Precious 'Mettle'- Gold Bullish Breakout

Commodities / Gold & Silver 2019 Jul 05, 2019 - 04:37 PM GMTBy: The_Gold_Report

Precious metals expert Michael Ballanger discusses the mettle necessary to trade precious metals at this time. "Mettle"—the ability to cope with difficulties or to face a demanding situation in a spirited and resilient way.

Precious metals expert Michael Ballanger discusses the mettle necessary to trade precious metals at this time. "Mettle"—the ability to cope with difficulties or to face a demanding situation in a spirited and resilient way.

Given the performance of my beloved Gold and Gold Miners in the past month, could there have ever been a more fitting word describing our sector than in the word "mettle"? Insert the words "the constant and unrelenting interference by the Fed/Treasury-sanctioned bullion banks" for the word "difficulties"; insert the words "egregiously overbought condition" for the words "demanding situation" and the definition might be appropriately restated as "the ability to cope with the constant and unrelenting interference by the Fed/Treasury-sanctioned bullion banks or to face a(n) egregiously overbought condition in a spirited and resilient way."

One of the advantages I have over the 40-something or 30-something gold "advisor" is that, being a sexagenarian, I have little if any need for adulation. The need for adulation in males approaching the onset of quasi-middle-age is the result of their libidos producing an inordinate amount of testosterone, a throwback to the days when post-pubescent males were driven to violence from the absence of sexual release. It closely resembles "Pon Farr," a condition affecting Vulcan men that was famously acted out by the late Leonard Nimoy in the famous Star Trek episode whereby he underwent a blood fever, became violent, and was about to die before the screenwriters found an ingenious way to have him bypass the need for fulfillment by substituting sex for beating the living shit out of Kirk. (There's a message there somewhere.) Unlike Vulcans, the male body and brain in humans have astounding mechanisms for dealing with advancing maturity; the final burst of testosterone is what creates the "Middle Aged Crazy" syndrome where men with perfectly sculpted families and wonderful wives suddenly watch them fall from priority one to priority seventeen. It is not their fault; they were given it at birth; they are innocent. Mother Nature gave our species a survival tool called "male aggression" and when it is underactive, our species dies from boredom; when it is overactive, our species simply dies.

In the universe of the blogosphere, the dominance of testosterone causes the 30-something and 40-something gold commentators to constantly and quite annoyingly remind readers of just how wonderfully "right" they were in making a bullish call on gold in May, fully forgetting that they ALSO called the "bullish breakouts" in gold at the $1,350–1,375 resistance in August 2016 (it crashed to $1,125), September 2017 (it fell to $1,225), April 2018 (it plummeted to $1,180), on February 20, 2019 ($1,330 back down to $1,283). There was about $400/ounce of drawdown AFTER these "bullish breakouts" echoed throughout the digital canyons of gold buggery before finally surging to the recent top at $1,442. Testosterone does that, from time to time.

