Silver Prices in an Exponential Financial System

Commodities / Gold and Silver 2016 Oct 26, 2016 - 03:35 PM GMTBy: DeviantInvestor

Our financial systems create exponential increases in:

Our financial systems create exponential increases in:

- Debt

- Prices for stocks

- Prices for commodities

- Currency in circulation

- Prices for gold and silver

Why? Fractional reserve banking, central banks creating more currency, and politicians who spend governments deeper into debt each year… but this article isn’t about why.

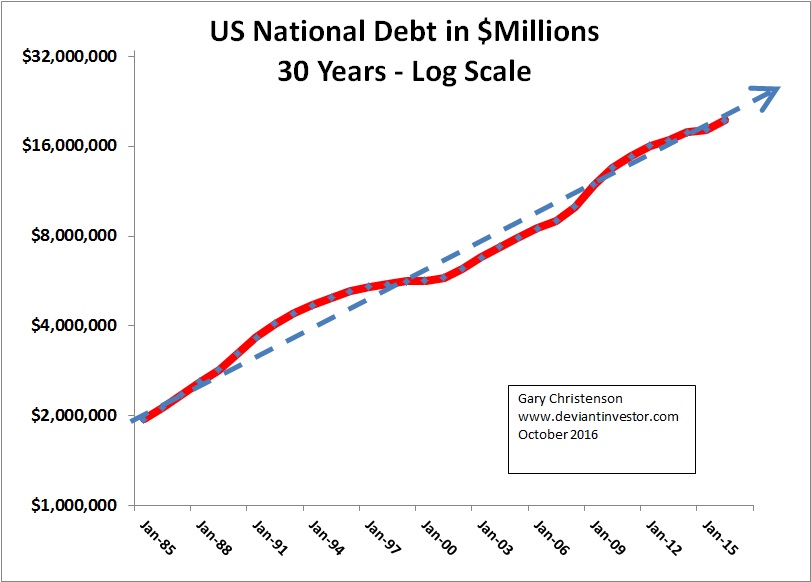

Student loan debt in the U.S. is about $1.4 trillion, auto debt is about $1 trillion, official national debt is nearly $20 trillion, corporate debt is huge and the list goes on. Much of it will never be paid in current dollars. Default will occur via repudiation or hyperinflation. Look at the official national debt below:

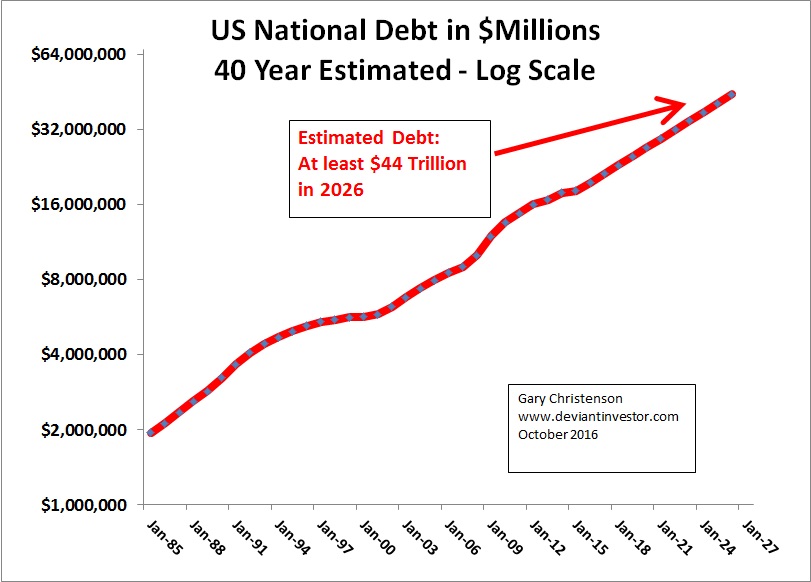

Official national debt has increased exponentially since 1913 and somewhat more rapidly since 2001. Project out another ten years and we see the following:

Increasing debt at about the same rate as the past 30 years projects north of $40 trillion in 10 years, BEFORE the massive increase in debt that will accompany new wars, more social programs, out of control Medicare spending, and 100 other items on the “out of control” list.

