Low Interest Rates Helping Australia Transition from the Mining Boom

Interest-Rates / Austrailia Mar 23, 2017 - 05:30 AM GMTBy: Nicholas_Kitonyi

Australia’s transition from its reliance on mining exports to other sectors appears to be gathering pace as more businesses continue to take advantage of the low interest rates.

Australia’s transition from its reliance on mining exports to other sectors appears to be gathering pace as more businesses continue to take advantage of the low interest rates.

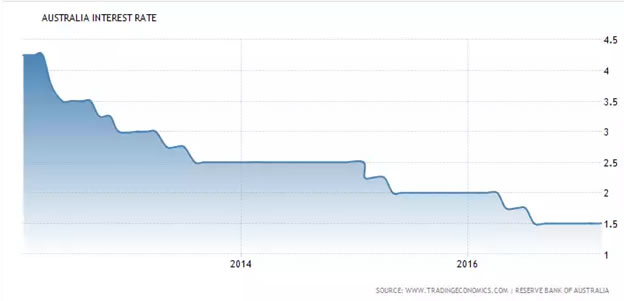

The Reserve Bank of Australia reduced the base interest rate, popularly referred to as the cash rate, twice last year from 2% to 1.75% and again to 1.5%. The cash rate remains fixed at 1.5%, which when compared to many developed countries is still one of the highest.

The US base interest rate currently stands at 0.75% following the most recent hike whereas the UK reduced its rate from 0.5% to 0.25% last year. On the other hand, the rate for the Euro area remains pegged at 0% whereas Japan’s interest rate has been below 0% since the start of 2016.

China is one of the few notable major economies to have a higher interest rate than Australia with a current rate of 4.35%. China has for several years been one of the main consumers of Australia’s mining products.

However, the world’s most populous country has experienced significant economic slowdown over the last few years, which together with the collapse of the commodity prices have contributed to the end of Australia’s mining boom. As such, Australia has had to transition from its reliance on mining exports to a more dynamic economic model, which includes creating a more favorable business environment for entrepreneurs.

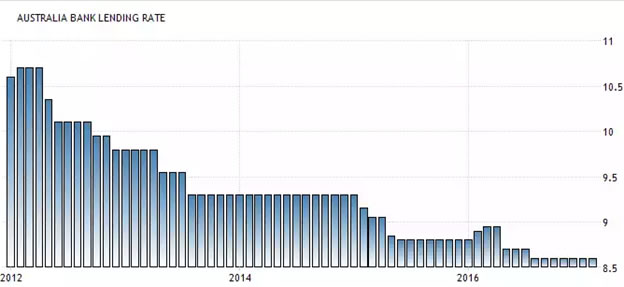

By lowering interest rates, this has enabled banks to lower their lending rates, thereby boosting the country’s small loan market. Currently, Australia’s bank lending rate stands at 8.6% down from 10.65% from five years ago, and nearly 9% last year.

Based on these numbers, it is correct to say that Australia is still far off from the likes of the US, the EU and the UK. However, per Rob Sinclair Finance, an Australian-based startup that helps small businesses and individuals to access financing, the recent interest rate cuts are having a positive impact on the country’s small loan market with many people now looking to expand their businesses. This is boosting entrepreneurship in the country thereby helping in the transition from the mining boom of the yesteryears.

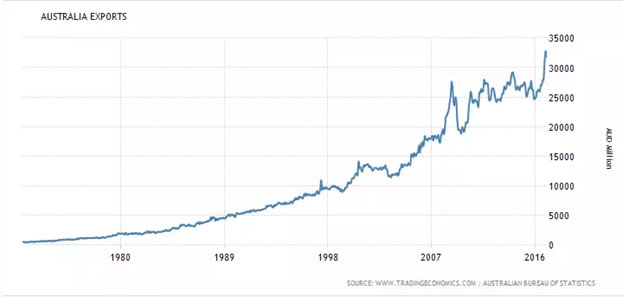

Australia’s mining sector contributes more than 50% of the country’s exports, which means that a slowdown was expected following the end of the mining boom. Reports indicate that between the year 2000 and the year 2010, the value of exports from mining rose by over 120%, from $63 billion to $139 billion. This is believed to have played a huge part in Australia’s massive growth in exports during the late 1990s to the 2010s period.

That growth appeared to slow down after the year 2010 characterized by high volatility in the value of exports on an annual basis as demonstrated in the chart above. In 2016, there was a sharp spike in Australia’s exports which coincided with the reduction of the base interest rate.

While the country continues to experience high iron ore, coal, and LNG exports (in that order) from the mining sector, analysts believe that Australia’s export market will be dominated by energy in the coming years with the country expected to be the world’s largest exporter of LNG.

In addition to this, Australia is expected to continue growing its Agricultural exports while at the same time expanding its manufacturing sector. As such, the country is now moving from its reliance on mining products which currently account for about 10% of its GDP to a more diversified economic model.

The reduction of interest rates also makes Australia’s products cheaper relative to other currencies, which could also explain the rapid increase in the value of exports last year.

Conclusion

The bottom line is that Australia’s mining boom might be over, but that is not likely to affect its overall economic growth going forward.

The country has taken measures to transition from its reliance on the mining sector, and while this sector continues to play a major part in the overall GDP—agriculture, entrepreneurship and manufacturing sectors are expected to augment its exports portfolio.

By Nicholas Kitonyi

Copyright © 2017 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.