Gold Benefits from Uncertainty Thanks to Twitter and UK Election

Commodities / Gold and Silver 2017 Jun 01, 2017 - 03:02 PM GMTBy: GoldCore

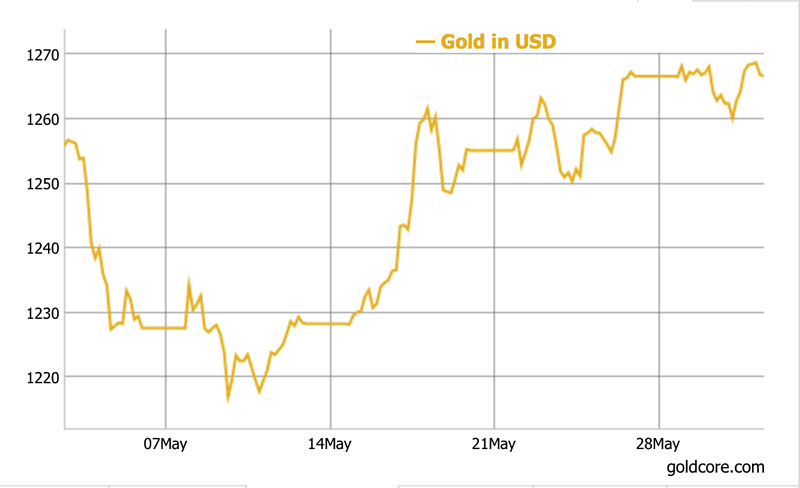

Gold hits five-week high

Gold hits five-week high- Reaches $1,273.74/oz, highest since April 25th

- Sterling recovers after UK polls point towards a hung Parliament

- Expected Fed-tightening capped gains

- 90-dead in Kabul, further signs of increasing tension in Middle East

- Trump expected to pull out of Paris Accord and Trump’s anti-Iran axis already feuding

Yesterday gold hit $1,273.74/oz, a level not seen for five weeks. Analysts point to some safe-haven demand for the yellow metal on account of the geopolitical tensions, upcoming UK elections and tomorrow’s non-farm payroll data.

We suggest investors look beyond data releases and political peacocking, and instead look at what the greater picture shows which is uncertainty on all fronts.

All about the Federal Reserve

Amongst mainstream financial analysts, all eyes appear to be on the expected Federal Reserve rate hikes. Thomson Reuters data shows traders see an 87% chance of a 25-basis-point hike at the next Federal Reserve meeting, this month.

Softer economic data of late, may mean that the Janet Yellen and her team might not be so keen to ramp up rates this month. Investigations into Russia’s alleged involvement in the 2016 U.S. election and possible collusion with Trump’s campaign also have clouded the prospect of a rate hike next month. The plan was for two further rate hikes this year in order to tighten the central bank’s balance sheet.

Fed policy tightening is expected to be negative for gold. But times might be changing as we note that in both December and March, following rate rises, gold decided to rally. This might be on account of expectations of over-tightening by the Fed and which would tip the country into a recession. Good news for gold.

Should the Fed over tighten, then they are likely to return forward guidance. As we know this is a great environment for the gold price due to increased inflation and a weaker currency.

Jitters over UK elections

In what feels like groundhog day for many UK-voters, there will be an election next week. To listen to the international media one could be forgiven the election is about Brexit. It is a general election which has consequences far beyond Brexit negotiations. Many of these consequences are unknown, which suggests a positive environment for gold regardless of the outcome.

When the election was initially called it seemed as though Mrs May’s election was a dead cert, however the polls suggest it might not be so easy. This morning news of a YouGov poll commissioned by the Times show Mrs May has a battle ahead of her. YouGov found the Conservative lead has slipped dramatically in recent weeks and is now within the margin of error. In April, when the election was first called, the Tories had a 24-point lead over Labour.

The YouGov Poll also found 30% of respondents think Jeremy Corbyn would be a better Prime Minister, this is the highest it has ever been. Meanwhile, Teresa May’s personal favourability has slipped to by 2%, to 43%.

Investors would be prudent to remember that whilst Mrs May is using the “promise of Brexit” to improve the country’s fortunes, the outcome of the ‘divorce’ remains unknown regardless of who is elected. With a Conservative victory the market might feel slightly reassured as there is no change in management, however we are still unsure how Brexit will actually look. A Labour victory is effectively double the uncertainty as we have not seen Corbyn lead, let alone run a Brexit negotiation.

Trump tension

Trump continues to be a cause for concern in both the US and the wider community. Concern comes from the usual basket of goodies the President serves on a daily basis, namely strange tweets, misinformed statements on foreign relations and the desire to show independence when the opposite is required.

