Counter Cyclical Market Winds Blow, Gold Miners Front and Center

Commodities / Gold & Silver 2019 Jan 31, 2019 - 05:37 PM GMTBy: Gary_Tanashian

As the stock market cracked on October 10th we noted…

As the stock market cracked on October 10th we noted…

Looks Who’s Holding Firm Amid the Carnage; the Gold Miners

And sure enough the GDX bottoming pattern noted in that post (and before that in an NFTRH subscriber update) played out perfectly amid the stock market carnage going on all around it.

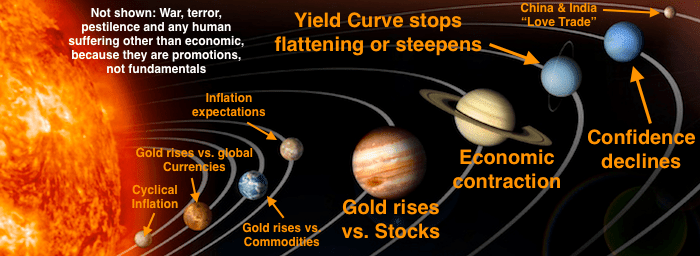

Was I trying to predict something? Of course not. I was just following general rules we’ve had in place through all of NFTRH’s 10-plus year history and privately for myself since early in the bull market that began in 2001. Very simply, the counter-cyclical winds must blow and the Macrocosm must come front and center for a constructive fundamental view of the gold stock sector. That first crack in the stock market was a good start.

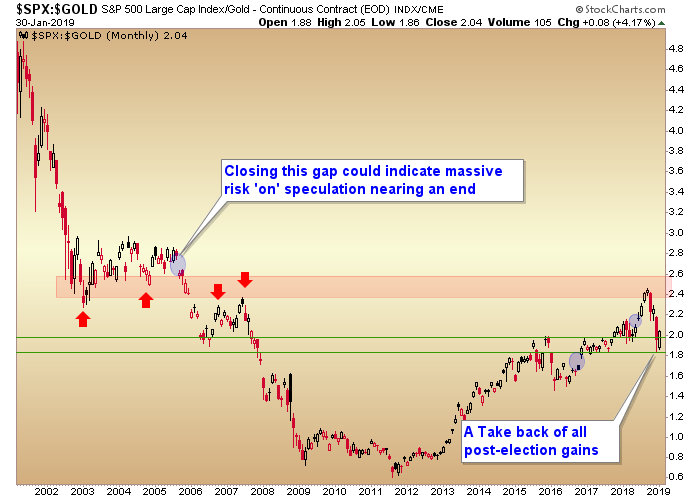

With respect to the Gold vs. Stocks planet, the S&P 500 topped vs. gold right at our targeted resistance…

…and has been repelled back to pre-Trump rally support, as expected. The above is a monthly chart for which time moves slowly. Keep in mind that no matter how bullish things get for gold/gold stocks in the near to intermediate-term a case still exists for the SPX/Gold ratio to one day close that upper gap and end the major bull market in stocks.

With respect to other fundamentals, the Yield Curve remains a holdout as it continues to flatten, and a decline in confidence is probably early in process (with an accent on “process” as that is what it is and it will take time). But what of the other prominent fundamental condition, Economic Contraction, which would signal a counter-cyclical economic backdrop?

Yesterday before the Fed rolled over evidently to the surprise of some (but not the pros, as CME traders had forecast almost no chance of a hike over the next three meetings and they are stacking odds that the Fed is done for 2019 (with a few even starting to see a 2019 rate cut), per this NFTRH 536 excerpt posted on Sunday, before the fact…

