Trump or HIlary? Which Presidents Have Been Best for the Gold Market?

Commodities / Gold and Silver 2016 Sep 16, 2016 - 07:41 PM GMTBy: Arkadiusz_Sieron

In previous articles, we have examined the gold’s performance in different election cycle years. Now, we deepen our analysis and investigate the behavior of the shiny metal in each presidential cycle in more detail. We analyze how gold performed under each President and which governing party (or whether the new President is an incumbent or a newcomer) affects the gold market the most.

In previous articles, we have examined the gold’s performance in different election cycle years. Now, we deepen our analysis and investigate the behavior of the shiny metal in each presidential cycle in more detail. We analyze how gold performed under each President and which governing party (or whether the new President is an incumbent or a newcomer) affects the gold market the most.

The first cycle ran from 1973 to 1976, when Richard Nixon (who in 1971 closed a gold window), and later, after the Watergate scandal, Gerald Ford were in office. As the gold standard was abandoned, while inflation and uncertainty surged, it was a good period for the shiny metal, which rallied 114.27 percent.

The next presidential term was even better for gold, which skyrocketed 392.50 percent under Jimmy Carter in 1977-1980 due to the rampant inflation and weak greenback. Carter was definitely the best president for the price of gold. However, gold’s move in the post-election year was much stronger after Nixon’s nomination, and the annual returns gradually deteriorated over the term, while the dynamics after Carter’s nomination was the opposite (weak reaction and improving returns over the term).

The Ronald Reagan’s era was not positive for gold, as the improving domestic economy pushed the shiny metal down 41.29 percent during his first term and only 21.09 up during the second term. In both cycles, the post-election year was the worst for gold. The same applied to George H. W. Bush’s presidency. The first year after the nomination was the weakest for the yellow metal, which lost 21.27 percent overall during the term.

After George H. W. Bush, Democratic Bill Clinton took the office for two terms, but gold remained in a bear market. It gained only 12.77 percent during the first four years and lost 28.04 percent over Clinton’s second term, as the U.S. dollar was strong. It is notable that the post-election year in the first election won by Clinton was the second-best for the shiny metal in that cycle.

The George W. Bush’s presidency was definitely supportive for gold, which surged 46.60 percent over the first term and 113.11 percent over the second due to rising fiscal deficits. However, the post-election years were the weakest in both election cycles.

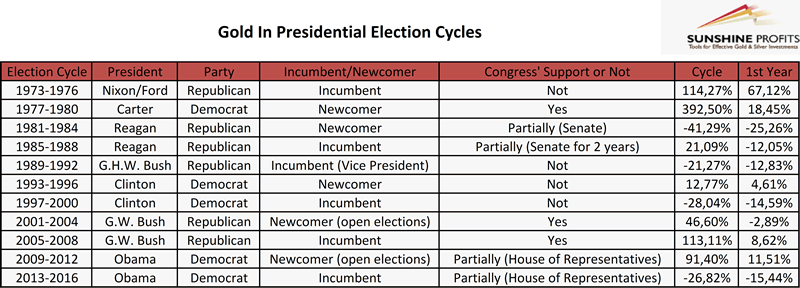

The first term of Barack Obama continued to be positive for the yellow metal, which rallied 91.40 percent due to worries about the post-recession economy. In that cycle, the post-election year was not the worst, but the second worst. During Obama’s second term, gold plunged 26.82 percent. The table below summarizes gold’s behavior in each presidential election cycle.

Table 1: Gold’s performance in presidential election cycles between 1973 and 2016

What are the conclusions for our analysis of gold’s behavior during the post-1971 presidential election cycles? First, including the first half of 2016, there were eleven presidential election cycles since the 1970s when gold started to be freely traded. Gold increased during seven of them and usually (in eight cases) experienced the worst performance over the cycle in the post-election year.

Second, there were six Republican presidential terms and five Democratic. The latter were far better for gold, as it gained, on average, 88.36 percent over Democratic presidencies and only 38.75 percent over Republican presidencies. Although it makes some sense, as Republican governments are a bit more focused on curbing inflation and fiscal deficits, the process was very sensitive to Carter’s presidency under which gold skyrocketed.

Third, when a newcomer became the president gold behaved much better (100.40 percent) than in case of incumbents’ victories (28.72 percent) in the whole cycle, but worse in the post-election year (1.28 percent versus 3.47 percent, respectively). But when we separate Republicans and Democrats, we see different outcomes. Gold performed stronger under Republican incumbents than under Republican newcomers or Democrat incumbents, both in the whole election cycle and in the post-election year. Again, due to Carter’s presidency, Democrat newcomers were, after Republican incumbents, the best for gold in the post-election years. Fourth, gold gained more over cycles when presidents had support in Congress (184.07 percent versus 19.43 than when the Congress was dominated by the second party). However, we doubt whether it was an important factor in the gold price dynamics. The analysis is based on very little data and it is not easy, as sometimes presidents had support for half of their presidency or support of the House of Representatives or Senate, only).

The bottom line is that the long-term analysis of gold’s behavior in presidential election cycles is inconclusive. Gold marked its best time under Carter’s presidency, but otherwise it went up and down under both Republicans and Democrats, incumbents or newcomers. It seems that the gold’s performance depends much more on the broader economic context, including monetary policy, rather than who leads the government. It shined when the U.S. economy was in stagflation both under Nixon/Ford and Carter. And the yellow metal was weak when the U.S. economy strengthened, no matter whether it was under the Republican Reagan or the Democrat Clinton. It suggests that the choice between Donald Trump and Hillary Clinton may be not as important for the gold market as is commonly believed. Certainly, Trump would be an unprecedented president due to his unpredictability and populism, thus gold may get a boost if he wins. However, investors should remember that the post-election year is usually the weakest year in the presidential election cycle.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.