are others. The aforementioned EEA would be the next layer. Participation in the IMF/World bank scam is another layer. Codex Alimentarius is yet another layer and so forth. Then there are other layers that aren’t so much economic as geopolitical in nature like NATO. Words do mean things and nationalism isn’t a bad thing, nor should it be construed as meaning anything more than it does. The same goes for cooperation. We’ve been conditioned to believe that this is an all or nothing proposition; that we have globalism or we freeze out in the cold. The US had trading partners long before globalism even became a buzzword. ‘Favored nation’ status was the terms used pre-globalism. Is there anything wrong with two sovereign nations sitting down and saying ‘We are good at this, you are good at that; rather than both of us trying to do things we aren’t good at, let’s work together’. Cooperation doesn’t mean total domination, but sadly, that is what it’s become of late.

When nations ‘cooperate’ and their citizens lose liberties or their life savings and economic freedom (or both), that is not cooperation. It is collusion. It is robbery. It is graft. It is anything but cooperation in and for the best interests of the citizens.

Immigration – A Trigger Point?

The eight-hundred-pound elephant in the corner that nobody in the media seems to want to talk about is immigration. Our colleague Nadeem Walayat in the UK constructed an outstanding analysis of what we feel personally is the triggering point. Put frankly, Britain is being overwhelmed with immigrants. Such is the same in America and elsewhere in what were formerly regarded as ‘First World’ countries. While this is probably the worst time to try to introduce immigration to any discussion, we are not interested in political correctness and thankfully there are some others who feel the same way and we thank Nadeem for his courage. The charts we’re including below are his and his analysis is hyperlinked above.

Much of the problem comes from the fact that membership in the EU allows free movement of people, products, and capital. So it stands to reason that people in the debt-ridden, economically gutted nations of the EU would look to move to areas where they feel they’ll get a better deal. Or maybe they’re looking for handouts. Regardless of why, England is now flooded with immigrants from all over the EU – and elsewhere. The only way to stop it is quitting the EU. That the immigration issue trumps the other intrusions by the EU – a group high on the euphoria of control and central planning – is instructive. The immigration situation has caused myriad problems in England and it is hitting people in their wallets. That is the best way to get anyone’s attention. It is also ironic, that the EU might eventually be killed by its own monster. In exerting stranglehold economic control over its member nation-states, the ‘freedom’ it does allow is in the worst context possible: it has sent the message to every one of its members that those members have NO control over their borders. Does this sound familiar to the Americans reading this piece?

Uncontrolled immigration is one of the tools the globalists have been deploying to destroy the sovereignty of nations for decades now and it is getting worse by the year. Throw in the threat of terrorism and it is an act of lunacy to suggest that any nation have a completely open door, no questions asked policy. The internal economic workings of nations are complicated and there is a delicate balance when it comes to poverty and prosperity. The dumping of people by the hundreds of thousands a year into England has put a tremendous strain on the internal balance.

Add to the above the fact that a good portion of these people are immediately getting a subsidy for working called ‘In Work Benefits’ where a low, but working family receives government subsidies that total far in excess of the wages earned. We suppose this is slightly better than America, where people are paid to immigrate, then do nothing, however, neither system is sustainable. These various flavors of public handouts all fall into the ‘to each according to his needs from each according to his means’ mantra of pure socialism.

Conclusions

In conclusion, Brexit is a big deal and even as the vote looms, the establishment is scheming to try to derail the vote. A petition is being circulated for signatures stating the vote should be postponed because of the murder of a British MP late last week. Brexit, even more than a referendum on the EU, is a referendum on socialism since that is what the EU anirtually all of the alphabet soup groups mentioned in this article are pushing with their policies, edicts, and proclamations. Regardless of how things turn out we are hopeful that the world will take notice and people across the globe will force referendums on their own countries’ involvement with socialism and the kleptocratic global ‘authorities’. The American freedom documents state that authority to govern is derived from the consent of the governed. That principle isn’t true just in the United States and Brexit is putting the global establishment on notice. A truly historic week is shaping up. We encourage all British citizens to ignore the polls and the media. It is obvious there is much opinion shaping going on right now by the establishment. Use your own minds and decide for yourselves.

By Andy Sutton

http://www.andysutton.com

Andy Sutton is the former Chief Market Strategist for Sutton & Associates. While no longer involved in the investment community, Andy continues to perform his own research and acts as a freelance writer, publishing occasional ‘My Two Cents’ articles. Andy also maintains a blog called ‘Extemporania’ at http://www.andysutton.com/blog.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.