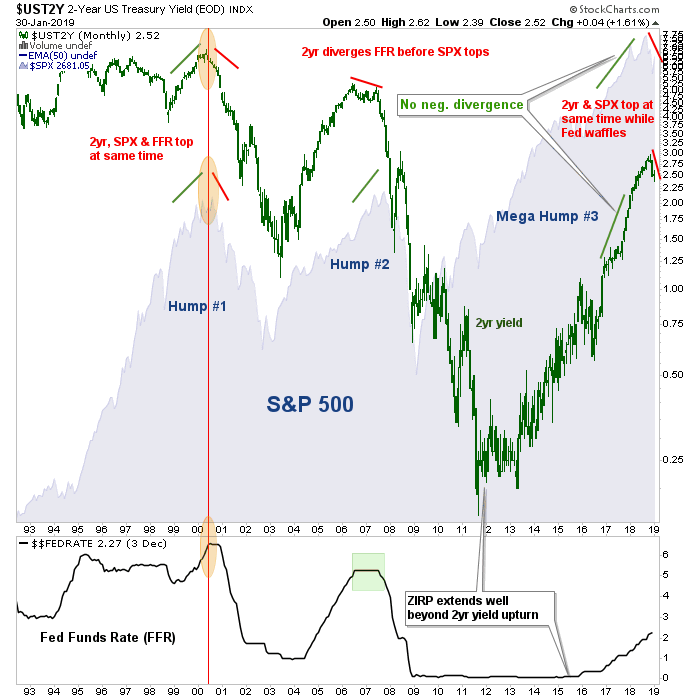

Why did Mr. Powell roll over? Was it pressure applied by Wall Street interests? Was it the tweet-o-holic president? Please, while I did not hear Powell admit it (perhaps because it is so simple as to be laughable), the Fed sat on its hands because it was instructed to do so, finally, by the 2 year Treasury yield as explained in this pre-FOMC post…

A Talky Bond Yield Chart With a Story to Tell

Below is said talky chart, to tell you its story. I am over-simplifying when I promote the idea that all the Fed had to do is look at this chart and back off. Being economic eggheads surely they pour over loads of data. But folks, it really is as simple as this.

As in 2000, the S&P 500 and the 2yr yield rolled over together. The Fed is traditionally ruled by the bond market. It is the most glaring of misconceptions (believed by a majority) that the Fed “decides” to raise or lower interest rates and the bond market follows.

Powell was firm despite a belligerent and robo-tweeting Trump. The Fed was firm well into the stock market correction. But a daily chart would show that the 2yr yield cracked its 200 day moving average in December. That is likely when Powell had his come to Jesus moment. It had little to do with outside noise.

Well how about that? A gold stock post has become a macro post! I would love to just for once write a public article touting the gold stocks and stimulating your greed response. We’re all gonna get rich together! That’s the tenor in some corners of the gold analysis community when the macro barn door opens.

But I will do what I have to do, which is to write about details because that is where the Devil is. Chances are that a big opportunity is forming, with its beginnings at that GDX bottoming pattern noted in the October 10th post linked above. Part of the process was in noting the potential for improving gold sector fundamentals (while getting slagged by drive-by gold haters) as noted in this post from November 4th…

A Notable Lack of Interest in Gold

Dial in to today. The Fed has rolled over at the direction of the 2yr Treasury yield. The stock market is relief rallying and despite this the gold price is rising and maintaining its constructive stance vs. SPX and many other cyclical, risk ‘on’ markets.

Personally, I am positioned in several quality gold miners and royalty plays (as reviewed each week in NFTRH) but not yet locked and loaded for the really big gains. It sounds like the writing of an old fart, but slow and steady really does win the race. There remain technical resistance obstacles for the gold stock indexes/ETFs, gold and silver. Also, leading indicators like the HUI/Gold ratio have not yet triggered a trend change.

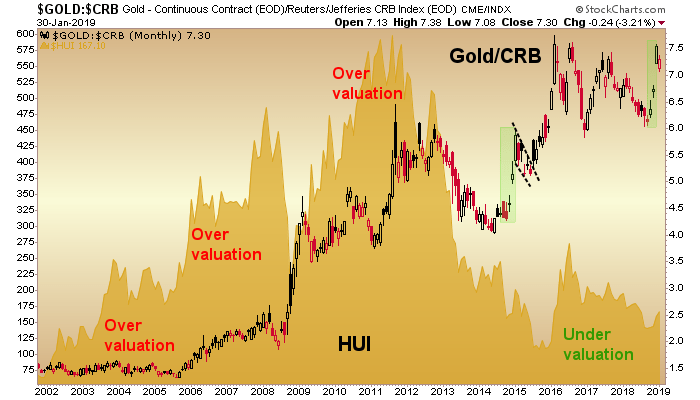

Of course, the fundamentals have, as expected, led us right to the gateway of change. For an ironclad approach we are managing both the sector/macro fundamentals and the technical indications because if/when they both slam into place the under valued gold sector, as illustrated by this chart and several other indicators, is going to have a lot of catching up to do.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.