The Fed and Gold in 2017

Commodities / Gold and Silver 2017 Jan 27, 2017 - 11:18 AM GMTBy: Arkadiusz_Sieron

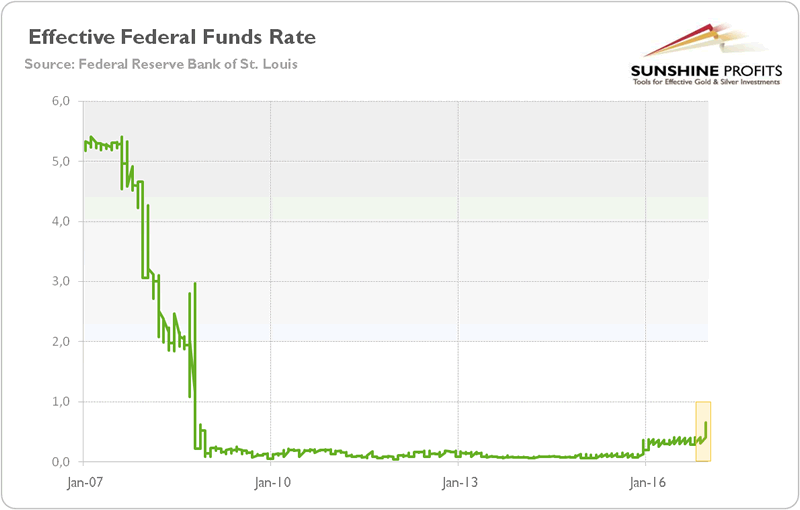

As everyone already knows, the Fed has finally hiked its interest rates for the second time in a decade and for the first time since December 2015, when it ended the zero interest rate policy. The chart below shows the current level of the effective federal funds rate after the recent move.

As everyone already knows, the Fed has finally hiked its interest rates for the second time in a decade and for the first time since December 2015, when it ended the zero interest rate policy. The chart below shows the current level of the effective federal funds rate after the recent move.

Chart 1: The effective federal funds rate after the second Fed hike in a decade.

What does the Fed hike mean for the U.S. economy? Theoretically, it could be negative for households and companies as higher interest rates imply higher borrowing costs. However, this quarter-point increase was widely expected, hence it was already priced in. Actually, the market-determined long-term real interest rates have increased about 40 basis points in the aftermath of the U.S. presidential elections. Hence, the Fed is already behind the curve. Hence, it is not so simple that higher interest rates threaten growth. It seems that the opposite is true right now: interest rates are higher since growth expectations are stronger. Indeed, markets seem to be comfortable with the Fed’s move, as credit spreads are still relatively low. There is agreement that the economic outlook has improved, which justifies higher interest rates. In other words, the Fed’s tightening is considered as a vote of confidence in the economy and as a sign of policy normalization after the unprecedented measures implemented after the financial crisis. This is not good news for the gold market, as the hike may strengthen the confidence in the U.S. economy and its currency, which is gold’s biggest rival.

However, the Fed raise had been already factored into the price of gold. The upward revision of the FOMC members’ projection for the federal funds rate from two to three hikes in 2017 was much more important for the bullion market. Consequently, investors’ expectations of the Fed’s pace of tightening also increased. For example, the market odds of at least one hike by June rose from 62.9 percent to 78.5 percent. Markets generally believed the Fed and are expecting two hikes with higher probability than 50 percent – in June and in September – and put more than 40 percent odds of the third hike in the last month of 2017 (as of December 21, 2016). The steeper path of interest rates is bearish for the gold market.

Now, the key question is whether the Fed will deliver these three hikes. We all know about its poor track record and remember how it chickened out again and again last year. Therefore, there are some good reasons to expect that the Fed’s stance will soften over the year, which would be positive for gold, which shines under a dovish rather than a hawkish central bank. This was exactly the case of 2016, when the yellow metal flourished when the Fed turned out more dovish than expected and struggled when the U.S. central bank adopted a more hawkish stance. Actually, gold started its bull market (or its upward correction as others would say) just after the December Fed meeting.

