The Great Gold, Silver Price Manipulation Conspiracy Explained

Commodities / Gold & Silver Aug 28, 2008 - 09:47 AM GMTBy: Mike_Shedlock

Gold and silver prices have crashed. Ted Butler, Rob Kirby, James Conrad and others are all blaming manipulation. Let's take a look at those manipulation theories starting with Ted Butler.

Gold and silver prices have crashed. Ted Butler, Rob Kirby, James Conrad and others are all blaming manipulation. Let's take a look at those manipulation theories starting with Ted Butler.

Lessons of a Lifetime

Here are a few excerpts from Ted Butler's Lessons of a Lifetime .

The drastic sell-off in silver (and gold) is further proof of an ongoing manipulation to the downside.

My comment: That is a rather interesting statement. Gold and silver did not act as expected so somehow that constitutes proof in and of itself of an ongoing manipulation. However, Butler offers more proof as follows.

The proof that this sell-off was criminal lies in public data provided in the Commitment of Traders Report (COT) and a basic understanding of how the futures market works. This has been the most extreme sell-off in the recent history of silver and gold. We are farther below the moving averages than at any point since I have been writing about silver. Price movements this severe are likely to be intentional and not accidental.

My Comment: Many stocks are far from moving averages. Nearly the entire financial sector is far from moving averages for example. Furthermore gold and silver have often been far above their moving averages, and not that long ago either. Is it only manipulation when gold and silver are below and not above their moving averages?

Every criminal act must have a motive and an opportunity to commit the crime. By the simple process of elimination, those responsible for this crime are the concentrated commercial shorts on the COMEX. No one else fits the profile. They had the means (through their dominant and monopolistic position), the profit motive and the skill to cause the sell-off.

How is it possible that the commercials could buy back short positions on thousands of contracts at times of steep sell-offs, without triggering a rise in price? There is only one possible and plausible explanation - through discipline and collusion.

My Comment: With futures, for every long there is a short. When a long sells his position, a short automatically covers. This does not take collusion. But to be fair it does not disprove collusion either. This is simply how the futures market works.

If longs are desperate to get out, shorts will automatically cover at increasingly lower prices. Butler asks how it it possible for commercials to close positions during sell-offs without triggering a rise. The answer is that it is impossible for it to be any other way!

All that matters is how desperate longs are to get out. By the way, the exact same things happens on the way up too, except in opposite fashion. Butler somehow sees a rising market as normal action.

Let's continue with more articles on alleged manipulation.

The Smoking Gun

At least 20 people sent me The Smoking Gun by Ted Butler. Let's take a look.

For years, the data contained in the weekly Commitment of Traders Report (COT), issued by the CFTC, have indicated that several large COMEX traders have manipulated the price of silver and gold.

My Comment: To be more precise, for years Butler has insisted that the COT reports indication manipulation in gold and silver. Allegations are one thing, proof is another.

The recent widespread shortage of silver for retail purchase coupled with a price collapse appears to have shaken these analysts' confidence that the COMEX silver market is operating ‘fair and square.' Well it should, since there is no rational explanation for a significant price decline going hand in hand with product shortages other than collusive manipulation. My Comment: There is indeed a rational explanation for a decline in the price of gold and silver. The dollar has staged one huge rally, and fundamentals suggested the dollar should rally. This is not hindsight, this was called in advance. I talked about the US dollar many times recently. Here is a list.

- August 08 Trichet Puts Spotlight on the Euro, Dollar

- August 09 U.S. Dollar Rally Continues

- August 11 Currency Intervention And Other Conspiracies

The last one on the above list caused a bit of a controversy . Some irrationally stated that a tiny (relative to the forex markets) intervention sparked a week long dollar rally. Steve Saville voiced an opinion on the dollar rally as noted in Steve Saville On The US Dollar And Gold .

In summary, there is no need to concoct manipulation theories in order to explain the dollar's rebound. A more plausible explanation for the currency market turnaround is that the recent intermediate-term trend reversals in the commodity markets removed the pressure that had previously been preventing the US dollar from moving back towards fair valuation.

We think the dollar's move back towards fair valuation is still in its infancy, but the market looks over-extended in the very short-term so some consolidation is likely over the coming 1-3 weeks.

