Gold And Silver – Think Prices Are Manipulated? Look In The Mirror!

Commodities / Gold and Silver 2017 Oct 15, 2017 - 04:23 PM GMTBy: Michael_Noonan

Almost everybody complains or laments how both gold and silver are being manipulated, and they are, going back at least to the 1920’s and 1930’s and not just recently. Curiously, very few are even aware, let alone consciously complaining, about how manipulated their lives and those of everyone around them have been and continues to be.

Almost everybody complains or laments how both gold and silver are being manipulated, and they are, going back at least to the 1920’s and 1930’s and not just recently. Curiously, very few are even aware, let alone consciously complaining, about how manipulated their lives and those of everyone around them have been and continues to be.

It has been a few months since our last commentary. We used to present one each week, but over the last several months, it makes less and less sense to provide one. The lies by all governments and the media are too many and too constant, and too many people remain cluelessly content in their chosen ignorance to resist and force changes.

In the United States, shortly after Trump’s upset election and in what appeared to be genuine but naive speech promising to Make America Great Again, the sycophant NeoCons, AKA the Deep State, the second most dangerous faction in this country, second only to the hidden-from-sight elites that they so willingly serve in order to bring about the One World Order, staged a coup against the elected president.

Trump promised to Drain The Swamp, but the Swamp has shamelessly enveloped him to prevent populism from becoming more popular. Let us repeat, the NeoCons staged a coup in this country, and a good number of people support all anti-Trump efforts without even realizing how insidious the NeoCons are and how they have been selling this country into the ground.

Massive loser, Hillary Clinton, still expounds how she lost the election, blaming mostly Russia, without the slightest grasp of reality that she was solely responsible for her ignominious defeat. Still, she has a voice and a large following despite the corrupt nature of the Clintons since their Little Rock, Arkansas days, when Bill was a penniless governor.

Now, after a trail of dead people over the past few decades that used to be loosely associated with the Clintons, they have become billionaires. Seems like most people to not care how that came about.

It is impossible to get people to wake up to the George Orwell 1984 clarion call, now in the present tense. Snowden’s exposure of the NSA and the massive spying the government illegally uses to invade everyone’s privacy did little to cease and desist the appalling misuse of government. If that wake-up call of how government treats people as the enemy failed to spark any revolt against the abuse of power, expect more of the same, and worse, which is what is happening.

People do not care that the government is run by unknown foreigners who quietly control and pull all the strings for corporations, medicine, education, media, the entire judiciary, etc, etc, etc. The American flag is the corporate government flag and not the Constitutional flag most assume it to be. The Constitution, and the flag it represents, are dead. They do not exist in the corporate federal government.

Why was Lincoln killed? Why was JFK killed. Why does hardly anyone realize why Martin Luther King was killed? Hint: he represented a reformation that was the antithesis of the direction the elites wanted this country to follow. King was uniting people. He was preaching the value of individuals and how they relate to others. It was a form of populism that could not be tolerated. It was also against the purpose of the Pope and the Catholic church to keep people subjugated to a false religion run by Rome.

Why has the UN invaded this country using programs like Agenda 21, Agenda 2030? Why are most people unaware of what is going on as the UN is setting them up to no longer own property in their own country?

We are not even covering just the tip of the iceberg that is sinking this country faster than when the Titanic went down. It has become too overwhelming to present even simple premises that are entirely false in their nature but advanced as true by the mainstream media. There are dozens of topics, issues that need to be addressed like the poisoning of our children with vaccines filled with harmful chemicals, chemtrails in the skies polluting the air we all breathe, the use of foreign-controlled debt instruments, passed off as “money” in this country; the fact that there is no law in this country that requires anyone to file taxes with the IRS, yet people volunteer themselves into financial servitude for the elites.

Our voice is too small to fight against the tsunami forces of the elites to make a difference, except for ourselves, for we have a fairly informed understanding of the evil forces that control the world. It is easier to explain the manipulation of the precious metals markets than it is to expose the manipulation of everyone’s everyday life, and we have not even touched upon the stupidity of Europeans, the Eurozone, the destructive politicians who serve the elites and not the people in that part of the world.

If countries like Germany and Sweden want their rape-ugees, they can have them. It is all a part of the plan of the elites to rid people of their individualism, and it looks like most Europeans are more than willing to be compliant.

All politicians and bankers lie. Charts do not. Charts even help read the manipulated lies that are forced into the markets to keep them suppressed. One problem with charts is that many do not understand them, including a lot of technical analysts who misuse them, and as a result, the message gets lost because of incompetents and many choose not to put any weight on their reliability.

