James Rickards: Gold Price $10,000 Long-Term Forecast

Commodities / Gold and Silver 2017 Mar 10, 2017 - 02:14 PM GMTBy: GoldCore

James Rickards: Long-Term Forecast For $10,000 Gold

James Rickards: Long-Term Forecast For $10,000 Gold

James Rickards, geopolitical and monetary expert and best selling author of the ‘The New Case for Gold’ has written an interesting piece for the Daily Reckoning on why he believes gold will reach $10,000 in the long term.

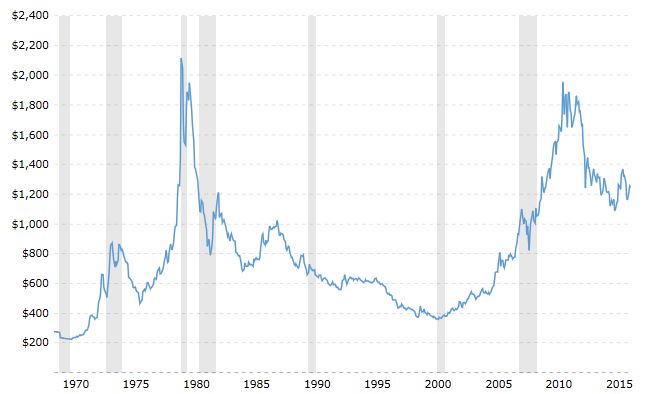

Gold in USD Adjusted for Inflation 1970-2017 – Macrotrends.net

He warns of the many systemic and geopolitical risks including the EU elections, from nuclear North Korea, tensions with Iran and “rapidly rising tensions between the U.S. and increasingly powerful China in the South China Sea.”

James Rickards believes that the EU elections “could potentially bring the future of the European Union into grave doubt” and that the “bottom line” is that “there are plenty of potential geopolitical shocks that could threaten the current system, in addition to existing concerns about a stock market collapse or debt crisis.”

“The time to prepare is now” advises Rickards.

From the Daily Reckoning:I believe the Fed is preparing to raise into weakness and will have to reverse course in April or May. What happens to gold then? It’s going to go higher again, because the Fed will cheapen the dollar, and that’s very bullish for gold. So I expect gold to take off in the spring and finish the year very strongly. It could challenge $1,300 or $1,400.

Now, as many of my readers know, my long-term forecast is for $10,000 gold. We’re obviously not there now. So how do I arrive at $10,000?

I want to give the basis for that forecast. I never give any forecast without giving the analysis behind it. Anybody can pull a prediction out if a hat. If you don’t have the analysis to back it up I’m not interested.

So let’s go through the math, because there is a solid mathematical basis for $10,000 gold. It’s actually the implied non deflationary price of gold under a gold standard.

The combined M1 money supply in the world is about 24 trillion dollars. That includes the United States, China, the Eurozone and Japan. Those four entities combine for over 70% of global GDP.

Now, the official gold in the world is about 33,000 tons. That’s not counting private gold, because private gold is not part of the money supply.

So if you wanted to restore a gold standard, how much gold do you need to back up the money supply? My estimate is about 40%.

Historically, central banks have run successful gold standards with less backing. In the 19th century, for example, the Bank of England only had about 20% gold backing. In most of the 20th century, the U.S. had 40% gold backing.

I use the higher number, 40%, because I think a higher number might be needed to restore confidence in event of a collapse. The point is, 40% is a debatable, but reasonable figure.

Many people say there’s not enough gold to support the money supply. That’s one of the objections to gold standard. But my answer is that’s nonsense. There’s always enough gold to support the money supply. It’s a question of price.

Now, if you back 40% of the $24 trillion of money supply with the amount of official gold, it implies a gold price around $9,000 an ounce. But I predict $10,000.

So how do I arrive at $10,000 an ounce?

That’s because I expect central banks to print a lot more money by the time this issue comes to a head. So, by the time the printing presses stop running around the world, that $9,000 number will likely be in the range of $10,000.

The point is, $10,000 an ounce is not pie in the sky. It’s not a number I pulled out of a hat to get headlines. It’s the actual mathematical implied non deflationary price of gold. If you reintroduced a gold standard at a lower price, it would be deflationary. They’d have to reduce the money supply in order to bring it into alignment with the price of gold.

So I expect $10,000 is where gold will have to be, given the amount of official gold and the projected amount of printed money to give it 40% gold backing.

That’s the basis of my forecast. It’s rooted in history and sound monetary management. It’s rooted in simple mathematics. If anything, the number’s probably going to go higher. A year from now, that $10,000 figure might be even higher.

This is important because gold maintains a prominent place in the international monetary system, despite what elites say.

