Gold - Wonderland

Commodities / Gold and Silver 2016 Jul 11, 2016 - 05:34 PM GMTBy: Gary_Tanashian

“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?” –Alice in Wonderland

“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn’t. And contrary wise, what is, it wouldn’t be. And what it wouldn’t be, it would. You see?” –Alice in Wonderland

Silver out performs gold as both rise with Treasury bonds, which are in turn rising with stocks, as Junk bonds hit new recovery highs while USD remains firm as inflation expectations are out of the picture. This is highly atypical, maybe even unprecedented.

Some, deeply dug into their particular disciplines and biases, might say it is dysfunctional, as this backdrop simply does not make sense using conventional methods of analysis. Why again did I name this service Notes From the Rabbit Hole?

When the S&P 500 was robo rising month after month, year after year as it did from 2011 to 2015, you did not need the market report with the funny name because all was linear and as it should be. The same actually, could be said for gold. It was linear and as it should be in its relentless downtrend. Casino patrons simply ride the trends!

But today things are making sense simply because we don’t have a need to make them make sense as linear thinkers would do; we go with the indicators and charts.

As I watch the macro burp up all kinds of paradoxes and inconsistencies, I can’t help thinking back to the day that the ‘Hero’ announced Operation Twist, which in turn got me announcing “they are painting the macro”. When Ben Bernanke took the bold step into the great unknown of extreme and unconventional policy I felt the markets had been disconnected from commonly accepted wisdom maybe not for good, but for as long as the system and its current modes of operation are in effect.

To review, Operation Twist forced changes upon the macro because it “sanitized” (the Fed’s actual word for it) inflation expectations right out of the picture. The mechanics of this sanitization were the Fed selling short-term Treasury bonds (putting upward pressure on short-term yields) while simultaneously buying long-term Treasury bonds (putting downward pressure on long-term yields). The yield curve was changed from out of control (up) to in control (and down trending). From the Calculated Risk blog (http://www.calculatedriskblog.com/)…

September 21, 2011: “Operation Twist” announced. “The Committee intends to purchase, by the end of June 2012, $400 billion of Treasury securities with remaining maturities of 6 years to 30 years and to sell an equal amount of Treasury securities with remaining maturities of 3 years or less.”

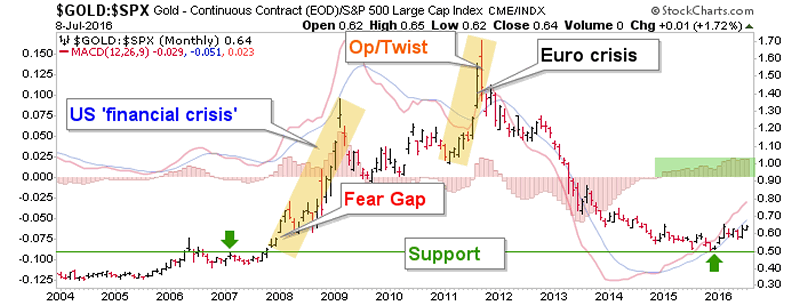

Commodities (led by silver) blew off in early 2011 amid gold bugs’ and inflationists’ mantras like ‘Helicopter Ben is causing hyperinflation!!!’, and gold blew off later, into the time frame of Op/Twist’s announcement as the world knee jerked into the metal during the acute phase of the Euro Crisis. Talk about dysfunction.

Well, he showed ‘em but good that he was not “Helicopter Ben” but rather, the bringer of a deflationary phase that has lasted until this day (judging by ‘inflation expectations’, which remain slammed to the mat).

Bernanke, the “hero” actually gave his own country something better; while much of the rest of the world had to deal with deflation, the US, a largely consumer driven economy, leveraged its strong currency to “service itself”, as I have often written after Payrolls reports showing Healthcare Services, Leisure & Hospitality Services and Professional Services, etc. leading the employment picture.

We began the counter-cyclical Macrocosm theme a year ago but using the Greenspan era blueprint, we can watch to see if it to morphs to ‘inflationary growth’.

But might inflation actually get out of control this time? Might deflation reemerge with a vengeance and liquidate the system? Or might disparate market signals simply coexist on occasion (like now) due to dysfunction by policy?

The point I am trying to make is that while I probably get a little aggressive in critiquing lazy, linear thinkers (especially in the gold bug camp) predicting the end of the world all the time, I keep a tin foil hat in my office as well. When I wrote about Bernanke “painting the macro” with Op/Twist and posted those Outer Limits “sit quietly and we will control all that you see and hear” posts, it was firmly affixed and blocking the government’s mind control and scanning activities.

The macro has been painted by US policy and increasingly and aggressively now, by global policy. Bonds, the instruments that used to be gauges of economies, valuations and inflation are little more than tools, manipulated at will by US and global policy makers. So the tin hat is on, but please put the lie to this statement if you can.

So why is silver out performing gold, yet Uncle Buck is holding steady? Why is risk ‘off’ gold rising along with the most risk ‘on’ asset on the planet, Junk bonds (see an interesting clue in the Macro Indicators segment below)? We are in uncharted waters and open minds are what’re needed. With the world huddling in post-Brexit deflation mode, we should just continue to follow the indicators and the charts while realizing that in due time, the macro fundamentals will emerge. Even though the stimulus is dysfunctional, some semblance of normal trends will emerge just as they did post Op/Twist.

But if the current situation is a close out to the 2011-2015 ‘Twist’ period, when dysfunction morphed to commonly accepted economics, what’s to say that we will not resolve to a new sort of dysfunction; an unexpected dysfunction?

This chart was created years ago to illustrate what I thought was in progress, which was a “close out” of fear and hysteria as marked by the gap up in gold vs. SPX in January of 2008. That gap (actually two of them) was the first step to the acute phase of the US financial crisis, which was ultimately the trigger for the unprecedentedly unconventional policy that followed and remains in effect today.

While I originally expected that the new phase (as indicated by Gold-SPX) would involved a deflationary counter-cycle, recent data points (including the Semi Equipment sector) indicate the opposite condition may yet emerge. Again, the indicators will tell.

NFTRH 403 then put its thinking cap on top of its tin foil hat and logically and methodically covered precious metals, stocks and stock markets, commodities, currencies and most importantly of all, the key market indicators. The result is that our preferred themes remained intact, not because I want them to be intact, but because work said so.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.