Gold And Silver Are Money. Everything Else Is Debt. Globalist’s Biggest Scam

Commodities / Gold and Silver 2016 Sep 10, 2016 - 06:39 PM GMTBy: Michael_Noonan

Last week, in “Fiat ‘Dollar’ Says Gold And Silver Will Struggle,” we said the following:

Last week, in “Fiat ‘Dollar’ Says Gold And Silver Will Struggle,” we said the following:

[See 4th paragraph]

Money does not exist in this country. In fact, money does not exist anywhere in the world. What is money? So few people know, and many who profess to know do not. Money is a commodity with a recognized value. Gold and silver remain the last known standard of real money. Remember J P Morgan’s famous words: “Gold is money. Everything else is credit.”

The globalists, through their creation of the Federal Reserve, have sold the biggest lie ever to the world and continue to get away with it. People everywhere believe the fiat-created Federal Reserve Note, falsely called the “dollar,” is actually a monetary dollar. We have often stated how Federal Reserve Notes are evidences of debt issued by the Fed. We also always add that debt is not and can never be money, yet almost every American wrongly believes debt is money because they believe the Fed “dollar” is money.

Only gold and silver are money!

Gold and silver each are a commodity. They have universal recognition and acceptance. Their value is determined by the market by what people choose to accept as payment for goods and services offered. By contrast, the Fed “dollar” is not money. It is a currency. A currency represents the actual money. In today’s world, there is no currency that represents actual money. Fiat is imaginary. It does not exist except in one’s mind. Yet, around the world, everyone’s imagination believes their local currency is money.

Only gold and silver are money!

If you go to a restaurant and use valet parking, you receive a stub to reclaim your car by the valet at the end of dinner. The ticket stub is not the car, it represents the car to be “redeemed” upon presentation. There is no currency in the world that represents money, and no currency can be redeemed for money. Always remember, Only gold and silver are money!

This is a very simple truth, yet few accept it as truth. Almost everyone is too willing to believe that imaginary currencies are real money. For as long as most of the world is willing to accept this false premise, the globalists will always rule the masses much like sheep being led to financial slaughter.

How do most people measure the value of gold and silver? By their imaginary currency. Always remember, every currency is imaginary because it is backed by nothing. Any currency’s “value” is dictated determined by the source, the central bank issuing the imaginary money currency. When you understand the basic difference between money and currency, you will fully understand the globalist’s massive “money” Ponzi scheme which is aided and abetted by every government guilty of perpetrating the fraud, and make no mistake, the fraud is on you.

The only way to measure of the value of gold and silver is by the daily fluctuating number of fiats [of any country’s issuance] required to buy either metal. The value of gold and silver do not go up and down. It is the number of fiats that increases or decreases that determines how gold and silver are “priced” on any given day.

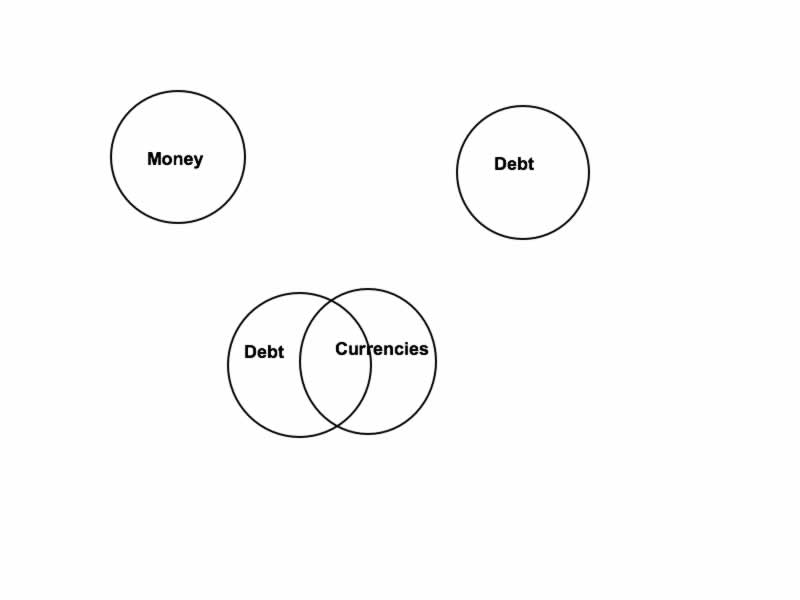

If people do not understand the basics, they will continue to believe that debt is money. The two are not and can never be interchangeable. In a Venn diagram, money and debt can never intersect for they have nothing in common. By contrast, because currencies are actual debt, not only do they intersect, [as we show in this simple diagram], they are concurrent overlaying circles, one and the same.

