Energy Fuels Provides 'Strong Leverage to Potentially Increasing Uranium Prices'

Commodities / Uranium Feb 24, 2017 - 10:53 AM GMT  Uranium has risen 30% from the very low prices of late last year and a trio of analysts agrees that Energy Fuels is in position to take advantage of a rising price environment.

Uranium has risen 30% from the very low prices of late last year and a trio of analysts agrees that Energy Fuels is in position to take advantage of a rising price environment.

Uranium's 30% rise from the low of $17.75/lb on Nov. 30, 2016, is fueled by a number of supply and demand factors that has industry watchers optimistic that the tide has turned. On the supply side, Kazakhstan's state-owned Kazatomprom announced in January that it would cut production by 10%; the company supplies 40% of the world's uranium. The company also announced the opening of a trading office in Switzerland. That could help placing the material in the market on a more orderly basis. Justin Chan, an analyst with Numis Securities, told Proactive Investors that "Kazatomprom's establishment of Swiss marketing arm suggests that inventory management may become a policy tool. An inventory policy rather than direct supply would see it act as more of a swing producer or swing seller, using inventory and production levels to influence the uranium price."

Industry watchers also found hope in Rick Perry's Senate confirmation hearings as U.S. Secretary of Energy in January when he said that he would take a hard look at the Department of Energy's practice of bartering uranium. This bartering is believed to place between 5 and 8 million pounds of uranium into the market annually.

On the demand side, there are currently 60 nuclear reactors under construction worldwide and another 160 planned, according to the World Nuclear Association, and existing reactors are having their lives extended. In the U.S., "over 75 reactors have been granted license renewals which extend their operating lives from the original 40 out to 60 years, and operators of most others are expected to apply for similar extensions," reports the Association. In December, the state of Illinois passed a bill providing subsidies for the operation of three reactors run by Excelon; the reactors had been expected to shutter in 2017 and 2018.

Macquarie Bank analysts wrote in a Jan. 20 report, "With the closure of a large number of nuclear power plants announced earlier in 2016 on economic grounds, legislative actions in New York and Illinois keeping some of these open will provide both more optimism and spot market demand into 2017."

Additionally, it is believed that the Trump administration's pledge to make the U.S. energy independent will encourage the development of more nuclear power reactors.

Japan's restart of nuclear power reactors is also a factor on the demand side. According to the World Nuclear Association, "five Japanese nuclear power reactors have already cleared inspections confirming they meet the new regulatory safety standards and have resumed operation. Another 19 have applied to restart." The Institute of Energy Economics, Japan estimates that "seven Japanese nuclear power reactors are likely to be in operation by the end of next March [2017] and 12 more one year later."

