Will Gold and Diamonds Rival Bitcoin in Tokenized Economy?

Commodities / Gold and Silver 2017 Dec 12, 2017 - 12:29 PM GMTBy: Nicholas_Kitonyi

Whenever I look at the Bitcoin price chart, it makes no sense and that means investors no longer move the market, but rather, the market moves them. If the prices are skyrocketing, instead of sitting back and looking at what’s behind the rally, they are now joining the bandwagon without taking a second to think.

Whenever I look at the Bitcoin price chart, it makes no sense and that means investors no longer move the market, but rather, the market moves them. If the prices are skyrocketing, instead of sitting back and looking at what’s behind the rally, they are now joining the bandwagon without taking a second to think.

Of course, Warren Buffett would disagree with them. In fact, he recently warned that bitcoin bubble is real. How long this bubble will continue to balloon remains to be seen, but it is quite clear that sooner rather than later, there will be a burst and those caught in the blast will not like the impact on their income statements.

A tumble in the price of bitcoin could result in huge losses for those riding the price curve.

One of the reasons why most analysts expect a massive crash or at least a correction in the price of bitcoin is because unlike fiat currencies, bitcoin is not backed by gold reserves or a country’s economic fundamentals.

The most realistic catalyst that bitcoin investors could point out is that most online platforms and shopping malls are now accepting various forms of cryptocurrencies as a method of payment. Recognition and acceptance have given it some leverage to claim legitimacy but without tangible value, it remains to be seen how bright the future of bitcoin will be. For the skeptics, it’s pretty much another pipedream that will in the end, turn the dreams of many into nightmares. So, could this bring a short-lived dream of what has been one of the most promising markets in the fintech industry to a premature end?

Not really. There is still some some hope. Or is there? Maybe the real winner in this cryptocurrency menace, which is blockchain technology could save the day. But how?

The blockchain technology has launched what many are now calling the tokenized economy. Tokenization basically refers to the way in which blockchain startups are using the technology to replace “sensitive data with unique identification symbols that retain all the essential information about the data without compromising its security.” This phenomenon has allowed players in the cryptocurrency market to come up asset-backed crypto coins that now have some real value attached to them.

And while these asset-backed cryptos are yet to gain traction in the same fashion depicted by Bitcoin and Ethereum, some investors are finding them to be more realistic investments as we head towards uncharted waters in the market. GoldMint and OneGram are good examples of gold-backed cryptocurrencies. Every coin has a certain value attached to them relative to the value of gold bullion stored in various gold reserves.

Gold is already tradable across several forex trading platforms, which means that there is nothing too original about gold-backed cryptos. This is probably why the cryptocurrency market players have gone a notch higher to introduce tokenized real estate and diamond-backed cryptocurrencies in the tokenized economy. There are also suggestions of tokenization of the construction industry as blockchain continues to disrupt various industries in the market.

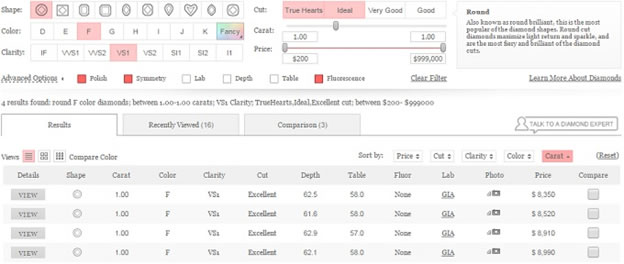

Bringing real estate into picture will have many retail investors interested, but the prospect of trading diamonds in tokens might be even more lucrative. To individual and retail investors, diamonds are scarce and inaccessible investment products. This is partly because of the security requirements associated with buying, transportation and storage of diamonds. In addition, unlike is the case of gold where pricing can be determined per ounce, calculating diamond prices can be a little complicated for ordinary investors. There are so many filters to apply when trying to determine the price of a specific diamond type, carat size and cut, among others.

A sample diamond price selection chart.

With tokenization, investors can easily buy tokens of different diamond types and carat sizes to come up with well-balanced mini diamond portfolios. The best part about this is that, they wouldn’t be required to buy at least a full stone for each diamond type. They can buy a token of each, which would be cheaper than buying full stone.

In return, this will result in increased liquidation in the diamond market. Soon, diamond-backed cryptos could be traded on leading forex trading platforms as we have noticed recently with bitcoin and Ethereum.

However, given the progress made by bitcoin and the hype that surrounds it, it is hard to see any cryptocurrency toppling it in the foreseeable future. Bitcoin has already earned its place amongst investors as many perceive it to be the future of the currency market.

And while there are genuine critics about bitcoin’s legitimacy in the market, the increasing adoption of blockchain and its various applications on trading instruments appear to have bought it a new lease on life. Gold and diamond backed cryptocurrencies will certainly appeal to investors that seek some level of tangible value, but even they cannot really claim to have intrinsic value. Interesting times lie ahead in the cryptocurrency market.

By Nicholas Kitonyi

Copyright © 2017 Nicholas Kitonyi - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.