Low / Negative Interst Rate’s Legacy

Interest-Rates / Negative Interest Rates Aug 18, 2016 - 12:22 PM GMTBy: Raymond_Matison

In all of global human history, interest rates have never been this low. Indeed, Europe has trillions of Euro bonds yielding a negative interest rate, meaning that an investor pays for the privilege of having lent to a borrower with its attendant credit exposure, and agrees beforehand to get less in return than he originally “invested”. America’s fixed income yields have been declining for over thirty years, and now are also at record lows – hovering close enough to zero such that some expect negative rates to come to our domestic market in the not too distant future.

In all of global human history, interest rates have never been this low. Indeed, Europe has trillions of Euro bonds yielding a negative interest rate, meaning that an investor pays for the privilege of having lent to a borrower with its attendant credit exposure, and agrees beforehand to get less in return than he originally “invested”. America’s fixed income yields have been declining for over thirty years, and now are also at record lows – hovering close enough to zero such that some expect negative rates to come to our domestic market in the not too distant future.

Globally low interest rates are destructive, particularly against the backdrop of much higher interest rates over the last three decades, and specifically to advanced economies. Advanced economies have achieved a high level of citizen savings, individual investment accounts, and have also developed retirement systems which provide adequate retirement income to an entire nation of citizens. The reality of actual returns being much lower today than could reasonably have been predicted, even assuming prior conservative interest rate assumptions, underfunds pension assets such that people will experience lower pension benefits, which may not even pay out for the duration of their lives. This fact is so devastating to our society that it is as impossible to truly comprehend as it is envisioning the billions of galaxies in our universe.

Contrariwise, developing countries which have low levels of savings, invested assets, or prospective pensions are not affected negatively by these lower interest rates. Often these simpler societies still depend to a larger degree in the support of broader families for maintaining its senior citizens. In addition, since such developing economies have relatively low levels of existing debt low interest rates are a boon to their economic development.

Interest rates and the insurance industry

Insurance is an integral and important part of our society and economy. In the last century small individual premiums collected from millions of policyholders by the life insurance industry were combined to provide significant capital flow for our nation’s industrial growth. Today life insurance provides protection against loss of income of a family breadwinner, while annuities provide retirement income to millions of policyholders – by still aggregating policy premiums and investing them for their ultimate benefit. Low or negative interest rates has a destructive effect by decreasing investment income and returns, and reducing the level of ultimate benefits, while raising premiums and annuity contributions which need to be paid in. In fact, persistent low investment or negative rates can and will seriously weaken or even destroy the life insurance industry – in turn perversely affecting millions of lives who were depending on life insurance company benefits.

The property-casualty insurance industry is likewise important to a healthy functioning of the economy. Lenders providing funds for building factories, airplanes, ships or other integral parts of a vibrant economy require insurance to guarantee solidity of loan collateral. Likewise, mortgage loans won’t be made without homeowners insurance, or credit insurance guaranteeing full repayment of the loan in the event of retail borrower’s demise. Low interest rates also negatively affect the property-casualty industry, increase premiums and subvert its financial solidity.

A part of financial institution revenues and profits, such as those of insurance companies and banks comes from investment income on assets or loans. To the extent a market environment dictates lower rates, the revenues and profits of such institutions is decreased, since a given portion of such investment income has to be accredited to the policyholder or bank depositor. As interest rates decrease, the financial institution’s spread is reduced negatively affecting profits. In this context very low or negative interest rates are destructive.

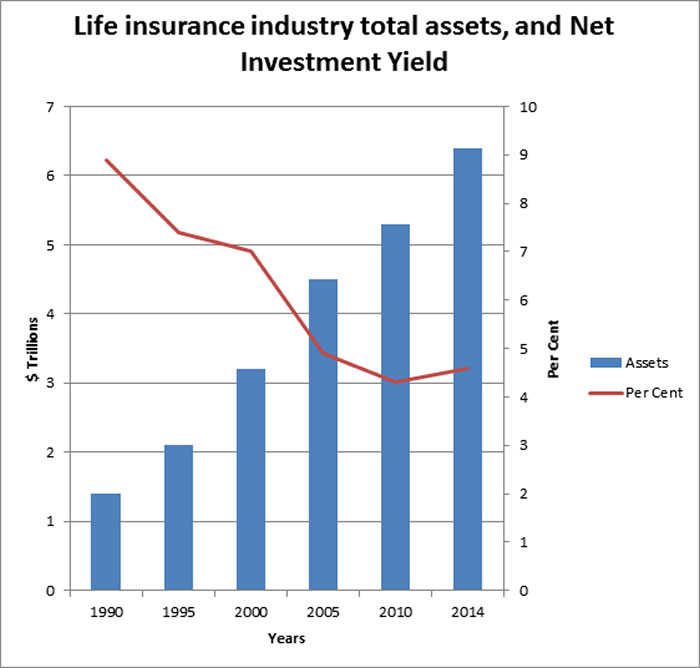

The following chart depicts the growth in assets of America’s life insurance industry from the year 1990 to 2014, the latest year for which industry data is currently available. This chart shows that total insurance industry assets have grown from a total of $1.4 trillion in 1990 to $6.4 trillion in 2014. These assets are largely funds held as liabilities for policyholder benefits. During this same time period the net return on invested assets declined from 8.9% in 1990, to 4.6% in 2014.

