Why the US Navy Is the Best Sector to Invest in Now

Companies / US Military Sep 10, 2018 - 03:30 PM GMTBy: John_Mauldin

BY ROBERT ROSS :

Defense stocks are booming big time.

BY ROBERT ROSS :

Defense stocks are booming big time.

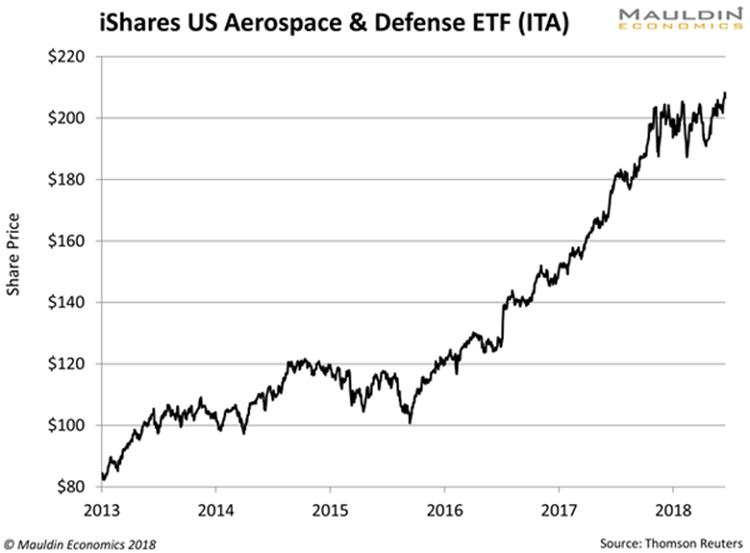

The iShares US Aerospace & Defense ETF (ITA) just hit an all-time high last week:

But this isn’t a one-off.

iShares US Aerospace & Defense ETF has delivered a return of 56.1% over the last two years. That’s nearly double the 30% S&P 500 return over the same period.

If we go back five years, iShares US Aerospace & Defense ETF jumped 132% versus the S&P 500 return of 72%.

My regular readers know defense is our top go-to sector for making safe profits.

I like defense stocks for several reasons. But their key advantage over other sectors is that their main customer is the US military.

The Industry That Never Quits

The US military is an awesome force.

It employs 2.2 million people. That’s more than the population of Wyoming, Vermont, and Alaska… combined.

To maintain this military force requires a lot of money.

The US will spend $700 billion on the military in this year alone. The next closest nations are China ($146 billion) and Russia ($69.2 billion).

The US spends so much on its military that the combined military budgets of China, Russia, Saudi Arabia, and India don’t equal even half the annual US defense budget.

The US spends 90% of its military budget on American companies. That means billions of dollars flow into publicly traded US defense companies.

But that’s not the only incredible thing about US military spending.

Defense Spending Never Gives Up

US defense spending almost never goes down.

The chart below shows US defense spending, with recessions highlighted in gray.

Source: St. Louis Federal Reserve

In five of the last six recessions, defense spending actually grew!

That’s very rare for any industry, and shows us that military spending is very stable.

During recessions, consumers spend less and businesses cut back investment.

That’s exactly what happened during the Global Financial Crisis. Between 2008 and 2009, US consumer spending fell 8.2% and domestic investment plunged 30.1%.

Yet, during this same period, the US hiked military spending by 12.2%.

This steady and reliable spending makes defense company profits very stable. It’s a major reason why the iShares US Aerospace & Defense ETF has crushed the S&P 500 during this bull market.

Now let’s look where the best investment opportunities lie in this sector.

Investing Behind the Sea Wall

Shipbuilding is my favorite segment.

The US has by far the largest and most dominant navy in world history. This enables the US to control both the Pacific and Atlantic trade routes. That’s a capability that Washington won’t soon give up.

To maintain this influence, the US invests heavily in its naval clout. Under the current US budget, Navy spending will rise 2.0% per year through 2022. That’s compared to the Air Force budget, which will decline 1.2% over that same period.

This stable outlook is good news for investors in shipbuilders. Since the government releases expenditures that look ahead five years, investors have a clear view of where its priorities lie.

And if you follow the money, it looks like the Navy will be a big winner.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.