Stock Market Technical Data Points Snowballing Into The Abyss?

Stock-Markets / Stock Markets 2019 Jun 03, 2019 - 11:14 AM GMTBy: Submissions

Or Is This The Time To Relax Or Take Action?

Or Is This The Time To Relax Or Take Action?

There is so much to write about I could fill five pages and still receive an Incomplete. I know myself would not read five page, but here goes and will try to make it brief. IMO there is a sense of urgency snowballing since early May. The Russell 2000 broke out of a well defined base on May 3rd and I thought the final leg of our decade long Bull Market was underway through the fall. Two trading days later President Donald tweets China has reneged on several agreed upon aspects of the negotiations. The market reversed swiftly and significantly. All breakouts failed, a very bad sign and it only gets worse.

The issues they reneged on were around enforcement of their endemic cultural cheating process. Similar to the issues we have with Iran, Russia, and North Korea. Maybe we should get the North Korean negotiators to help at the table, oh wait they have all been executed. Never mind. These negotiations are intended to level the extremely uneven playing fields shaped over the last thirty years. Because we are the richest, most influential player we tended to make nice and cut generous deals. Not to mention some of the sweetheart deals (see VP’s Cheney & Biden) for family members. Net net we have gotten the raw end of the deal on most negotiations, Trump admin is attempting to play catch up.

The Trade War is now on and will probably escalate before coming to calming down agreements are made at the Osaka G-20 meetings end of June. In the meantime prepare for a June Swoon roller coaster (I hope there are some descent ascents?). G-20 might stem the market downturn…for a bit. There is so much at stake, the next hundred years of trade. These negotiations will be incremental and tinkered with over decades. With Xi not wanting to deal with Donald another four years (because he negotiates like they do, slippery and conniving) he will bite the bullet taking his economy into recession diminishing Trump’s re-election bid. He much rather debate with clear thinking Joe Biden. China’s recession pulls the world down with them and that slowing exacerbates the corporate debt bubble, which is hiding until it doesn’t. That is the house of cards much of the economy has been built on, financial engineering as opposed organic sustainable growth. That’s my read.

CURRENT MARKET

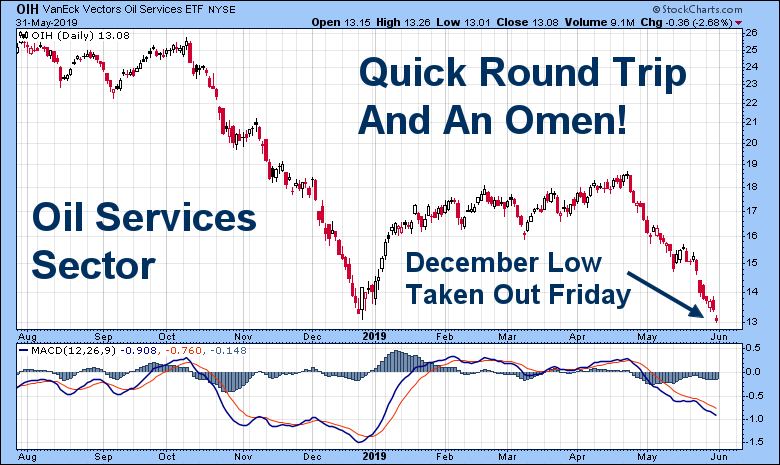

As I wrote earlier this month, I thought equities would decline in fits and starts through the fall and then flush. October is known for scary sell offs and seemed timely. Since the break May 3rd most of the technical data has confirmed equities are headed lower in the snowballing sequence. New lower lows are the biggest of the tells. Support levels parting like a hot knife through buttah is anothah. Take a look at the Oil Services Sector, it has taken out the December low! Unbelievable! I am guessing it will have good company soon.

