Inflation Spikes in 2017, Supporting Gold Prices Despite Increased Odds of March Rate Hike

Commodities / Gold and Silver 2017 Feb 17, 2017 - 10:17 AM GMTBy: Jason_Hamlin

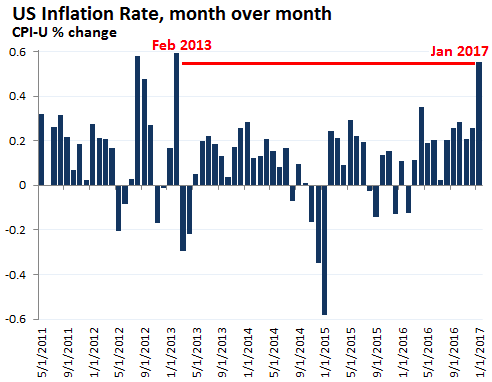

Inflation is coming. In fact, inflation rose at the fastest pace in four years during January. Consumer prices surged 0.6% in January from December, double the consensus forecast of a 0.3% rise. This marks the sharpest monthly increase since February 2013, according to the Bureau of Labor Statistics.

Inflation is coming. In fact, inflation rose at the fastest pace in four years during January. Consumer prices surged 0.6% in January from December, double the consensus forecast of a 0.3% rise. This marks the sharpest monthly increase since February 2013, according to the Bureau of Labor Statistics.

Source: BLS St. Louis FED / Wolfstreet

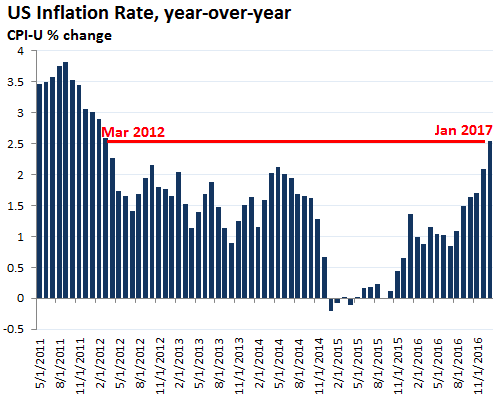

The year over year chart helps to highlight the acceleration in inflation that we have seen over the past several months. The January spike is certainly more than a blip on the radar.

Source: BLS St. Louis FED / Wolfstreet

The year-over-year non-seasonally adjusted Headline CPI came in at 2.50%, up from 2.07% the previous month. While a sharp rise in the gasoline index accounted for nearly half the increase, there were advances in the indexes for shelter, apparel and new vehicles. Energy prices jumped 4% month over month, including gasoline which jumped 7.8%.

While many analysts have been calling for rampant inflation or even hyperinflation, it has failed to surface over the past decade. All of the money printing, fiscal stimulus, bank bailouts and explosion of the FED’s balance sheet has failed to generate any alarming inflation in official statistics. However, if you buy groceries or pay for health care, you might have a different take on the situation.

In fact, prices for beef and seafood have risen roughly 50% over the past ten years. Rice, pasta and bread are up around 40% in the same time period. Prescription drug prices are up 44% and health care premiums have skyrocketed. The price of college tuition is up 150% since 2000. Housing prices, to purchase or lease, have also climbed significantly over the past six years. The bottom line is that prices for nearly everything have been rising much faster than wages. Consumers are feeling the pain in their pocketbook and savings account, as their standard of living declines. If these latest inflation figures are a sign of things to come, that pain is going to get much worse.

What is causing prices to rise so fast?

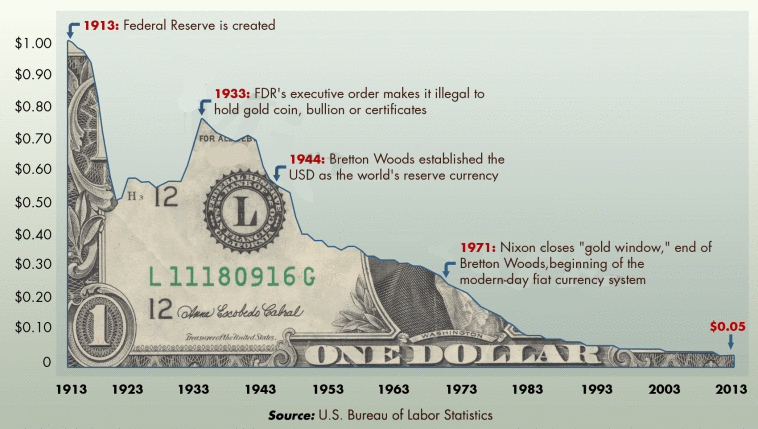

It is the unholy alliance of the Federal Reserve and government. The Federal Reserve continues to debase the value of the dollar by creating trillions of dollars out of thin air in order to keep the economy afloat and enrich their bankster buddies. We’ve all seen this chart, but it a potent visual aide in understanding the extent to which the dollar has been devalued over time. One dollar from 1913, when the Federal Reserve was created, would be worth only 5 cents today!