Shortage Of Silver Eagles

Now let's address the shortage of silver eagles and other retail forms of silver and gold. For that I will refer to a conversation I had with Dave Meger, head metals trader at Alaron. Dave plays the seasonal tendencies in gold and silver as good as anyone I know. Here is a snip from Dave's Meger's gold forecast from August 20.

Gold and silver have seen a small bounce off the extreme oversold condition. Remember I stated several times in my last few reports that I did not believe a bottom in the metals would be made until a capitulation move lower was seen.

I have been stating that Gold and Silver will still be strong in the month of September and into year end - the only question has been "Where will the bottom be made?" The sharp correction was a typical long liquidation break that seems to always go much deeper than most expect as longs are squeezed out of the market.

I called Dave to ask about the shortage of silver. I was halted mid-sentence. "Careful" Dave said. "There is not a shortage of gold or silver, there is only a shortage of certain retail forms of gold and silver. Producers have no real incentive to make some of these forms. If someone wants gold or silver they can always buy a future and take delivery."

Retail Demand A Contrary Indicator?

What follows now is my opinion. Retail investor demand for gold and silver may very well be a contrary indicator. Retail investors ignored gold at 250, 350, 450 all the way up to $1000. Now they are finally interested in buying this dip. Is this a good sign or a bad sign?

Continuing with Butler's "Smoking Gun"

Facts speak for themselves. Here are the facts. As of July 1, 2008, two U.S. banks were short 6,199 contracts of COMEX silver (30,995,000 ounces). As of August 5, 2008, two U.S. banks were short 33,805 contracts of COMEX silver (169,025,000 ounces), an increase of more than five-fold. This is the largest such position by U.S. banks I can find in the data, ever. Between July 14 and August 15th, the price of COMEX silver declined from a peak high of $19.55 (basis September) to a low of $12.22 for a decline of 38%.

For gold, 3 U.S. banks held a short position of 7,787 contracts (778,700 ounces) in July, and 3 U.S. banks held a short position of 86,398 contracts (8,639,800 ounces) in August, an eleven-fold increase and coinciding with a gold price decline of more than $150 per ounce. As was the case with silver, this is the largest short position ever by US banks in the data listed on the CFTC's site. This was put on as one massive position just before the market collapsed in price.

This data suggests other questions should be answered by banking regulators, the CFTC, or by those analysts who still doubt this market is rigged. Is there a connection between 2 U.S. banks selling an additional 27,606 silver futures contracts (138 million ounces) in a month, followed shortly thereafter by a severe decline in the price of silver? That's equal to 20% of annual world mine production or the entire COMEX warehouse stockpile, the second largest inventory in the world. How could the concentrated sale of such quantities in such a short time not influence the price?

My Comment: The facts speak for themselves. The rooster crows every morning at dawn. The sun comes up without fail. In other words, correlation is not causation. Two US banks sold 27,606 futures. Ho hum. Investors bought 27,606 futures. Ho hum. Remember that for every long there is a short. Who was left to buy, and at what price?

The fact of the matter is silver rose from $5 to over $20. Commercials were short the entire way. If the commercials were not hedged, they would have been blown out of the water somewhere along the line.

What real legitimate business do 2 or 3 U.S. banks suddenly have for selling short such quantities of speculative instruments over a brief time period? Do we want banks to be engaging in this type of activity? If the manipulation was not successful, would U.S. taxpayers be called on to bail out yet another bank speculation gone bad?

My Comment: The answer is obvious. For every long there is a short. The market makers must take the other side of the bet. I keep pointing this out and it keeps falling on deaf ears. If longs want to prove a shortage of gold or silver all they have to do is take delivery and keep taking delivery. Instead we see herding behavior by longs accompanied by huge price runups. Buying interest then dries up and prices fall. It does not take collusion for this to happen.

The data in the Bank Participation report is so clear and compelling that it is hard to conclude anything but manipulation. It is beyond credulity to conclude other than two or three banks caused one of the most severe price collapses in precious metals history. The CFTC has a lot to answer for as the regulatory agency responsible for preventing this type of blatant manipulation.

My Comment: Closer examination reveals that there is nothing but allegations from the manipulation crowd. So let's continue with still more articles.

Wake-Up Call

Rob Kirby repeated many of the same arguments as butler in Wake-Up Call . He also offered this chart.

As I stated before, there were no compelling fundamentals. In fact there were compelling fundamentals brewing for a US dollar rally. What happened was entirely predictable. I talked about it in Gold, Silver and the Great Unwind .

