Plungers Big Trade - The Oil Short

Commodities / Crude Oil Apr 18, 2017 - 06:31 PM GMTBy: Plunger

The big trade of this year positions oneself for the upcoming US recession. In speculating and investing if one can get the main concept right everything else falls into place. Various trades will branch off from this theme. The trade is not priced into the market at all since we are betting against the accepted narrative. We can use various proxies to play the trade, as just about anything economically sensitive may qualify. Base metal producers, car companies, sub prime financiers, retail establishments, the list goes on. The main vehicle I have chosen to execute the trade is the oil price. I have chosen this because both fundamentals and technicals indicate to me it is over priced and due for a fall. It trades deep and has a record of falling under distressed economic conditions.

The big trade of this year positions oneself for the upcoming US recession. In speculating and investing if one can get the main concept right everything else falls into place. Various trades will branch off from this theme. The trade is not priced into the market at all since we are betting against the accepted narrative. We can use various proxies to play the trade, as just about anything economically sensitive may qualify. Base metal producers, car companies, sub prime financiers, retail establishments, the list goes on. The main vehicle I have chosen to execute the trade is the oil price. I have chosen this because both fundamentals and technicals indicate to me it is over priced and due for a fall. It trades deep and has a record of falling under distressed economic conditions.

"All that we see or seem is but a dream within a dream." - Edger Allan Poe

That's what we have lived over the past 8 years, an economic mirage. A historic FED fueled reflation rally, that was just a dream. Central banks led by Phd academics applied their unproven pet theories of substituting credit conjured from thin air in place of accumulated savings to stimulate demand. We are now going to see if their theories worked. Von Mises explained in "Human Action" that a credit-fueled boom ends in one of two ways:

"Either the banks continue the credit expansion without restriction and thus cause constantly mounting price increases and an ever growing orgy of speculation, which, as in all other cases of unlimited inflation ends in a "crack-up boom" and in a collapse of the money and credit system. Or the banks stop before this point is reached, voluntarily renounce further credit expansion and thus bring about the crisis."

That is where we are right now, at the beginning of the credit restriction, the crisis will then follow. Its time to take the trade before its begins to be priced into the market. The oil market is rife with false understandings that should soon be exposed. Chief among them is that OPEC is in control. A belief in an OPEC put reminds me of the belief in the central bank put which existed in 2008. That dream was soon blown away. The false idea that producers will simply shut down production once they reach their all in costs is simply wrong. Sovereigns and independents have bills to pay, the costs of infrastructure can be written off.

Diego Parrilla has written a wonderful book "The energy world is flat" where he describes forces converging on the energy markets which ultimately work towards lower prices. These forces have converged to put crude oil on the defensive. Substitution, regional convergence, lower transportation costs have essentially made Oil into strictly a transportation fuel. Oil once the source of power generation is no more. Oil now competes at a disadvantage with virtually most other energy sources.

Consumers have defended themselves in various ways and geopolitics no longer add much of a premium into price with ample storage capacity and diverse supplies. Peak oil turns out was a very linear static view of the world. It ignored the dynamism of the market. These are forces that will exert a downward pressure on prices for years to come and when a faltering economy runs headlong into the largest spec long position of any commodity in history prices will drop.

Distressed producers and investors

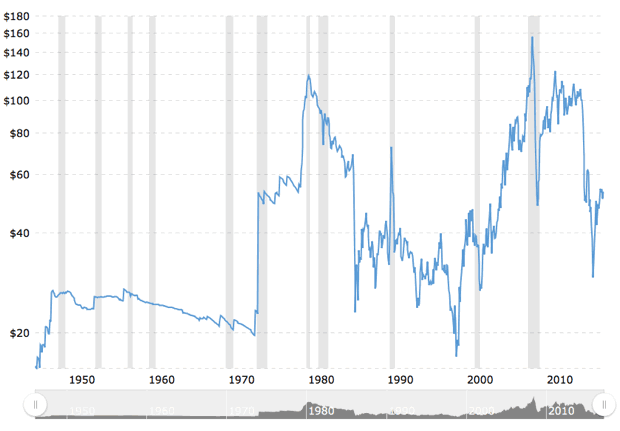

Reversion to the mean is a statistical certainty. The only question is what duration do we use to determine it? If one is to look at the oil price spanning the entire modern era (post WWII) the mean price, in today's dollars, would be around $35. So its not hard to imagine a dip below the mean during a mean reversion cycle.

