Debt is Financial Life – Nonsense!

Interest-Rates / Global Debt Crisis 2017 May 04, 2017 - 03:22 PM GMTBy: DeviantInvestor

Examine the picture below. The global economy thrives on debt and credit. We purchase essential products using debt/credit. The U.S. dollar bill is a debt of the Federal Reserve. All debt based assets have counter-party risk.

Examine the picture below. The global economy thrives on debt and credit. We purchase essential products using debt/credit. The U.S. dollar bill is a debt of the Federal Reserve. All debt based assets have counter-party risk.

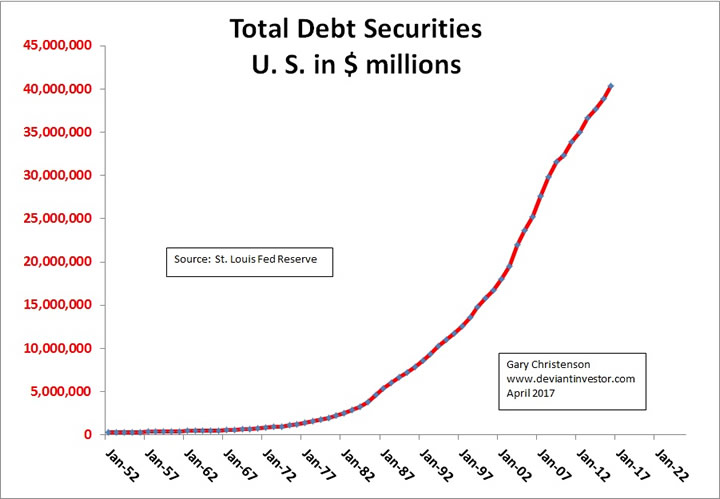

The St. Louis Federal Reserve publishes data on “Total Debt Securities” in $ millions. Note the rapid rise since 1971 after President Nixon encouraged rapid devaluation of the dollar.

Yes, the total U.S. increases debt rapidly – about 9% per year on average since 1971. A graph of U.S. national debt looks similar and shows about the same rate of increase.

Gold bullion and coins are NOT debt and have no counter-party risk, in contrast to debt based assets. But who cares about gold?

- Central banks profess little interest in gold, although they own a substantial quantity.

- Wall Street makes little profit from gold – no interest there.

- The middle class struggles to pay debts and shows little awareness of gold. (A change in attitude is coming!)

How does increasing debt affect us?

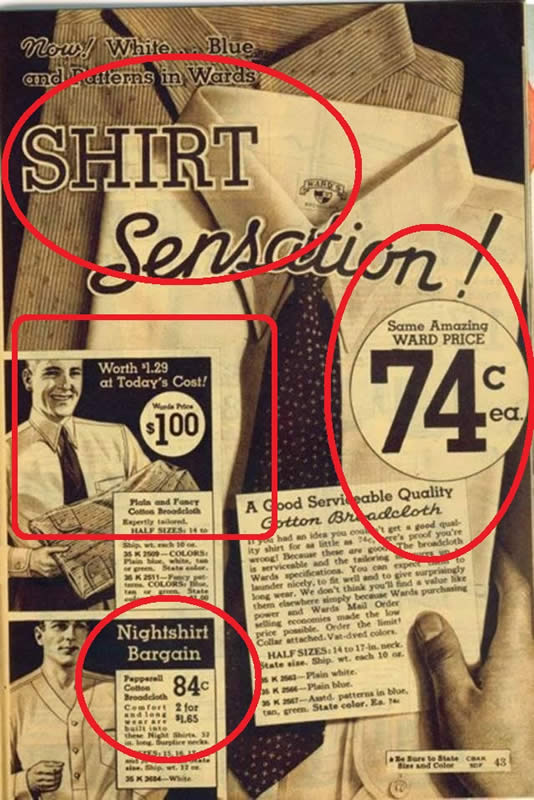

- Rapidly increasing total debt means more dollars in circulation and higher consumer prices.

- Increasing debt service for the masses. How much do you owe for mortgage debt, auto loan debt, student loan debt, credit card debt? How much interest do you pay each year?

- More profits for Wall Street.

- Debt increases every day – globally.

- Zimbabwe, Venezuela, Greece, and many more in the near future.

From 1934 Montgomery Ward Catalog:

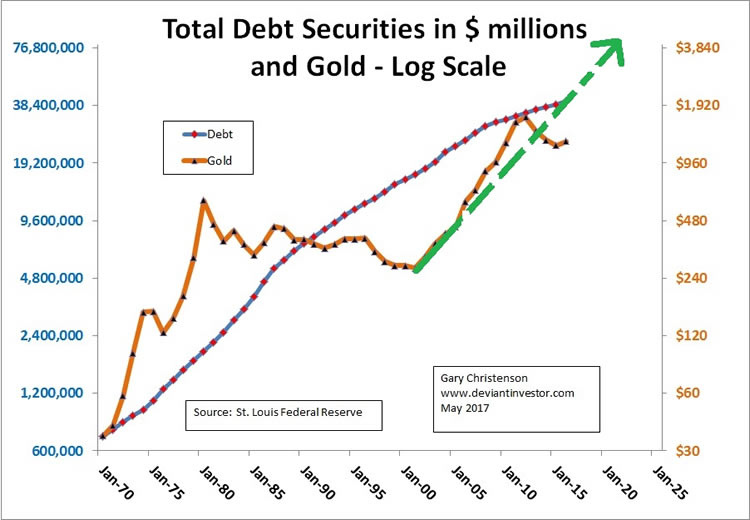

Debt and Gold:

On the log scale you can see:

- Total debt increased rapidly until about 2008, but the rate of increase has slowed since then. Regardless, debt is growing more rapidly than the economy which forces prices higher.

- How much debt can the economy carry? Is “peak debt” or “debt saturation” the reason why central banks in the EU, Japan and the US have pushed interest rates to near and below zero? Can this end well?

- Gold rose more rapidly than debt until 1980, fell for 20 years, and has increased since 2001.

- On average gold increases along with debt.

- Expect much higher prices for gold as the dollar and all fiat currencies are devalued.

Thought Experiment:

- Which government expects to spend less and reduce debt each year?

- Will military and Medicare expenditures decrease in the next 10 years?

- Name the congressmen who want to spend less and balance the budget each year?

- Does Wall Street support a reduction in spending, debt, and their profits?

- Does the Federal Reserve want to reduce the profits of big banks?

- Do Social Security recipients want their benefits reduced?

- Do “Big Pharma” and the “Health Care Cartel” want their revenue and profits reduced?

- Will the multi-decade trend of increasing debt and increasing prices reverse except as a consequence of a disastrous collapse?

Do you expect total debt to decrease in the next decade?

CONCLUSIONS:

Option A: More debt, more expenses, higher prices. Expect the same failed fiscal and monetary policies, more wars, increasingly fragile economies, accelerating consumer price inflation and an excess of “happy talk” from leaders. Gold and silver prices will rise.

Option B: Catastrophic collapse possible, global depression, nuclear war or expanded conventional war and much trauma for most people of the western world. In this hopefully unlikely collapse scenario, should you own gold and silver with no counter-party risk, or debt based paper that might be worth much less in purchasing power, or could become utterly worthless?

Given the debt policies of the western financial world, the following makes far more sense!

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2017 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.