Read Karl Denninger: The Certain Destruction of Our Nation

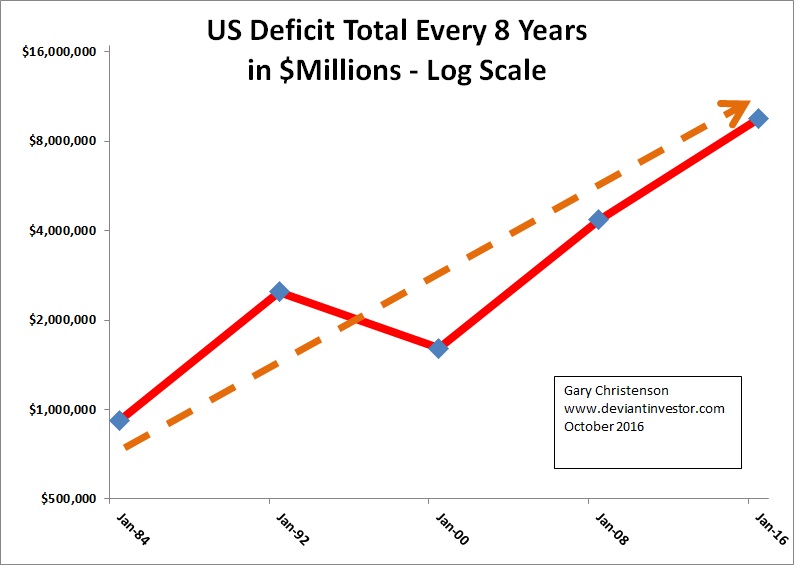

Exponential increases in total debt are also seen in the increases in the net deficits. The following shows the net increase in debt every eight years.

