Ransomware Attack, Debt - You’d Think We’d Be A Little More Worried…

Interest-Rates / Global Debt Crisis 2017 May 16, 2017 - 05:55 AM GMTBy: John_Rubino

By now everyone with an Internet connection is aware of the “ransomware” attack that shut down hundreds of thousands of computers over the weekend.

By now everyone with an Internet connection is aware of the “ransomware” attack that shut down hundreds of thousands of computers over the weekend.

The fact that the onslaught is just beginning — as the military-grade hacking tools developed by the NSA and recently leaked are weaponized by hackers and released into the wild — should, you’d think, be worrisome.

Most people are probably also aware that North Korea, which claims to have nuclear weapons, just tested a missile capable of carrying a payload to the capital cities of its neighbors. See Putin says world shouldn’t threaten North Korea, after latest missile landed near Russia.

And yet here we are on Monday morning with global stock markets hitting new highs, as if the world is a stable, well-managed, nearly risk-free place. It’s easy to understand cybersecurity and defense stocks doing well today. But banks and home builders? Seems like their world is anything but benign.

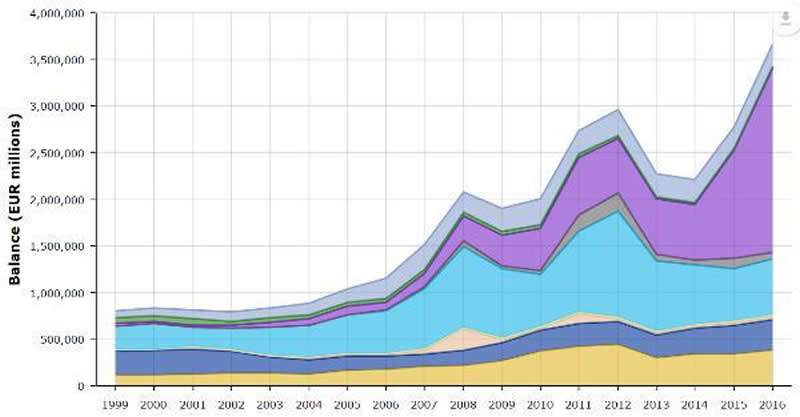

So what’s happening? The same thing that’s been happening for many years. The world’s governments are reacting to uncertainty with massive infusions of newly-created currency. Below, for instance, is the European Central Bank’s balance sheet – a proxy for how many new euros it has created and dumped into the economy. Note that the line went parabolic in 2014 and shows no sign of flattening. Fully one trillion new euros hit the market in 2016 and have to go somewhere. For the 1%, it’s apparently easy to relax and buy Apple and Google when that much cash keeps flowing in.

And Europe is frugal compared to China, where total credit growth (public and private combined) is on track to approach $3.5 trillion this year. That would be a record year for even the US. For a developing country like China it’s ridiculous.

Speaking of the US, here’s Credit Bubble Bulletin’s Doug Noland on what we’re up to:

I expect U.S. system Credit growth to surpass $2.2 TN this year, roughly broken down by the government sector ($850bn), Business ($750bn), Household Mortgage ($350bn) and Consumer Credit ($250bn). Another big federal deficit is expected, with the perception of a blank checkbook ensuring that deficits inflate until the markets decide otherwise. Rising home prices coupled with low mortgage rates ensure a 2017 expansion of mortgage borrowings. Loose financial conditions and record debt issuance would seem to ensure another big year of Business debt growth. And while there appears to be some tightening in subprime auto and Credit cards, I would be surprised to see Consumer Credit expand by much less than 2016. As such, the relatively stable outlook for U.S. Credit growth certainly supports the global liquidity and market backdrop.

None of this is surprising. The tens of trillions of dollars borrowed in the recent past were largely misspent, so to prevent a crisis of epic proportions, ever-greater amounts of credit have to be created and disseminated. Inflate or die, as the saying goes.

To call this a classic Ponzi scheme is by now too obvious to be worth explaining. No society has ever created this much debt, and seen so much of it become non-performing. Which is the same thing as saying no society has ever set itself up for such a sudden, dramatic change in sentiment when something big finally goes wrong.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.