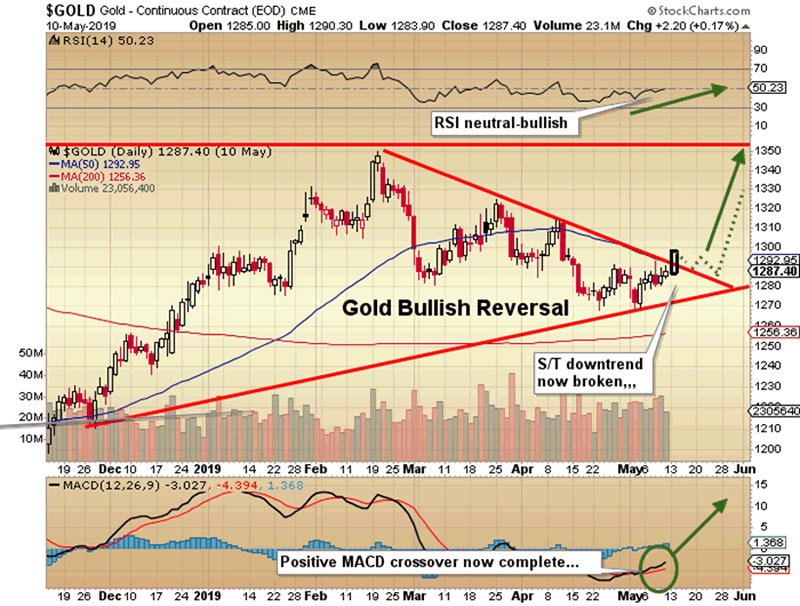

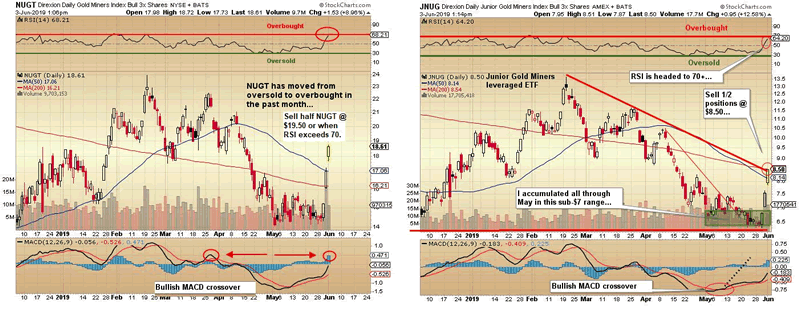

The point I make is that in the weeks and days leading up to the move in gold from $1,267 to $1,440, I sent out no fewer than ten missives explaining in detail what I was watching, why it mattered, how it might fail and where I was putting my cash. As gold tentatively danced around the $1,350 level, I sent out three tweets and four missives laying out my distrust in the move. On May 10th, I sent out this chart clearly identifying the "trade" with gold at $1,287 when the world was quagmired in USD strength and recession fears and trade war jitters while the MACD quietly completed its bullish crossover and RSI began to ascend toward 50 (en route to nearly 90). It was a terrific trade and the leveraged ETFs (JNUG [Direxion Daily Junior Gold Miners Index Bull 3X Shares] and NUGT [Direxion Daily Gold Miners Index Bull 3X Shares]) generated 50% returns, which I nailed on the initial run to $1,356 with the RSI at 72.

Like the cat that inadvertently jumps on a hot stove, I am absolutely terrified of the lawlessness that prevails in the Crimex cesspool of paper trading. I have been burned over the years by blind allegiance to the tenets and fiber of technical analysis but only after several hundred thousand dollars vaporized by bullion bank thievery finally sunk in, I decided to act and think like a commercial trader in order to avoid these dramatic drawdowns. Five out of the last six moves in gold to $1,350–1,375 and RSI into the 70s, the bullion bank behemoths were able to cap the advance and send gold reeling and each time that happened, I was flat all leveraged gold positions while retaining all portfolio positions in the unleveraged ETFs (GDX [VanEck Vectors Gold Miners ETF] and GDXJ [VanEck Vectors Junior Gold Miners ETF]) and all physical gold positions (GLD [SPDR Gold Trust] and SLV [iShares Silver Trust]).

By following the tools that have been successful, I was able to avoid that $400/ounce drawdown that killed off so many aspiring gold bulls between August 2016 and June 2019. The only trading I was doing was in the leveraged ETFs and the associated call options and it was only ten days ago with the RSI in the high 80s that I wrote about selling half positions in GDX (which I did at $26) and the GDXJ (which I did at $35), which returned 19.12% and 23.28% respectively. Now, had I held onto all unleveraged positions, I would have made an unbelievable score because NUGT advanced an additional $10 on the RSI move from 73 to 89 as an orgy of panic-buying and short-covering propelled the biggest advance since early 2016. However, the $60/ounce move in gold that I "missed" in the leveraged vehicles by using 70-plus RSI as the trigger point pales in comparison the approximate $400/ounce haircut avoided five times in three years. I'll take that trade any day of the week.

