What to Expect at a Critical Stock Market Point: End of a Wave 2 Rally

Stock-Markets / Stock Markets 2018 Apr 26, 2018 - 03:23 PM GMTBy: EWI

"Most investors are convinced that the bull market never went away."

The great game of Wall Street -- where huge amounts of money are at stake every trading day.

Many speculators play this game by watching for events outside of the stock market that they believe will "trigger" the next big move in prices.

However, the real driver of all those green up arrows and red down arrows is nothing more or less than investor psychology. This famous Kal's cartoon sums it up perfectly:

First investor: "I've got a stock here that could really excel."

Second investor: "Really excel?"

Fourth investor: "Sell?" -- and the crowd goes, "Sell, sell, sell!"

First investor again: "This is madness! I can't take it any more, good bye!"

Second investor: "Good bye?"

Third investor: "Buy?" -- and the crowd goes: "Buy, buy buy!"

As random and unpredictable as this cartoon makes it look, EWI's research reveals that investor psychology actually goes through similar phases during every market cycle. So, if you know the current psychological phase of the market, you can make a high-confidence prediction about the next phase.

This leads us to what we call Elliott waves, which are simply reflections of these psychological phases. In other words, each wave represents a set of investor attitudes, sentiments and behaviors during a specific phase of the market cycle.

The Wall Street classic book, Elliott Wave Principle: Key to Market Behavior, by Frost & Prechter, states:

... a knowledge of wave personality can be invaluable. Recognizing the character of a single wave can often allow you to interpret correctly the complexities of the larger pattern.

Specifically, EWI's analysts have observed that the stock market trend develops in five waves, while the reaction against it develops in three waves. So, in a bull market, expect five waves up, followed by a downward move of three waves. In a bear market, expect five waves down, with the upward correction occurring in three waves.

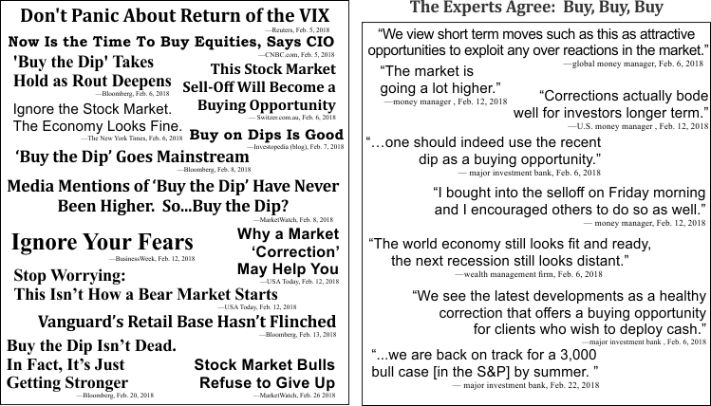

With all of the above in mind, consider these recent expressions of investor psychology. The news excerpts were compiled by the editors of our Elliott Wave Financial Forecast and shown in the March issue:

Do these positive investor sentiments seem odd in the face of the stock market volatility that occurred after the January 26 DJIA high?

Well, there is an explanation.

The March Financial Forecast said:

The bullish response to the market's decline is exactly what the Wave Principle suggests should occur at a trend reversal. Near the end of a second-wave rally in a bear market, Elliott Wave Principle by Frost and Prechter states that "investors are thoroughly convinced" that the bull market "is back to stay." In the current case, most investors are convinced that the bull market never went away.

Since that analysis published, the DJIA's Elliott wave pattern has provided our analysts with even more clues about the stock market's next big move.

If you are prepared to take the next step in educating yourself about the basics of the Wave Principle -- access the FREE Online Tutorial from Elliott Wave International.

The Elliott Wave Basic Tutorial is a 10-lesson comprehensive online course with the same content you'd receive in a formal training class -- but you can learn at your own pace and review the material as many times as you like!

Get 10 FREE Lessons on The Elliott Wave Principle that Will Change the Way You Invest Forever.

This article was syndicated by Elliott Wave International and was originally published under the headline What to Expect at a Critical Market Point: End of a Wave 2 Rally. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.