You see, the FED can create unlimited amounts of dollars to suit their needs. Want to start another war? Let’s just borrow and print. Should the government balance the budget? Nah, just borrow, print and kick that can down the road. Big bank profits slipping? Reduce their borrowing costs, pay them interest on excess reserves and increase their leverage. That will fix it! After all, the Federal Reserve is believed to be majority owned by the big banks and their executives. So, it is no surprise that a quasi-federal institution would be working to benefit their largest shareholders.

We now have a President well versed with using debt and committed to massive new spending on infrastructure and the military. Deficits are likely to explode higher and the overall debt load will climb. My guess is that he will prioritize immediate economic growth over the disastorous long-term impact of unsustainable debt. Some of the increased deficit spending my be offset by increased tax revenues, if he is able to get corporations to repatriate cash and bring factory jobs back to the United States. Still, I believe we are likely to see rising annual deficits under Trump.

While the official CPI is growing at 2.5%, John Williams at Shadowstats.com believes the true inflation rate is closer to 6%. This measure reflects the CPI as if it were calculated using the methodologies in place in 1980. In general terms, methodological shifts in government reporting have depressed reported inflation, moving the concept of the CPI away from being a measure of the cost of living needed to maintain a constant standard of living.

Note that no matter which measure of inflation you use, inflation is currently spiking higher. We will need to watch closely in the coming months to see if this is a temporary spike or the start of a new major uptrend in the inflation rate. The worry is that inflation has a way of spiraling out of control, especially when massive amounts of new fiat funny money finally begin flowing through the economy. While the velocity of money has yet to pick up, as of Q4 2016, we are seeing other signs such as retail sales soaring 5.6% year-over-year in the latest reading.

What Does Increased Inflation Mean for Gold Investors?

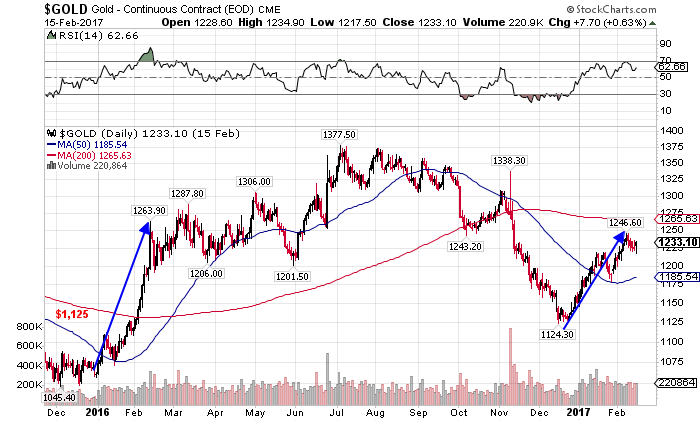

Gold is off to a strong start of 2017, much like the strong start to 2016. It is up 8% despite the December rate hike, again similar to gold rising after the December 2015 rate hike. Gold had a small correction during mid-February last year and appears to be correcting again in mid-February this year. History repeats.

But the interesting thing in 2017 is that gold is holding up this time around despite increased odds of a March FED rate hike. The odds have recently doubled from 20% to 40% after hawkish comments from Janet Yellen stating that a March rate hike is not off the table. Of course, a spike in inflation also supports another rate hike sooner rather than later.

So, on the one hand gold should be dropping on increasing rate hike expectations, but on the other hand the spike in inflation is supporting the gold price. Gold tends to perform well during period of inflation when the dollar loses value. The Federal Reserve over-promised and under-delivered in terms of rate hikes in 2016 and the market may be betting on a more gradual pace than previously anticipated.

The bottom line is that the Fed is sitting on a powder keg, after years of QE and a zero-interest-rate policy (ZIRP) that have caused mind-boggling asset price inflation. The stock market and bond market are both in overvalued bubble territory waiting to pop. Real estate prices are back in bubble territory, with many markets now above pre-financial crisis highs. Banks are more levered than ever, with the persistence of too-big-to-fail and moral hazard unabated. When you throw in the increasing political instability occurring globally, it is only a matter of time before one of the bubbles pop and create a ripple effect throughout multiple markets.

I expect gold and silver price to continue much higher during 2017 and believe that all dips should be viewed as buying opportunities. Mining stocks have been giving investors leveraged returns of roughly 3X the advance in gold. Several of the junior mining stocks that we track in our newsletter are up 50% or more in just the first two months of the year!

In addition to gold, we have been generating significant profits in uranium stocks, lithium stocks, cannabis stocks and other sector. Get all of our top picks by becoming a Gold Stock Bull Premium Member.

Please note that our subscription prices are going up March 1st, so you may want to consider locking in current rates before they increase. It is currently less than $1 per day for the subscription. We believe it will pay for itself many times over.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. Click here for instant access!

Copyright © 2017 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.