Silver: Train Leaving Station Soon!

Commodities / Gold and Silver 2017 May 18, 2017 - 03:19 PM GMTBy: Gary_Tanashian

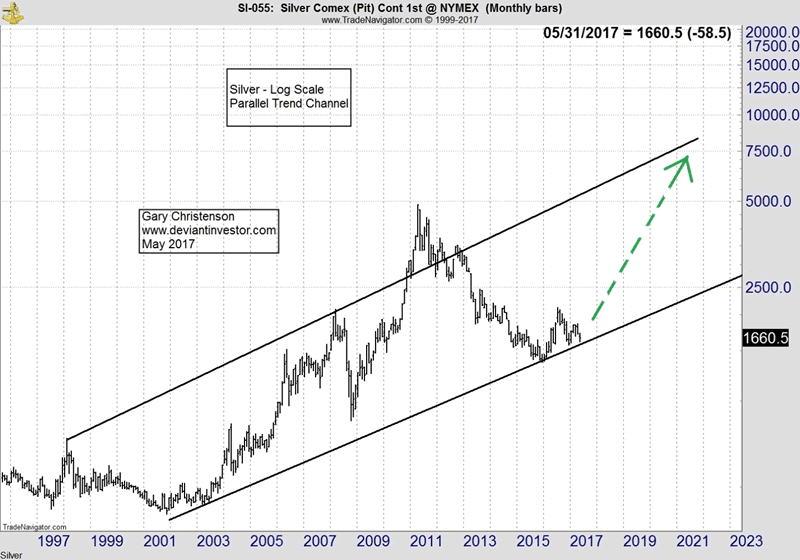

Silver prices are rising along the bottom of a 20 year log scale trend channel (shown later). There are no guarantees in a manipulated paper market, such as COMEX silver, but it is possible that silver prices will collapse further, or more likely, move substantially higher, sooner rather than later.

Silver prices are rising along the bottom of a 20 year log scale trend channel (shown later). There are no guarantees in a manipulated paper market, such as COMEX silver, but it is possible that silver prices will collapse further, or more likely, move substantially higher, sooner rather than later.

Silver prices COULD fall from their current level of $16 – $17 to under $10. Other events that COULD occur include:

You could win the Powerball Lottery.

The U.S. congress could balance the budget and reduce debt.

The Federal Reserve could apologize for destroying the dollar.

President Putin and Hillary could sing “Kumbaya” together.

The Middle-East could ascend into a century of peace.

And it is possible that silver prices could drop under $10.

But realistically, we know:

- The Federal Reserve has devalued the dollar for over a century and is openly advocating for at least 2% inflation – more devaluation. Expect continuing declines in the purchasing power of the dollar.

- The U.S. congress, the President, the military, thousands of military contractors, the medical/health/sick care system, and millions of people collecting Social Security do NOT want spending decreased. Expect more spending, deficits, ever-increasing debt, and of course, more consumer price inflation. Silver prices will rise.

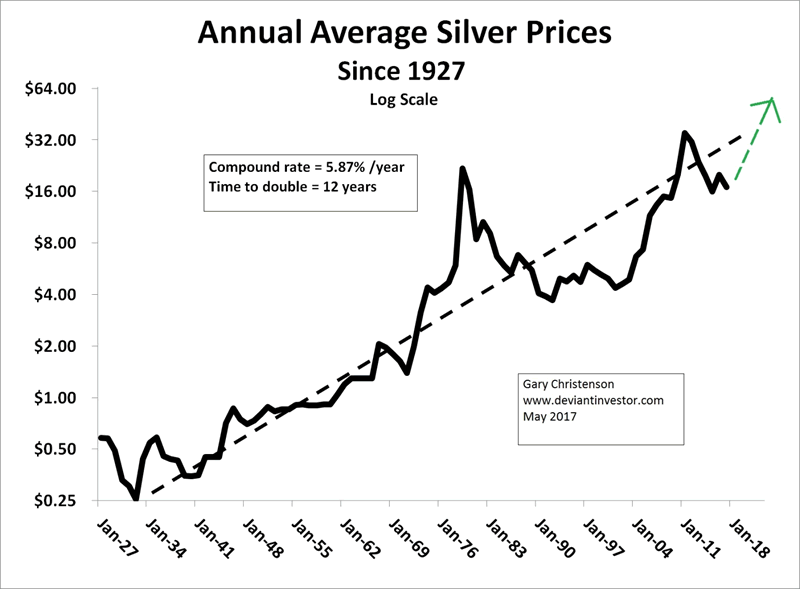

- Silver prices have risen exponentially for the past 90 years as the dollar has been consistently devalued. Expect continued silver price rises. See log scale graph below.