Source: ACLI Life Insurance Fact Book

Historically, pension plan contributions have been calculated on expected investment returns at or above 7%. It is likely that life insurance industry’s net investment return for the year 2016 will be under 4%. Given that companies have also purchased fixed income investments such as mortgage backed securities, and shale energy bonds which once were investment grade but now are highly problematic, suggests that unexpected future losses can become significant. These reduced investment returns and new industries with problem investments underscore how risky the insurance industry has become due to a multiple year financial repression through monetary easing and low interest rates.

Since Europe has even a lower interest panel, and over $13 trillion of bonds outstanding at negative interest rates, its insurance industry is at even greater risk of failure than those in America. Accordingly, neither Europe’s insurance industry nor its banks can long survive, and will soon crash. Our global financial interconnectedness will then bring this calamity to America’s shores.

Interest rates and national debt

From the perspective of our national budget, low interest rates over the last decade have been more than just desirable – they have been necessary. Our national debt in 1990 was $3.2 trillion, but exploded to $18.2 as of 2015. The nation’s interest cost on outstanding debt has barely grown from $265 billion in 1990 to $402 billion in 2015. The following table shows this relationship between national debt and interest cost.

Source: U.S. Budget Data

Each one percent rise in the interest rate on our debt increases the budget deficit by approximately $190 billion. It is easy to understand why the government doesn’t want a return to normalized interest rate levels. However, this chart (as the previous one on the life insurance industry) makes one suspect that these relationships are not long sustainable.

Historic movement of interest rates

History has confirmed that interest rates do and will go both up and down over a period of time. Since they are historically low at this time, it is reasonable to expect that sometime in the future they may rise. If that were to be the case, it would be likewise devastating for all invested asset classes. Remember that higher interest rates would produce a significant loss of value in all bond portfolios. The stock market, when not manipulated by monetary policy of the FED, is valued by discounting projected dividends or earnings of companies. Therefore, any rise in interest rates would also bring about a decline in the value of the stock market. The veracity of this last observation was demonstrated over the last several years in that even mere expectations of a modest rise in interest rates by the FED spooked the market.

Since interest rates are at historic lows, it implies that both bond and stock values are at historic highs relative to economic considerations. Therefore, any increase in interest rates would produce a reduction in value of every investment portfolio. Accordingly, the lives of senior citizens would be negatively affected from insufficient income on savings, investment portfolios, and pensions. The future security of retired people would become drastically underfunded. The lives of all working Americans would also be negatively affected as they would not be able to grow their assets to a value which would provide a respectable level of living when they are ready to retire. Add to this the circus-like hall of mirrors for evaluating the solidity of the Social Security system and citizens of the formerly richest nation on earth will become destitute.

Agents of interest rate changes

Low or high interest rates do not happen in a vacuum; for the last one hundred years they have been more or less ordained by our central bank as it satisfies insatiable but variable demands for government spending. One hundred years ago, when the nation’s debt was low, the FED expanded our money supply providing funds for America’s ability to participate in WWI. Money expansion is correlated with lower interest rates that made it easier to service that war debt. In the 1920’s when money and credit expansion accelerated again there was a predictable stock market boon. In the later 1920’s when money and credit growth was slowed and interest rates raised, stock margin calls caused massive selling which brought on the stock market crash and the Great Depression.

The confluence of government ill-conceived domestic and foreign policies with FED monetary accommodation and interest rate setting combined have always had a harmful effect on its citizens. Consider the result of President Roosevelt’s confiscation of public gold money in 1933. When the public turned in their $20 gold coins, they received $20.67 in paper currency. It is common knowledge that soon thereafter the government devalued the dollar and raised the price of gold to $35, essentially stealing this difference from the public. But, unfortunately, that is not the limit of the theft! Had an obedient citizen turned in his gold coin to the banks as government required, the loss was far greater than the difference between $20 and $35. If you continued to hold the gold, it would fetch approximately $1350 today. Had you received the $20 in cash and held it till today, you would have purchasing value equivalent to $0.03 – basically a total loss. So the theft has been complete.

