US Economy Ten Points or Ten Miles to ‘Bridge Out’?

Politics / US Politics Nov 14, 2018 - 03:37 PM GMTBy: Andy_Sutton

In what has already been a very interesting week, we’ve witnessed distractions galore. Allegations of election fraud by pretty much everyone except the people who should be winning some of these elections if Americans truly wanted a different future. We already digress. Cognitive dissonance is fully on display. Just below the surface has been the buzz about DeutscheBank – probably the biggest elephant in the room right now. Well, check that. Make it the second biggest elephant. It’s been propped up for nearly a small dog’s life by powers that know if DB folds, their plans to consolidate more wealth from the small people of the world would be disturbed and they’d have to run Act III. Maybe, like QE, there are many more Acts yet to unfold.

In what has already been a very interesting week, we’ve witnessed distractions galore. Allegations of election fraud by pretty much everyone except the people who should be winning some of these elections if Americans truly wanted a different future. We already digress. Cognitive dissonance is fully on display. Just below the surface has been the buzz about DeutscheBank – probably the biggest elephant in the room right now. Well, check that. Make it the second biggest elephant. It’s been propped up for nearly a small dog’s life by powers that know if DB folds, their plans to consolidate more wealth from the small people of the world would be disturbed and they’d have to run Act III. Maybe, like QE, there are many more Acts yet to unfold.

It is a pretty certain bet that absolutely nothing will be done to change America’s destiny for the next two years thanks to a gridlocked government. Not that it had been doing much to change destiny anyway. There are certain ironies here, which are so rich, we’ve been compelled to write them down for perhaps another day, but not this one. Dragging names into this will only cause people to shut down, mentally running into their corner in the biggest binary brain battle ever.

We’ll get to the point. US GDP. Federal Public Debt. Yes, we’re going to beat that horse one more time. Why? Because it’s a huge elephant in a room full of distractions. It is the single deciding issue that can end America’s way of life forever – and it will. Unlike the insane murmurings of those who think this debt will be paid off, it won’t be and we’re going to tell you why. We’re not going to ask you to buy anything or subscribe for another insipid ‘free trial’. Yes, we’re tired of that nonsense also. Currently, America’s Debt/GDP ratio is 116%. That is a full ten points higher than the same numbers that sent the citizens of Greece, Italy, and Cyprus in particular to the wall to pay off said debts with austerity. 106% caused riots in all three countries to various levels, economic distress, broken home, broken economies, and broken hopes and dreams. This is becoming a rather annoying theme. Elite, rich bankers and politicians go to the Caymans to vacation while the people go to the wall.

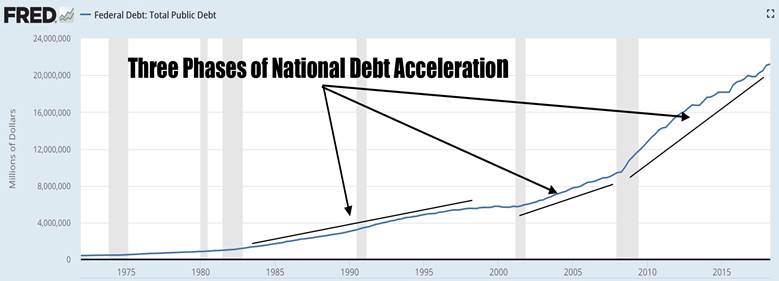

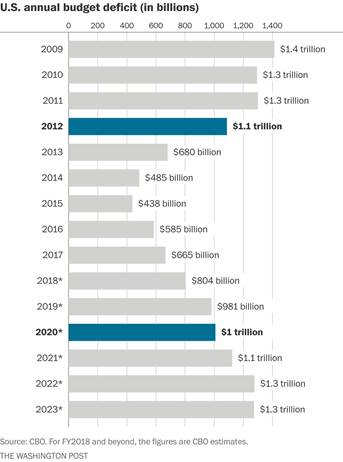

The chart above shows the US Federal Public Debt from 1971 – the year the gold standard ended until the present. There are three very clear accelerations on the chart and we’d have marked a fourth that might have been a shred of hope until current and future policy was directed towards more trillion-dollar deficits for at least the next several years, according to the Congressional Budget Office. Chances are very good the slope of the debt curve will increase once again, becoming larger moving forward. The citation for the CBO report is would be hilarious if the matter wasn’t so serious. CNN prefers to blame the issue on one set of puppets, developing amnesia when it comes to what their own puppets have done. Let’s set the record straight – nobody and we mean nobody has done a thing to even put a dent in the federal deficit, let alone think about paying it off. This is pure Keynesianism to the nth degree. It is an exercise in the ridiculous. But it won’t be Congress, the CBO, or any of these puppet policymakers who go the wall for this. It will be you. Yes you. And us.

