Correction in Bitcoin Price?

Currencies / Bitcoin Jul 06, 2016 - 06:37 AM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

The road to a Bitcoin ETF has proved to be pretty challenging for the Winklevoss twins. First mentioned in 2013, the ETF has yet to be approved by the SEC, more than 2 years after the initial filing. In the recent days, the filing was amended to change the exchange the ETF would be traded on. On the Forbes website, we read:

In their three-year-long quest to offer a Bitcoin ETF, twin brothers Cameron and Tyler Winklevoss made several amendments to their regulatory filing with the Securities and Exchange Commission Wednesday.

After initially deciding to list the proposed Winklevoss Bitcoin Trust (which would go by the ticker symbol COIN) on Nasdaq, they’ve switched to BATS Global Markets, which has become a popular choice for newly launched ETFs and is known for a having technologically advanced exchange.

The amended filing also named the Winklevoss’s Gemini Trust Company as the custodian for the bitcoin held by the Trust, and set the value for the Trust’s bitcoin at the 4pm Eastern Time spot price each day on the Gemini exchange.

The main piece of news is that the twins have switched their preferred exchange from Nasdaq to BATS, which might make it easier for them to launch the ETF as the exchange is popular among ETF providers. It is unclear whether the Winklevosses decided to change the venue on their own initiative or some kind of suggestion was put forward by SEC officials. One way or another, that kind of filing after a lengthy period of silence (the previous amendment is dated Dec. 2014) might be indicative of some kind of action taking place behind closed doors. If this is true, we might finally see the ETF on track, and the whole process might gain some speed.

For now, let’s focus on the charts.

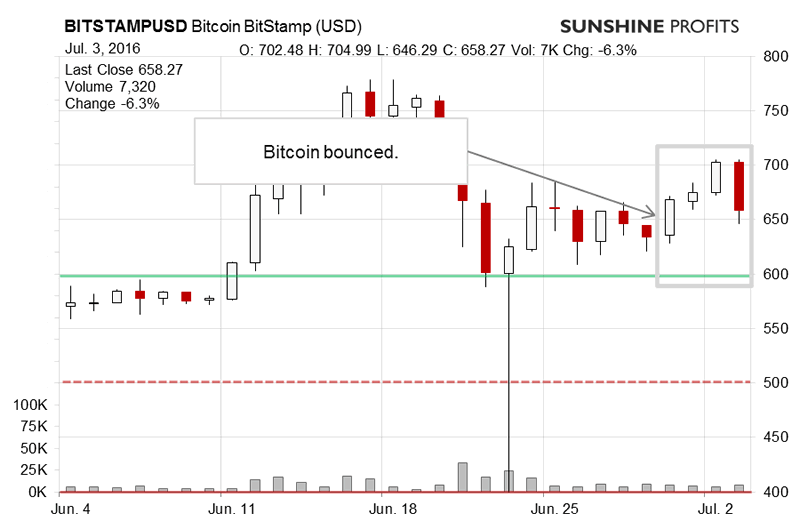

On BitStamp, we saw a bounce to the upside Thursday-Saturday. This was, however, followed by a relatively strong downswing yesterday. Recall our previous comments:

(…) we saw a decisive move to the upside over two days and on visibly larger volume – Friday and Saturday. Sunday was a day of action suggesting a possible reversal. The volume was weaker which also supported the reversal hint. Today, however, we’ve seen some appreciation, which is not a clear sign of a move down. From a short-term point of view, we are now in overbought territory, after a day of a possible reversal followed by appreciation on decreased volume. This is a bearish indication. For the time being, the fact that we are above the November 2015 high still makes the situation relatively risky. If we see a move back below this level, we might re-renter short positions.

Today, we’ve seen a move up (this is written around 11:30 a.m. ET). This doesn’t necessarily change the situation. The volume today has been lower than it was during the previous moves up. This is a moderately bearish indication. The RSI is now almost as overbought as it was in early November 2015. The situation is not yet bearish enough to get on the bearish side of the market.

The main difference now is that the market has put some time between the current price and the recent high without moving higher. This seems a bearish indication as Bitcoin hasn’t continued its march to the upside. On the other hand, the stagnation period is one with decreased volume. This might actually overturn the bearish conclusion. The picture is quite cloudy at the moment.

With the following swing to the upside being not particularly strong, we have a bearish hint. Additionally, Bitcoin failed to close far from its open on Saturday and moved down yesterday. This, too, are bearish hints.

The recent move to the upside weakens the previous bearish hints. On the other hand, the depreciation yesterday is a bearish event and the volume on which the move took place was higher than the volume during the upswing. All of this means that we are back to a cloudy picture.

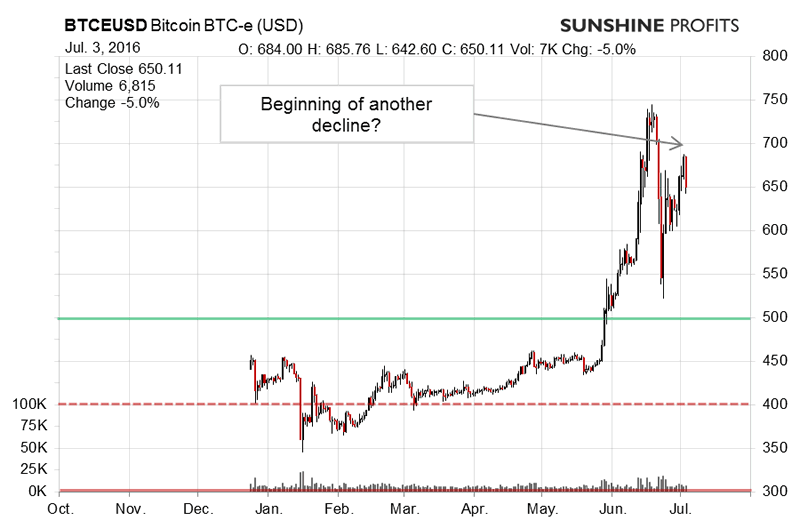

On the long-term BTC-e chart, we see a quite interesting situation. We see a strong rally, a sharp decline, and a bounce to the upside followed by a day of depreciation. Recall our previous comments:

We definitely saw a confirmation of a move to the downside. Both the magnitude and the volume of the move to the downside have been relatively significant. In fact, the volume on Tuesday, the second day of the decline and the first day of violent action, was the highest since January and visibly higher than on any of the days of the recent rally. Actually, the main question now is if the move hasn’t exhausted itself already. Our take is that it hasn’t as the RSI is still above 30 and we would like it to drop below this level before considering the situation oversold. We might see a pullback, however, in our opinion the situation remains bearish.

We actually saw a pullback coinciding with the Brexit vote. The action after the pullback has been moderately to the downside. It would seem now that the recent bounce up might have been a corrective upswing within a decline. This might be even truer given the fact that Brexit might have contributed to the swing up. As such, the situation now is still bearish, in spite of the recent upswing. On top of that, the RSI is still above 30, suggesting we haven’t hit oversold levels yet and there might be room for decline.

There’s still room for decline and we are still leaning toward the opinion that the next strong move will be to the downside. The action we see now is similar to what we saw back in 2013 and 2014 – a strong rally, sharp decline and a bounce up. Back then the action was followed by a lengthy period of depreciation. This doesn’t have to be the case now, but it might be a bearish hint. At present, we would prefer to see some more depreciation. Possibly even one day could do, depending on the magnitude of the move. Stay tuned.

Summing up, in our opinion no speculative short positions are favorable at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.