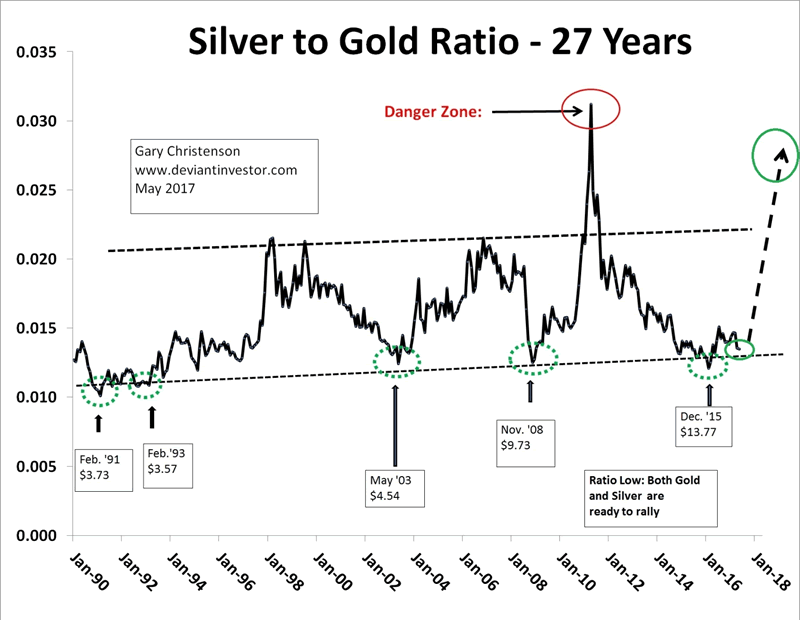

SILVER TO GOLD RATIO:

Examine the silver to gold ratio for the past 27 years. Low silver to gold ratios indicate long-term buy zones for silver. Silver prices are there now.

How High Will Silver Prices Rise?

The answer depends upon many variables. A partial list includes:

- COMEX silver prices are “managed” by large players, including JPM, which previously have wanted silver prices to remain low. That may be changing. Read Ted Butler.

- How rapidly will the Fed and commercial banking increase the supply of dollars and how much will they devalue the dollar?

- How extreme will our political circus become? Distractions will be necessary. The usual response is war after a suitable scapegoat has been identified.

- “False Flag” operations may direct blame and attention away from policy failures and toward some “common enemy.” Wars increase silver prices.

- When will U.S. citizens lose confidence in the dollar?

- How rapidly will foreign countries including China, Russia and Saudi Arabia redirect commerce away from the dollar?

- Hyper-inflation or 1970s style inflation?

- Rise of the IMF and Special Drawing Rights as a global currency?

SUMMARY:

Silver prices for the next decade are dependent upon many unknowns. However, a conservative chart interpretation is shown below.

The log trend channel has contained most silver prices for the past 20 years. A “more of the same” financial world suggests silver prices will rise toward $100 in the next 5 – 7 years.

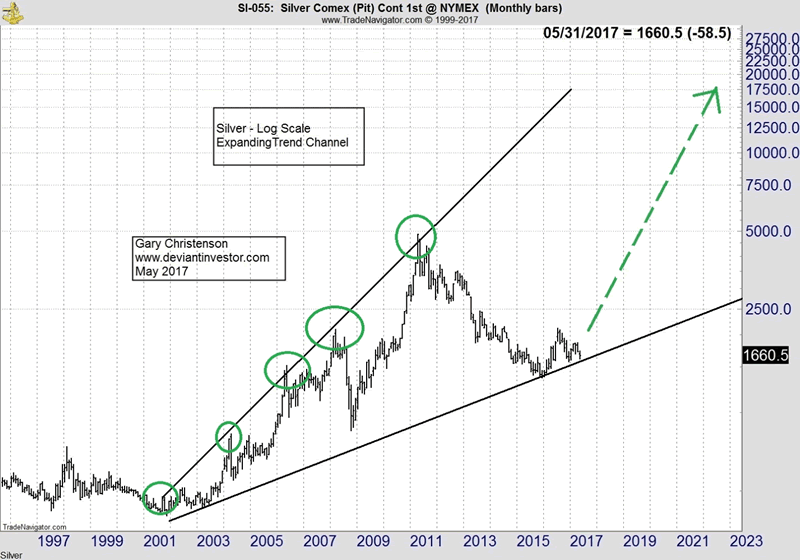

A more aggressive chart interpretation shows prices for silver peaks rising rapidly during the past 17 years.

A blow-off rally in silver – quite possible – suggests silver prices rallying toward $200 – $300 per ounce. For comparison, Bitcoin was $3 a few years ago and recently exceeded $1,700. Amazon stock sold for about a buck 20 years ago. Today it is near $1,000. Silver near $200 is not impossible in a few years.

CONCLUSIONS:

- Silver prices have risen exponentially for 90 years as the dollar has been devalued. Expect further devaluation and higher silver prices.

- There are many financial and political catalysts that could propel silver prices well over $100.

- A conservative graphical interpretation shows $100 silver within a few years.

- A “blow-off” graphical interpretation shows $200 – $300 silver is possible in a few years.

- If the powers-that-be create or can’t stop hyper-inflation of the dollar, $500 silver will look inexpensive by the end of next decade.

- It is difficult to look beyond our “normalcy bias” and consider the possibility that the DOW could drop more than 50%, like it did in the 2008 crisis, or silver could increase in price by over a factor of 30, like it did from 1971 – 1980.

- Read Steve St. Angelo: Amazing Leverage in Silver Market.

- Read “Silver and Gold Find Support.”

- The “silver train” has not left the station … yet.

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2017 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.