Trump Clueless On Trade Tariffs

Politics / Protectionism Jun 23, 2019 - 06:30 PM GMTBy: Steve_H_Hanke

President Trump doesn’t like U.S. trade deficits. He also doesn’t like migrants flowing into the U.S. from south of the border. His tariffs and tariff threats are slowing trade and world economic growth. And this will, in turn, increase the migrant flows into the United States. After all, as foreign economic activity slows, and more foreigners are either thrown out of work or find their incomes drying up, they will be motivated to migrate. Trump remains clueless as to why tariffs fuel migration.

President Trump doesn’t like U.S. trade deficits. He also doesn’t like migrants flowing into the U.S. from south of the border. His tariffs and tariff threats are slowing trade and world economic growth. And this will, in turn, increase the migrant flows into the United States. After all, as foreign economic activity slows, and more foreigners are either thrown out of work or find their incomes drying up, they will be motivated to migrate. Trump remains clueless as to why tariffs fuel migration.

But, that’s not Trump’s only international trade blind spot. He and his cabinet think that U.S. trade deficits are a problem, and that they are caused by foreign countries that manipulate their currencies and engage in unfair trade practices. These ideas are wrongheaded.

These misguided ideas have plagued other administrations—even those lead by free-market presidents, like Ronald Reagan. Indeed, I spent many days, while at Reagan’s Council of Economic Advisers, trying to defend the President’s free-trade ideas. But, at the end of the day, the free-trader faction, which was led by the likes of Reagan himself, lost the war. The protectionists who harbored exactly the same wrongheaded ideas as Trump rolled us.

As my longtime colleague and close friend Bill Niskanen, who was a member of Reagan’s Council of Economic Advisers, put it in his definitive book: Reaganomics: An Insider's Account of the Policies and the People (Oxford University Press, 1988):

"Trade policy in the Reagan administration is best described as a strategic retreat. The consistent goal of the president was free trade, both in the United States and abroad. In response to domestic political pressure, however, the administration imposed more new restraints on trade than any administration since Hoover. A strategic retreat is regarded as the most difficult military maneuver and may be better than the most likely alternative, but it is not a satisfactory outcome."

For those who want even more detail and a confirmation of that provided by Nisknanen, there is nothing better than the magisterial treatise by Douglas Irwin, Clashing Over Commerce: A History of U.S. Trade Policy (University of Chicago Press, 2017).

Let’s turn to the simple economics and evidence about the trade deficit that proves why President Trump’s trade message and protectionist policies are, to put it simply, wrong. In economics, identities play an important role. These identities are obtained by equating two different breakdowns of a single aggregate. Identities are interesting, and usually important, by definition. In national income accounting, the following identity can be derived. It is the key to understanding the trade deficit.

(Imports - Exports ) ≡ (Investment - Savings) + (Government Spending - Taxes)

Given this identity, which must hold, the trade deficit is equal to the excess of private sector investment over savings, plus the excess of government spending over tax revenue. So, the counterpart of the trade deficit is the sum of the private sector deficit and the government deficit (federal + state and local). The U.S. trade deficit, therefore, is just the mirror image of what is happening in the U.S. domestic economy. If expenditures in the U.S. exceed the incomes produced in the U.S., which they do, the excess expenditures will be met by an excess of imports over exports (read: a trade deficit).

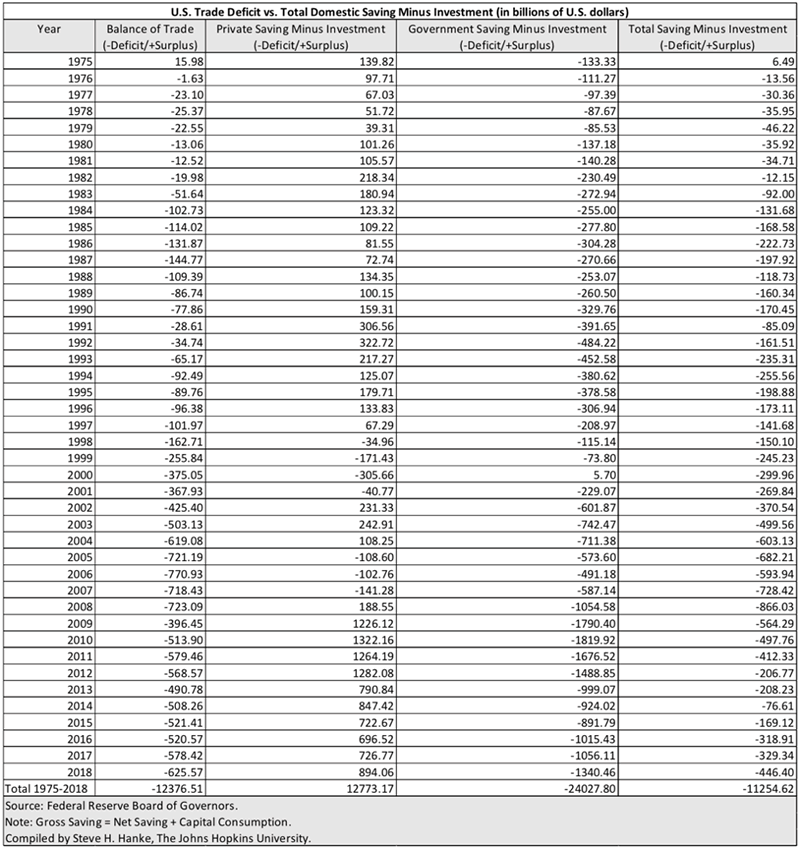

The table below shows that newly released U.S. data support the important trade identity. The cumulative trade deficit the U.S. has racked up since 1975 is about $12.377 trillion, and the total investment minus savings deficit is about $11.255 trillion. The data talk, and they talk pretty loudly.

Prof. Steve H. Hanke

So, President Trump can bully countries he identifies as unfair traders, he can impose all the restrictions on trading partners that his heart desires, but it won’t change the trade balance. Never mind the fact that most economists think President Trump’s ideas on trade are wrong. When it comes to trade, Trump is the master of the message and the optics. In consequence, his base is with him on trade, and so are a surprising number of others.

The problem is that Trump’s trade message is tailor-made for delivery on Twitter and television. Indeed, those media outlets are suitable for “sound bites,” but not for complex arguments and data points.

That’s why economics is at a disadvantage when it comes to Trump’s favorite media. Nevertheless, this is what economics has to say about the trade deficit bugaboo. First, it is not a “problem.” Indeed, the U.S. has run a trade deficit every year since 1975, and the U.S. has done relatively well since then. The sky didn’t fall because of our trade deficit. Secondly, the trade deficit is not made by foreigners who engage in unfair trade practices. It is homegrown—made in the U.S.A. To the extent that domestic savings in the U.S. falls short of domestic investments, the economy must import more than its exports, resulting in a negative trade balance.

To finance the excess of imports over exports, the U.S. must import capital from abroad. This can be done without strain because the U.S. dollar is the world’s reserve currency. Our borrowing from abroad shows up in the huge chunk of U.S. public debt that is held by foreigners.

As it turns out, the Trump administration’s fiscal policies, which promise an ever-widening fiscal deficit, will throw a spanner in Trump’s trade policy works. If his fiscal deficits are not offset by an increase in private savings relative to private investment, increases in the Federal deficit will translate into larger trade deficits. So, the U.S. trade deficit will not only be made in the good, old U.S.A, it will be made by President Trump himself, an arch-enemy of trade deficits.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2019 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.