Our nation has experienced accommodative interest rates and massive credit expansion to satisfy the desires of self aggrandized financially ignorant politicians who have moved the country in a direction contrary to sound economic principles, non-interventionist military principles, and towards socialistic welfare programs, wealth redistribution contrary to majority public sentiments of those paying taxes. Such trends have continued under both political parties. It makes one suspect that there are forces directing our national policies exclusive of those ill-advised elected politicians, implying that the assumed sovereignty of our nation may in reality be in doubt.

Past and future defaults

Prior to 1971, when the FED’s gold window was closed, the promise and opportunity to exchange dollars for $35 (adjusted to $42 in 1973) had been then foreclosed to all foreign banks. This U.S. default deprived every country at that time to convert its dollars to gold. For example, a country whose central bank had held merely $35 million in its bank reserves had the right to 1 million ounces of gold. That amount of gold would be worth $1.1 billion today, whereas the $35 million in cash adjusted for loss of purchasing power as computed by the government’s CPI Index is worth only $6.0 million today. Essentially, again, it is nearly a total loss.

Over the last 40 plus years foreign countries have accumulated an estimated $7 trillion of dollars which are used as a banking reserve asset. Due to the persistent huge U.S. trade deficits over decades, many experts expect the dollar to be eventually devalued. This loss may not be gradual, but could take place as a large adjustment at one or several points in time. When this happens, these foreign countries, and U.S. citizens will once again take unimaginably large losses.

One hundred years is a relatively short period for one to experience three dramatic currency default events. The lessons to be learned from these events, is that the government over this time period has not done much, if anything, to protect the assets and currency of its own citizens. Quite to the contrary, government always spends in excess of collected revenues, damning the public to take losses of its hard-saved heavily taxed income and assets with the invisible tax of inflation and bondage of increasing public debt. Similarly, the government has not respected its foreign trading partners and has confiscated their investment in our dollars with equal vigor. Our government and FED’s current joint financial repression will be the final debauchment to destroy the value of paper dollar held assets. And in this regard, the American public will not be exempt. Hence the last one hundred years, will show three major events wherein the holders of dollars have been – politely stated - financially raped. Trust the FED and your government, or whoever is in control? You decide.

Foreign country resistance to the global reserve dollar

This failure of our government to keep monetary promises is the reason why foreign countries or country groups such as BRICS, or CRISIS (see: BRICS? No, CRISIS - http://www.marketoracle.co.uk/Article53009) have been attempting to distance themselves from the use of dollars in trade, or borrowing dollars for internal development. These countries decades long experience is that it is dangerous for them to do trade in dollars, borrow in dollars, have a fully convertible currency, or hold dollars as a banking reserve asset. Accordingly, these countries are now not fighting a financial war with the U.S., nor manipulating their currencies, they are trying to protect themselves from the historically learned lesson that any financial promises made by America will eventually be broken, and that they have to act defensively to protect their assets from plunder. Our domestic citizens also need to heed this lesson, but they are less aware than foreign governments, and this is to their own greater risk and detriment.

Past and current monetary system

The old gold-based currency system worked according to international agreements and standards. For example, international trade was settled with net gold transfers as determined by trade surplus or deficit. Domestically, people used paper money which appeared to be backed by gold. Thus it could seem to the public as if there were two linked means of payment for goods. It was gold for national or commercial buyers and sellers across borders, and paper money for domestic retail transactions.

Under the old gold-based system a trade deficit created by a greater value of imports when compared to exports caused gold to be transferred to the trade surplus country. The trade deficit country then had a reduction in its gold supply, which would dictate a commensurate reduction in its money supply, unless it proactively chose to have more money in circulation than its gold holdings could properly support. In such a case, the larger than proper relationship between paper dollars and gold would create inflation reducing the value of that currency for both international trade and domestic use.

Our current international payments system is based solely on fiat-based paper dollars which are used for both international trade settlements and domestic retail purchases. Accordingly, the U.S. can bring into existence money at the Federal Reserve when it purchases newly issued Treasury bonds. Our decades-long trade deficit is paid for with these newly minted dollars which the trade surplus country uses to purchase Treasury bonds providing it interest earnings. However, since the dollar and U.S. Treasury securities can be counted as a part of foreign bank reserves, and allows the trade surplus country to expand its money supply, such money expansion creates inflation in the developing surplus countries, while the lower-priced import products promote deflation in America. It is not overstating the case that America can print money with which to purchase real goods produced by foreign material and labor which injures producing countries through internal inflation and loss of investment value of its Treasury bond holdings due to loss of purchasing power of our forever-increasing dollar money supply.

Future Monetary system

A new money system is needed that is fairer to America’s trading partner countries and possibly billions of laborers that produce real goods. The decade-long upheaval of foreign countries trying to avoid the dollar in trade and settlement underscores its dissatisfaction and scorn. Increasingly, foreign countries which are too big to be intimidated by the U.S. are conducting new trade agreements in their own currencies. They apparently have concluded that the risk of holding currencies of some countries other than the dollar is less financially risky than being bound to the limitless expansion of the U.S. reserve dollar money supply.

