The S&P Is A Bloated Corpse

Commodities / Gold and Silver 2017 Oct 10, 2017 - 11:53 AM GMTBy: Raul_I_Meijer

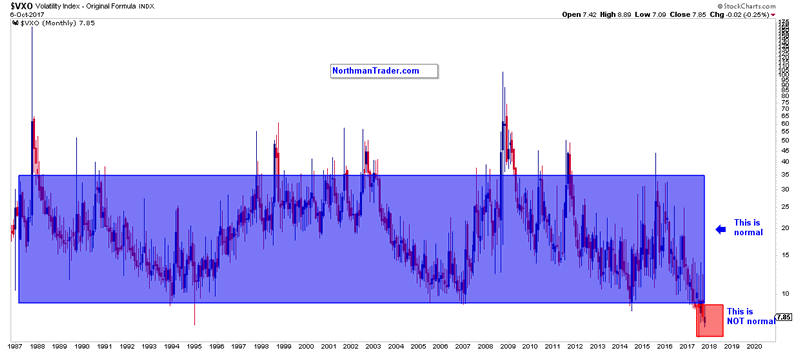

According to Hyman Minsky, economic stability is not only inevitably followed by instability, it inevitably creates it. Complacent humans being what they are. If he’s right, and would anyone dare doubt it, we’re in for that mushroom cloud on the financial horizon. We know that because market volatility, as measured for instance by the VIX, the Chicago Board Options Exchange (CBOE)’s volatility index, is scraping the depths of the Mariana trench.

According to Hyman Minsky, economic stability is not only inevitably followed by instability, it inevitably creates it. Complacent humans being what they are. If he’s right, and would anyone dare doubt it, we’re in for that mushroom cloud on the financial horizon. We know that because market volatility, as measured for instance by the VIX, the Chicago Board Options Exchange (CBOE)’s volatility index, is scraping the depths of the Mariana trench.

Two separate articles at Zero Hedge this weekend, one by NorthmanTrader.com and one by LPLResearch.com, address the issue: it is time to be afraid and wake up. And that is not just true for investors or traders, it’s true for ‘everyone out there’ perhaps even more. Central bank policies, QE and ultra low rates, have distorted the financial system to such an extent -ostensibly in an attempt to save it- that the depressed, compressed volatility these policies have created can only come back to life with a vengeance.

Feel free to picture zombies and/or loss of heartbeat as much as you want; it’s all true. Financial markets haven’t been functioning for years, and there have been no investors either, only gamblers and profiteers, as savers and pensioners have been drawn and quartered. Central bankers have eradicated price discovery, nobody knows what anything is really worth anymore, be it stocks, bonds, housing, gold, bitcoin, you name it.

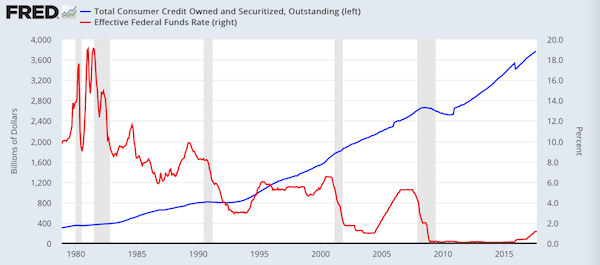

If you make interest rates ‘magically’ disappear anyone can spend any amount of money on anything they fancy buying. And it’s not just traders and investors either. Scores of people think: look, I can buy a house, others think they can buy a bigger house, many will get into stocks and/or bonds, because prices just keep going up. Even savers and pensioners are drawn into the central bank Ponzi, often in an effort to make up for what they lose when their accumulated wealth no longer pays them any returns. Shoeshine boys are dishing out market tips.

Crypto may or may not be a new tulip, but many Silicon Valley start-ups -increasingly funded by crypto ICO’s- certainly are. There’s so much money sloshing around nobody can tell, or even cares, whether they are actually worth a penny. It’s all based on gossip multiplied by the idea that they will be smart enough to get out in time in case things go awry.

People mistakenly think that a market’s heartbeat can be found in for instance rising stock prices, the Dow, the S&P. But that’s simply not true. The S&P is a bloated corpse increasingly filling up with gases that will eventually cause it to explode, with guts and blood and body parts and fluids flying all around.

The US stock market’s heartbeat manifests itself in volatility, and the overall economy’s heartbeat in interest rates. Rising and falling volatility and interest rates is how we know whether a market is in good health, or even alive at all. They are its vital signs.

That follows straight from Minsky. Ultra-low rates and ultra-low volatility, especially if they last for a longer period of time, are signs of trouble. The markets the central banks’ $20+ trillion QE and ZIRP have created are bloated corpses that no longer have a heartbeat. They are zombies. But markets, unlike natural bodies, won’t die, they can’t. They will instead rise from their graves and take over Wall Street, the City, and then everyone else’s street.

Bernanke, Yellen, Draghi and Kuroda are sorcerer’s apprentices and Dr. Frankensteins, who have created walking dead monsters they have no control over. But the monsters won’t turn on them personally; that’s the tragedy here as much as it is the reason why they have worked their sorcery. They themselves won’t go bankrupt, other will. No skin in the game.