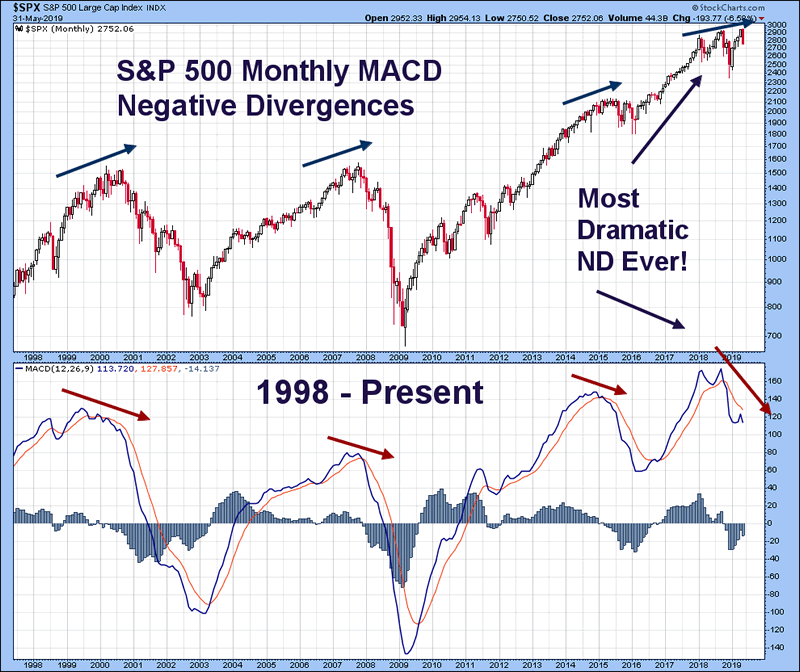

Nearly every single major index/sector closed on the low of the month! THAT…is not good. Another snowball data point. As I have shared my biggest concern technically are the monthly charts with their significant negative divergences (S&P 500 below). I know for some this might be deeper in the weeds than you like, but it is truly not rocket science. Each red arrow shows the MACD rolling over while the Index continues higher signaling a drop is coming. The Bear Market in 2000 dropped 50% and 2007 57%. 2015 was in the midst of the financial engineered Bull Market compromising the signal and dropping only 15%. The previous three were gentle MACD rollovers and this year shows a much more severe angle. Which lends to this signaling a deeper and more protracted correction.

Again every index/sector is showing the steepest negative divergence since 1980, the furthest my charting service takes me back. I cannot tell you how serious a warning this is in my work. I wrote about it in March. This is the Third Blown Bubble by the Fed this century lending to the probability it will take a decade or more to recover.

The current data point that has me most concerned is my original Flush in The Fall call could occur sooner. This unease revolves around the conversation of the talking heads/pundits on the tube of late. Folks who run big money say they have already raised cash and are ready to hit the sell button quicker than James Holzauer. This kind of talk does not usually occur until we are 15-20% in the hole. That evidence appeared in Fridays action, post Mex tariff news, stocks opened -280 Dow points bounced for most of the day and then closed on the lows -370. Sellers did not get prices wanted throughout the day so piled in at the close. Look for more of that in the coming weeks, maybe this week?

So any type of angst will probably escalate the selling which can often feed on itself. I thought the PPT would show last week and maybe they did with no success? I believe there are too many sellers and their support is better spent at lower levels, maybe much lower?

In 2001 Charles Schwab did a town hall ad telling investors and clients “Just relax.” This is the Wall St. mantra fed to their advisors and clients while their trading desks are selling like mad men. Interestingly I could not find the ad, probably scrubbed because of how embarrassing in retrospect. I did find the SNL parody of it, very funny and true.

WHAT TO DO?

The Wall St. Advice mantra of Buy and Hold, “We are in it for the long term” has cycled to an end for now. We will probably have a 5-10+ year trading range market after we bottom in the next couple of years. Well executed tactical/dynamic strategies will outperform. I have suggested to those who have 401k’s and IRA’s to shift to Government Bonds and Money Market for now and let’s see how the dust settles. No tax consequences there.

The action in May is clearly suggesting the June Swoon follow on? This is not a forever call. Usually before a market recovers from deep corrections a bottoming pattern forms providing decent re-entry points. The Monthly Negative Divergences are pointing towards a 40-60% correction over the next 12-24 months. If I’m wrong we just wait for bottoming patterns.

I did call a bottom a week after the actual low this past January 2nd, so it can be done. Obviously no guarantees. Many advisors/pundits say “No one can time the market” which is code for “I don’t have a clue on how to time the market.” It is not easy, but current indicators are obviously very compelling. Sorry for the length, but these are critical times. It is better to be informed than afraid. Whatever you do don’t forget my disclaimer.

Final Thought “

My father was a successful businessman, but was ruined by the ’29 crash. A big stockbroker jumped off the ledge and landed on his pushcart.” – Jackie Mason(Remember him- still alive)

More later,

Max Power

Disclaimer: Remember everything I said could be wrong, the market always has the last word.

I’m Max Power and welcome to my site. I have been in the investment arena for over thirty years and charting the markets for twenty. I am convinced all financial market analysis; cyclical, fundamental, quantitative, seasonal, etc. will inevitably reveal technical supply and demand patterns via charts.

Copyright 2019 © Max Power - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.