If a currency is a promise to pay, what is the promise you receive? None, zip, nada. All you can get is more of the same in different denominations. Currencies are more akin to the car game, Old Maid, where one wants to avoid being the last holder of the queen card designated as the Old Maid.

The American public will be in for the financial shock of their lives when they wake up one day and discover what they own are nothing more than Old Maids that have been devalued by 30%, 40%, maybe even 50%. The Old Maids will be the fiat Federal Reserve Note, falsely know as a “dollar,” but they will have declined in value relative to gold and silver, aka real money.

If it takes 1,300 fiat Federal Reserve Notes to purchase an ounce of gold, and one day, overnight, gold is revalued so that it takes 5,000 fiat Federal Reserve Notes to purchase the same one ounce of gold, it is not the ounce of gold that has changed. Instead, the number of fiats has been devalued, worth much less than the Federal Reserve once said they were worth which is why more and more will be required to buy the unchanged ounce of gold, and silver.

If you own an ounce of gold, you can exchange to for 1,300 Federal Reserve fiat Notes by today’s measure. When the fiat is devalued overnight, your ounce of gold will then be able to be exchanged to 5,000 fiat Notes. In other words, your wealth effect will have been preserved. This is why you want to buy and hold gold and silver. All governments have sold out their citizens to the globalist’s fiat Ponzi scheme.

Earlier, we posted an article, “Anything & Everything Goes – The Corrupt and Deranged Governance of America,” because we like the George Orwell quote:

“The further a society drifts from the truth, the more it will hate those who speak it.”

The globalists hate the truth, and they do everything possible to keep the truth suppressed.

Knowing the difference between money and currency is a perfect example. Remember, the money currency you hold in any bank is even more “unreal” than the paper currency that you may still think is money, because anything digitalized is pure fiction.

If you have a family, they are real. If you have a digitalized family, they do not exist, except in your mind, just like currency.

If you want money and want to survive the massive economic failure that is destined to come, buy and hold gold and silver. The world has not been awash in debt more than it is now and that mushrooming debt cannot be sustained

What’s in your wallet?

For the moment, we are in the calm of the proverbial eye of the largest hurricane ever, and it is the calm before the inescapable storm that will be more financially destructive than the 2004 Indian Ocean tsunami. If you fail to understand what money is vs what currency is, you remain at risk.

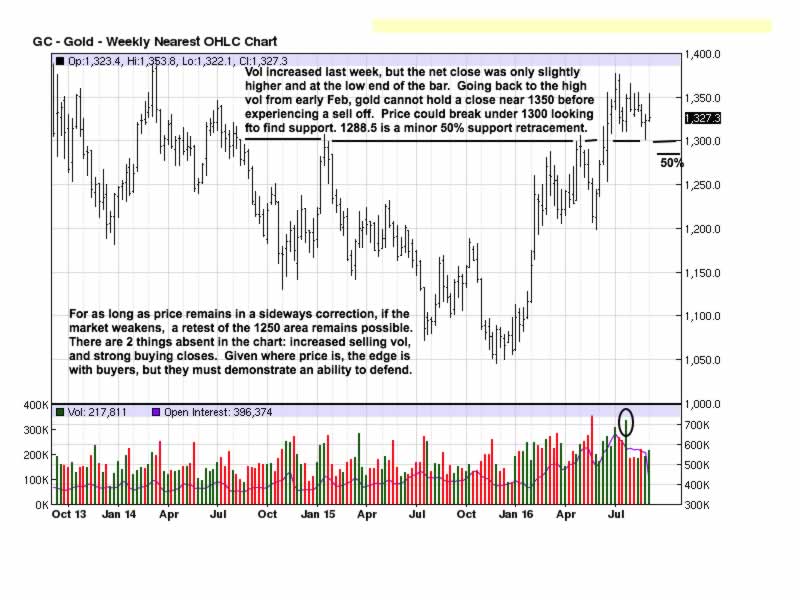

The trend in gold has turned up, and it is at the beginning of the next phase. Timing has been difficult because it is impossible to apply reason to fiction, that which is unreasonable. The only rational way to respond to the globalist fiction being peddled around the world is to be prepared. The best way to be prepared, in terms of gold and silver, is to own it, for one day, the price will be off the charts, as it were.

