Will the Stock Markets 2016 Bullish Run Continue in 2017?

Stock-Markets / Stock Markets 2016 Dec 29, 2016 - 04:55 PM GMTBy: Nicholas_Kitonyi

After an underwhelming 2015, the global stock markets peaked again in 2016 registering significant rallies across world. This came despite having a series of surprises in the geopolitical spectrum with Britain voting to leave the EU while the US voted Donald Trump to become the country’s 45th president against all odds.

After an underwhelming 2015, the global stock markets peaked again in 2016 registering significant rallies across world. This came despite having a series of surprises in the geopolitical spectrum with Britain voting to leave the EU while the US voted Donald Trump to become the country’s 45th president against all odds.

Oil prices gained some ground after plunging in 2015, and this can be said to have played a part in the resurgence of stock prices in 2016. At some point, it looked as though 2015 was going to mark the beginning of another financial crises, which threatened to erase the recovery witnessed since 2009.

The US Market

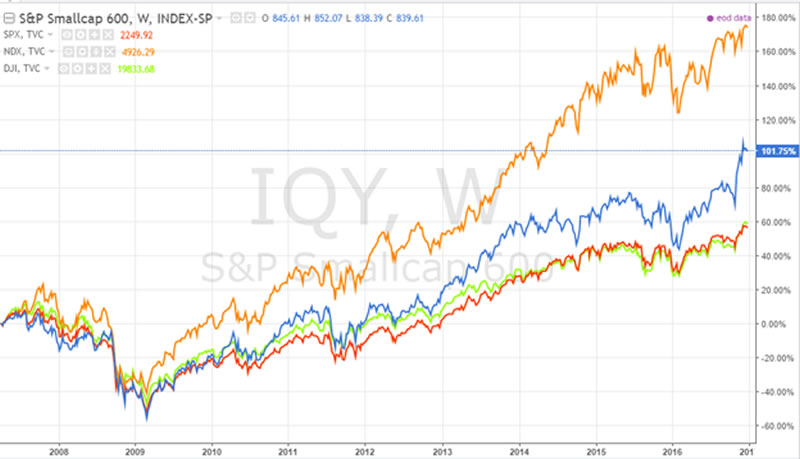

As demonstrated in the chart below, the stock market has recovered significantly over the last six years, and now, the 2008/2009 global financial crisis appears to be nothing more but a blip in an upward trending market. The NASDAQ 100 is up nearly 180% since 2007 while the S&P 500 and the Dow Jones Industrial Average are up nearly 60% over the same period.

On the other hand, for those who prefer to follow small cap stocks, the S&P Small Cap 600 Index has gained more than 100%. And per predictions obtained from one of the best stock alerts platforms for small cap stocks, the market could get a little choppy in 2017 as the effects of some of the major events of 2016 begin to take toll. The recent interest rate hike could be followed shortly by a period of uncertainty in the market as witnessed in early 2016. This creates a perfect opportunity for short term traders looking to capitalize on both long and short trades.

The US stock markets have been on a steady rally over the past few years and this is indicative of the country’s progress in stimulating economic growth. First, the Federal Reserve introduced quantitative easing, which provided the government with money to roll out in the economy. That created a conducive environment in the stock market.

And after the ending of the QE, the process of increasing interest rates started during which investors rallied stocks to new highs in anticipation of increased returns. The Federal Reserve forecasted a potential three more rate hikes in 2017, which are one less the number forecasted for 2016. Of course, we ended up having just a single rate hike. So, does that mean that we could end up with zero rate hikes in 2017?

It’s highly unlikely especially given the fact that Trump, who has been quoted severally questioning Fed’s cautious approach on interest rate hikes, will be inaugurated next month. Nevertheless, that will create more uncertainties as to whether the current Fed chair Janet Yellen will continue in her position, or Trump will replace her with his own appointee.

Europe

On the other hand, across the Atlantic and into Europe, the stock markets have been significantly volatile since 2009 with Germany’s DAX 30 being the only major index to have gained significantly in the aftermath of the global financial crises.

As demonstrated in the chart above, the DAX 30 is up more than 60% when compared to the heights achieved in the pre-financial crisis era in 2007.

UK’s FTSE 100 Index has gained just 11% over the same period while the French CAC 40 still has some 15% climbing left to break even.

Now, just like the US markets, 2015 saw the three indices drop significantly while the resurgence in 2016 appears set to continue through 2017. The European Central Bank has had a series of quantitative easing schemes started over the last few years, and the latest one is believed to be very much behind the current rally. The Brexit vote did affect stocks momentarily, but the main effect is expected in the coming months as the separation process drags on. This is likely to cause a few shocks in the market, but the overall outlook remains bright based on manufacturing numbers from Germany, France and Italy.

The ECB has kept interest rates at sub-zero levels for quite a while and that is likely to help in curbing the level of risk in the market. You could say that the Eurozone and the UK are more-or-less following in the footsteps of the US.

What about Asia?

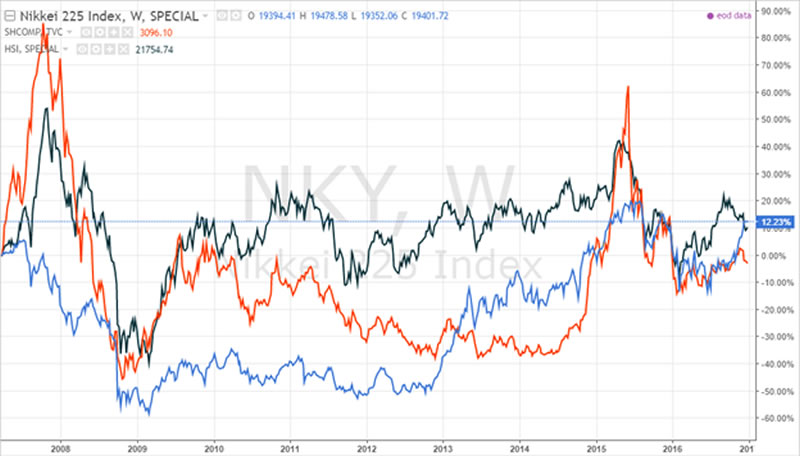

The Shanghai Composite Index has been the most volatile of the three main indices in the region. The same could be said about South Korea’s Hang Seng Index, which is yet to reach the highs achieved prior to the global financial crisis of 2008/2009.

The only major index to eclipse its pre-financial crisis high in Asia is Japan’s Nikkei 225, which is up just 12%.

Asia, has been one of the regions that investors feared could pull the rest of the global market stocks down after significant economic slowdowns in China and Japan. However, the Bank of Japan has not been shy to deploy quantitative easing programs alongside increased accumulation of gold bullion to leverage the value of the Yen.

China on the other hand, has seen a significant decline in economic growth after achieving double digit growth rates from late 1990s to late 2000s. The year 2017 will be very interesting for stock market investors.

By Nicholas Kitonyi

Copyright © 2016 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.