Notice that"concentrated, manipulated, short selling arrow". Once again I point out that for every short there is a long. In essence, dollar bears were recklessly plowing into short-dollar long-gold plays just as Trichet was about to drop a bombshell on the currency markets.

The market was expecting Trichet to tighten and the dollar to sink. Instead Trichet reversed course. There was a mad scramble to exit the short-dollar long-gold trade. Gold got hammered in the process. This is Manipulation?

Disconnect Between Supply And Demand

Let's now turn our attention to the last article in the series. James Conrad presents some new arguments to consider in The Disconnect Between Supply and Demand in Gold & Silver Markets .

There is a huge demand for both gold and silver right now in India and North America. North American shops are completely bare of silver. Indian shops are empty of both silver and gold. Even the Indian banks don't have any gold or silver. The big western bullion banks, based in New York and London, control both the gold and silver trade. Reports from India are that they are refusing to extend Indian bank lines of credit, forcing the small banks to deliver to clients, collect money, and pay down lines of credit, before being allowed to take delivery of another gold or silver shipment. This is very abnormal. Normally, if a banker's bank knows that its customer-bank has firm orders, it would extend the smaller bank a bigger line of credit. Not now.

By refusing to extend lines of credit, the big bullion banks are essentially rationing a very thin supply.

My Comment: It's no big secret that liquidity is drying up. The simple fact of the matter is banks halted loans for houses, commercial real estate, credit cards, home equity lines, etc. Exactly why should banks be extending lines of credit for silver when they are not doing so for anything else? Seeking to halt speculation makes perfect sense. There has been rampant speculation in everything and quite simply market forces are putting an end to it.

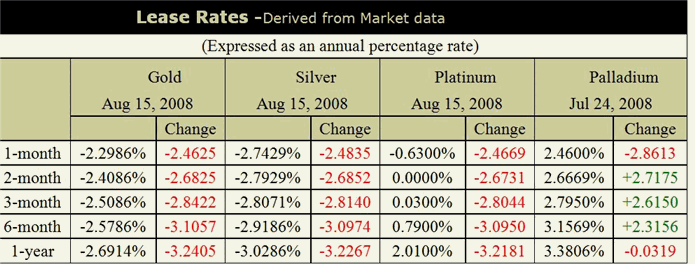

Lease Rates

Conrad does present one new argument for which I have no answer. It pertains to lease rates.

As of a week ago, if you are a dealer, and you lease gold or silver, from the bullion banks, incredibly enough, THEY WILL PAY YOU! At the end of this article, I have attached a chart, showing the current negative lease rates for the various metals.

It does not make sense to me for lease rates to be negative, assuming they are indeed negative, as stated. However, just because something does not seemingly make any sense, is not proof of manipulation in and of itself.

More importantly, the alleged "disconnect" between supply and demand is completely imaginary.

Price Action vs. Physical Accumulation

I have heard one more argument recently regarding the alleged manipulation. Here it is: " The ETFs have shown no dishoarding for the huge falls in the metals which stands out like a sore thumb. "

The argument is totally flawed. It presumes that repricing up or down must be accompanied by accumulation or dishoarding. For starters, the price of gold and silver ETFs must follow the futures market or there will be an arb play. For example, if the futures market rises or falls and the ETF does not, then there would be an instant profit available by exploiting the difference.

Repricings of all sorts in all markets can happen, even on zero sales. Consider the housing market. A builder finishes a subdivision. 50 people paid $400,000. The builder has 3 homes left and offers them for $350,000. Before any sale is made, the every house in the neighborhood would instantaneously be repriced lower by $50,000.

Clearly that housing example involved news. (By the way it does not have to. Sentiment can change overnight without news). At any rate, inquiring minds might be looking for news and/or sentiment changes that would have affected gold in the alleged manipulation timeframe.

Inquiring minds would not have to look too far. Trichet's reversal on interest rates was grounds for an immediate repricing of both the dollar and gold, and that holds true even if demand for the physical picked up at lower prices.

Report on Large Short Trader Activity in the Silver Futures Market

On May 13, 2008 the Commodity Futures Trading Commission addressed every issue, point by point raised above in exquisite detail. The only exception is lease rates. Note: This is a lengthy excerpt.

Inquiring minds very much need to consider the other side of the story as presented in Report on Large Short Trader Activity in the Silver Futures Market .

