Trump’s Tax System Could Spark The Wave Of Self-Employment

Politics / Taxes Feb 20, 2017 - 04:06 PM GMTBy: John_Mauldin

Government is necessary.

Government is necessary.

That means we have to pay for the things government does. Hence, we have taxes.

The goal of tax policy should be simple: raise the required revenue to pay for whatever government actually—minimally—needs to do. And government should do those things as fairly and neutrally as possible.

And like we’ve talked about previously in my Thoughts from the Frontline (subscribe here for free), is that what happens? No.

The Current Tax System Is Pretty Bad

The outcome, over years and decades of incremental amendments and exceptions, is we now have a system that no one fully understands. It is one that creates all manner of twisted, counterproductive incentives. Large parts of our economy, indeed entire industries, exist only because the tax system makes them profitable. Others don’t exist because the tax system makes them unrewarding.

Why do we endure this? Because, as much as we complain about the tax system, we all get something out of it. Nearly everyone has a vested interest in keeping some part of the current system intact. We also fear that any change will only make taxes worse—a perfectly rational fear, too.

So, to the extent that the House Republicans want to give us a better system, I applaud them for trying.

I think there will be major unintended consequences, no matter how well-intentioned the efforts. You see, you simply cannot overhaul our current tax system, as invasive as it is, without making winners and losers.

The Proposed Tax System Might Be Better

As I travel around the country, I am rather amazed to see how few people actually understand what is being proposed on the tax front.

So, here is what is being proposed as the new tax system. This is how they describe the plan in their own words (and their own font, too).

Simpler, fairer, and flatter. Jobs and growth. An “IRS that puts taxpayers first.” All this sounds great compared to what we have. But how will they achieve these lofty goals?

The Better Way blueprint changes both individual and corporate income tax policies. Highlights for individual and family taxpayers include:

- A three-bracket tax rate schedule with the top rate reduced to only 33%

- Elimination of itemized deductions except mortgage interest and charitable giving

- Larger standard deductions and child/dependent care tax credits

- Streamlining of education tax benefits

- Elimination of the Alternative Minimum Tax (AMT)

- Improved Earned Income Tax Credit (EITC)

- Repeal of the Estate Tax and Gift Tax

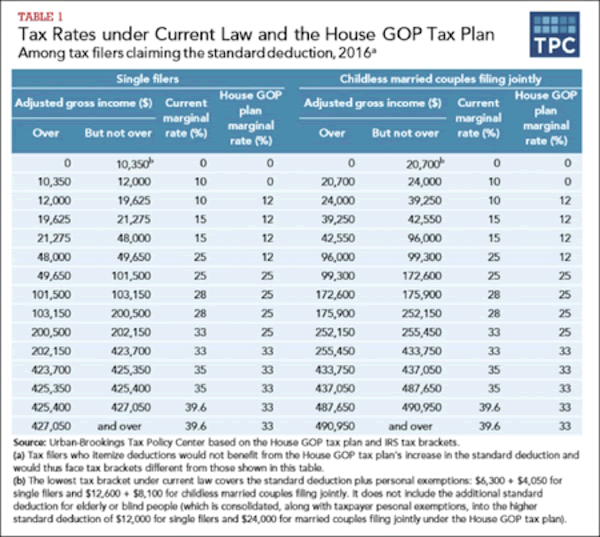

Here is a handy comparison chart from the Tax Policy Center. It shows both the current rates and new rates by income level.

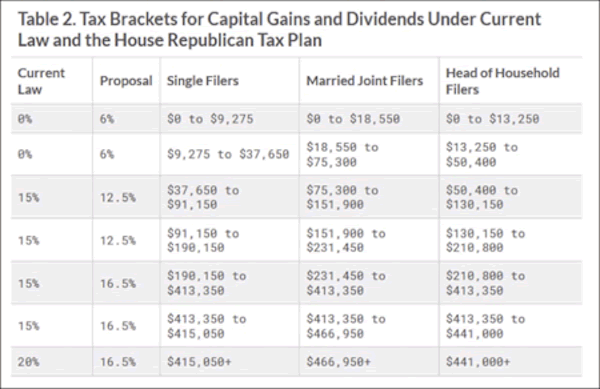

Different rates apply for capital gains and dividend income. The following chart from the Tax Foundation shows those rates under current law and the House GOP proposal. Note that the plan makes these rates even more attractive with a 50% deduction for capital gains, dividends, and interest income.

For the most part, we see marginal rates going down, though the revised deductions and other features make direct comparisons difficult.

Consequences of a Better Way?

They haven’t written all the fine rules and details yet, but given the system as proposed, care to make a wager with me as to how many self-employed individuals will manage to have their actual on-the-book W-2 wages drop to under $200,000 and the rest of their earnings become self-employed income?

Again, the tax rate on income for proprietorship and pass-through entities (LLCs, sub-S corporations, and the like) tops out at 25% under this plan. High-earners who aren’t already business owners or contractors will reorganize. Something similar happened with the 1986 Reagan tax reform.

If this presently proposed tax reform passes as currently written, a very similar reorganization will happen. By the way, this response is not a bad thing. It’s just something that happens when you change the rules on taxation.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.