Gold is up this year not just in Dollars but in Every Major Currency

Commodities / Gold and Silver 2017 Oct 05, 2017 - 08:28 AM GMT“Even those of us who have been tracking gold’s progress for decades frequently give in to the ease of quoting gold’s value in terms of fiat currency – most commonly in US dollars. And yet, we have it the wrong way round. Gold is in fact the centre of the economic universe, and all the fiat currencies (including cryptocurrencies) revolve around gold.” – Jeff Thomas, InternationalMan.com

Most gold investors are aware that major national currencies have been in an uptrend against the dollar since the beginning of the year. What might be surprising is the degree they are up against the dollar. Here is the scorecard:

Euro –– +10.3%

Japanese yen –– + 4.2%

Chinese yuan –– + 4.5%

Swiss franc –– + 5.1%

British pound –– + 8.9%

Australian dollar –– + 9.0%

Canadian dollar –– + 7.2%

(As of 9/27/2017)

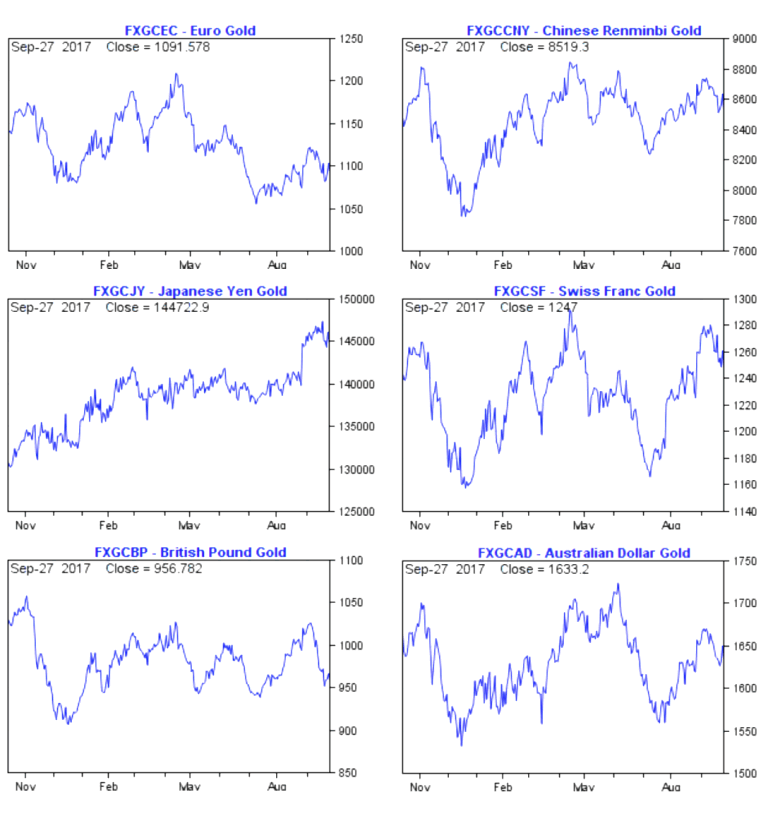

Even more surprising is the degree to which gold has strengthened against those same currencies. Here is that scorecard:

Euro –– + 1.1%

Japanese yen –– + 8.0%

Chinese yuan –– + 6.5%

Swiss franc –– + 6.1%

British pound –– + 3.4%

Australian dollar –– + 2.1%

Canadian dollar –– + 3.2%

U.S. dollar –– + 11.5%

(As of 9/27/2017. See charts below.)

Gold and the dollar are often referred to as safe havens in the same breath, but what these numbers tell us is that – at least for now – gold increasingly has become the safe haven of choice. It is too early to know whether or not the across-the-board uptrend in gold will continue, but it is worth noting and monitoring. Clearly, significant capital is finding its way to the gold market globally and we suspect that institutional investors and funds have played the dominant role.

Why is gold’s appreciation against domestic national currencies important to the individual American gold investor?

It identifies an important trend in gold ownership taking hold in the top economies around the world – a developing investor mindset and response to host country monetary policies that could be of immense importance going forward. It is revealing that the same phenomenon has taken root concurrently in all eight of the countries represented by the currencies listed above.

The pattern reflects concern about central banks’ ability to lift local economies out of a persistent disinflationary malaise. It also suggests that for many investors gold, not the U.S. dollar, looks to be the safer and more productive alternative should things take a turn for the worse.

As long as the low interest rate environment and concerns about overvaluation in the stock and bond markets persist, asset managers and investors are likely to continue shifting resources to underpriced gold (and silver). Given forward guidance provided by the central banks, it appears those policies and concerns will be with us for years to come.

Thus far, gold’s performance against major currencies has flown under the radar in financial circles and outside the notice of the mainstream media. That is not likely to remain the case for long.

In the October issue of News & Views, we pick up where this article leaves off with a very important companion piece: How Professional Investors Radically Altered the Gold Market. We also explore what has brought the Old Guard back into the precious metals market. Last, we include a CLIENT SPECIAL ADVISORY in conjunction with the 20th anniversary of The ABCs of Gold Investing.

In the October issue of News & Views, we pick up where this article leaves off with a very important companion piece: How Professional Investors Radically Altered the Gold Market. We also explore what has brought the Old Guard back into the precious metals market. Last, we include a CLIENT SPECIAL ADVISORY in conjunction with the 20th anniversary of The ABCs of Gold Investing.

We invite you to sign-up for our free monthly newsletter with appreciation to our current and prospective clientele. Immediate access to this month’s edition.

Charts courtesy of Gold Charts$Us/Nick Laird. With thanks.

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.