It’s Not Technology but the Fed That Is Taking Away Jobs

Economics / Employment May 16, 2019 - 03:04 PM GMTBy: John_Mauldin

You’ve likely heard of the term “income inequality.” It means wealthy people are making a larger share of our collective income.

You’ve likely heard of the term “income inequality.” It means wealthy people are making a larger share of our collective income.

In one sense, it’s nothing new. The people with the highest incomes have more of the total. Math guarantees it.

But the top’s share has largely grown in recent decades, as has the share of assets owned by the wealthiest.

In fact, Ray Dalio of Bridgewater Associates says that income inequality is now at the same level it was in the Great Depression.

Let’s review some charts from my friend Bruce Mehlman’s latest fascinating slide deck. It does a good job of explaining the drivers of this trend and its striking scale.

The State of Income Inequality

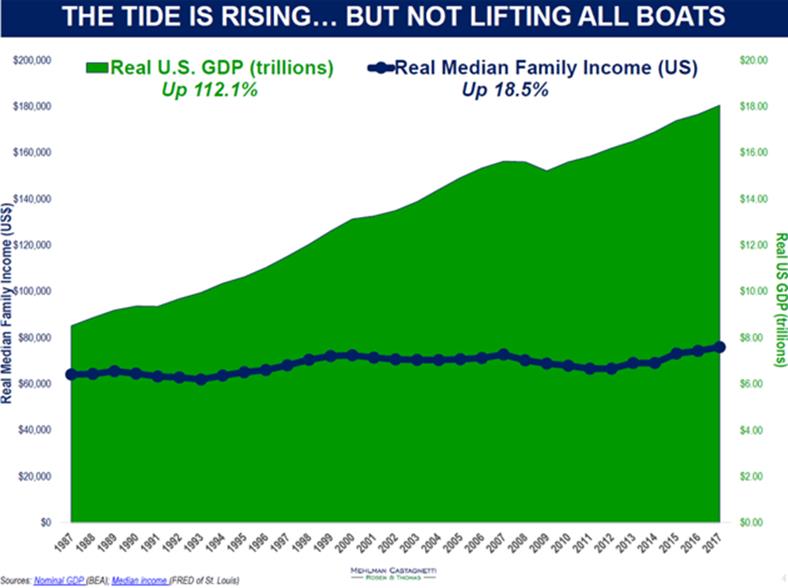

If you take GDP as a gauge for national income, it’s been growing far faster than median family income—even adjusted for inflation. The wider that gap gets, the more people feel left behind.

Source: Bruce Mehlman

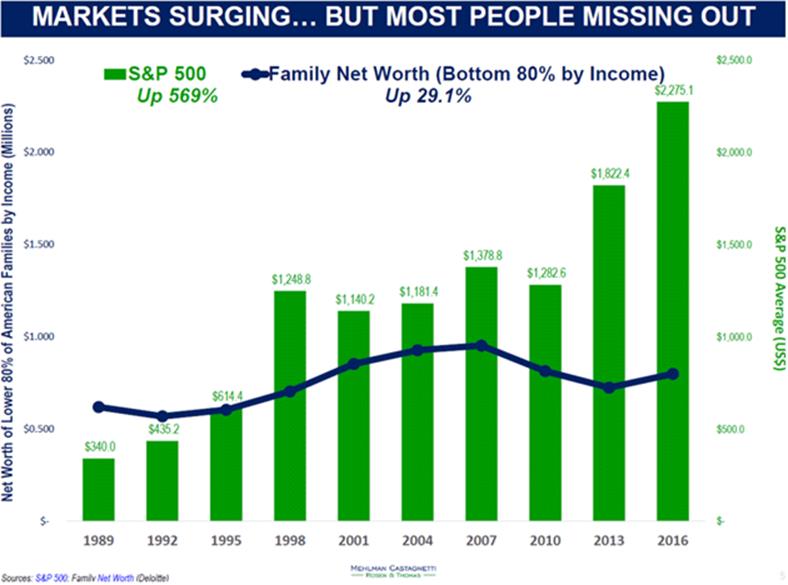

Here’s another one comparing stock market growth and family net worth. This isn’t really surprising since the top quintile owns most of the stocks. The lower 80% see little direct benefit. But the magnitude of the disparity is still remarkable.