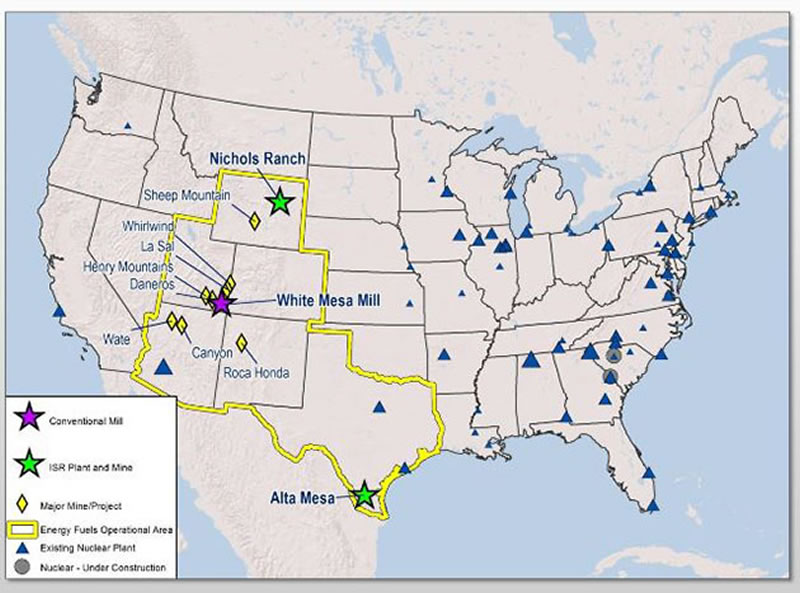

Energy Fuels Inc. (EFR:TSX; UUUU:NYSE.MKT) is positioned to take advantage of the rising tide for uranium by continuing to explore and develop its properties. On Feb. 17, it reported that the Environmental Protection Agency (EPA) issued an aquifer exemption for the Jane Dough wellfield at the Nichols Ranch project in Wyoming; this allows for future in situ recovery. The wellfield, according to the company, is important in sustaining "long-term uranium production at Nichols Ranch. . .once all thirteen header-houses in the Nichols Ranch wellfield have been constructed, the Company expects to advance production into the Jane Dough wellfield, which will be connected to the Nichols Ranch Plant."

Colin Healey, an analyst with Haywood Securities, noted that the "receipt of EPA concurrence on the Aquifer Exemption for the Jane Dough resource area represents positive incremental progress and de-risking of EFR's Wyoming ISR uranium production pipeline. . .Jane Dough is part of EFR's currently producing Nichols Ranch ISR project, and hosts a contained resource of 3.6 Mlb U3O8 (1.5 Mt grading 0.11% U3O8), which will add substantially to the permitted resources at the project once final approvals and regulatory authorizations are in place (expected in coming months), increasing the permitted total contained uranium by more than 100%."

"EFR will continue measured production from its ISR operations pending uranium price improvement, but remains very well positioned to ramp up production in an improving uranium price environment, where we are looking for a sustainable material improvement in supply/demand fundamentals over the course of the next 2-3 years and beyond," Healey wrote.

Rob Chang of Cantor Fitzgerald noted on Feb. 17 that "while expected, the approvals from the EPA and the WDEQ are necessary milestones in the development of Jane Dough. We continue to view Energy Fuels as our top leverage play to the uranium recovery."

Energy Fuels is also continuing to explore its Canyon Mine in northern Arizona. On Feb. 2, Energy Fuels released assay results that confirm that it is "continuing to discover large and high-grade areas of uranium mineralization, which the Company expects will result in a larger recoverable uranium resource than what is currently described in the existing technical report for the Canyon Mine." Energy Fuels also stated that it is "continuing to discover additional zones of high-grade copper mineralization, both inside and outside the areas of potentially recoverable uranium mineralization."

In an earlier release of high-grade eU3O8 drill results at Canyon Mine, Energy Fuels noted that "These drilling results continue to increase the Company's level of confidence that production costs from the Canyon Mine have the potential to be low-cost and competitive with the best underground uranium mines globally, including mines in Canada, based on industry-published cost estimates. In addition, the possibility of recovering copper and silver as co-products of uranium recovery has the potential to make the economics of the Canyon Mine even better."

Stephen P. Antony, president and CEO of Energy Fuels stated, "Core drilling at the Canyon Mine continues to produce exciting and, in some cases, unexpected results for both uranium and copper. This is certainly a fascinating deposit that appears to be full of valuable metals in multiple zones. This is particularly exciting, as uranium prices are showing recent strength."

Heiko Ihle with Rodman & Renshaw noted, "While we had initially envisioned Canyon as an eventual high-grade uranium mine, we remain impressed by the continued strong copper grades encountered at the site. . .we expect additional near-term drilling results to serve as a potential catalyst for Energy Fuels in 1H17."

"Energy Fuels is a strategic U.S. uranium producer that is poised to take advantage of future U3O8 price improvements. Notably, Energy Fuels is the only United States producer of uranium utilizing both ISR and conventional mining methods. In our view, this places the firm at a distinct advantage among its peers, since management has the ability to scale production based on the uranium market," Ihle added.

"Although the uranium market has remained depressed as a whole, we feel that Energy Fuels has accumulated a strong combination of both conventional and ISR projects that should provide investors with strong leverage to potentially increasing uranium prices going forward," Ihle concluded.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles and interviews have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Articles page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate ho9usehold or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) Energy Fuels Inc. is a billboard sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.

Additional Disclosures for this Content

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.