One can take the facts from charts and draw their own conclusion[s] and not have to rely on others, including what we see. Most do not look at annual or quarterly charts, but they can and do tell a compelling story.

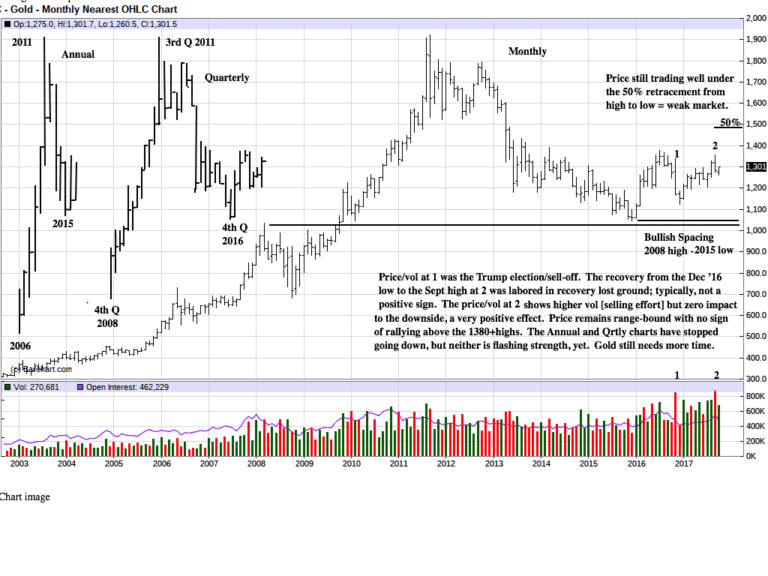

For the first time since the 2011 top in gold, the annual chart shows a higher high, higher low, and a higher close in 2016. This adds to support the growing reliability that 2015 is the low of the correction. There is still work to do, but it is a factual message from that time frame.

On the Quarterly chart, since the free fall of prices in 2013, price has moved sideways. [We market the 4th Q low as 2016 when it should read 2015.] There was every opportunity and likelihood that price would move lower after the low close of 2015. Yet, price did the opposite. This is another fact worth considering. What happened to the momentum of the sellers in control since the 2011 highs? This is an important change in market behavior. It does not mean a bull market is underway, but it tells us price stopped going lower.

The monthly chart amplifies the importance of the 2015 low. It did not fill the gap from the rally high back in 2008. The low of 2015 left a small space that did not fully retrace that important high. The space is referenced as Bullish Spacing. You can also see how small the December 20125 bar was. Sellers could not extend the bar lower. Why? Buyers were present and showing an ability to stop the downside momentum.

Price has since been moving sideways, actually continuing the sideways decline that started in 2013. Has the gold market been manipulated since the highs. Consensus overwhelmingly says yes. Still, one can read the overall manipulation and see how it has changed. Price is still being suppressed, but with less and less success.

Look at the two volume bars marked 1 and 2 on the monthly chart. The downside effort was greater for bar 2, but the lack of downside movement tells you that buyers were more than meeting the effort of sellers. Large volume almost always indicates smart money is controlling the activity.

While there is no reason to say a bull market in gold is underway, we can conclude that the character of the market has changed and continues to change, and that change has become more positive.

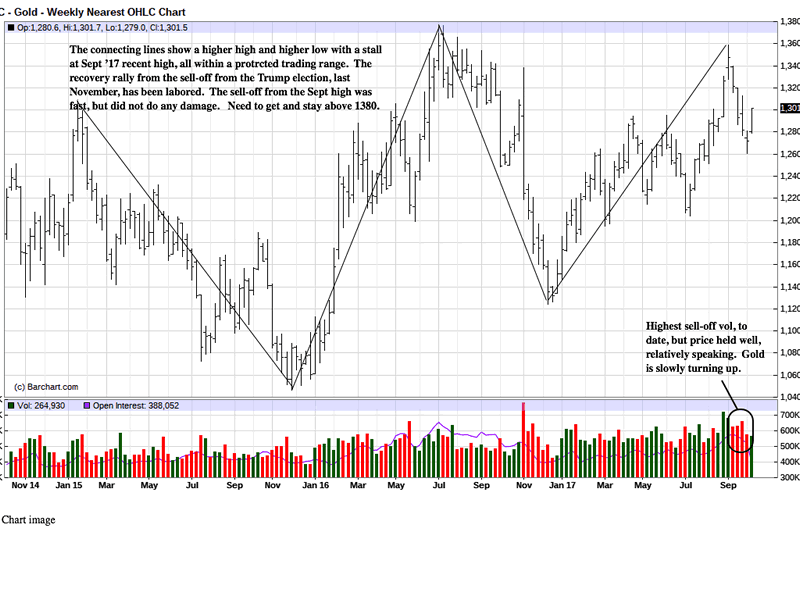

The September rally retested and ultimately failed to hold the sell-off from the high volume November decline. Sellers were defending their position from that level. It appears that the steadily higher selling volume starting in September has been unable to push price lower.