One example of this came on Tuesday when Trump tweeted, “We have a MASSIVE trade deficit with Germany, plus they pay FAR LESS than they should on NATO & military. Very bad for U.S. This will change,”

This tweet from Trump harks back to 1987 when US Treasury Secretary James Baker took issue with German policy. For many this resulted in the stock market crash of October 1987.

This morning the US dollar hovered near a 6-1/2 month low against a basket of major currencies on. Today, markets will also be closely watching for Trump’s announcement on whether or not the United States will continue to be part of the Paris Accord.

Whilst an agreement over whether or not to fight climate change may seem a tenuous link to make with precious metal prices, Trump’s decision will say so much more than his thoughts on global warming. A step away from the Paris Accord shows once again Trump’s desire to focus on his ‘America First’. In isolation the decision might not count for much but is the statement about Trump’s intentions to work with others, that are of most concern. He is pushing further towards an isolationist and protectionist agenda.

This adds to geopolitical tensions that are already quite fraught. Trump’s decision to effectively reject what is really the rest of the world’s view in terms of how to deal with something, could see the tension gauge ramp up an extra couple of notches, something else that is good for gold.

Middle East problems remain despite Trump (!)

All eyes were on the Middle East just ten days ago when President Trump made his first international visit to the region. The President made a few speeches and all concerned were expected to feel revived and reunited in the fight against those wanting to cause harm in the Middle East. However, no sooner had the President left the region, media attentions were back on Western problems such as handshakes, photo-op barging and angry tweets.

It hasn’t taken long for the Middle East to demonstrate that it needs a bit more than some FaceTime. Yesterday an attack in Kabul left 90 dead. Whilst no one has claimed responsibility for it Afghanistan’s intelligence service, the National Directorate of Security, issued a statement attributing blame to the Haqqani Network, a Taliban-affiliated group in Pakistan. The National Directorate also claimed the group had received help from ISI, the Pakistani intelligence service.

Trump’s anti-Iran axis is also already beginning to fray around the edges. Less than two weeks after his visit. Qatar is embroiled in a public feud with both Saudi Arabia and the United Arab Emirates (UAE) over their conciliatory line on Iran and support for the Muslim Brotherhood. A spat between Doha and other members of the GCC could have major implications for the Middle East with long-term repercussions.

Conclusion: We’re still uncertain

It seems we conclude many market updates with reference to the overall uncertainty regarding geopolitics and finance. But there is little else to say.

It can be both entertaining and worrying to look at Trump’s behaviour and attribute much of the blame for the current chaos, to him. But the truth is, whether he had been elected or not, we would still be watching the UK general election, the Middle East would still have major problems and the Federal Reserve would still be turning it’s back on the realities of the damage that it has caused.

The future might seem uncertain but the ways in which we can protect ourselves remain constant and certain. Gold and silver act as both financial insurance and portfolio diversifiers.

Data shows more people are choosing to invest in gold. This tells us that savers are no longer concerned about the increasingly lower, opportunity cost of holding gold. Instead they are realising that the uncertainty we see across the globe is not because of one event such as an election or tweet, instead it is the general air of uncertainty and concern as to how this will pan out.

Those looking to insure their portfolio against global events should ignore the day-to-day reports and instead prepare for these uncertain times by diversifying and owning gold and silver. For many years, gold and silver have protected investors and savers from uncertainty, both economic and political.

Gold Prices (LBMA AM)

01 Jun: USD 1,266.15, GBP 984.81 & EUR 1,128.01 per ounce

31 May: USD 1,263.80, GBP 987.79 & EUR 1,129.96 per ounce

30 May: USD 1,262.80, GBP 982.46 & EUR 1,132.23 per ounce

26 May: USD 1,265.00, GBP 983.41 & EUR 1,127.87 per ounce

25 May: USD 1,257.10, GBP 969.48 & EUR 1,119.57 per ounce

24 May: USD 1,251.35, GBP 963.29 & EUR 1,119.58 per ounce

23 May: USD 1,259.90, GBP 969.62 & EUR 1,119.17 per ounce

Silver Prices (LBMA)

01 Jun: USD 17.13, GBP 13.33 & EUR 15.26 per ounce

31 May: USD 17.31, GBP 13.48 & EUR 15.43 per ounce

30 May: USD 17.27, GBP 13.42 & EUR 15.49 per ounce

26 May: USD 17.29, GBP 13.45 & EUR 15.41 per ounce

25 May: USD 17.15, GBP 13.23 & EUR 15.29 per ounce

24 May: USD 17.03, GBP 13.14 & EUR 15.22 per ounce

23 May: USD 17.14, GBP 13.22 & EUR 15.25 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.