Capturing that move below $35 is what this trade is all about. As I said earlier what makes this the Big Trade is not the percentage move, but in getting the theme right and using that theme in your other investments.

Yesterdays Geniuses Tomorrows Suckers

People always invest the most money at the wrong part of the cycle. I believe this is what happened in the oil patch. The big asset players, the Blackstone's, Carlyle's, Blackrock's and others bought at what they thought was the bottom. They believed they were the distressed buyers in 2015. Perhaps Jesse Livermore would say they are still suckers, but just suckers in a higher class. These private equity players all bought using debt and are highly levered. But I believe the game isn't played out yet. If prices drop precipitously these guys will be selling at fire sale prices.

Mechanics of the trade.

This is a broad theme, hence the name The Big Trade. One could pick various entities to short. GM, Chrysler, Auto Nation, Carmax and subprime auto lending companies such as ALLY, NAVI, SC and CAR & HTZ would be a good place to start. Also energy companies with a large amount of debt are also prime candidates. But let's for now focus on oil.

I have taken an initial short position using an option spread on the USO. I have also shorted outright the 3X ETF UWT. One can taylor ones risk reward by adapting different levels of leverage using options. These are trades I hold and am in no way giving specific advice to anyone else in constructing their own trade positions. We are all our own managers here.

When oil starts its downward impulse I will likely buy a direct put on one of the oil ETFs and buy DWT or SCO. But I will try to time the moment to reduce the amount of decay that one carries while holding that instrument.

Back to the Big Picture

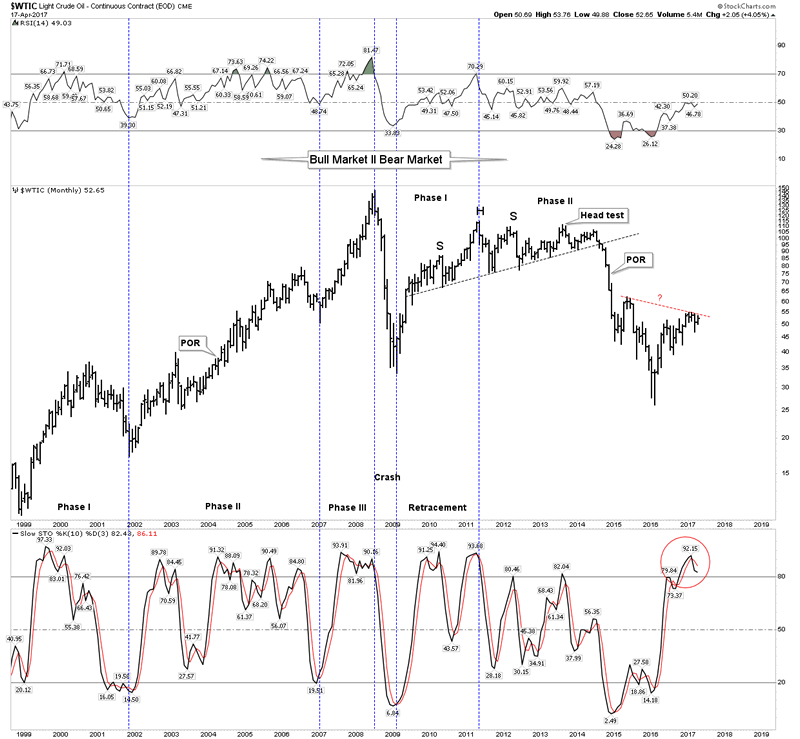

Looking again at the big picture phase chart we see below I believe we are in phase II of the secular bear market which started in 2008. I suspect it wont be over until the end of the next recession. I have no idea how low oil could go, but I presume the 2015 lows will be tested as a minimum.