During the past 20 to 25 years, the Commodity Futures Trading Commission (CFTC or Commission) has received numerous letters, e-mails and phone calls from silver investors alleging that the price of silver futures on NYMEX has been manipulated downward.

In 2004, Dr. Michael Gorham, Director of the Division of Market Oversight (Division) addressed silver investors' concerns in an open letter (2004 Silver Letter) that considered the plausibility of a long-term short-side manipulation of the silver futures market and provided an analysis of activity in the silver futures market. That letter concluded that the existence of a long-term manipulation was not plausible and that an analysis of activity in the silver futures market did not support the conclusion that the market was being manipulated.

Recently, silver commentators and a group of investors that rely upon them have reasserted their allegations that the silver futures market is being manipulated downward by a small group of traders on the short side of the market. As a result, DMO staff decided to revisit this issue by taking a fresh look at activity in the silver futures market.

The analysis draws the following conclusions:

There is no evidence of manipulation in the silver futures market.

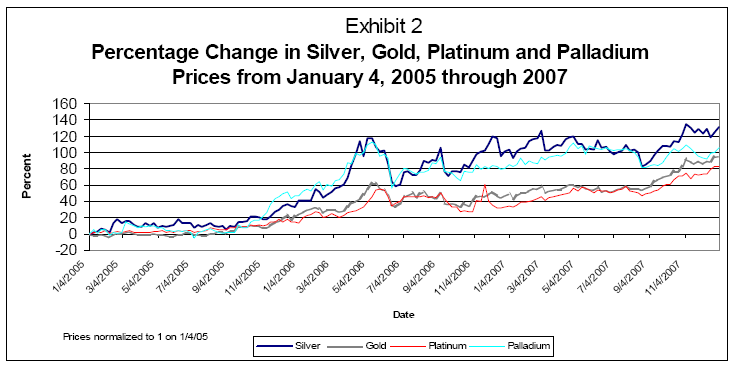

• Silver cash and futures prices have risen dramatically between 2005 and 2007, with silver outperforming the gold, platinum and palladium markets, suggesting that silver futures prices are not depressed relative to other metals prices.

• NYMEX silver futures prices tend to track closely the price of physical silver.

• Concentration levels for the top four short futures traders in the silver futures market are comparable to those observed in the gold and copper futures markets, and generally are lower than the levels seen in the platinum and palladium futures markets.

The composition of the traders comprising the top four short futures traders, in terms of net positions, changes over time. These traders represent a diverse group, and their futures positions are driven by an even more diverse group of customers.

• There is no observable relationship between short-futures-trader concentration levels and silver prices.

• There is a slightly positive relationship between the total net position of the large short futures traders and silver prices; this suggests that larger short futures positions are associated with higher, not lower prices.

Advocates of the short-side manipulation argument contend that silver futures prices have been manipulated downward for close to 25 years. What these advocates fail to indicate, however, is where prices should be, except to argue that prices should be higher than they have been currently or in the recent past.

With respect to the claims of silver commentators that prices are being suppressed, it should be noted that these commentators have never articulated a credible explanation as to why, for more than 25 years, buyers have not entered the market to purchase silver (at the supposedly depressed prices), thereby driving up prices to a level that these commentators believe is reasonable. In this regard, no barrier to entry has been identified that would prevent individuals or firms from buying cash silver or entering into long silver futures positions.

Given the similarities between price movements in these four metals, it appears that general market forces that have contributed to an increase in gold, platinum and palladium prices have also supported an increase in the price of silver. Moreover, the fact that the price of silver outperformed the prices of the other metals during the period, while not definitively answering the question of whether silver prices have been manipulated, calls into question the contention that silver futures prices have been manipulated downward. In short, there is nothing obvious in the silver price series between 2005 and 2007, when compared to other metals' prices, to suggest that silver prices have been manipulated downward.

Trader Concentration

An area that has drawn significant attention from silver commentators is the level of concentration among short traders in the silver futures market, as reported in the CFTC's weekly Commitments of Traders (COT) reports.

Silver commentators have argued that the four-trader net short position reported in the COT reports is unusually high and imply that it is indicative of an effort by a specific group of four or fewer traders to maintain low prices indefinitely. The commentators also imply that the futures positions held by these traders are “naked” in that they are not legitimate hedge positions or otherwise entered into to offset positions in the physical silver market. To evaluate this claim, staff examined the specific traders comprising the top four shorts and their overall futures positions, their motives for holding these positions, how the levels of concentration in the silver futures market compare to those in similar futures markets (i.e., gold, platinum, palladium, and copper), and the relationship between open interest concentration and the level of open interest held by these futures traders to changes in silver futures prices.