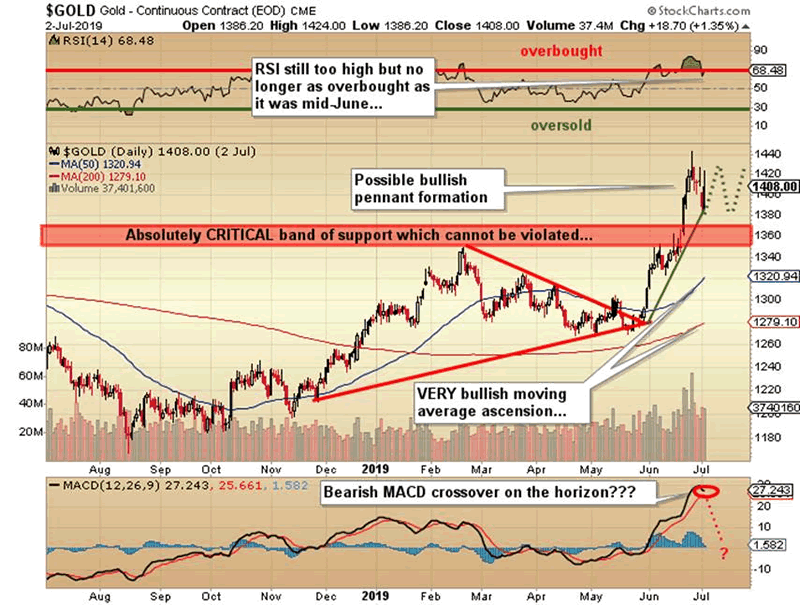

In describing the current status of the gold (and silver) market, I have to return to the title of this missive: "Precious METTLE" and the phrase "in a spirited and resilient way" in reference to the behavior exhibited by gold since the three-year cap at $1,350–1,375 was vanquished. The finality of the move was underscored by such resiliency that even a spine-tingling takedown by the bullion banks from $1,442 to $1,384 in one weekend has not been able to deter the bulls which represents a departure from the price-capping era. In my post-FOMC commentary on June 19, I wrote:

"Last point on gold: The singular greatest danger over the intermediate term is that there is no "breakout" on this run and that it catches an entire generation of generalists long at the top. As gold investors, we need a breakout above $1,375 that decisively surpasses that band of resistance in increasing volume and momentum such that resistance becomes support and the entire metals complex undergoes a structural lift in valuation and sponsorship. I am currently hedging against that materializing but praying that it indeed happens because the gold market since 2011 has been like eight years of root canal surgery without any sort of sedation or tranquilization. As I wrote about at $1,287 three weeks ago, we will have our day and whether it is here in June or later on in 2019, it is coming."