A few months ago, and before then sellers could push price lower with impunity dumping massive amount of paper contracts during overnight hours when trading was relatively thin. These days, sharp drops do less damage and are more quickly recovered.

It is not so obvious, but it appears that sellers are being absorbed by buyers who are not yet sufficiently strong enough the totally reverse the downward, now sideways, momentum.

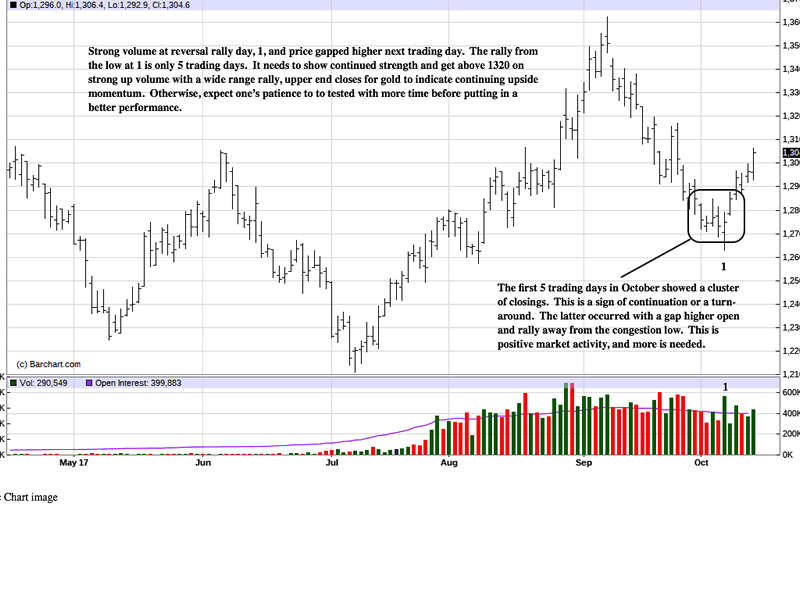

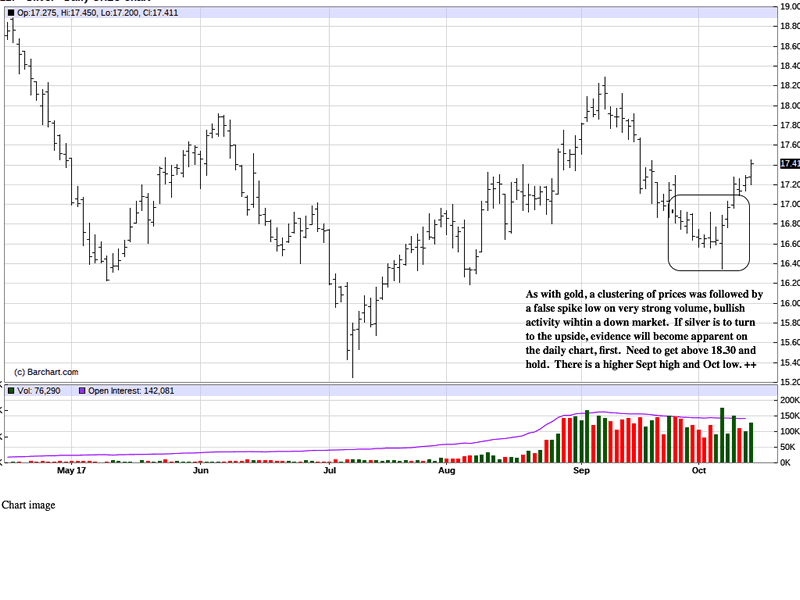

When a change in trend occurs, it shows up on the lower times frames first. We could be seeing such a shift on the daily chart that is not yet apparent on the higher time frames. The explanation of the October trading is such an example.

