Bonds And Stocks Will Crash Together In The Next Crisis (Meanwhile, Bond Yields Are Going Up)

Stock-Markets / Financial Crash Nov 16, 2017 - 10:34 AM GMTBy: John_Mauldin

BY JARED DILLIAN : I have been a bond bear for a while.

BY JARED DILLIAN : I have been a bond bear for a while.

Back in the summer of 2016, I spoke at a small conference out in San Diego. My topic: How interest rates were going to go up.

It didn’t go over very well with people. I haven’t been invited back to speak, which is too bad—because I was right. (You may also want to learn what I predicted about today’s bubble in my exclusive free report, Investing in the Age of the Everything Bubble.)

When I gave that talk, yields on 10-year notes were about 1.6%. Today, they are about 2.4%. That may not seem like a lot, but it is.

The evidence is starting to pile up that yields may be going even higher.

Quantitative Tightening Is Picking Up Speed

The Fed is letting assets roll off the balance sheet. A little at first, but more later. This is not a small thing! New Fed Chairman Jay Powell wants this to be smooth as a gravy sandwich, but we will see.

Meanwhile, the ECB is tapering, and will taper more…

The BOJ has pegged the yield curve and buys bonds when the market forces them into it…

The Bank of England seems to be finally lifting off…

What had once been a flood of global liquidity is now starting to run in reverse.

So, if you remember all the complaints about central banks, that:

1) They had inflated asset prices

2) And worsened inequality

Then you can expect:

1) Asset prices to deflate

2) And rich people to get poorer

Bonds and Stocks Will Go Down Together

This is what you have been waiting for, right? Rich people to lose money?

Rich people will lose money because asset prices will deflate. What kind of assets? Financial assets—stocks and bonds.

Yes, in the next bear market, stocks and bonds will likely go down together.

People have become accustomed to an inverse relationship between stock and bond prices. Funny thing about stock-bond correlation: The long-term average is zero, but sometimes it is 1, and sometimes it is -1.

There are a lot of people holding 70/30 or 60/40 portfolios of stocks and bonds who think they are diversified. They are probably not diversified. To be diversified today, you need to be a bit more imaginative about what asset classes you include in your portfolio—and have a healthy dose of cash.

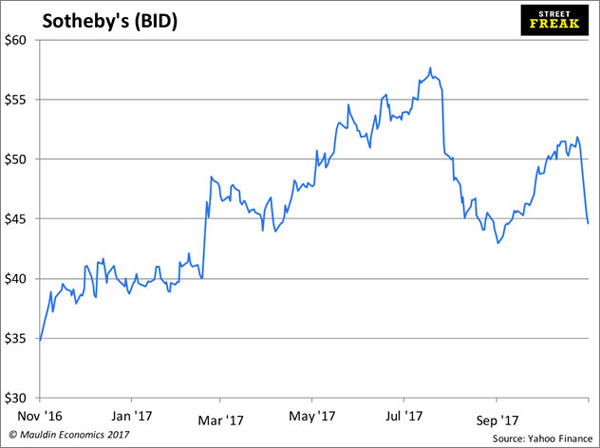

Anyway, a pretty good leading indicator of asset prices deflating and rich people getting poor is Sotheby’s, the auction house.

The chart is making lower highs. It seems quantitative easing didn’t just fluff up stocks and bonds, it fluffed up art and crap as well.

We might be onto something.

FANG and Bitcoin Signal the End Is Near

The Chicago Mercantile Exchange is listing futures on FANG and Bitcoin. You probably heard.

Most people would objectively say that FANG and Bitcoin are bubbles. There might be some disagreement, but not much.

These products are purely for speculation. We’re not even sure that Bitcoin serves any economic purpose.

Let’s look at the history of listing derivatives on bubbles.

The listing of ABX led to the destruction of the subprime mortgage market. The listing of CMBX led to the destruction of commercial mortgage-backed securities. Heck, even the Nikkei futures were listed right near the top of Japan in 1989.

And lots of people think that tulip futures are what did the tulips in.

I was talking with a good friend the other day, a bond salesman who has been around for a while. He is fifty and has quite a bit of grey in his beard. We were talking about how cool it was that 1-year Treasury bills yielded almost 1.5%, and how you can get 1.5% in an online savings account.

I said to him, are you listening to us? We’re talking about T-bills. Nobody talks about T-bills. But in 1981, everyone was talking about T-bills.

We will get back there eventually.

Grab Jared Dillian’s Exclusive Special Report, Investing in the Age of the Everything Bubble

As a Wall Street veteran and former Lehman Brothers head of ETF trading, Jared Dillian has traded through two bear markets.

Now, he’s staking his reputation on a call that a downturn is coming. And soon.

In this special report, you will learn how to properly position your portfolio for the coming bloodbath. Claim your FREE copy now.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.