Now The Markets Themselves Are Too Big To Fail

Stock-Markets / Financial Markets 2016 Aug 08, 2016 - 06:33 AM GMTBy: John_Rubino

The First Rebuttal website has coined a term that gets to the heart of an increasingly dysfunctional system: The too-big-to-fail stock market. The general thesis is that most major countries are over-leveraged to that point of maybe being unable to survive a garden variety equities bear market – and are doing whatever it takes to keep that from happening. Here’s First Rebuttal on the effects of such a prop-up-asset-prices-at-any-cost policy:

The structural economic problems of stalled incomes, peaked debt and welfare make operational expansion i.e. sustainable growth extremely difficult, which has led to investment concentration in secondary equity markets. And that means the higher valuations simply represent higher risks.

The offshoot is that as such a large concentration of total asset value is dependent on the market, it becomes necessary to maintain the market at all costs. The market has become too systemically important to allow it to fail. And that means policymakers have changed the function of the market. The market left to its own devices is a consequence of the underlying economy. Today, however, the market is being used as a (false) portrayal of the underlying economy. It is intentionally using the logical fallacy of confusing cause and effect.

That is, the thermostat is no longer meant to reflect the temperature inside the house, its only use is to convince you the house is warm. That means policies are being targeted at manipulating the thermostat rather than keeping the furnace hot. The consequence is a spiraling of resource misallocation, furthering the structural breakdown of economic activity making it ever more important to keep the market looking strong. The market is no longer a market as we understand the term.

The upshot: Markets no longer serve their intended purpose of efficiently allocating capital. Since capitalist wealth creation depends on functioning markets, today’s world can no longer be called “free” or “market-based” in any meaningful sense.

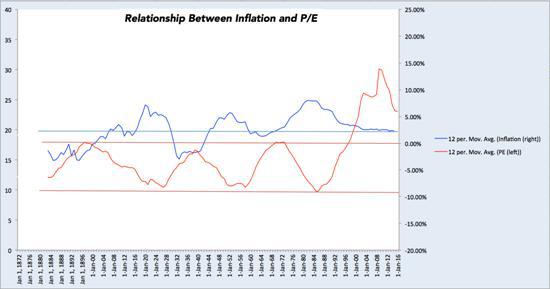

The article illustrates this phase change with a chart showing equity P/E ratios over the past century-and-a-half which reveals a dramatic spike beginning in the 1990s – that is, when Alan Greenspan and his successors at the Fed decided that the big banks had to be protected from the consequences of their own mistakes.

So what does this mean? First, while headlines continue to convey a sense of normality, under the surface the system is rotting away. Good jobs are becoming scarce and capital is being directed towards things that will never generate enough cash flow to pay off the related debt. Rising financial asset prices are increasingly disconnected from the falling value of underlying assets.

The evidence of this is everywhere, from pension plans that lie about their funding levels, to corporations that report “adjusted” non-GAAP earnings and are rewarded with higher share prices, to governments that report plunging unemployment rates while citizens leave the workforce in droves.

It’s no longer possible, in short, for most people to tell what’s real and what’s not. And since markets’ main function is to reveal underlying truths, it’s not a surprise that governments have decided to hijack the message.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.