Are UK Consumers Taking Too Much Debt?

Interest-Rates / UK Debt Apr 27, 2017 - 04:41 AM GMTBy: Nicholas_Kitonyi

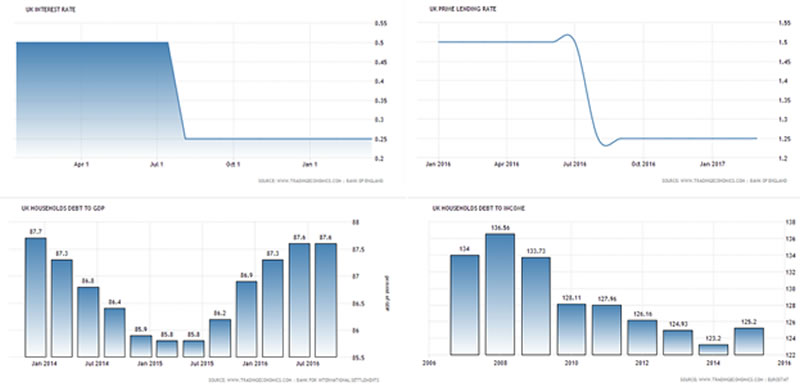

The UK lending market has benefited from the reduced lending rates after the interest rate was reduced to an historical low. The UK base interest rate was cut in half in August last year to 0.25% in a bid to stimulate economic growth and it has remained at this level for the last eight months. This affected the UK Prime Lending Rate, which fell to 1.25% from about 1.55% in July and has since remained fixed at this level.

The UK lending market has benefited from the reduced lending rates after the interest rate was reduced to an historical low. The UK base interest rate was cut in half in August last year to 0.25% in a bid to stimulate economic growth and it has remained at this level for the last eight months. This affected the UK Prime Lending Rate, which fell to 1.25% from about 1.55% in July and has since remained fixed at this level.

This has contributed to the increased debt load amongst UK consumers as they move to capitalize on the low lending rates. The good thing about low lending rates in an improving economy is that you can borrow money cheaply and invest it in income assets like property for higher returns. This is the case of the UK, which despite interest rates remaining low has continued to enjoy incredible growth in the property market.

However, interest rates in alternative lending markets remain high—especially in the high-risk customer category where borrowers can pay as high as 100% and 50% APR on payday loans and guarantor loans.

A deeper look at the relationship between the lending market and the UK economic growth indicates that debt is growing at a faster rate than the GDP over the last five fiscal quarters. The UK Household Debt to GDP stood at about 87.4 times in Q4 2016 compared to 85.4 times in Q2 2015.

The same picture is portrayed in the rate of Household Debt to Income. As of 2014, the ratio stood at 123.2 whereas a year later, it had jumped to 125.2. This clearly illustrates an increased update of debt by consumers in the UK, yet according to statistics, some of these people actually have no savings.

Recent data shows that more than 8 million individuals in the UK have no savings while a record 264 are declared insolvent or bankrupt every day as of November 2016. This figure does not include more than 300,000 people who are already too poor to be declared bankrupt because they cannot afford the bankruptcy fee of £525.

Some of these people mostly find themselves in these situations because of their involvement in the high-risk lending market. As noted earlier, high-risk lenders can charge interest rates of as high as 100% on payday loans. And for borrowers who manage to find a guarantor, they can be charged an interest rate of as high as 49% APR. Guarantor Loans provide lenders with some level of cushion should the high-risk borrower default payment. They are now amongst the most popular high-risk lending vehicles in the UK with several online platforms providing access.

The increase in consumer credit also indicates that there is a great deal of people who are not borrowing to invest. As demonstrated in the chart below, the consumer credit levels have been rising since 2014, and the trend seems set to continue to the foreseeable future.

While the monthly figures have been rather volatile, the overall trend indicates a linear growth with a minor dip coming early this year (again which could be because of the monthly volatility).

Now, when people anticipate that the economy will get better in the future, borrowing becomes an attractive financial activity in the market. However, when they borrow for the wrong reasons, the benefits associated with low interest borrowing vanish. This is why some individuals find themselves exploring lending opportunities in the high-risk lending market where their risk profiles matter less.

Conclusion

Statistics indicate that a majority of the people who borrow from the payday and guarantor loans markets have bad credit. Therefore, the rapid growth that this market has experienced over the last few years could be attributed to the increase in the number of people with bad credit.

And with more than 8 million people in the UK having no savings, it explains why the level of consumer credit has been going up. The question is whether or not, the UK consumers are taking too much debt that could curtail the economic growth witnessed over the last five years.

By Nicholas Kitonyi

Copyright © 2017 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.