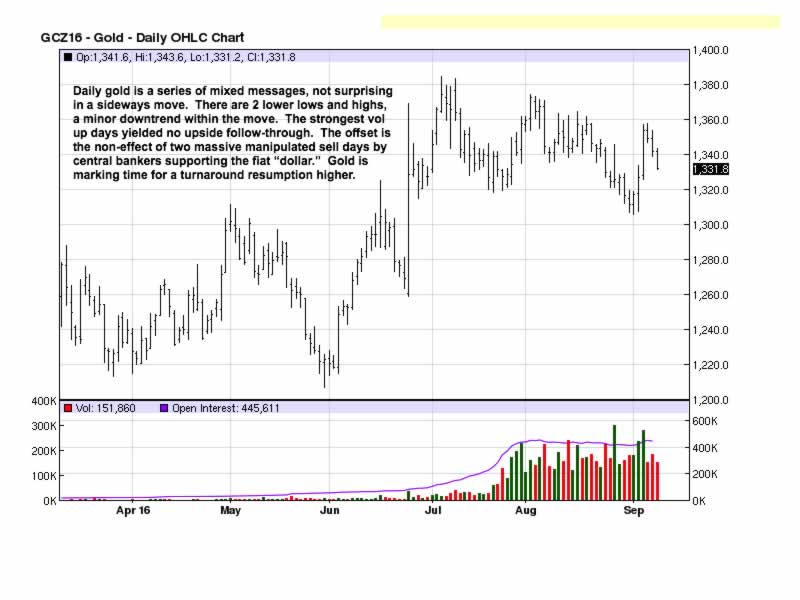

What stands out in the daily chart is what appears to be obscured and that is the last two separate massive sell days of thousands of gold contracts by the BIS, trying to punish those who choose to take their own path and not be a lemming to be led over the financial cliff that lies ahead. In the past, the massive manipulated sell days stood out on a chart. Now, it is more like trying to find Waldo. Truth and the price of gold will ultimately prevail.

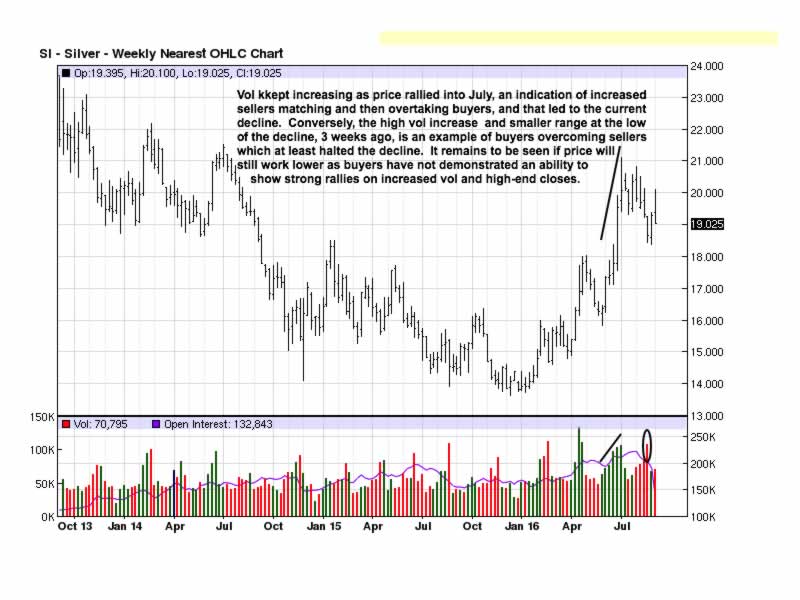

The two up slanting lines, one for volume, the other for price, demonstrate how the market advertises its intent. When the highest volume in a rally occurs at the high, it usually is a disguised show from sellers overtaking buyers, and a correction will follow. Silver is seemingly bidding its time more than gold, but it still is outperforming gold, and we expect that will continue.

It will be interesting to see if the current bullish spacing will hold while silver seems to struggle out of its sideways bottoming process. Bullish spacing occurs when the last swing low is above the high of the last swing high, an indication that buyers are not waiting to see how the market will retest that last swing high. It is unusual to appear in what is considered a relatively weak market.

So far, there has been no sign that the current near-term decline has ended.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.