This future new system would likely be comparable to the old gold-backed system, in that to Americans it would again appear that there are two methods of payment: a new currency that is used for international trade settlement and another that is used for domestic purchases or trade. This international trade settlement currency is already in existence through the IMF and its Special Drawing Rights (SDR) - a reserve currency comprised of the dollar, pound, Euro, yen, and yuan to be included later this year. It is possible to also include gold as backing in this new currency. Alternatively it could be even created by the issue of a new reserve currency from the Asian International Infrastructure Bank (AIIB). However any new basis of international trade settlement will neither allow the U.S. to create repeated large trade deficits without consequences, nor allow it to pay for them by printing additional dollars.

The domestic version of the new currency, still likely to be called a dollar, will be similar to the currencies issued by the majority of countries in the world, in that it will be exposed to fall in value based on the country’s trade deficit. Unless America suddenly would no longer import vast amounts of global goods, its new currency would face dramatic loss in purchasing power. In addition, continuing large trade deficits would require payment with its new reserve currency. Absent dramatic increases in domestic production and export, or large reductions in trade deficits, America would not have enough of this new reserve money, and would possibly have to pay for such deficit by selling U.S. public lands or other significant assets.

Current actions of the FED

The quantitative easing which has been going in recent years is arguably promoted by the FED to increase systemic liquidity. However, as it is actually an expansion of the money supply, in part to achieve the FED’s stated goal of increasing their target rate of inflation – it also is the blunt instrument which depresses interest rates. Thus, continued QE can bring about negative interest rates to our shores. This quantitative easing increases the supply of dollars in the system, and decreases their value and purchasing power. Of course Japan’s superhero efforts to print money and Europe’s valiant efforts in additions to that of the FED, in what observers call a “race to the bottom”, eventually will provide the necessary material for a book update on the Weimar Republic.

Resistance to negative interest rates in the U.S. will provide the final signal to investors and the public that confidence in the dollar is being finally lost. It will be cheaper, and less risky, to hold non-interest bearing gold than negative interest rate bearing bonds. Continued expansion of the money supply, financial repression, and negative interest rates are the precursor to currency collapse and hyperinflation. For the last several years the FED has been trying to raise the level of inflation. It will succeed – by unimaginable margins.

Elite economists may have formulas, models and rationale why negative interest rates are appropriate, but that concept will not sell on “Main Street”. The unwashed and uneducated masses instinctively understand that when very low or negative interest rates appear anywhere on the globe – something is wrong. And they are right. So despite base money “availability” and low interest rates, the common small businessman will not bite the bait. Instead he will save, recognizing the economic inversion.

Conclusions

Low and negative interest rates extant globally produce destructive results evaporating income on individual savings, fixed income investment, and is the primary cause of significant underfunding of all private, corporate and government pension plans. These low interest rates also debilitate the insurance industry which is necessary to facilitate economic activity, and which provides both family income protection and private retirement income.

Low interest rates are the narcotic enabler for governments to keep spending above national income, a co-conspirator for continuing military misadventures, and facilitator for socialist style welfare programs and wealth redistribution. When interest rates transcend the FED’s ability to control it and rise or normalize, business activity will further contract, tax revenues fall, stock and bond market gains with attendant capital gains taxes will disappear, the cost of servicing national debt will explode while the debt itself continues to rapidly expand, while the global dollar reserve currency is dethroned, as nation’s currency crashes, and the nation’s overall situation becomes cataclysmic. It will provide little comfort to know that the rest of the world is worse off.

Our world has finally arrived at a point with respect to its unrelenting QE and currency expansion, credit and monetary bubble, that low or negative interest rates are highly destructive to individual citizens, savings, and pension industry. It is deeply ruinous of the insurance industry and banks. Higher interest rates are now equally destructive and would blow up the federal budget from exploding debt service, and ruin millions of small business entrepreneurs, and decimate financial investments. In other words we are in a place where there is no escape from economic collapse.

Raymond Matison

Mr. Matison is a U.S. patriot who immigrated to this country in 1949. With a B.S. in engineering physics, an M.S. in Actuarial Science, work in the actuarial field, and as a financial analyst at Legg, Mason Inc., Lehman Brothers, and investment banking at Kidder Peabody, and Merrill Lynch provides a diverse background for experience. First-hand exposure to fascism, socialism, and communism as well as the completion of a U.S. Army military intelligence course in the 1960’s have inspired a continuing interest in selected topics in science, military, and economics. He can be e-mailed at rmatison@msn.com

Copyright © 2006 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.