Light Crude Oil Monthly Chart

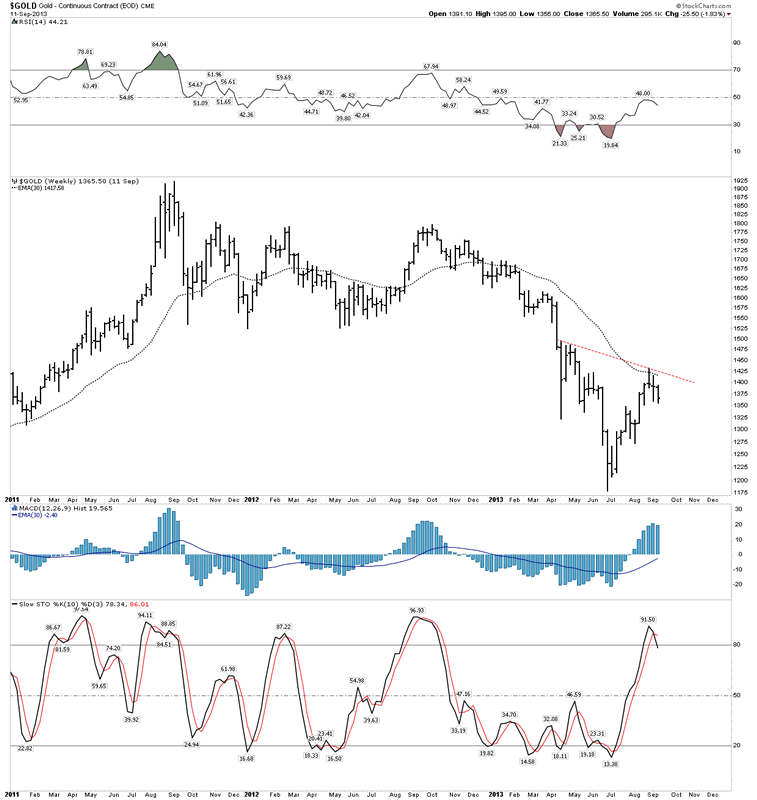

So for those still thinking about that "obvious" H&S bottom we see over the past 2 years, let's take a look at another chart you should be well familiar with:

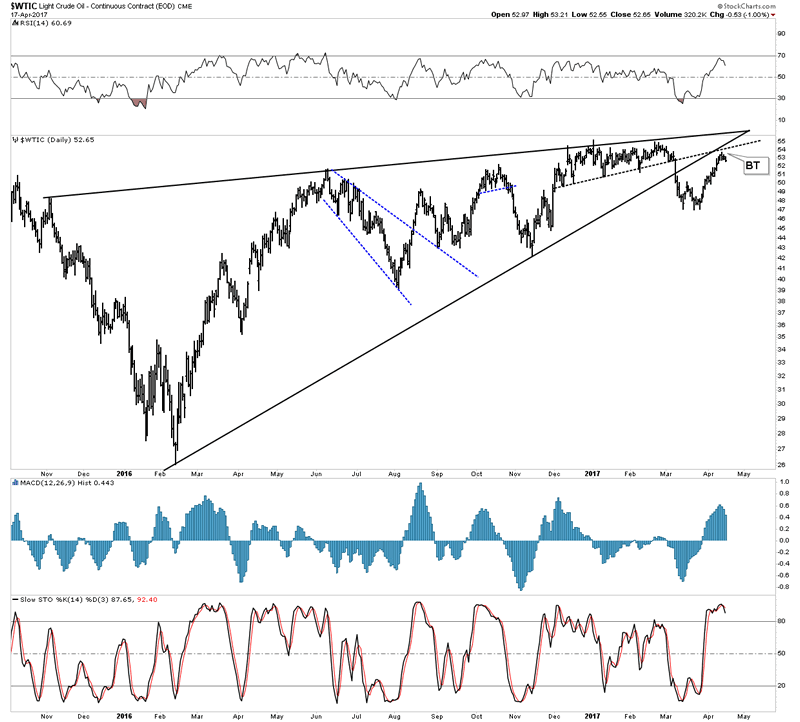

Light Crude Oil Weekly Chart 1

We all know that gold's price just kept on going down and the H&S was never was valid. I suspect the same thing will play out with oil.

Another Retracement in an ongoing bear market

What we have witnessed over the past year in the oil market is likely just another retracement of the decline from $114. Oil got bombed out at the bottom just like gold did in 2015. All the sellers had left, it could only bounce up. Mr. Bear needed a recharge so he put on a cyclical bull to draw in the usual suspects… the oil bugs, close cousins to the gold bugs.