Source: Bruce Mehlman

Income Inequality Drivers

One reason income may be unequal is that talent is unequal, too. Or at least the willingness of businesses to buy talent.

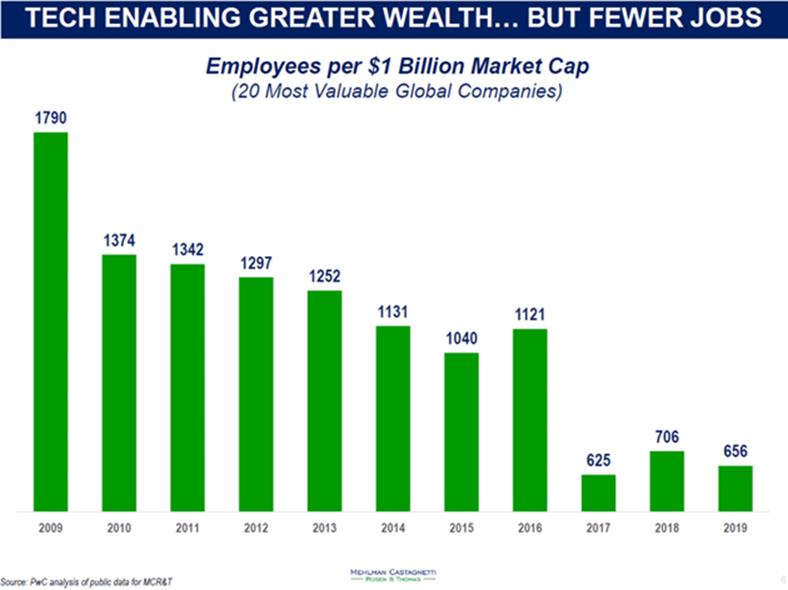

Here’s a chart showing the most valuable companies have been getting that way with a smaller headcount.

Source: Bruce Mehlman

Mehlman thinks the reason is technology, and I agree that’s a big part of it. But so are other things.

For one, there’s a growing number of monopolies whose existence is enabled by financial engineering and monetary policy.

My good friend Ben Hunt of Epsilon Theory notes that the S&P 500 companies have the highest earnings relative to sales in history.

Quoting Ben:

This is a 30-year chart of total S&P 500 earnings divided by total S&P 500 sales. It’s how many pennies of earnings S&P 500 companies get from a dollar of sales… earnings margin, essentially, at a high level of aggregation. So at the lows of 1991, $1 in sales generated a bit more than $0.03 in earnings for the S&P 500. Today in 2019, we are at an all-time high of a bit more than $0.11 in earnings from $1 in sales.

It’s a marvelously steady progression up and to the right, temporarily marred by a recession here and there, but really quite awe-inspiring in its consistency. Yay, capitalism!

Ben goes on to say many people think that is because of technology. He argues it is the financialization of our economy and the Fed’s loose policies.

I agree 100%. If you think they haven’t changed the rules since the 1980s and 1990s, you aren’t paying attention, boys and girls!

As unhappy as all this is making people now, imagine how it will be when recession hits. And then couple that with an ever-increasing explosion of new technologies that reduce demand for many types of labor (like automated driving).

No Solutions

Some degree of unhappiness and discontent is part of the human condition. It’s what drives us to improve.

But we accept challenges as long as we think we have a fair chance of overcoming them. Many Americans no longer believe they have that chance.

That’s partly because they have higher expectations—possibly too high. But right or wrong, the perception is there. It affects behavior. And more to the point, it affects what people expect from the government.

When they perceive less ability to reach the next level on their own, they look to Washington for help.

But there’s little politicians can do. Raising taxes on the wealthy won’t get us even close to a balanced budget, even at confiscatory levels. Raising taxes on the middle class won’t happen in a recession.

A value-added tax is the only program that has a shot at actually paying for current spending, but it’s anathema to both parties.

No matter how I look at this, I keep coming back to gigantic deficits that the Federal Reserve will have to monetize in some fashion.

It will probably pursue something like the previous QE rounds but on a vastly larger scale. This will likely lead to an era of Japan-like deflation and economic doldrums.

The Great Reset: The Collapse of the Biggest Bubble in History

New York Times best seller and renowned financial expert John Mauldin predicts an unprecedented financial crisis that could be triggered in the next five years. Most investors seem completely unaware of the relentless pressure that’s building right now. Learn more here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.