If gold is not money, if gold is not part of the monetary system, if gold is just a commodity that people trade, my analysis wouldn’t apply. But I believe that gold is money, and it always has been.

Gold has always been at the base of the international monetary system. To a certain extent it still is, whether or not central banks or the elites want to acknowledge it.

If gold was irrelevant, why does the U.S. have 8,000 tons? Why does the IMF have 3,000 tons? Why does Germany have 3,000 tons? Why has Russia tripled its gold supply in the last 10 years? Why has China more than tripled its gold supply in the last 10 years?

Why are they all hoarding and buying gold if it has no role in the monetary system?

The answer of course is that it does, but the monetary elites would just as soon not talk about gold bullion.

If you had the power of a central bank, why would you want gold to be part of the equation? It takes away their freedom to print money. Nobody kind of gives up power voluntarily, but they many not have a choice. A monetary system anchored to gold might be required to restore gold in event of another financial collapse.

The next question is, what’s the catalyst that could send gold soaring from today’s levels to $10,000 an ounce?

There are several potential catalysts.

It goes back to the avalanche metaphor I’ve used many times. Once enough snow builds up on the mountainside, it becomes unstable. At some point one snowflake will be the trigger that creates an avalanche.

Do you blame the snowflake or do you blame the instability of the system? The answer is you blame the instability of the system. One particular snowflake may have caused it, but the instability of the system is the real cause.

The current monetary system is unstable, the snow is piling up, and any number of snowflakes could trigger the avalanche. It’s hard to know exactly which one will be responsible, but it could be a geopolitical shock.

Iran recently deployed its navy to conduct exercises in all the important maritime choke points in the Middle East. President Trump has said if those Iranian speed boats get too close to our ships we’re going to blow them out of the water. We haven’t yet, as the navy’s rules of engagement have not permitted them to.

But now President Trump is apparently giving the green light. And the other day an American ship had to adjust course after an Iranian vessel came within 600 yards of it.

So with the Iranians testing us and the navy on full alert, how long will it be before there’s an incident where one of these boats is blown out of the water and maybe trigger something much larger?

That’s one example, but there are many others.

North Korea just conducted four ballistic missile tests that landed in the Sea of Japan. North Korean nuclear weapons will fairly soon be able to target the U.S, west coast. The U.S. is not going to allow that, and the State Department has said the U.S. is prepared “use the full range of capabilities at our disposal against this growing threat.” So we’ll probably have to attack North Korea if we can’t get China to rein them in.

The South China Sea is also another hotspot with rapidly rising tensions. China is flexing its muscles, pitting it against close American allies and American interests. One incident can easily escalate. There are many other geopolitical flashpoints that could trigger a major international crisis.

Another triggering snowflake could be a natural disaster. Or it could be a political earthquake.

The French elections are coming up over the course of two rounds in April and May. What if Marion Le Pen wins the election? I’m not forecasting that she’s going to win right now, but the market is underestimating her probabilities. We also have Netherland elections this month and German elections in October.

The outcome of these elections could potentially bring the future of the European Union into grave doubt.

The bottom line is, there are plenty of potential geopolitical shocks that could threaten the current system, in addition to existing concerns about a stock market collapse or debt crisis.

The time to prepare is now.

‘The Path to $10,000 Gold’ can be Read Here

Gold Prices (LBMA AM)

10 Mar: USD 1,196.55, GBP 983.56 & EUR 1,127.15 per ounce

09 Mar: USD 1,204.60, GBP 991.39 & EUR 1,140.64 per ounce

08 Mar: USD 1,213.30, GBP 997.70 & EUR 1,149.00 per ounce

07 Mar: USD 1,223.70, GBP 1,003.56 & EUR 1,157.62 per ounce

06 Mar: USD 1,231.15, GBP 1,004.74 & EUR 1,162.82 per ounce

03 Mar: USD 1,228.75, GBP 1,005.12 & EUR 1,168.05 per ounce

02 Mar: USD 1,243.30, GBP 1,013.17 & EUR 1,181.14 per ounce

Silver Prices (LBMA)

10 Mar: USD 16.89, GBP 13.91 & EUR 15.92 per ounce

09 Mar: USD 17.14, GBP 14.10 & EUR 16.23 per ounce

08 Mar: USD 17.40, GBP 14.32 & EUR 16.48 per ounce

07 Mar: USD 17.70, GBP 14.52 & EUR 16.74 per ounce

06 Mar: USD 17.81, GBP 14.53 & EUR 16.83 per ounce

03 Mar: USD 17.66, GBP 14.44 & EUR 16.76 per ounce

02 Mar: USD 18.33, GBP 14.93 & EUR 17.42 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.