Stocks, the Era of Centralization is Ending…

Stock-Markets / Stock Markets 2016 Aug 28, 2016 - 12:21 PM GMTBy: Graham_Summers

The most critical element of the BREXIT is that it is THE closing bell being rung on the period of Centralization from 2009 to today.

The most critical element of the BREXIT is that it is THE closing bell being rung on the period of Centralization from 2009 to today.

What do I meant by Centralization? I am referring to the era of Central Planning of the global economy by Central Banks.

In the US, we’ve seen the Federal Government/ Federal Reserve become involved in virtually every major industry in the economy including insurance, healthcare, housing/mortgages, banking, financial services, and even energy.

The US is not unique in this regard. Japan and the EU have also been in a period of Centralization, with their respective Central Banks becoming increasingly involved in their respective economies.

The BREXIT has ended this.

For certain, things were already becoming fractured due to Central Banks’ reliance on competitive devaluation.

In a world of fiat, all major currencies are priced against a basket of their peers. So when one Central Bank engages in a particular policy with the intent of devaluing its currency, that same policy inevitably puts upwards pressure on other currencies.

From 2008-2013, there was a degree of coordination between Central Bank. The best example would be when the Fed launched QE 3 in 2012, coordinating this policy with the ECB’s OMT program. At that time, the economic data in the US was in fact improving and the Fed should have been tightening. QE 3 was as much a gift to the EU as anything.

However, starting with the Bank of Japan’s massive QE program in 2013, everything changed. At that point, Central Banks began employing more extreme policies… policies that put tremendous pressure on other currencies… policies like QE programs in excess of $1 trillion… or NIRP.

At this point, Centralization began to come apart as Central Banks were now outright damaging each other’s efforts to devalue their currencies. However, it wasn’t until BREXIT that we received a REAL nail in the coffin for Centralization.

Let me explain.

In the world of Central Planning, politics, not economics, drives policy.

Any sensible economist would have realized QE and ZIRP couldn’t generate GDP growth around 2011. However, in the world of Central Planning, the political implications of admitting this (relinquishing control of the financial system and permitting debt defaults/ restructuring to begin) is akin to political suicide.

Put another way, if Janet Yellen or Mario Draghi were to stage a press conference to state “my life’s work is incorrect, I have no idea how to generate growth, it is time for market forces to take hold and price discovery to occur” not only they but EVERY other Central Banking economist/ academic would soon be unemployed.

For this reason, the end of Centralizaton was only going to come through one of two ways:

- Politically (if voters finally revolted against the status quo).

- Financially if market forces became so intense that even the Central Banks lost control of the system.

With Brexit, we’ve already had #1. We’re now on our way to #2.

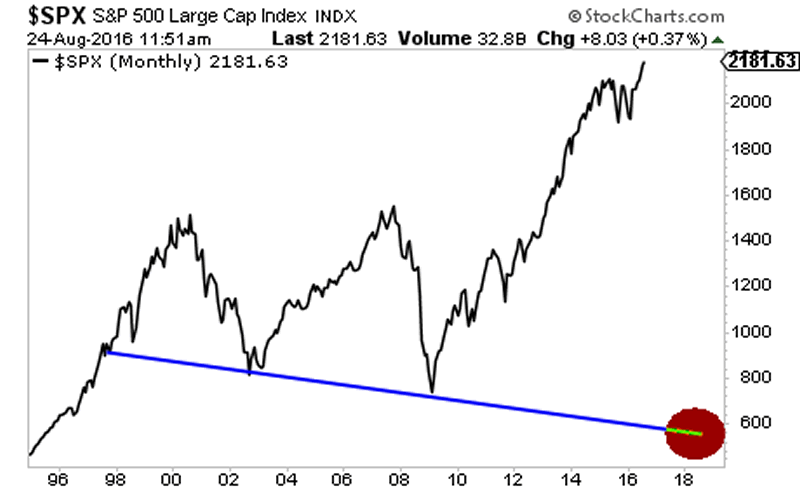

Indeed, we believe that by the time the smoke clears on the next Crisis, the S&P 500 will have fallen to new lows.

The Tech bubble was a stock bubble: a bubble focused on stocks as an asset class.

The Housing bubble was a real estate bubble: a bubble focused on houses, and even larger, more significant asset class.

This current bubble is the BOND bubble: a bubble in the senior most asset class in the financial system

We firmly believe the markets are preparing to enter another Crisis. With over 30% of global bonds posting negative yields, the financial system is a powder keg ready to blow.

If you’re an investor who wants to increase your wealth dramatically, then you NEED to take out a trial subscription to our paid premium investment newsletter Private Wealth Advisory.

Private Wealth Advisoryis a WEEKLY investment newsletter with an incredible track record.

Last week we closed three more winners including gains of 36%, 69% and a whopping 118% bringing us to 75 straight winning trades.

And throughout the last 14 months, we’ve not closed a SINGLE loser.

In fact, I’m so confident in my ability to pick winning investments that I’ll give you 30 days to try out Private Wealth Advisory for just 98 CENTS

If you have not seen significant returns from Private Wealth Advisory during those 30 days, just drop us a line and we’ll cancel your subscription with no additional charges.

All the reports you download are yours to keep, free of charge.

To take out a $0.98, 30-day trial subscription to Private Wealth Advisory…

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.