However, history does not have to repeat itself. 2017 will be different year than 2016 in four important aspects, all of them bearish for gold. First, the uncertainty about the Brexit and the U.S. presidential elections is behind us. Surely, the world remains a fragile place in the inhospitable, dark universe, but geopolitical risks upcoming in 2017, such as elections in Germany or France, may only further strengthen the U.S. dollar.

The second important difference is that Donald Trump won the presidential election. Like it or not, his victory changed the market sentiment. Now, investors expect higher inflation, higher interest rates, and faster economic growth. These expectations may be built on sand, but it does not change a situation where the current sentiment towards gold is negative, although it may change later in 2017.

Third, technical situation in the gold market is different. In December 2015, gold turned out to have been oversold, while in 2016 it has rallied about 30 percent in the first half of the year. Therefore, although gold plunged in November 2016, it was not oversold before the Fed’s move in December.

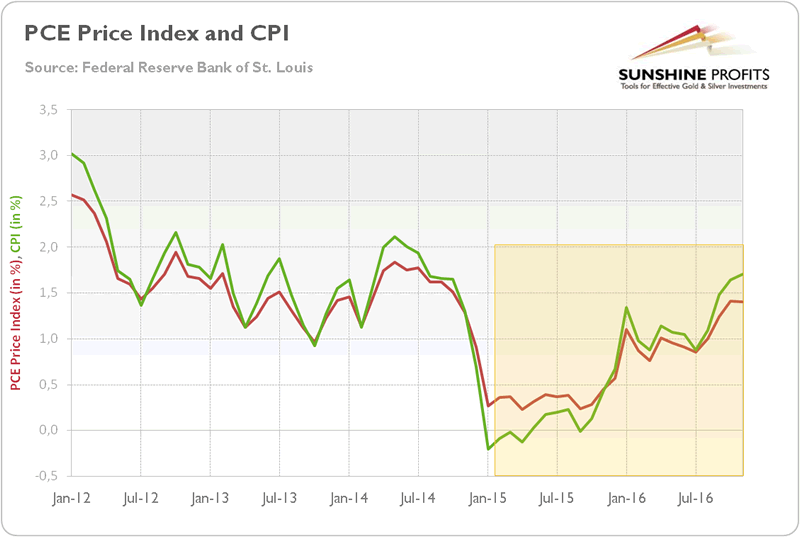

Fourth, the macroeconomic outlook also looks different. Last year, stock market and oil prices both crashed, and people were afraid of the slowdown in the global economy. But at the end of 2016 both oil prices and the stock market rallied, as people are optimistic about the economy. Moreover, the labor market strengthened, while the inflation rate rose, as the chart below shows.

Chart 2: The Personal Consumption Expenditures Price Index (red line) and the Consumer Price Index (green line) from 2012 to 2016.

Given all these shifts, the Fed’s stance also has changed. The recent Yellen remarks suggest that she is no longer willing to accept an overheating for a while. Hence, it seems that the U.S. central bank intends to neutralize possible expansionary fiscal policy with tighter monetary policy. Therefore, the Fed may indeed deliver three hikes or even try to raise interest rates more times this year, as it under-delivered in 2016. We are skeptical about this scenario, but this is what markets seem to believe right now.

The key takeaway is that the Fed has finally delivered the second rate hike in a decade. The move was widely expected, but the U.S. central bank surprised markets by revising up the projections for the federal funds rate in 2017. The more hawkish Fed, combined with a slightly improved macroeconomic environment, the eased geopolitical uncertainty and more optimistic market sentiment are negative factors for the gold market. This is why investors should not expect a replay of 2016 when the gold started its rally after the FOMC meeting. We cannot preclude such a scenario, but given the widened divergence between the Fed and other major central banks such as the ECB and the BoJ, we rather expect appreciation of the U.S. dollar, which would exert downward pressure on the yellow metal.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.