The analysis of open interest, collected daily from June 6, 2005 through January 16, 2008—a total of 659 days in the sample—indicates that the composition of market participants among the top four net traders is not static, though certain traders do appear in the top four significantly more often than others. For the period as a whole, there were a total of 10 different traders who at some point were counted among the top four in terms of their net short futures position. Of those 10, three were present in the top four more than 50 percent of the time. The trader most often in the top four was usually ranked number two in terms of net position size among traders, when present.

The trader present second most often was typically ranked fourth among the top four traders, and was never ranked first. Finally, the trader showing up third most often was usually the number one ranked trader, holding that position on 356 days of the 475 days in which they were present in the top four. Thus, the Commission's large trader data shows that, as opposed to the allegation that four traders dominate the market by consistently holding a large concentrated short position, the top four traders at any point in time may involve any of 10 different market participants.

Notably, these large traders are not always net short; of these 10 traders, four at times were among the top four net long silver futures traders. These data show that any scheme to manipulate the silver futures market would require involvement of up to 10 traders as opposed to the four that silver commentators suggest. This renders the allegation more implausible, as such a large diverse group would increase the difficulty and complexity of effecting concerted actions while ensuring discipline within the group.

In addition, the top 10 traders are not monolithic and represent a wide diversity of business interests with diverse customer bases. In this regard, staff interviewed five of the largest traders that are included among the group of 10. Based on these interviews and from the Commission's records, the staff has determined that the entities in this group are involved in the silver markets as dealer/merchants, index traders, swaps/derivatives dealers, money managers, banks and silver depositories. Two of the five traders interviewed indicated the futures positions they entered into were to offset activity that they engaged in with customers situated in the physical silver markets. This activity included buying silver from producers and selling silver to consumers in various manufacturing industries.

Few of the futures positions of these two traders represented proprietary trading of the firms. The remaining three traders were less active in the physical markets, but, nonetheless, they primarily established futures positions to offset other obligations, such as over-the-counter swap trades and other financially settled contracts, that they had entered into with their customers. For each firm interviewed, their futures trading activities are driven primarily by the desires and needs of the firms' customers to either buy or sell silver or to assume or hedge financial exposure to silver prices.

The understanding that the largest net short silver futures traders have an overall neutral position in the silver market is confirmed by information collected by NYMEX relating to several of these large traders. In August 2007, NYMEX contacted several of the largest short silver futures traders requesting specific information regarding their activity in the silver cash and OTC markets. The exchange found that these firms generally held significant forward purchase and sales agreements that, overall, left the firms with a net long silver exposure.

The short futures positions on NYMEX were approximately offset by their long cash exposure. This means that, contrary to the silver commentators' allegations, the largest net short traders in the NYMEX silver futures markets are not “naked” shorts, as the firms' overall exposure in the silver markets (considering their futures, cash and OTC positions) is approximately neutral.

Trotsky Weighs In

I asked my friend "Trotsky" if he had any additional comments to add on the subject of manipulation. Here goes:

You could add that it not unusual for a commodity market to experience a 23% correction in a short time. It happens all the time! In fact, during the 1970's bull market in the metals it happened several times as well. Were today's 'manipulators' at it back then too?

The 'physical silver and gold shortage' as you've correctly explained is an illusion. Only certain forms of retail product were in a shortage, and it is NOT bullish when the retail public clamors to buy the dip.

Also, I would emphasize the CFTC's explanation - one that has been confirmed by the former CEO of PAAS, who took on Butler's claims as well - that the large commercial shorts do in fact have offsetting positions in both physical and OTC derivatives markets, where they act as middlemen for a much larger group of customers.

Therefore, the apparent 'concentration' comes from the fact that these traders (the 10 biggest) tend to aggregate offsetting customer positions and hedge them in the silver futures market.

The fact remains, Butler and others have ZERO proof because if they had proof, they would present it. Furthermore, one would expect by now a whistleblower would talk, or some documents, or something to emerge. Instead the manipulation crowd continually infers things from watching the COT report, and their conclusions are simply wrong.

As the CFTC correctly states, to successfully co-ordinate an ongoing manipulation between 10 large traders over so many years (Butler has been writing about this for 20 years already) seems nigh impossible.

