Gold Up 1.8%, Silver Up 2.6% After Dovish Fed Signals Slow Interest Rate Rises

Commodities / Gold and Silver 2017 Mar 16, 2017 - 02:39 PM GMTBy: GoldCore

– Gold up 1.8%, silver up 2.6% – Fed signals slow rate rises

– Gold up 1.8%, silver up 2.6% – Fed signals slow rate rises

– Dollar sells off as Fed raises 0.25% to target range of 0.75 percent to 1 percent on inflation outlook and “ebullient” stocks

– Gold’s biggest 1 day percentage gain since September 2016

– Fed raises rates for only the third time since crisis

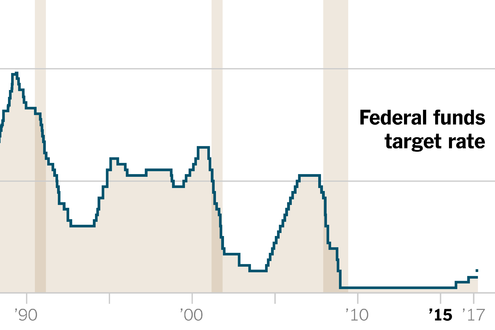

– Fade out Fed “jibber jabber” and focus on still ultra low rates (see chart)

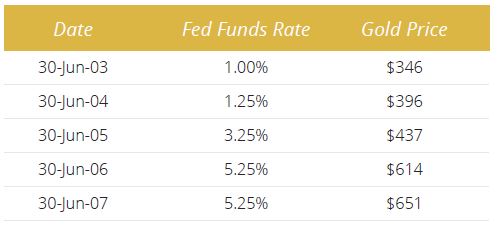

– Rising rates bullish for gold as seen in 1970s and 2003 to 2007 (see table)

– Silver rose 26% in 2003, 14% in 2004, 29% in 2005 and 46.6% in 2006

– Raise is too little, too late … Dovish Fed creating asset bubbles

– Dutch pro EU government have marginal win and populist Wilders does not see gains expected

– Pro-EU Dijsselbloem PvdA party likely biggest losers – risking his position as head of Eurogroup of Euro zone’s finance ministers

– Europeans will continue to reject increasingly undemocratic federal EU super state and risk of contagion remains high

– Geopolitical risk in form of Brexit talks and French elections seeing safe haven demand in UK, France and other EU countries

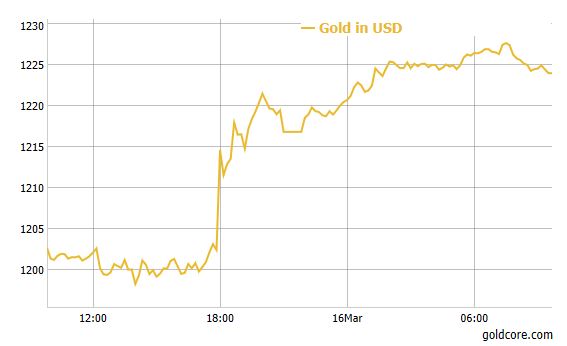

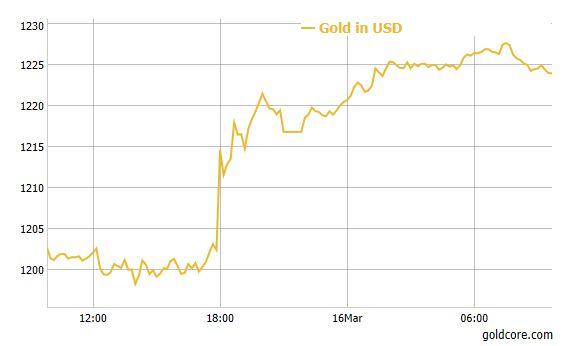

Gold in USD – 24 Hours

Gold rallied 1.8 percent yesterday as the U.S. Federal Reserve raised interest rates by an expected 25 basis points for the second time in three months.

Spot gold maintained those gains and moved as high as $1,228/oz overnight in Asia and gold has consolidated on those gains in European trading.

Gold had its biggest one-day jump since September. The Fed said in its policy statement that further hikes would only be “gradual,” with officials sticking to their outlook for two more rate hikes this year and three more in 2018.

