UK Average Mortgage Fee Highest in Over Five Years

Housing-Market / Mortgages Oct 25, 2018 - 09:45 AM GMTBy: MoneyFacts

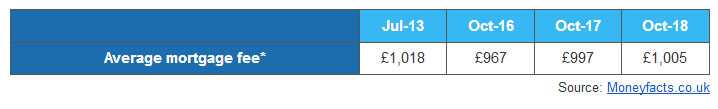

Remortgage activity is currently high as borrowers seek to get the best deal after the base rate rise. As a result, many providers are trying to look attractive as possible. However, although many lenders are reducing rates to appeal to remortgagors, this trend is not being seen for arrangement fees. In fact, the latest research from Moneyfacts.co.uk shows that average mortgage fees* are on the rise, increasing by £15 since August to stand at £1,005 this month – the highest average recorded in more than five years.

Charlotte Nelson, Finance Expert at Moneyfacts.co.uk, said:

“It is disappointing news that the average mortgage fee is not only on the increase, but it is the highest it has been in over five years, surpassing £1,000 for the first time since August 2013 (when the average stood at £1,001).

“Providers are currently fighting among themselves to be seen as the lender offering the lowest rate on the market, all in a bid to attract borrowers who are considering remortgaging after the recent rate rise by the Bank of England. However, the increase in the average fee is in direct response to these rate cuts, as lenders try and compensate these deals.

“Despite the Bank of England increasing the base rate twice since November 2017 – from 0.25% to the current rate of 0.75% – mortgage rates are still far lower than providers’ costs. For example, the average two-year fixed rate only stands 0.16% higher than it did in November 2017, increasing from 2.33% to 2.49%. By increasing fees, providers are making a small attempt to recoup some of this extra cost..

“As providers start to diversify into different sectors and types of products, the arrangement fee element of the deal allows them greater flexibility on not just the rates they offer, but the incentives they add as well. However, with all these extra elements, borrowers must be careful to pick the right product when choosing a mortgage.

“It is important to note that fees can vary in impact depending on how much you borrow, with the low rate/high fee scenario ideal for those looking to purchase properties at the higher end of the market, for instance. However, for the average borrower who remortgages every two years, the fees can soon add up and this additional cash could be better spent overpaying the mortgage.

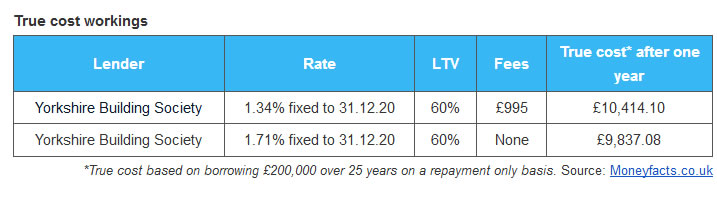

“While these low-rate deals look great on paper, the hefty fee that goes alongside them can mean that what appears to be a cheap offer, may in reality be a much costlier one. For example, based on the lowest rates available at 60% loan-to-value (LTV), opting for the lowest rate mortgage without a fee would make a borrower £577.02 better off (see below table) than opting for the cheapest rate in the market alone.”

*Average mortgage fee excludes fee-free deals

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.