Beware: Central Bankers are Driving Us into the Dirt

Interest-Rates / Global Debt Crisis 2016 Aug 02, 2016 - 04:46 PM GMTBy: Harry_Dent

One of the major triggers I’ve been warning about is already happening, even before we understand and/or admit that we are in a recession. Zero Hedge just picked up on an article from Jeff Cox at CNBC.

One of the major triggers I’ve been warning about is already happening, even before we understand and/or admit that we are in a recession. Zero Hedge just picked up on an article from Jeff Cox at CNBC.

Global corporate debt now sits at a record $51 trillion and is poised to hit $75 trillion by 2020 – just four years away. If interest rates rise and the economy slows, it will be very hard for companies to roll these bonds over – and then we get what S&P Global Ratings is calling “Crexit.”

The bond markets dry up for corporate lending, especially higher-yield junk bonds. This would set off a chain of corporate defaults and bankruptcies that would cause central banks to start to lose control of the economy, as they did in 2008 forward.

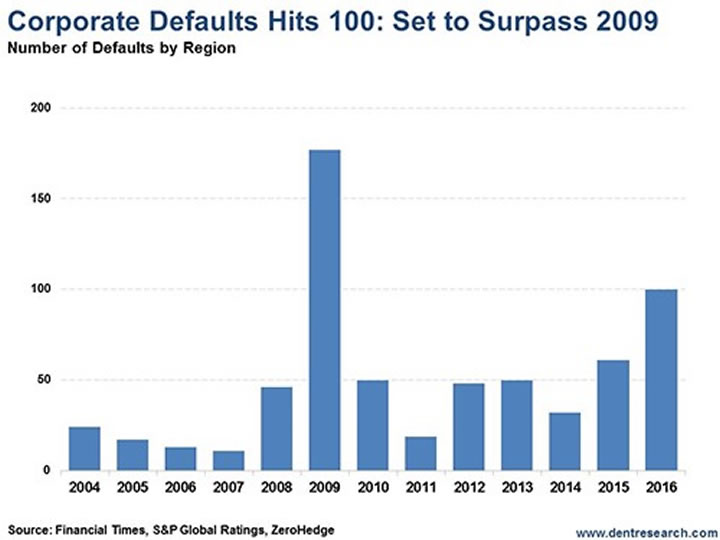

The simplest depiction of where we’re at comes from the chart below:

At the worst of the recession in 2009, we saw around 180 total corporate bond or loan defaults. As of the first half of 2016 alone, we just hit 100. That means 200+ by year-end… and we’re just at the beginning of the next financial crisis. Note that most of the 2009 defaults were in the U.S., as is the case again due to the energy “frackers.” But Europe has a bigger flurry coming this time.

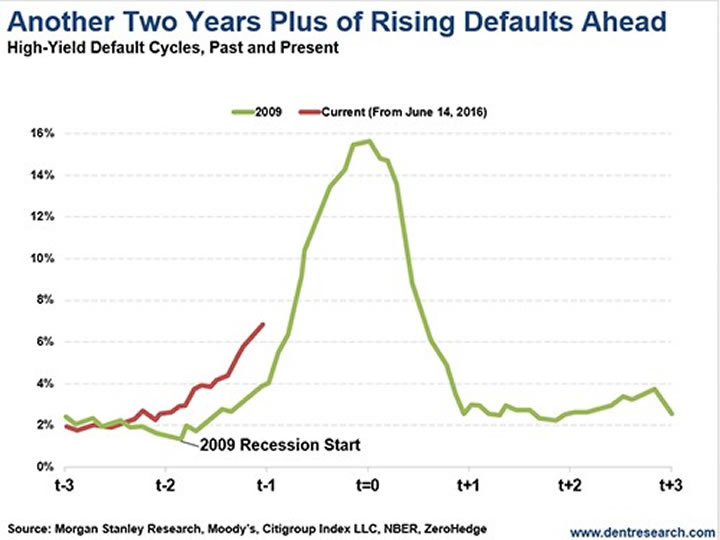

The next chart shows how that crisis is likely to progress:

We’re now nearing 5% default rates, as opposed to heights of 16% in 2009. Hence, we have a long way to go here – 300%+ or more, and I fully expect the next crisis to be much deeper than 2008/2009. After hitting $154 billion this year, we will see $100’s of billions of additional defaults in the years ahead.

S&P Global ratings consider a credit market correction inevitable; it’s just a matter of when.

So, how did this occur? It’s another product and cost of ZIRP and QE policies that appear to create something for nothing. Corporations lever up at such low rates and use that money to buy back stock and engineer mergers and acquisitions – all just re-arranging the pie, not growing it.

The entire fracking industry was a hugely bad investment in technologies that were not lower-cost, but higher. Only QE that pumped oil prices back up temporarily, and super-low-cost junk bond financing, made this industry viable. But no longer, with oil at sub $50 for years now… and many more to come, by my estimates.

When the economy slows and/or interest rates rise, to reflect default risks, then we get a negative spiral of more and more defaults. As I predicted, the (ex) frackers are leading this first round of defaults and we’ll see much more to come.

Bondholders and stockholders will lose, employees will lose, companies will disappear and we’ll face a deeper recession from not facing the last debt bubble… that’s the cost: you pathetic, douchebag, academic, never-had-sex-or-run-a-business central bankers!

And don’t even ask about pension funds’ and municipalities’ growing unfunded liabilities, with such low returns on their investments since 2008 and QE. To deal with unfunded pensions, some Chicago homeowners are seeing property tax increases of up to 300%… Holy crap Batman!

So, even homeowners lose with higher taxes and lower property values, as a result.

According to John Mauldin, states like Illinois, Connecticut, New Jersey, Kentucky and Massachusetts are just the first states that will face major defaults, as Puerto Rico is now.

Penalized by low-interest returns, investors will soon see corporate, municipal and even many sovereign bonds depreciate on top of that! Ditto even more for high-dividend stocks that are highly overvalued and that investors have also piled into during QE and ZIRP.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.