Will The Trump Trade Tariffs Send The Stock Market Into A Tizzy?

Stock-Markets / Stock Markets 2018 Mar 05, 2018 - 09:35 AM GMTBy: Avi_Gilburt

Each week, I believe the silliness being espoused as to what moves the market reaches a climax. Yet, the following week somehow always proves me wrong.

Each week, I believe the silliness being espoused as to what moves the market reaches a climax. Yet, the following week somehow always proves me wrong.

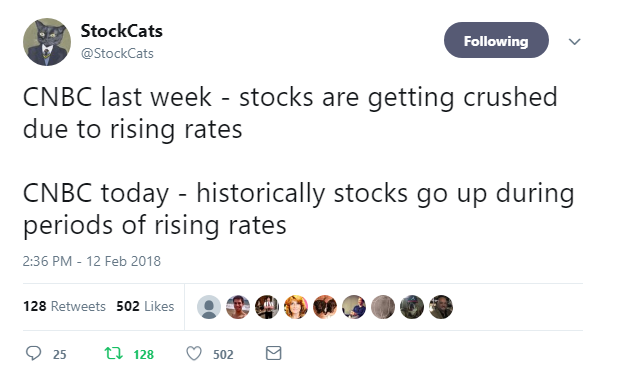

Two weeks ago, I noted how the pundits claimed the market dropped because of rising rates, but when the market rallied, the same pundits claimed that it was rallying because of rising rates.

Around the same time, these same pundits told us that if the CPI would suggest inflation is rearing its ugly head, the market would continue to tank. So, the CPI showed signs of inflation, yet market held the support I noted to my subscribers to the penny, and rallied that day.

And, I have shown you many of such instances which evidence the over-simplification being presented to you about how our market works. The problem is that markets do not work in the same way as physics. Yet, too many try to present in a similar manner.

This past week truly provided us with another head scratcher, well, at least for those of who engage in independent thinking and care about the facts.

In the early part of the week, the market rallied towards the 2800 region target we set as our expectation before we turned down, as we called for it to do. In fact, the market struck 2789SPX, and then turned down for most of the rest of the week.

And, what was the reason you were told for the turn down? If you were listening to the news towards the end of the week, it was “clearly” due to Trump’s trade talk of tariffs on steel. In fact, consider how many articles you saw with a similar title to this one: “Trump Tariff Plan Rattles Markets.“

Makes sense, right? The only problem is that the market turned down two days before Trump spoke about his steel tariff. But, I am sure there will be some of you who point to Powell’s statement about inflation approaching his targets as the cause of the drop early in the week. Yet, we have evidence the prior week of the market rallying after evidence of inflation was presented in the economic data.

Moreover, Trump tweeted on Friday morning how he believed that a trade war would be good for the US, and what did the market do on Friday? It bottomed in the morning and rallied for the rest of the day. And, yes, I have heard numerous pundits point to the Trump tweet as the reason the market rallied on Friday.

In fact, one of my subscribers sent me this post they found on a blog because they know I would get a chuckle out of it:

“The market seems to be saying that import tariffs are a good thing for business. Only dumb money would believe that to be true so we know who is driving the rally.”

I think it would be more appropriate to state that only dumb money would believe that the tariffs actually were the cause for the market moves this past week. And, the only way they can come up with such a ridiculous statement is based upon convoluted "logic."

Are you starting to see my point yet? Listening to or reading any analysis about the market which is based upon attempted correlations centered around the news of the day is the most ridiculous thing an investor can do. Yet, almost all of you read this stuff day in and day out thinking you can use it to outperform the market.

Actually, I stand corrected. Making a decision based upon attempted correlations centered around the news of the day is the most ridiculous thing an investor can do. And, if you attempt to do so, you will likely be broke quite quickly.

I want you to consider one last thing when pondering the usefulness of news: Why are the reasons for the markets move always being presented after the fact, and even then there is not often consensus?

People are trying to explain why the market moved after the fact, and often present conflicting ideas from that which they claimed moved the market the prior week (see the CNBC example above). Have any of them figured out how to tell us what the market will do before it happens with any reasonable amount of accuracy?

Last week, we noted that as long as we do not break below 2730SPX, the market was going to rally up towards the 2800 region before it turned down again. On Tuesday morning, the SPX struck 2789, and turned down over 140 points. And, the probabilities at this time suggest we are not likely done with the downside.

While I am not going to go into the details and charts that I provide to my subscribers, I will simply explain that we can see further upside action early in the coming week. But, as long as we remain below last week’s high, the market has a set up in place to retest the 2530 region, with strong potential to break down towards the low 2400 region before this correction runs its course. For now, 2600-2630SPX is going to be the support you need to watch should we see another downside follow through in the coming week.

Of course, I can always be wrong in my assessment. For this reason, I provide specific markers so you can know that my primary expectation is wrong. So, alternatively, if we see an impulsive 5-wave structure through the high made last week, that would be a strong suggestion that we are heading up to our next higher target of 3011-3223SPX earlier than I had initially expected. But, for now, I have to view this more immediate bullish potential as being a lower probability.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2018 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.