Now does it make a little bit of sense as to why all government and rich billionaires have been interested in doing is dividing people? This has been going on for quite some time now, getting worse all the time.

Many people email and tell us ‘Why get upset, it’s just a bunch of funny money – you guys say so yourself. What’s the big deal?’ It is funny money, but it’s not a funny issue. It’s the money that matters because the money is junk, which is half the problem. The money being junk is why we have been told we need to tolerate inflation if we want economic growth. The statement should be re-worded – most of the ‘growth’ we’ve seen since 1971 has been the result of inflation. It’s not even real. Using ‘real GDP’ numbers kept by the not-so-USFed gets us the 116%, but everyone reading this knows that prices are used to illustrate inflation when prices are simply the result of inflation.

Here’s the rub. At the end of the day, the currency doesn’t matter. It’s the labor that matters. Labor you ask? Yes, labor. One of the four factors of production and the biggest variable. Everyone remembers the Medieval period from high school history. We’re going back there after the USDollar gets flushed for good.

Notice there is always a period of overlap. The world hasn’t been without a reserve currency since the dark ages. The mean of the reserve currencies prior to the USDollar taking its place is 94 years – exactly how long the Dollar has had the reserve status. We are NOT saying that the USDollar will be gone by the end of year 94. There are those who will say ‘This time it’s different. We have all this technology and we’re so much smarter now that the Dollar will last forever.” If you want to bet your future on that, go right ahead. We’re advising a great deal of trepidation here.

Where we Were

Getting back to Medieval times, Feudalism became a way of organizing military, business, and the allocation of scarce goods. In the Feudal system existed lords, vassals, serfs, and slaves. It’s the lower two classes we are interested in for the purposes of this paper. The status of serf and/or slave was applied to those to owed some amount of money or labor to the vassals or the lords. These people have also been referred to as peasants in some history books and accounts. Slaves were generally sold with tracts of land by a lord to another lord with the idea being that the conveyance of land would be accompanied by a certain amount of labor to work that land. Serfs and slaves had some type of debt bondage by which they were bound to a lord. It is this last bit we’re interested in.

Over the period of the past few decades, much of the world has come to live in various states of debt. As inflation eviscerates the purchasing power of currency, it becomes harder and harder to maintain a prescribed standard of living. Americans, much like their European cousins have opted for debt and largesse instead of taking a hit to their standard of living. Personal debt measurements in America are even more frightening than the federal debt. What we see coming to pass is a return to a Feudal type system. When the USDollar is flushed by the establishment, we believe debts will be converted into years of labor. Just as immigrants to America in the 18th and 19th centuries had to pledge up to 7 years’ labor for the privilege of coming to the land of the free, debtors at the end of the Dollar Standard Era will be required to work off their debts in some manner.

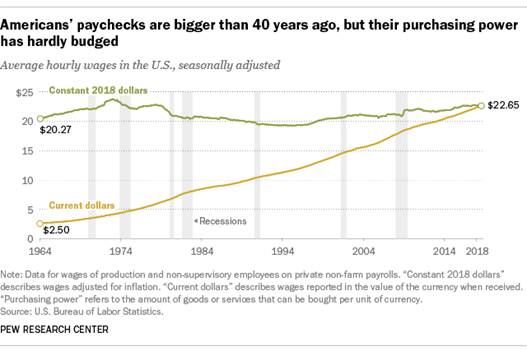

The big lie that inflation will make all the debt have no value is just that – a lie with a bit of truth. Certainly, money borrowed today will have more purchasing power than money borrowed a year from now. The problem arises in where debtors will get the excess dollars in the future to pay debts. It is well-known fact that wages have been fairly stagnant over the last two decades, depending on the research you happen to look at. Remember how taking on debt made its inroads in the first place. Because the dollar’s purchasing power was declining. It is not accident that store credit and, eventually, credit cards came into being just after an era that saw the USDollar lose a chunk of its purchasing power.