Fed raises rates for the third time since crisis

Source: Newsreportonline.com

Silver rose 2.6 percent to $17.31 an ounce and traded another 1% in trading this morning to $17.50 an ounce. Platinum was up 2.8 percent at $965 per ounce while palladium was up 2.5 percent at $771 an ounce.

The Fed remains ‘dovish’ and signaled just three more rate hikes in 2017 as expected. They attempted to appear hawkish and suggested they would increase interest rates three times in 2017.

It is worth remembering that they promised three rate hikes for 2016 and yet only one rate hike materialised. We expect given the fragile nature of the so called economic recovery that this will be the case again.

It is prudent to focus on what the Fed does rather than what it says.

The Fed has been promising higher interest rates most years since 2008 and yet there have only been three interest rate rises since 2008. Yesterday’s rate rise was only the third rate rise since the 2008 financial crisis.

Source: New York Federal Reserve for Fed Funds Rate, LBMA.org.uk for Gold (PM fix)

Rising interest rates are likely to be bullish for gold as was the case in the 1970s and again in the 2003 to 2007 period (see table above and research note 5 Key Charts Show Rising Interest Rates Good For Gold here.

Silver saw similar gains – rising 26% in 2003, 14% in 2004, 29% in 2005 and 46.6% in 2006.

It is also worth noting that gold has risen from below $1,100 per ounce since the Fed first increased interest rates after the crisis at the end of 2015.

We believe the Federal Reserve is still well “behind the curve” and this latest small interest rate rise is too little, too late. The Dovish Fed is creating asset bubbles with U.S. stocks looking very overvalued indeed.

Many share this view including former senior Fed officials. U.S. interest rates should be on course to more normal levels of around 3% by now given that the Federal Reserve has achieved all of its targets, former Fed governor Heller said yesterday.

Investors were also focusing on Wednesday’s elections in the

Netherlands and concerns about contagion in the EU, which is also aiding gold’s safe-haven appeal.

The centre right, pro EU government in Holland had a marginal win and populist Wilders did not see the gains that were expected. However it was not all rosy for the EU and Dijsselbloem’s PvdA party appeared to be the biggest losers in the election. This means that his position as head of Eurogroup of Euro zone’s finance ministers is at risk.

Anti EC and EU super state sentiment remains high and senior EU and EC bureaucrats remain very unpopular. Another example of this is with EU President Donald Tusk who faces a criminal probe in Poland and even his own country will not back him for a second term as EU Council president.

Most European citizens are pro-EU and pro-Europe but are concerned about the increasingly undemocratic, corporate and militaristic Federal super state that certain EU elites are attempting to foist on the citizens of Europe. This important nuance is frequently missed in the simplistic and binary, pro EU, anti EU, “you are either with us or against us” narrative.

Despite the Dutch election, geopolitical risk globally remains high, especially in the EU. This will be seen in the coming ‘Hard Brexit’ negotiations and the French elections (April 23 and May 7) which will support gold and see continuing safe haven demand for gold in the UK, France and other EU countries.

Access Daily and Weekly Updates Here

Gold Prices (LBMA AM)

16 Mar: USD 1,225.60, GBP 998.74 & EUR 1,143.24 per ounce

15 Mar: USD 1,202.25, GBP 986.69 & EUR 1,132.04 per ounce

14 Mar: USD 1,203.55, GBP 992.33 & EUR 1,130.86 per ounce

13 Mar: USD 1,207.80, GBP 989.79 & EUR 1,132.07 per ounce

10 Mar: USD 1,196.55, GBP 983.56 & EUR 1,127.15 per ounce

09 Mar: USD 1,204.60, GBP 991.39 & EUR 1,140.64 per ounce

08 Mar: USD 1,213.30, GBP 997.70 & EUR 1,149.00 per ounce

Silver Prices (LBMA)

16 Mar: USD 17.46, GBP 14.21 & EUR 16.28 per ounce

15 Mar: USD 16.91, GBP 13.87 & EUR 15.92 per ounce

14 Mar: USD 17.00, GBP 14.02 & EUR 15.99 per ounce

13 Mar: USD 17.02, GBP 13.92 & EUR 15.95 per ounce

10 Mar: USD 16.89, GBP 13.91 & EUR 15.92 per ounce

09 Mar: USD 17.14, GBP 14.10 & EUR 16.23 per ounce

08 Mar: USD 17.40, GBP 14.32 & EUR 16.48 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.