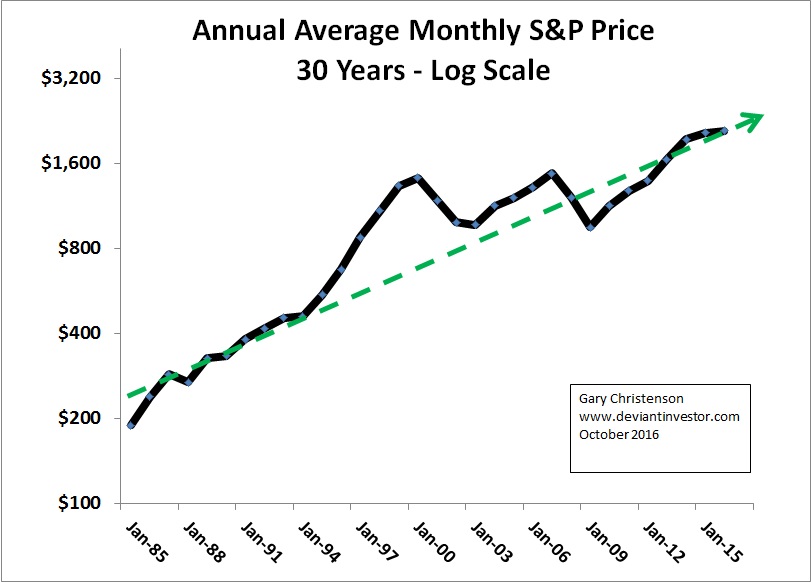

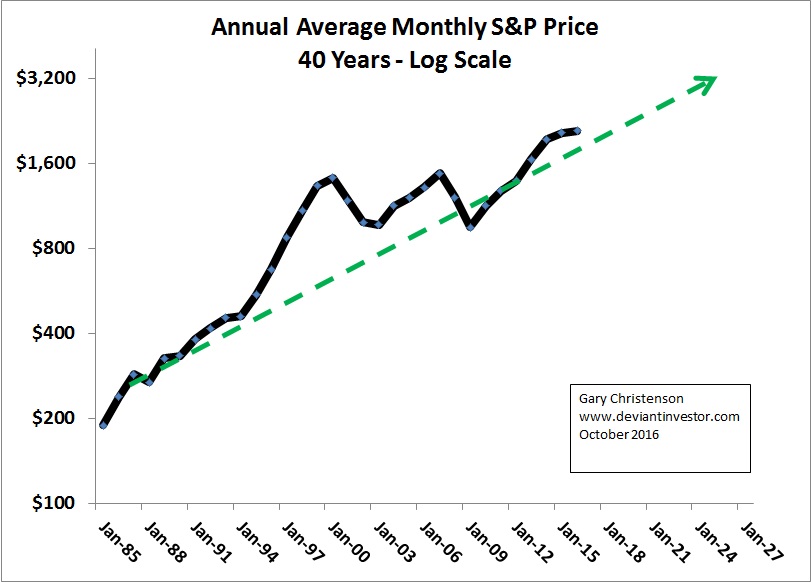

But along with exponential increases in debt and deficits we also see similar increases in the S&P and Silver.

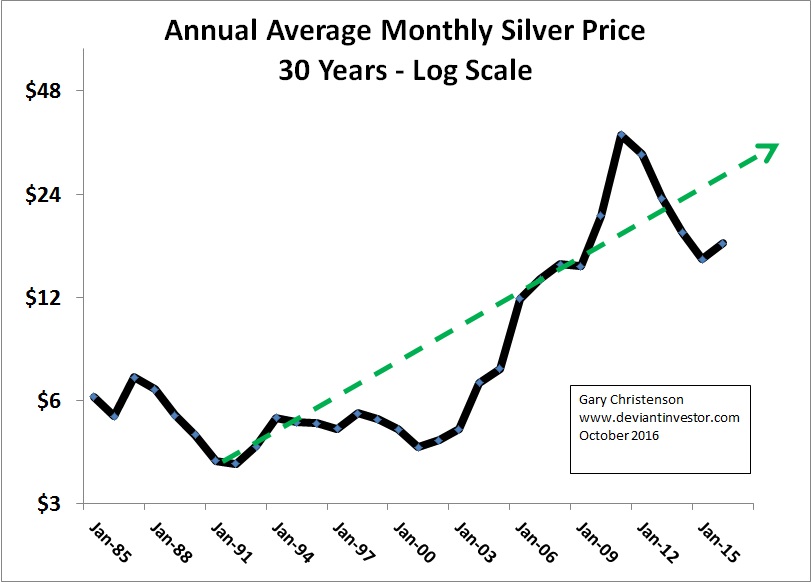

The S&P has increased from about 200 to over 2,000 in 30 years, with a number of significant crashes during that time. Silver has increased from an annual average of about $4 to a peak over $48 since 1990.

Our financial systems exponentially increase the quantity of currency in circulation and consequently the prices for practically everything increase. Think college tuition, medical care, beer, cigarettes, food, gold, silver, postage and more. A few prices have come down or increased more slowly, such as televisions and computers, thanks to technological innovations.

But on average prices for almost everything, including stocks, have increased since 1913 and will continue to increase until our economy is crushed with a major financial and economic reset. Until then, expect erratically higher prices, UNLESS:

- Congress balances the budget

- Central banks stop creating currencies

- Governments reduce total employees, expenses and taxes

- Militaries are reduced in size and expense

- Medicare expenses are capped or reduced

Clearly none of the above will happen in our current world.

What can we expect for silver prices?