Their interests would diverge too often for one thing, and cartels have proved to be ineffective in both practice and well-established economic theory (see OPEC, which can not determine the price of oil in spite of controlling 40% of output).

So far NO-ONE has reported that they have suffered large losses from silver's 400% rally. That in and of itself is indirect confirmation that the commercial shorts have offsetting positions. And lastly, the mere fact that silver has rallied by 400% at all shows that there is no outside force controlling this market in a downward direction with the slightest success.

Butler and others act as if their issues have not been addressed. Clearly they have been addressed, on multiple occasions in great detail, by many people in addition to the CFTC.

Close scrutiny shows that the preponderance of evidence is solidly in supportive of the fact that there is no conspiracy or collusion between large COMEX traders.

Butler's gun keeps firing, but there is no smoke. It's a blank every time. The Great Gold And Silver Conspiracy Is Easily Explained. There simply is no conspiracy.

Addendum #1

Jon Nadler, Senior Analyst Kitco, Chimes In On The Precious Metals Conspiracy

The amount of hate email I have been receiving in response to "The Great Gold, Silver Conspiracy Explained" is large but not unsurprising. People simply want to blame others for their own trading mistakes. I will have more on that in a separate post.

Most of the emails I received are unprintable because of the profanity. However I will print one of them anyway with slight edits. I will voluntarily withhold the name of the person writing although no such request was asked. ...

See Jon Nadler, Senior Analyst Kitco, Chimes In On The Precious Metals Conspiracy for a continuation of this story.

Addendum #2

To this already amazingly long post I want to add two more articles debunking the conspiracy theories. Both are by Antal Fekete.

Please consider PUTTING LOIN-CLOTH ON THE NAKED BOGEYMAN .

What is seen and what is not seen

Those who hold that there is market manipulation are victims of an optical illusion. What appears as an oversize naked short position involving no more than eight trading houses or bullion banks, is just the visible side of basis trading in silver. ...

The high concentration of short positions is due to the fact that governments and wealthy individuals wanting to earn a return on their silver holdings prefer to take their business to a select few trading houses and bullion banks with the necessary expertise and capital to trade the silver basis on a large scale. ...

Silver Hoard In China?

Here is a second article by Fekete: WHAT GOLD AND SILVER ANALYSTS OVERLOOK

Analysts keep talking about supply/demand factors, instead of concentrating on the falling basis and looking for other signs of the coming backwardation in the gold and silver markets. They should also answer the question: Whatever happened to the Chinese silver, remnants of China's defunct silver standard?

Whatever Happened to the Chinese Silver?

The most populous country, China has one of the oldest civilizations on earth. It had been on a silver standard since time immemorial before the Communists overran the mainland. Nobody knows how much silver was involved in running China's monetary system, but the amount must be mind-boggling. In addition, China was forced to absorb enormous amounts of silver (both through legal channels and through smuggling) after silver was demonetized by the rest of the world and the price of silver collapsed. We do know that this addition to the Chinese money supply created an inflation horrible enough to cause the fall of the Kuo-min-tang regime and the ascension of the Communists to power in 1949. We do not know what proportion of the monetary silver the Communist government left in the hands of the people while confiscating the silver in the banks with characteristic ruthlessness. Finally, we do not know whether or not China was buying silver clandestinely during the twenty-year period between 1980 and 2000 when the price was falling.

Be that as it may, the silver left over from the silver-standard days, plus the silver subsequently flowing into China, is largely unaccounted for. The question is: where is this Chinese silver? It appears that China does hold the silver wild card, and hasn't played it yet. We cannot lithely assume that China will play it stupidly. The possibility exists that China will play it intelligently. For all we know, China may already be active, if only clandestinely, in the silver market and has been deriving handsome profits from it.

The alleged naked short positions in silver may in fact be genuine hedges for Chinese-owned silver. In other words, China may have decided upon a strategy to derive a steady income from her silver treasure, at least for as long as prices remain low, in preference to the alternative strategy of driving up the price of silver and then cashing in. I haven't examined the evidence and I am not suggesting that this is the case. All I am saying is that there is another possibility that could explain the anomalous market behavior for silver. One reason why I find the theory of inordinate and growing naked speculative short positions unattractive is because it assumes that the insiders are either stupid or suicidal or both. It is dangerous to underestimate one's opponents.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.