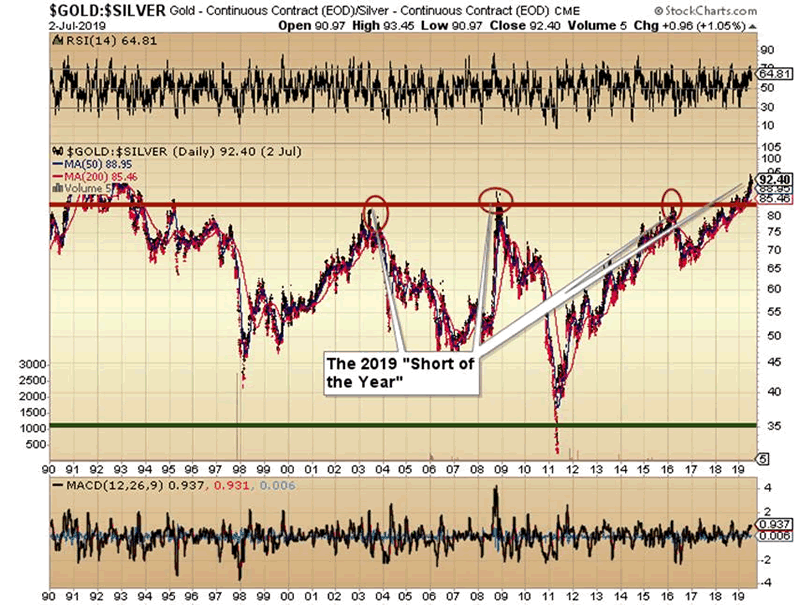

That "greatest single danger" has not occurred (thus far at least) and gold now resides comfortably above the three-year band of resistance and that singular event has changed the landscape and my trading strategies moving forward. With apologies to John Maynard Keynes, when conditions change, I change and since conditions are now unequivocally bullish for all things golden, I am now looking to buy back the half positions in GDX and GDXJ sold a few pennies higher than where they reside today. As for the leveraged ETFs (NUGT and JNUG), I will stick to my guns and only initiate new positions when RSI approaches 30. As for gold and silver, all indications favor silver over the short-term horizon as it carries far less downside risk and far less vulnerability to massive profit-taking due to the fact that with the gold to silver ratio (GTSR) above 90 (eyes rolling while stomach turning), silver has been an absolute dog in any and all analysis. They used to refer to silver bulls as "gold bulls on steroids" but with the manner in which the silver bullion banks, the most notable being JP Morgan, have capped, sat upon, choked, muscled, and generally manipulated the price of silver, the silver bugs are now hiding in the dark sanctuary of silence. In fact, any time a silver "luminary" posts his or her bullish opinion, the comments range from vitriolic to laughable in their assault and ridicule.

With that in mid, I am initiating a 100% position with all profits from the June long position in JNUG and NUGT in shorting the GTSR at 92.40. I will target a drop back below 80 as an initial reassessment zone but the true 2019 target is 60 or under. It traded briefly under 40 in 2011 and down to 65 in mid-2016 but has bounced around in the 75–82 range until gold made its June 2019 explosive move shockingly unaccompanied by silver. In over forty years of covering silver from the periphery of gold, I cannot recall a worse period of underperformance and it is evident from the sentiment numbers that someone or something has silver on a rope with the investment world finally shuttered into a Pavlovian trance that places a radioactive fence around all things silver. With retail attitudinal conditioning so acute, I am opting to fade that prevailing concept and go long silver by way of limited-risk SLV August $14 calls (@ $0.55) and by shorting the GTSR.

You have all read my missives over the years and been exposed to my unfailing belief that 5,000 years of historical utility as protection against currency debasement and monetary inflation would prove trustworthy for gold's true portfolio role. The world as we used to understand it would have allowed a move to well above the old highs by now but the 2007–2008 banking crisis and gold's responsive move to over $1,900/ounce frightened the elitist, policy-making bankers and pols so viscerally that they have spent the past eight years doing everything in their power to keep the brakes on it by discouraging retail speculation and institutional participation by way of relentless interference and intervention. On that note, something very significant happened in June when gold shrugged off the expanding open interest of bullion bank shenanigans, shattering with unparalleled force the shackles of repression and launching itself into a new phase of the bull market which we all know began on December 4, 2015 at $1,045/ounce. It can only be described as a "watershed" move and one that will be remembered decades from now.

For now, the next major resistance appears to be the April 2013 breakdown level at $1,525 gold which, by the way, saw a silver breakdown but from the unimaginable level of $25/ounce. However, of the fifty or sixty bloggers chortling on about the next few hundred dollars in gold, the key actionable event should be to identify that point where gold can be bought without the risk of a major drawdown and until it approaches oversold status with RSI around (or under) 30, I am sidelined with the full knowledge and acceptance that I might be left behind, bereft of all of my beloved leveraged ETFs that can at once make blood boil, then curdle, at the pressing of a bullion bank sell button. For now, the operative word for gold remains "mettle" and I pray that gold can continue to perform in a spirited and resilient way.

Now for my monthly testosterone shot…

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold Corp. My company has a financial relationship with the following companies referred to in this article: Getchell Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below. 2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. 3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp., a company mentioned in this article.

Charts courtesy of Michael Ballanger.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.