Gold Price Trend Forecast, Where are the Gold Traders?

Commodities / Gold and Silver 2017 Feb 06, 2017 - 03:04 PM GMTBy: Bob_Loukas

This is the 3rd piece on gold that highlights how unloved gold remains today. Considering the 2016 rally in gold and the turbulent times we now find ourselves in, to be honest I'm rather surprised there are not significantly more gold traders all over this market. Part 1 and Part 2 cover the initial stages of this rally from the December lows. Below is an excerpt from the Financial Tap Member weekly weekend report.

This is the 3rd piece on gold that highlights how unloved gold remains today. Considering the 2016 rally in gold and the turbulent times we now find ourselves in, to be honest I'm rather surprised there are not significantly more gold traders all over this market. Part 1 and Part 2 cover the initial stages of this rally from the December lows. Below is an excerpt from the Financial Tap Member weekly weekend report.

I am rather surprised to read across the blogosphere how a majority of Gold Traders appear to discount and undermine the current gold market. I can appreciate that the longer term cyclical outlook remains unresolved, but in the short-term at least, I believe the gold sector looks to be in great shape.

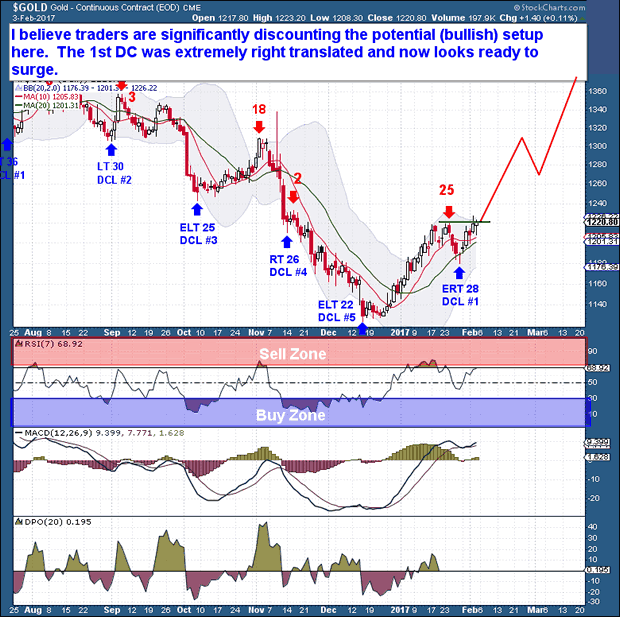

My view comes with the hindsight of the Cycle count. From what I can see, we recently completely a clear 1st Daily Cycle Low and have already moved higher to new Investor Cycle (Weekly Cycle) highs. Historically, with the second Daily Cycle just starting out, we are now in the most bullish portion of a 26 week Cycle. That means the performance over the next 3-4 week normally shows the best return for the entire Investor Cycle period.

In looking at the chart below, I see that new highs on Thursday confirm that we have a new Daily Cycle in motion. The DCL was relatively mild and short, but then again being a 1st DCL this is not unusual or particularly surprising. And if we consider the 1st DC rally was orderly and not excessively overbought, then there was no real need to see a punishing Cycle decline to counter that rally. Because the 1st DC that was extremely right translated, my most favored outlook is to expect a significant surge in gold over the coming 10 to 15 trading days.

I often receive emails from concerned members or posts on the Bull Bear Talk forum (http://www.bullbeartalk.com) asking if I'm sure the market completed a Cycle Low. If I see the possibility of a Cycle Low decline to come. Their concern is out of fear of losing, rather than seeing the opportunity in the setup. And generally that fear comes from a lack of proper trade sizing and risk management, because losing trades for some people ending up costing them far too much of their capital.

My answer is generally the same, in that we should always favor the possibility that best fits the evidence. If you're concerned about taking a trade, then take half the size so it's not a mental burden. But do not look for the outlier possibility to every scenario out of fear. If you're going to follow Cycle's analysis, then stick with the most plausible scenario and build your trade position around that narrative. Picking trade winners is difficult enough, but coming up with correlated asset arguments or unlikely Cycle outlooks means you're automatically going to be trading an idea that has a 33% win rate at best.