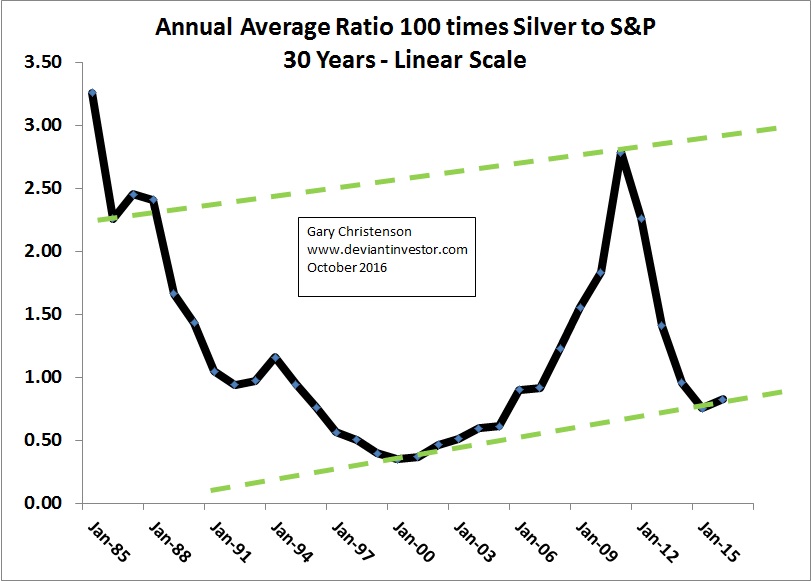

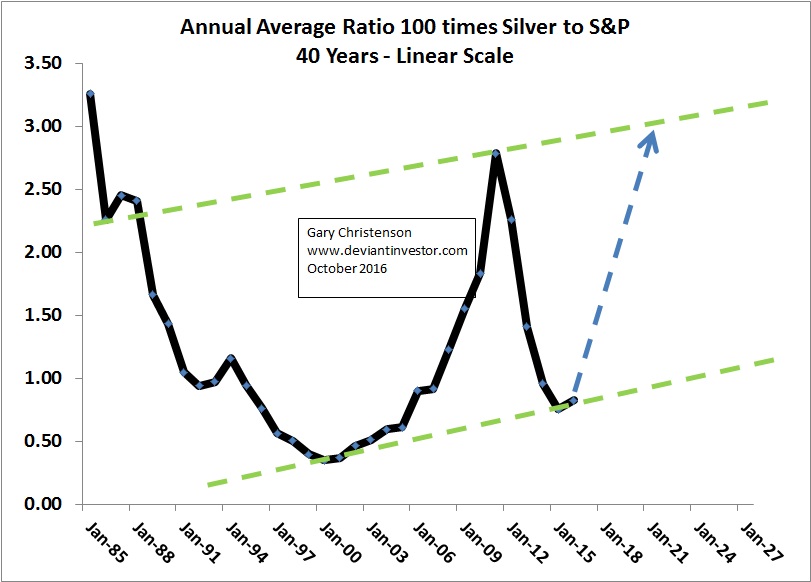

In the long term silver prices increase exponentially, along with other prices. Examine the following chart of the ratio of silver prices (times 100) to the S&P 500 Index using the annual average of monthly prices.

Conclusion: Silver prices are currently low compared to the S&P 500 Index based on 30+ years of prices. Central banks have levitated stock prices and “discouraged” silver prices since 2011 so this low ratio makes sense. What if the S&P continues its exponential increases and the ratio reverts back toward the high end of its range?

In ten years, given the exponential increases shown above, and assuming, more or less, current economic craziness continues without a massive “reset” then the S&P could be approximately 4,000, the silver to S&P ratio could be around 3.0, and the annual average price for silver could be roughly $100 – $150, with potential price spikes several times higher.

Can we expect the exponential increases from the past 100 years to continue?

- Of course not! All exponentially growing systems eventually crash. When is difficult to estimate.

- Nuclear war would change circumstances for most people, countries, and commodity prices. Nuclear war could happen accidentally or intentionally to cover and distract attention from criminal behavior, massive fraud, crashing economies, and policy failures. I trust other options will be used and we will be spared the devastation of nuclear war… but it is possible.

- The next U.S. president is likely to increase borrowing and spending. Much “free stuff” has been promised and “fiscal stimulus” will prevail. Perhaps he or she will push systems into hyper-inflationary mode, either accidentally or intentionally. In that case prices will be much higher. Reminder: Argentina has devalued its peso, compared to the US dollar, by 10 trillion to one since the 1950s. It can happen anywhere.

CONCLUSIONS:

- Silver and other prices increase exponentially.

- Silver prices are currently, relative to the S&P, quite low.

- A “reset” is coming sometime … It seems likely that silver will be reset much higher in both price and purchasing power.

- Hyperinflation is an insane response but may be used by the financial and political elite for their purposes. The same is true for nuclear war.

Silver flies, paper dies!

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.