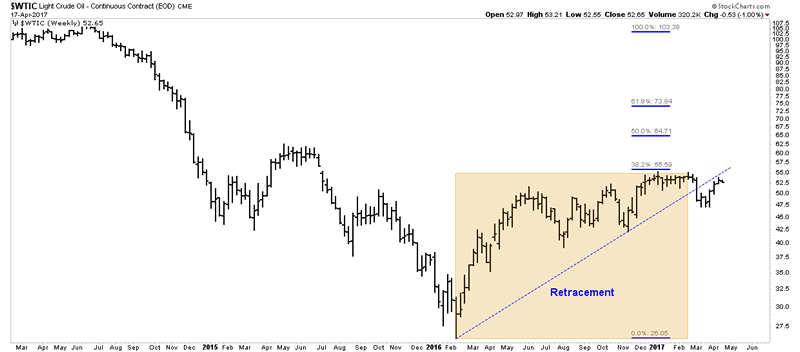

Light Crude Oil Weekly Chart 2

But according to chartology the bounce took the form of a giant bearish rising wedge which lasted about one year and recently broke down out of the wedge. It is now in an aggressive backtest which offers a low risk short entry.

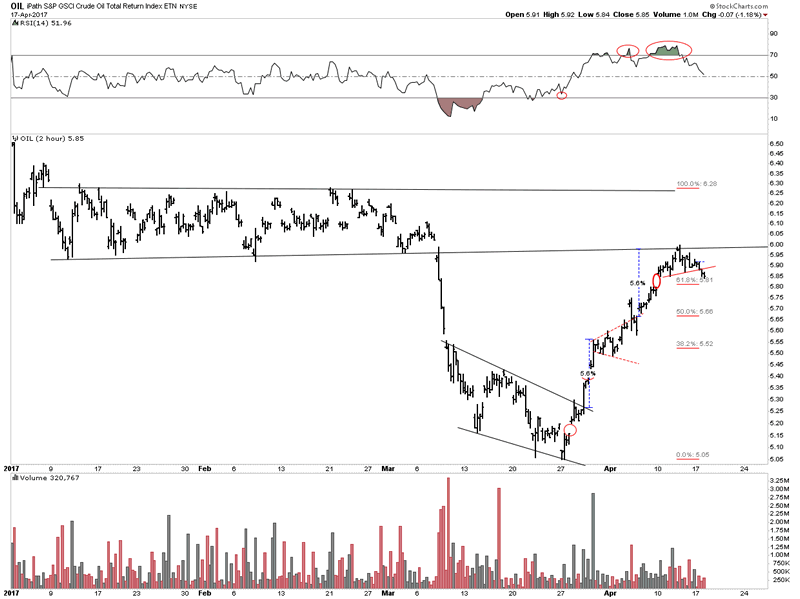

Light Crude Oil Daily Chart 1

Here is a close-up 2-hour duration chart depicting OIL ETF in its recent retracement after falling out of its massive one year retracement wedge. IMO this recent bounce over the past 3 weeks was fueled by initial bearish psychology. Several newsletter writers advised their flocks to short oil using leveraged vehicles after the initial breakdown had occurred. I am on record of entering my short, using UWT right at the initial break. I closed out the trade after the second bounce on March 23rd. The aggressive bounce starting on March 27th I view as a short squeeze jacking all the Johnny come lately's. That's how initial breakdowns often develop, Mr Market needs to squeeze out the shorts and retest the original breakdown level.

The run up to resistance since Mar 27 has several interesting features. Note the three running gaps in the chart. These are caused by urgency and cry out to be filled. Also price was projected precisely to the point of overhead resistance by the blue breakout to breakout 5.6% measurements. Finally, I found it interesting that price retraced just above FIB 61.8%. If you go back to Part I and look at the chart labeled the great retracement you will see the oil price retracement from 2009 to 2011 retraced exactly the same amount, just above the 61.8% level. All of these points lend credence that the bounce may now be over and its time to enter short.