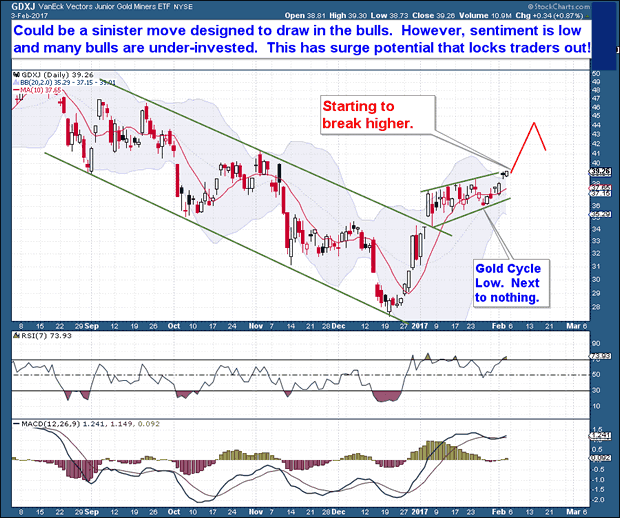

Always look at the evidence as it stands, meaning the recent price action and what has occurred, not what might occur. Look at the chart of precious metal miners below, for example. Sure, this could be a sinister move designed to draw in the bulls. But that goes to my point above; we cannot sit back and look at the worst case scenario, that's what defining a stop point is designed to protect us against. The chart below, with the evidence seen in gold/silver price, tell me that we have a great setup ahead.

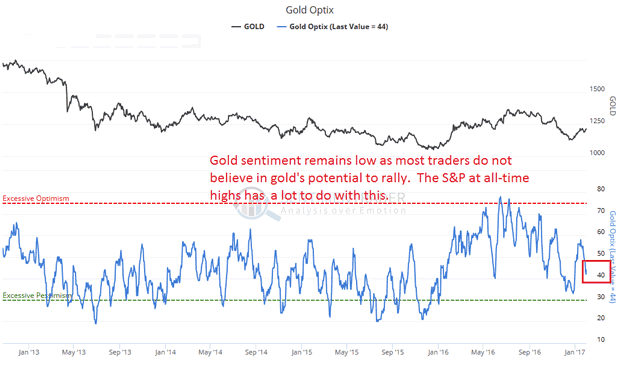

What I like most about this setup is that sentiment has actually been going down. A similar phenomena is being recorded within the COT report, where speculative traders have yet to offload their short position, let alone begun the normal short to long rotation see during every Investor Cycle.

Unless gold is back into a bear market trend, such as circa 2011-2015, then the sentiment chart below indicates that gold could rally for another 2-3 months before reaching the overbought levels associated with bull market, IC Tops.

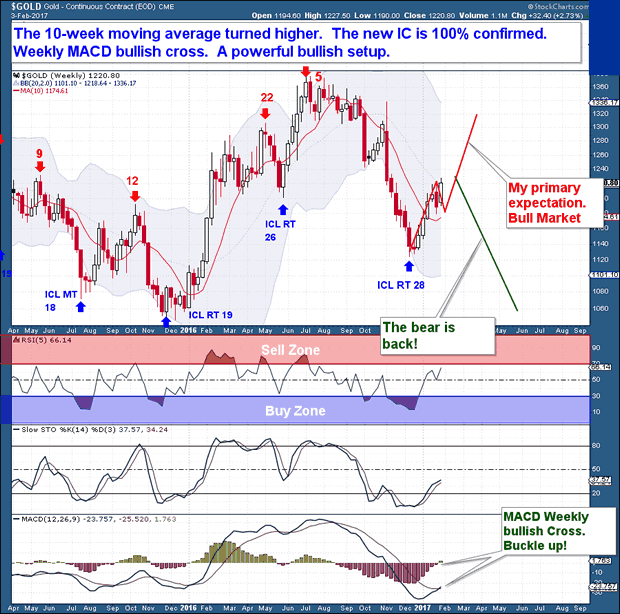

We have now completed seven weeks of this Investor Cycle and in my opinion we have a perfectly formed bull market Investor Cycle. The 10-week moving average has turned higher now, and trailing technical indicators show support for a mover higher supported for another month or two.

We also have a weekly MACD bullish cross developed. Essentially with a 2nd Daily Cycle just starting out, we have all the right confirmations and pieces in place now for the next powerful move. I continue to stress that nobody can tell you if this will end up as a powerful Right Translated Cycle, as seen in the first half of 2016. But I can say that a powerful bullish setup has formed and Gold Traders want to be positioned in a way where we can capitalize on a 2016 like rally. At the same time, it's not a call to be all-in, we want to remain defensive enough (risk defined) to come out relatively unscathed if a bear market decline returns.

The Financial Tap – Premium

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s Cycles. Along with these reports, members enjoy access to a real-time portfolio with trade alerts.

NOTE: It’s just $99 for a full 3 months of membership, a fraction of what one stopped out trade is likely to cost you. Consider joining The Financial Tap and receive two reports per week and the education you need to become a better trader or investor See >> SIGN UP PAGE!

By Bob Loukas

© 2017 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.