Enough with the metaphors. First, here’s NorthmanTrader:

In the movie Flatliners aspiring medical doctors tried to unlock the mysteries of death by, well, killing themselves. It was meant to be a controlled death of course, to flat line on the heart rate monitor for a few minutes to find out what wonders where to be found “on the other side” only to then return safe & sound thanks to medical intervention. Well, they soon found out the other side wasn’t everything it was cracked up to be and the main character soon got regular beatings as the sins of his past came back to haunt him.

In my view markets find themselves in a very similar script. The promise of investor nirvana where the pains of real life no longer matter. If you only pay attention to the record highs headlines it all looks rather fantastical these days. [..] any trader staring at the tape knows that we find ourselves in the most compressed price environment in history. This is not normal, there’s no heartbeat:

As I’m writing this I’m fully aware I may be viewed as the bear who cried wolf. After all I’ve been outlining structural risk factors for a while and markets have moved past my technical risk zones of 2450-2500 and most recently 2530. That’s what bubbles do. They blow past anyone’s expectations, they make believers of the unbelievers, make bears look like idiots and the most reckless look like geniuses. But an extreme market that only becomes more extreme is not any less extreme, it is just more extreme. As no risk is apparent these extremes are then dismissed as the new normal. Yet momentum driven price appreciation has absolutely zero predictive value of future price appreciation, it only appears as such at the time.

We find ourselves in a very unique point in history and in a world dominated by false narratives. It is a challenge to keep an analytical grip on reality, but I’ll try to tie a few threads together here to put everything in a macro context. Firstly the underlying base reality: Free money, easy money, whatever you want to call it, permeates everything we see in financial markets. Indeed I would argue price appreciation has been paid for with unprecedented and, in my view, unsustainable volatility compression. A couple of charts really highlight this. Most clearly perhaps is the precise trend line tagging we can observe in the correlated picture of price appreciation and volatility compression since the February 2016 lows:

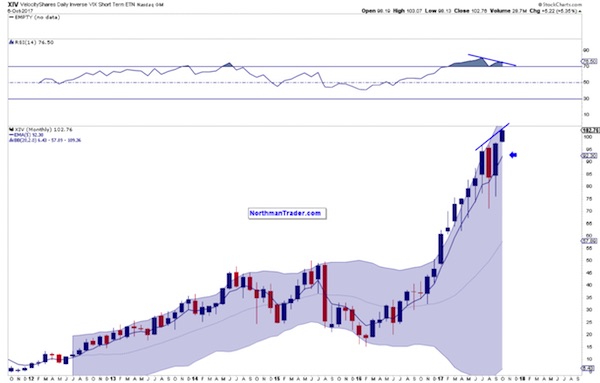

The $VIX’s corollary, the inverse $XIV, embarked on an explosive near one way journey since the US election coinciding with over $2 trillion central bank intervention in just the first 9 months of 2017:

And it has continued to this day and just made another all time high this past week on a massive negative divergence. It is the magnitude of this volatility compression that explains the current trading environment we find ourselves in.

[..] Debt expansion at low rates continues to sustain the illusion of real prosperity for the 90%:

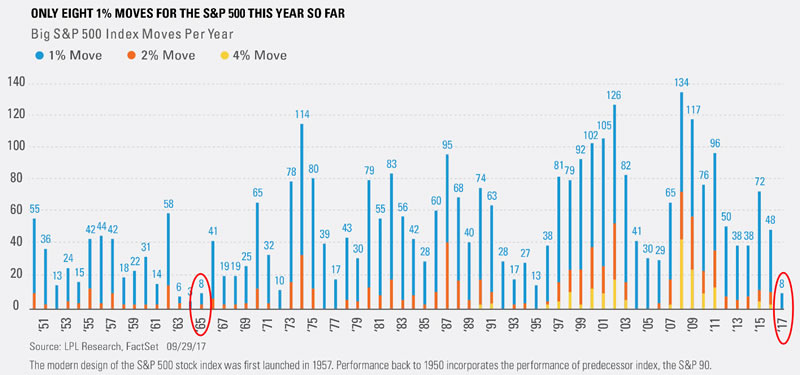

And then LPLResearch with another indicator that goes to show we’re dealing with a zombie here: stock prices are not moving, either up or down. Or rather, they’re moving up all the time, but in too small increments. Yeah, like that bloated corpse.

Where Did All the Big Moves Go?

There have only been eight moves of at least 1% for the S&P 500 Index so far this year—the least since 13 in 1995. The all-time record was an incredible three in 1963. What about a big move? The last time the S&P 500 moved at least 4% was nearly six years ago. In fact, the S&P 500 had four consecutive days with 4% (or greater) changes in August 2011. Other than 2008 and the crash of ’87, that is the only other time since the Great Depression to see four consecutive 4% changes. That isn’t anything like today’s action.

As the chart below shows, so far in 2017, big moves have been nonexistent; and even 1% changes have been rare. Per Ryan Detrick, Senior Market Strategist, “If you had forecast that the 11 months after the 2016 U.S. presidential election would be one of the least volatile periods ever, you would be in the minority. Then again, the last time we saw a streak of calm like this was the year after John F. Kennedy was assassinated in November 1963. Once again proving that the market rarely does what the masses expect and usually surprises us.”

You want a heartbeat. That tells you if a body or a market is alive, healthy, functioning. We don’t have one. We haven’t for years. But we will again. Natural bodies can tend towards equilibrium, i.e. death. Markets cannot. They’re doomed to flatline, and then to always come back from near death experiences. They tend to do so in violent ways though. When volatility at last returns, so will price discovery. It won’t be pretty.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.