So, with stagnant wages and a deteriorating dollar, where are those extra greenbacks going to come from to pay off all this consumer debt. Sure, the dollar will be worth less (and eventually worthless) down the road, but if there is no way to access more dollars, the whole idea of borrowing strong money today and paying with weak money a decade from now appears to be pretty foolish. But that is what Americans and many others have done. In fact, as the future of the USDollar – especially internationally – comes into much doubt, people are doubling down instead of scrambling to escape the enormity of the hole they’ve dug for themselves.

Connecting the Dots – Where we are Going

We started this missive discussing federal debt. Then we jumped over to consumer debt for a bit. Now it’s time to join the two. Because, much in the way the bail-in resolution mechanism means banks can tap their depositors to make the bank whole from its own poor choices, governments can attach their debt to their citizens to make up for decades of fiscal insanity. But guys, the article doesn’t explicitly say that we’ll have to pay the national debt! No, it doesn’t. Not directly. But you will. First it will be in the form of increased taxes. But guys, our taxes went down! The latest puppet helped the middle class! Not really. If the government had a surplus from which to pay for the tax cuts, that would be one thing. However, that is not the case. The recent tax cuts got put right on the nation’s tab with the creditors of the world. You’ll pay for this in terms of taxes, loss of government programs, subsidies, and other emoluments that nobody even bothers to think about anymore. All this will happen before the dollar does its last dance. When the USGovt goes into receivership for the national debt, such debt will be transferred to the citizens of America. Surely, a bunch of old rich politicians aren’t going to work off trillions in debt. They’re going to walk away. You’re going to the wall for it.

But if there’s no dollar, how are we going to pay anything? With your labor. That’s what this whole thing has been about the whole time we’ve been building our very own fiscal Titanic. It was never about paper tickets. The paper tickets we call money are just a way to bind all of us to a corrupt system that was bankrupt the day it was launched and is even more so now. In case you’re wondering, this is the case in every first world country that has an IMF/World Bank modeled central bank. This is why countries that don’t have such a system are called evil by stuffed shirts in the policy rooms and media slums of the world. Since there is more than one person involved, it is a conspiracy most definitely, but it’s no theory. Sad to say, but this one is true beyond any shadow of doubt. And it’s coming to your door whether you are ready or not. It doesn’t care if you don’t believe it can happen. It doesn’t care if you think you’re insulated. It’s going to come to all of us. We’re just putting on the record who you have to thank for it. Ron Paul was the last person of serious interest involved in Congress to call for the end of America’s central bank and this ridiculous nonsense that has been going on for almost 105 years now. Many more have campaigned on a ‘lower the deficit’ platform, with great fanfare, but their reversals immediately after gaining office are rarely mentioned. Andy is not a fan of bringing political figures into our essays, but this time it needs to be noted for the record that the current PIC (puppet ‘in charge’) also ran on a fiscally conservative platform and instead delivered the first trillion dollar deficit in nearly a decade. He is not alone. Check the record below for yourself and having done so, look above at the 94 years of the USDollar’s reserve status. Like everything else in America is the USDollar living on borrowed time as well?

Graham Mehl is a pseudonym. He is not an ‘insider’. He is required to use a pseudonym by the policies of his firm when releasing written work for public consumption. Although not an insider, he is astonishingly bright, having received an MBA with highest honors from the Wharton Business School at the University of Pennsylvania. He has also worked as an analyst for hedge funds and one G7 level central bank.

Andy Sutton is a research and freelance Economist. He received international honors for his work in economics at the graduate level and currently teaches high school business. Among his current research work is identifying the line in the sand where economies crumble due to extraneous debt through the use of economic modelling. His focus is also educating young people about the science of Economics using an evidence-based approach.

By Andy Sutton

http://www.andysutton.com

Andy Sutton is the former Chief Market Strategist for Sutton & Associates. While no longer involved in the investment community, Andy continues to perform his own research and acts as a freelance writer, publishing occasional ‘My Two Cents’ articles. Andy also maintains a blog called ‘Extemporania’ at http://www.andysutton.com/blog.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.