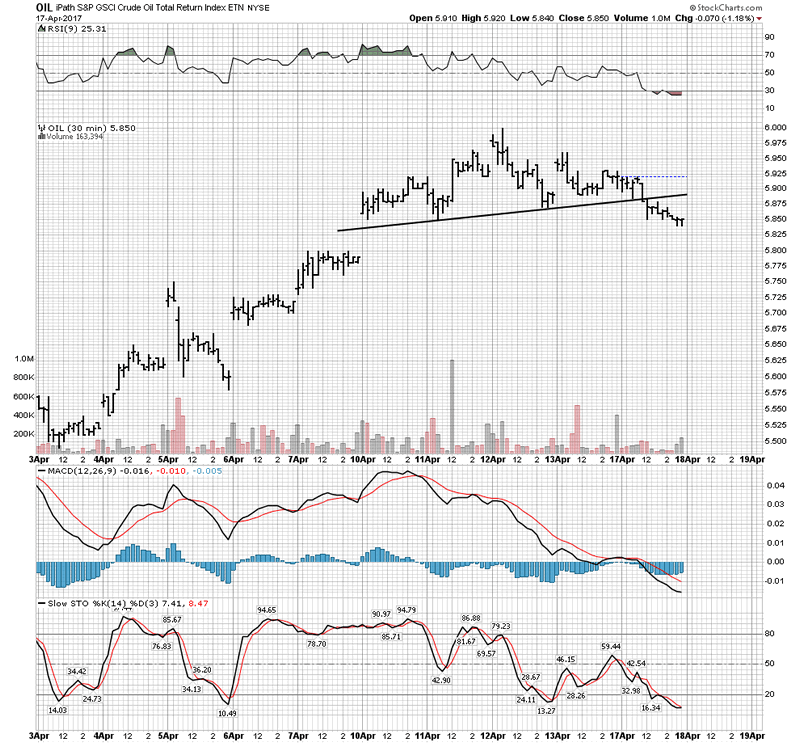

Light Crude Oil 2-Hour Chart

Here is todays action. There is a chance we have a top with the break of the short term NL.

Light Crude Oil 30-Minute Chart

Risk Factors

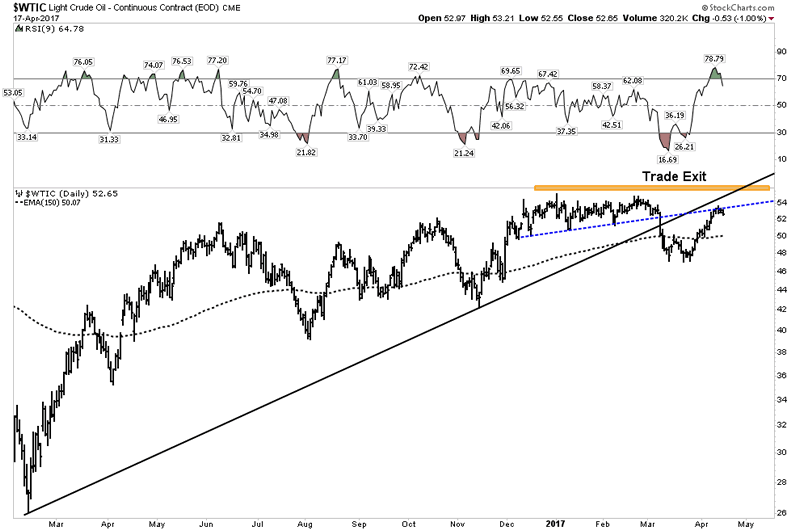

It's easy to be wrong so I have controlled risk of potential loss by buying call options at higher strike prices. Waking up tomorrow to find the Iranians have blocked the straits of Hormuz would be painful, but not a wipeout. However I consider this a low risk entry because if prices close above the February highs I close out the trade. That's only $3 per bbl of risk above today's price. That's limited exposure, despite leverage. Above that point we reevaluate our investing premise and if its still valid we wait for the next entry set-up.

Normally I don't short when above a rising 30 W EMA, however I see this as a unique set-up with defined risk exit points. When weekly stochastics turn down and the 30 W EMA tilts down it would be appropriate to add to the short position. Until then its a starter entry. The plan is to ladder into the trade as the technicals improve and we increase the probability of success.

Light Crude Oil Daily Chart 2

By shorting UWT and selling in the money Jan18 USO calls it aligns the decay of these vehicles in favor of the trade. This also skews the risk reward favorably.

So that's the Big Trade. My objective is to earn 50-60% on my capital deployed over a period of 10 months. If the oil price drops to $30-35 this should be achieved. What makes the trade big is not the rate of return but the economic implications. Again, get the main theme right and other things fall into place. Other trades will be related to this central theme.

Trade aggressively but protect your capital.

Good Luck,

Plunger

Copyright © 2017 Plunger - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.