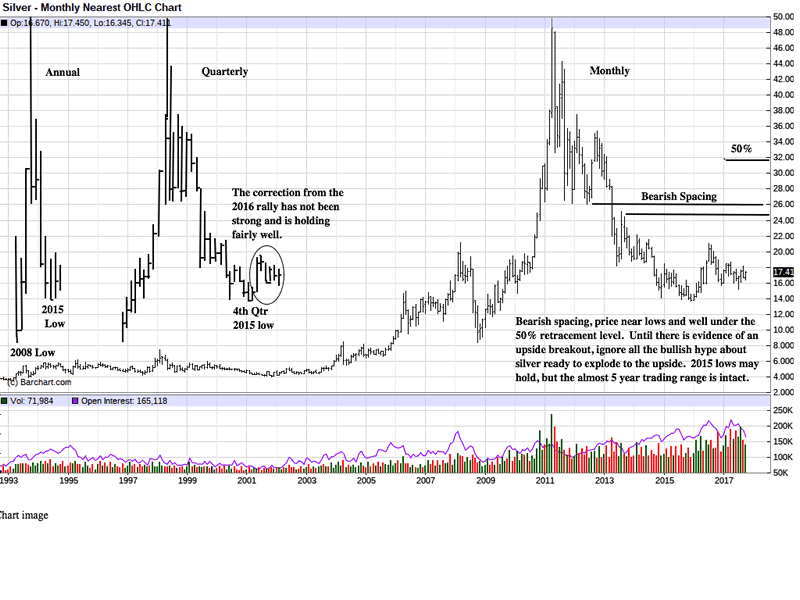

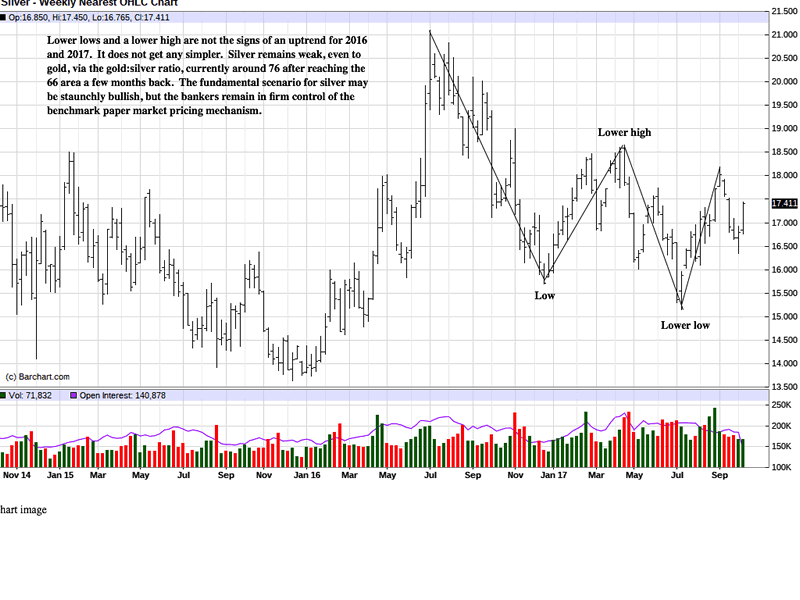

Silver is much weaker than gold, and the chart makes that very clear. We tend to favor silver over gold, at present, mostly because the gold:silver ratio is very high favoring gold.

Many times, silver will lead gold in an up market. When that happens, the gold:silver ratio retracts. Currently, it is running around 76:1. It takes 76 ounces of silver to buy one ounce of gold. That ratio can come back into the 40s or 30s in a strong up move where it takes less ounces of silver to buy the same ounce of gold.

For now, the most positive chart development on these higher time frames is the labored correction of the last five Quarters, seen in the oval below. However, silver remains in a relatively weak condition, fundamentals notwithstanding.

As is presented on the weekly, lower lows and lower highs are not conducive to a sustained move to the upside. Simple facts that lead to the same conclusion. Many may tout silver as being a huge upside potential. The charts do not support that premise, at present.

AS already mentioned, changes in trend show up on the lower time frames first. The weekly shows a weak formation. The daily is giving a different read, for the near term and not yet confirmed.

While the paper market remains under pressure, this is a massive gift for those buying and accumulating physical gold and silver. Both metals have no third-party counter risk, and both are the only true form of money in existence. Always remember, fiat currencies are a form of debt, and debt can never be money. That is one fact that should be preeminent in one’s mind.

Buy the physical, and do not keep it in a bank or safe deposit box. It will be confiscated.

If you do not hold it, you do not own it, and owning paper substitute means nothing.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2017 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.